Jump to: Types of Silver for Stacking | Economic Factors | Investment Considerations | Acquiring Silver for Stacking | Geographical Considerations | Silver vs Other Precious Metals | FAQs

Introduction to Silver Stacking

Silver stacking is the practice of accumulating silver, typically in bars, coins, rounds, and other bullion products.

Silver stackers primarily use the white metal to diversify their portfolios as it offers a more affordable alternative to gold. Additionally, silver holds intrinsic value outside the fiat currency system, making it a reliable store of wealth in uncertain economic times.

In this article, I have outlined the key aspects of silver stacking that you should understand before starting, including strategies to consider even before accumulating silver.

Types of Silver for Stacking

Silver bullion is a silver product manufactured mainly for investing. Usually, these products will be crafted with high-quality procedures with weight, authenticity, and purity guaranteed by their manufacturer, either a private mint, or a sovereign mint, such as the United States Mint.

Silver bullion tends to be highly liquid due to international recognition. The American Silver Eagle coin, the United States' official silver coin, and is a very attractive option amongst silver stackers.

Silver coins

Silver Bullion Coins

Each silver product will have a specific appeal depending on the investor's goals. Due to manufacturing costs, and that it is currency of a sovereign government, silver coins hold a more significant premium than silver rounds and bars. To better understand, think about the intricate designs, security features, and all the different manufacturing costs involved in the minting of a coin.

The 1 oz American Silver Eagle and the Canadian Silver Maple Leaf are the most popular silver coins in the market, holding both investment potential and historical significance.

Check out our list of the best silver coins to invest in 2025.

Silver Bars

Silver Bullion Bars

Silver bars are primarily valued for their metal content rather than collectibility, making them an excellent choice for investors aiming to maximize their silver holdings.

1 oz silver bar is the most popular available size due to its ease of storage and liquidity.

Silver Rounds

Silver Bullion Rounds

Not to be confused with coins, silver rounds are disc-shaped silver ingots mainly valued by their silver content rather than any design. Since they're produced by private mints, they carry no legal tender status or face value. It is not as collectible and appealing as coins but as affordable and easy to obtain and stack as silver bars.

1 oz Silver Rounds are very popular among new and experienced stackers.

Now that you know some of the products, let me present some market aspects of silver stacking worth learning before you start.

Check out our Scottsdale Stacker Collection page

Economic Factors Influencing Silver Stacking

The value of silver products, whether tangible or not, depends heavily on the silver spot price. The spot price is actually the paper traded, futures market price in which contract prices are traded 2+ months in advance. They do not account for the actual price of the physical metal, meaning the costs involved to mine, refine, mint, and distribute the physical metal for retail sale. This cost is what is known as the “Premium”. The premium accounts for the difference between the “paper” spot price and what you can actually purchase the physical metal. It is very important to understand the spot prices are live and will fluctuate continuously until the time a trade is locked in. Live spot prices are based on real-time trading in global commodity markets, reflecting the balance of supply and demand.

Industrial demand plays a significant role in the value of silver and influences stacking strategies.

Silver being a high use industrial commodity as well as a precious metal also means it is usually more volatile than gold. This can cause Silver to experience more substantial price fluctuations. In addition, this volatility makes timing crucial for silver stackers looking to buy or sell silver effectively.

Economists have stated that since 1971, when Nixon took the US off the Gold Standard, the US dollar has lost nearly 98% of its purchasing power. The US Dollar is a fiat currency (meaning by decree) that continues to lose value due to inflation. Inflation is when the government spends more money than it takes in revenue. When the government spends more than it takes in, they simply print more money into existence. Compared to Gold and Silver, you cannot simply print more gold or silver, thus they have been money for over 5000 years and are a tangible asset that helps investors retain their purchasing power.

That is, when inflation rises, the amount of things you can buy with fiat money decreases, but the value of Gold and Silver tends to appreciate. In this way, Gold and Silver both serve as safeguards against fiat currency depreciation.

Investment Considerations

Long-term investment strategy

Silver holds a stable and essential role in modern industry. Nearly every computer and cellphone contains silver, as its exceptional electrical conductivity and durability make it the ideal material for coating electrical contacts in printed circuit boards and switches.

Risks Associated with Silver Stacking

While silver offers potential benefits, it also carries risks. The market can be volatile, with prices influenced by industrial demand, investor sentiment, and economic conditions.

This volatility can lead to significant price fluctuations, which may not align with everyone's financial goals. Moreover, direct possession of physical silver requires secure storage and possibly insurance to protect against theft or damage, adding to the investment cost.

Learn all about our fully segragated and insured SD Depository.

Incorporating Silver into a Diversified Investment Portfolio

Integrating silver into a diversified portfolio can enhance financial stability. Silver is money, its value does not depend on fiat currency, so it works as as a medium of exchange outside of the current financial system. Many feel this provides a buffer to the ever depreciating dollar during economic downturns.

This non-correlation with other asset classes can reduce overall portfolio risk in both the short and long term for those who distribute their investments among different assets.

Acquiring Silver for Stacking

Now that you know the risks and benefits of investing in silver, you might be wondering about the next steps.

When building a silver stack, it's essential to approach the acquisition process thoughtfully to ensure the authenticity and value of your investment.

- Start by choosing reputable dealers with positive reviews and a strong reputation to minimize risk.

- Begin your stack with silver coins, rounds, or bars that are affordable to you so that any mistakes made due to inexperience are not too costly.

- Ensure your silver products are genuine by checking for proper markings and certificates and buying from reputable sources.

- Assess the premiums over the spot price for different silver products. While lower premiums can be attractive when buying, be sure to consider the potential premiums when selling as well.

- Opt for silver in forms that are easily tradable and recognized, such as American Silver Eagles or 1-ounce silver rounds, to facilitate future sales or trades.

These measures can help you make informed decisions and build a silver stack that aligns with your investment goals and risk tolerance.

Geographical Considerations

United States Market: Trends and Practices in Silver Stacking

If you are a silver stacker in the United States, it's essential to select items that are both popular and widely recognized, especially if you intend to use them for barter. American Silver Eagles, pre-1965 coins (commonly known as junk silver), and silver rounds from reputable mints are highly liquid and widely accepted.

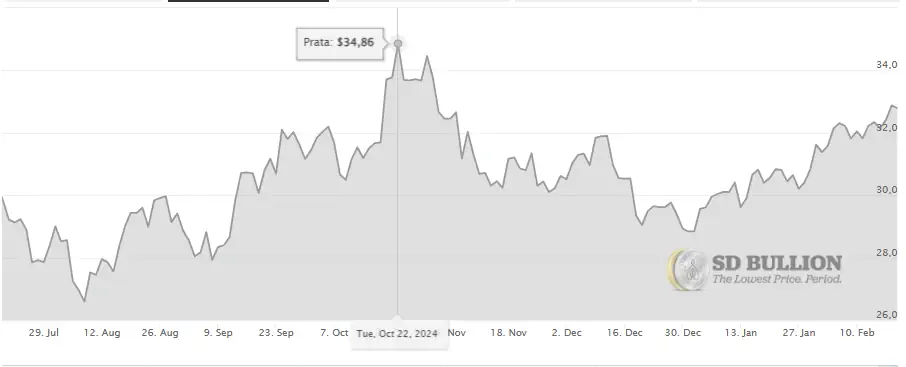

As of February, 2025, the silver prices have risen to approximately $33.00 per ounce, the highest since October, 2024.

This surge is primarily attributed to global trade uncertainties and a confident trend in the gold market, which often positively impacts silver due to their correlated demand as precious metals.

For long-term wealth preservation, investors may prioritize low-premium bars and rounds, as they offer more silver content per dollar spent.

Consider potential sales tax exemptions in certain states when purchasing silver, and consider secure storage options like home safes or private vaults. Understanding local demand and liquidity will help you build a strategic silver stack that aligns with your financial goals.

Comparisons with Other Precious Metals

A fundamental difference between gold and silver in stacking is that gold performs better in economic uncertainty than silver due to its historical and social value, so it is also more liquid than silver. Gold is easier to manage as its value is quite concentrated when compared to Silver. For example, currently you can hold two tubes (40x 1oz coins) of American Gold Eagles in the palm of your hand while the same amount of money in American Silver Eagles would weigh over 225 lbs.

It is important to know that many Silver investors consider Silver to be one of the most undervalued assets available today. It is in such demand in our day to day life that we oftentimes take it for granted. Yet we consume more silver on an annual basis worldwide than we are currently producing, leading to a potential supply deficit. This leads many to closely watch the Gold to Silver Ratio or GSR. It is understood that for every ounce of gold that is mined, 10 ounces or Silver is also produced. However Gold is currently trading near 90:1 on the GSR. Many investors speculate that should the GSR rebalance to something more like 40:1, there is a great opportunity to benefit from holding silver.

Final Considerations

By acquiring physical silver, such as coins, bars, or rounds, you are securing tangible assets that can hedge against inflation and market volatility.

Staying informed about current market trends is crucial for silver stackers, as it enables you to make informed decisions when buying silver and enhances your understanding of the precious metals market.

Whether you're just starting to stack silver or have been collecting silver for years, strategic planning is key to success.

Is it a good idea to stack silver?

Silver stackers accumulate physical silver bullion, such as coins, bars, and rounds, to sell at a favorable price or protect one's wealth to live off it later in life. This practice is a key component of precious metals investing, offering tangible asset ownership to hedge against inflation during economic uncertainty. Therefore, silver stacking offers investors the opportunity to diversify their portfolios and protect their wealth over time.

How much silver can I legally own in the USA?

There is no federal limit on silver ownership in the U.S. However, some states impose sales taxes on silver purchases, while others offer exemptions for bullion or collectible coins. Under the Bank Secrecy Act, financial institutions must report cash transactions worth over $10,000, including large silver purchases. Selling significant amounts of silver may also require IRS reporting as taxable income.

How many ounces of silver should I stack?

The amount of silver you should stack depends on your strategy, whether for short-term barter or long-term wealth protection. People stack silver for various reasons, including retirement savings, barter, or selling when prices are favorable. If you are starting, 50 to 100 oz or even junk silver of various sizes can be a good entry point. However, silver is far more volatile than gold, so those planning to navigate market fluctuations or eventually live off their stack may need a more substantial amount. Always consider your budget and financial situation when determining how much to stack.

Do I need insurance for my silver stack?

Insurance for your silver stack depends on where and how you store it. Home storage may seem convenient, but standard property insurance often provides minimal coverage, typically between $250 and $2,500. Increasing coverage requires special amendments and professional appraisals, and even then, payouts may be based on wholesale prices rather than market value. Bank safety deposit boxes offer security but are not insured by the FDIC (The Federal Deposit Insurance Corporation) or most banks in the United States. The best option for silver stackers' complete protection is a private vault depository, which offers specialized security, insurance, and liquidity options, ensuring your silver is safeguarded and accessible when needed.

Should I stack silver for long-term or short-term gains?

You can stack silver for both long-term and short-term gains, but the ideal products for each strategy differ. Most stackers view silver as wealth insurance, like gold, since it holds value outside the financial system. Bars are cheaper per ounce for those with limited budgets and easier to store, while coins have higher premiums but are more widely recognized. Coins like the American Silver Eagle offer strong liquidity and easy tradeability. Silver is a reliable hedge for long-term stability, while short-term gains depend on market fluctuations.

What are the best silver coins for stacking?

Most investors begin silver stacking to preserve wealth, so the best options are widely recognized high-purity and highly liquid coins or bars. The American Silver Eagle, Canadian Silver Maple Leaf, and British Silver Britannia are among the most popular choices. These coins are known for their exceptional quality, strong market demand, and government backing. Their widespread recognition makes them easier to buy, sell, and trade. Choosing well-known silver products ensures better liquidity and value retention. Always consider local popularity and premiums when stacking silver.

Should I stack silver coins, rounds, or bars?

Since silver stacking is primarily for wealth preservation, ease of storage and liquidity are key factors for investing in silver. Coins and rounds have intricate designs and may also appeal to collectors. Silver bars are the best option if your main goal is stacking large quantities at the lowest cost per ounce. They typically have lower premiums and are easier to store in bulk. However, coins offer greater recognition and liquidity, which may benefit resale.

Disclosure:

YOUR OWN DUE DILIGENCE IS RECOMMENDED BEFORE BUYING, THIS CONTENT IS FOR EDUCATION AND ENTERTAINMENT PURPOSES ONLY.

THE ANALYSIS AND DISCUSSION PROVIDED BY SD BULLION, INC.

AT SDBULLION.COM AND RELATED MEDIA PLATFORMS IS FOR EDUCATION AND ENTERTAINMENT PURPOSES ONLY.

IT IS NOT RECOMMENDED FOR TRADING PURPOSES NOR IS ANY OF THIS CONTENT FINANCIAL ADVICE. EMPLOYEES AND CONTRIBUTING AUTHORS TO SD BULLION ARE NOT INVESTMENT ADVISERS AND INFORMATION OBTAINED HERE SHOULD NOT BE TAKEN AS PROFESSIONAL INVESTMENT CONSULTING.

THE COMMENTARY ON SDBULLION.COM REFLECTS THE OPINIONS OF THE RESPECTIVE AUTHORS AND NOT THAT OF SD BULLION, INC.

YOUR OWN DUE DILIGENCE IS RECOMMENDED BEFORE BUYING.