Silver Coins: Top Sellers

Silver Coins for Sale at SD Bullion

Silver is, and has for a long time, held the distinction of being one of the most popular precious metals used as a store of value. In fact, the Roman Empire used gold and silver to strike currency coins over two millennia ago.

Fast-forward to the 21st century, silver bullion is one of the most popular investment vehicles when it comes to portfolio diversification and hedging against economic downturns.

Silver coins are not only a prudent investment choice due to their precious metal content but they also attract high demand from many collectors seeking an educational and fulfilling hobbie.

What is a Silver Coin?

A silver coin is a government-issued silver bullion product with legal tender status from the issuing country. It typically has a face value or, in some cases, can be accepted as payment based on the current silver spot price (e.g. the Mexican Silver Libertad Coins I'd link to a higher priority category here) .

However, you will hardly see silver bullion coins being used as regular payments because they are mostly valued by their fine silver content, which will be significantly higher than most face values attributed by Central Banks.

Most silver coins have a rounded shape with raised edges, which allows them to be stacked in piles for storage purposes. However, some collectible coins might present a different shape, depending on the design and the series.

Silver coins can be produced by Sovereign Mints (e.g., the US Mint or the Royal Canadian Mint) or by private mints (e.g., the Scottsdale Mint) in partnership with a sovereign nation's Central Bank.

Types of Silver Coins

As we have stated before, humankind has been making silver coins for thousands of years. With the advancements in minting techniques, the market is full of different options to attract investors and coin collectors.

Bullion coins - produced mainly for investing purposes. Mintage figures are usually higher among bullion coins.

Burnished Coins - these coins display a more satin look and clearer design elements. They undergo a special treatment process which cleans the blanks from undesired oxides formed during the annealing and rimming processes.

Proof Silver Coins - in addition to having their blanks specially cleaned, the dies used in the making of proof coins also undergo a special polishing process that creates the mirror-like effect on the blank surfaces.

Numismatic coins - older coins with historic value. They are usually rare and valued more for their collectibility than for their precious metal content.

90% Pure Silver coins - also referred to as 90% Constitutional Silver or "Junk Silver." The term indicates older US coins, before the debasement of silver in the 1970s, that are from "common dates" and, therefore, still abundant in the market, so they carry little to none numismatic value. Though they are still valid legal tender, they are valued based mostly on their silver content alone.

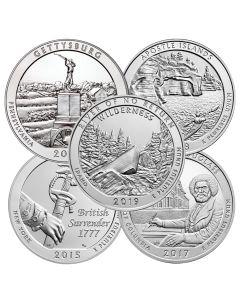

Collectible coins - Typically referred to as coins with higher premiums that have been struck with a special finish, either colorized or with a different shape. They are typically themed, celebrating special occasions or temporary designs from a themed series (e.g., America the Beautiful Quarters). It may also refer to graded coins.

Characteristics of Silver Coins

The standard weight for a silver coin is 1 Troy ounce or 31.1 grams. Some mints produce fractional sizes as well, or heavier options, e.g., 5 oz.

Most silver coins nowadays are, at least, .999 pure silver, or even .9999 fine.

Some coins also display a mint mark, indicating their origin. For instance, coins minted at the San Francisco Mint carry an "S", whereas coins from the West Point branch, will typically display a "W." Mint marks can add to numismatic value.

Popular Coins: Silver Eagles, Maple Leafs, Britannia Silver Coins

SD Bullion has 1 oz Silver Eagles, Maple Leafs, Silver Britannia Coins, and Kangaroo Silver Coins; maintains an incredible repertoire of the best silver bullion coins from top-notch mints across the world. Sourcing from around the globe and from the good ol' USA, our inventory features most of the world's most collectible and popular coin series – in various weights and graded varieties.

American Silver Eagle Coins

The US Silver Eagle is the official American silver bullion coin. It is, arguably, the most popular coin program in the world.

Struck by the United States Mint at its various facilities, these coins captured the hearts of investors and collectors the moment they hit the market on November 24th, 1986. Ever since, people around the world wait for its annual release with bated breath – year after year.

This coin features display the brilliance of Adolph A. Weinman on the obverse side, showcasing one of his finest designs from the Walking Liberty Half Dollar. Lady Liberty is depicted striding towards the rising sun in this image, with the American flag draped around her shoulders.

The reverse side bears John Mercanti's rendition of the Heraldic Eagle with 13 five-pointed stars hovering above it. This design is borrowed from the National Seal of the United States – and cleverly modified to fit the theme of this silver coin.

In 2021, the year the program celebrated 35 successful strikes, the United States Mint announced a new reverse design, featuring the works of Emily Damstra, a member of the US Mint's Artistic Infusion Program (AIP), which portrayed a more natural bald eagle amid flight and grasping a branch in its talons.

Even after over three decades, the excitement that an American Silver Eagle release brings is palpable – with both collectors and investors jostling for a piece of the action.

In 2024, the United States Mint produced the first bullion Silver Eagle coin with a privy mark. The 2024 Star Privy Silver Eagle coin has been produced in a very limited mintage strike of only 500,000 units.

Canadian Silver Maple Leaf Coins

This coin series was launched in 1988, following in the release of the American Silver Eagles two years prior. Since then, it has become one of the best silver coins in the world in terms of annual sales.

Over the years, the Royal Canadian Mint has added several security features to the design. The imagery, however, has remained the same since launch.

All Canadian Maple Leaf Coins now feature radial lines and micro-engraved laser marks for additional security.

The coins' reverses feature an incredible portrayal of a single maple leaf – rendered in such breathtaking detail that you can't help but stop and look closely. The veins and texture on the leaf design are extremely realistic, making the design pop out.

For nearly three decades, the obverse of these coins featured different renditions of Queen Elizabeth II. However, in 2024, after her passing, the coins started featuring the portrait of King Charles III.

Austrian Silver Vienna Philharmonic

The famed Austrian Philharmonic Silver Coins joined their gold counterparts in the precious metals market in 2008. They are one of the most famous releases from Europe, selling over 54 million units in a five-year span. These coins feature designs honoring the Vienna Philharmonics.

The reverse design showcases the array of instruments used by the Vienna Philharmonic Orchestra, while the obverse features the Musikverein Golden Hall's Great Organ. In fact, the Musikverein is a concert hall in the Innere Stadt borough of Vienna, where the actual Vienna Philharmonics plays.

These brilliant designs were rendered by Thomas Pesendorfer in 1989, and they are used on both the gold and silver releases to this day due to their popularity and significant history.

Australian Silver Coins

The Perth Mint is owned by the government of Western Australia and is responsible for the production of bullion coins. Some of their most popular series includes:

-

the Lunar Series, which features annually changing designs based on the Chinese Zodiac and the Lunar Calendar.

As the country is also part of the British commonwealth, Australian silver coins also depict the sovereign queen or king of the United Kingdom.

Other Popular Silver Coins

Other options available in the bullion market include:

-

the Chinese Silver Panda, from the Chinese Mint;

-

the British Silver Britannia, from the Royal Mint;

-

the Mexican Silver Libertad, from the Mexican Mint; and

Value and Pricing of Silver Coins

Silver Spot Price

The spot price of silver refers to the current market price at which silver can be bought or sold for immediate delivery. This price fluctuates based on supply and demand dynamics in the global market, economic data, geopolitical events, and investor sentiment.

The spot price serves as a baseline for determining the value of silver coins, though bullion dealers will typically add a premium to account for business costs and a profit margin, ultimately affecting the final pricing of silver coins.

Other Factors Influencing the Value of Silver Coins

Several other factors influence the value of silver coins beyond the spot price of silver:

-

Rarity and Demand: Limited mintage and high collector demand can significantly boost a coin’s value.

-

Condition and Grading: Coins in pristine condition, especially those graded by professional services like NGC or PCGS, typically command higher prices.

-

Historical Significance: Coins with historical importance or unique backstories often have higher collectible value.

-

Design and Craftsmanship: Detailed designs, special editions, and high relief or proof finishes can increase a coin’s appeal and price.

-

Silver Content and Purity: The amount of silver content (normally measured in troy ounces) and its purity (typically .999 pure silver) directly impact the intrinsic value of the coin.

Investing in Silver Coins

When compared to gold and other precious metals, silver bullion exhibits unique characteristics in terms of value and pricing.

Silver is incredibly malleable and ductile. This means it can be easily bent and shaped. Additionally, it has the world's highest conductivity (for both electricity and heat). Due to these intrinsic characteristics, silver enjoys high demand from the industrial sector. Therefore, silver prices tend to see higher swings than gold, for instance.

Silver is much more abundant on the Earth's crust than other precious metals, such as gold, platinum, and palladium, so it is much cheaper. Therefore, a larger group of investors can afford and benefit from it.

Here are 5 other reasons to consider investing in government-minted silver coins:

-

Unlike rounds and bars, counterfeiting legal tender coinage invites much heavier punishments. Hence, these products are deemed relatively safe from counterfeiters, with ‘relatively' being the key phrase – as even coins have been known to be counterfeited. However, most coins now carry advanced anti-counterfeiting techniques. Some notable examples include the edge notch in Silver Eagles, the Silver Maples' encrypted Bullion DNA, and the tinctured lines and surface animation of the Silver Britannias.

-

Unlike other silver investment vehicles, government-minted silver coins adhere to the highest quality standards. Of course, there are many privately-minted silver rounds and bars that give even the best bullion silver coins a run for their money. However, by being issued by a sovereign country, silver bullion coins come with that nation's entire responsibility behind their making.

-

Due to the constant demand for government-minted coins, this particular silver investment vehicle is known to be much more liquid compared to bars and rounds. In fact, in times of crisis across the world, coins have proven to be easier to trade than other forms of silver.

-

Government mints constantly launch series and coin sets that attract collectors from across the world. Some of these series have extremely low mintages, while featuring brilliant/historical imagery – making them much more collectible compared to rounds and bars.

-

They have a face value guaranteed by a sovereign government. This is an important feature for some investors, even though the value of the silver content in coins far exceeds the face value. The importance placed on face value stems from the fact that this investment can never become worthless in the true sense of the word, however improbable that scenario may be.

Silver Coins vs Silver Bars vs Silver Rounds

Silver coins are often minted by sovereign mints, or private mints in partnership with a sovereign country. Therefore, their quality is assured by the country that issued them.

On the other hand, most silver bars and silver rounds are produced by private mints and they don't carry a face value.

The result is, silver coins are much more popular and, therefore, more liquid. It will be easier to sell back silver coins than other forms of silver bullion.

SD Bullion CEO Chase Turner's Overview

Silver coins are some of the most stunning products on the market today. My personal favorites are the Silver Eagle, Silver Britannia and Silver Maple Leaf. Silver coins have been traded for thousands of years and I believe they'll always hold a place in our financial future.

The best thing about silver coins is their ability to appreciate in value at a higher rate than bullion bars or rounds. That's why I would always recommend having the right silver coins in your metals portfolio. In the long-run they should net you more value than traditional bullion.

FAQs

What is the best silver coin to buy?

The best silver coins to buy are the most popular ones, such as the American Silver Eagle, Silver Britannia and the Canadian Silver Maple Leaf. They are the two best-selling silver coins in the world, which means they are easier to liquidate.

Are silver coins worth keeping?

Yes, silver coins are worth keeping for their investment potential and possible collectibility. Silver bullion offers a hedge against inflation, diversification, and liquidity. Silver coins are more affordable than gold coins and silver bullion enjoys a higher industrial demand, supporting long-term value. While you still have to consider storage costs, their benefits often outweigh the drawbacks for many investors and collectors.

How much is a silver coin worth?

A silver coin will be worth around the silver spot price at any given time. For instance, as of July 2024, the silver spot price is fluctuating at around $30, so that is what you should expect a one troy ounce .999 fine silver coin to be worth.

How do silver coins compare to the Silver Eagles in price and overall market acceptance?

American Silver Eagles tend to outperform other silver bullion coins in premium percentage. That happens because the US Silver Eagles are regarded as the most popular option in the market right now. For the past 10 years, the average premium percentage over spot for Silver Eagles has been around 22%, while for Silver Maples has been close to 15%, and 17% for US Junk Silver coins. That also means you can expect higher premiums yourself when you decide to resell your Silver Eagles.

Why are silver coins more expensive than Silver Rounds?

Silver Coins are produced by sovereign mints or by a private mint in partnership with a sovereign country. That means they enjoy legal tender status and possibly carry a face value in the country that issued them, while silver rounds do not. Additionally, counterfeiting legal tender silver coins comes with graver criminal charges. Finally, when you purchase a silver coin, the quality and purity of your coin is guaranteed by a Federal government, rather than just by a private mint.

Why would I want a Silver Coin that's minted in another country?

Even though a silver coin has been minted in another country, its value is mostly based on its pure precious metal content, and not its face value in another currency. Additionally, silver coins represent a lot of their country's history and culture. They attract both investors and coin collectors for their artistry and possible numismatic relevance.

Do Silver Coins have counterfeit measures minted into them? What are they?

The most relevant silver coins in the bullion market right now have counterfeit measures. For instance, the Silver Eagles have a reeded edge variation; Silver Maples are imprinted with radial lines in the background and the RCM's unique Bullion DNA technology; and Silver Britannias display a beautiful surface animation as you tilt the coin from side to side, and a small padlock on the obverse that changes to a trident's spear with micro-text laser engraved.

How do I verify the authenticity of silver coins?

Most silver coins have anti-counterfeiting measures. For instance, Silver Eagles have a reeded edge variation, Silver Maples the exclusive RCM Bullion DNA technology, and the Silver Britannias a micro-engraved padlock that changes to a trident depending on the view perspective. Additionally, there are several tests you can take at home, such as the magnet test or the density test. Finally, if you are still unsure about the authenticity of your silver coin, take it to a coin dealer for a proper investigation.

What are the storage options for silver coins?

You can store silver at home, at a bank vault, or even at a third-party depository. At home, you may consider hiding your silver coins in different locations around your house, or at a safe. Just make sure to keep them out of damp locations or places of high moisture levels. Consider the use of desiccant packets to avoid tarnish. Also keep in mind bank vaults are not FDIC-insured. Many experts will argue that a fully-insured third-party depository is your best option.

Can I include silver coins in my retirement portfolio?

Most modern silver coins are IRA eligible, so you can include them in your retirement portfolio. At SD Bullion, every product page will give you the information if that product is IRA approved or not. Silver coins must be .999 fine to be accepted as funds for self-directed individual retirement accounts.

How can I resell my silver coins, and what determines their resale value?

You can resell your silver coins to brick-and-mortar coin shops or to online bullion dealers. Check with your bullion dealer their buyback process and make sure to deal only with trusted companies with multiple years of experience and positive reviews. SD Bullion has had over 450,000 satisfied customers and has featured in the esteemed Digital Commerce 360's 2024 Top 1000 Database.

Which silver bullion coins have the highest resale value?

American Silver Eagles are the silver bullion coins with typically the highest resale value. They are minted by the US Mint and enjoy the status of arguably the most popular option in the silver market right now.

Should a new customer buy silver coins, bars or rounds?

The answer depends on the new customer's investment goals. Silver coins are typically considered more liquid because they are easier to resell, however that comes with higher premiums. If your goal is to look for the maximum amount of silver content per dollar invested, consider allocating part of your portfolio to silver bars or rounds.