Buy Palladium Bullion Products

With the recent release of the American Palladium Eagles, the first palladium-based official coin from the United States Mint, debates about the use of this precious metal have cropped up all over the place. Nonetheless, the gradual, but steady, bloom in the number of palladium investment vehicles seems to have settled this debate once and for all. Although investors are naturally drawn towards precious metals like gold and silver, other options have made diversification much easier -- solidifying your precious metals portfolios better. Palladium products are now available in all shapes and forms, including rounds, government-backed coins, and bars. Although the United States does have palladium resources, the bulk of the world’s supply is still mined in Russia (41%) and South Africa (38%).

As of now, the US Mint American Eagles and the Canadian Maple Leaf Coins are the most widely-recognized coin programs to receive palladium variants. Many other mints across the world are expected to follow suit after witnessing the immense popularity that palladium variants mentioned above enjoyed.

Unlike gold and silver, palladium history isn't as richly documented. The first record of a palladium coin was one issued by Sierra Leone in 1966, closely followed by Tonga in 1967. Since then, countries like Australia, Canada, and many others issued palladium coins, but more as single, sporadic commemorative releases rather than as part of an annual coin program, until these past few years.

Palladium Bars

Just like other precious metals, one of the most cost-effective ways of adding palladium to your tangible assets is via palladium bars. They're much easier to store and transport, especially when dealing with relatively heftier weights. Their lower premiums over the spot price of palladium make them smart investment options for those who just want to add pure palladium to their precious metals assets.

Palladium Rounds

Palladium Rounds give investors and collectors access to popular designs as well as the coin-like round shape without the relatively higher premiums that accompany legal tender coins. They're considered an ideal option for those wanting to invest in relatively lighter or even fractional weights of palladium. Although they don't bear any face value like palladium coins, the value of the pure palladium content remains the same.

Palladium Coins

Legal-tender palladium coins are backed by sovereign governments, giving investors and collectors some peace of mind. In addition to inspiring trust, their government-backed nature makes them more collectible than other palladium investment vehicles, much like gold and silver coins. Although these face values are merely indicative, they're considered a stamp of government-backing, making them more reliable investments in the eyes of many investors. Their limited mintages and higher premiums over the spot price of palladium make them rarer than other vehicles of palladium investment. Collectors who love to maintain complete sets are naturally drawn towards coin programs run by famous government mints because they have a much higher chance of running successfully for decades at a time.

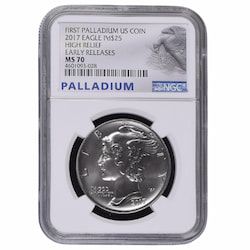

American Palladium Eagle Coin Design

These popular American Palladium Eagle Coins feature the famed ‘Winged Liberty’ design created by Adolph A. Weinman on their obverses; this design was first used on the ‘Mercury Dime’ in 1916 and has enjoyed widespread popularity ever since its release.

American Palladium Eagles are released in 3 variants – bullion, proof, and uncirculated. Even though the market is anxiously waiting for its release now, the decision to strike these coins was taken hesitantly.

Although palladium has extensive industry uses as gold does, it hadn't really caught on as a mainstay in precious metals investments until a few years ago. However, the recent surge in popularity of this metal indicates a paradigm shift in the minds of investors who see the value of adding palladium to their tangible assets.

This surge in popularity has propelled palladium prices by 20% (annualized over 2016), much higher than any other precious metal. Even though this meteoric rise in the value of palladium has persuaded many investors, a few remain unconvinced.

Palladium is one of the rarest precious metals on Earth. In fact, it is 15 times rarer than platinum, which is even rarer than gold -- one of the most popular precious metals in the world.

The palladium market is just starting to bloom and the rarity of palladium, coupled with its broad variety of industrial uses, bode well for it as an investible precious metal. Investors and collectors can expect to see a wide range of palladium-based products cropping up on the precious metals market, as mints try to fulfill the increasing demand for the metal.

However, just like any other precious metal, palladium prices will also fluctuate depending on the condition of the market at specific points of time.

Even though palladium hadn’t really caught on as an investible precious metal, palladium-based ETFs have existed on the market for much longer – displaying the confidence investors have had on the metal as an asset. One of the most significant contributors to the lack of palladium products in the market is its rarity, making it relatively difficult for interested individuals to obtain a quality palladium product, compared to say gold or silver.

The release of the American Palladium Eagle Coins by the United States Mint is expected to affect the market favorably, driving up investor confidence in palladium when an official bullion coin struck using the metal is available.

As an investible asset, the coming years seem to bode well for palladium products. If the Palladium Eagles are a success, as experts expect, we anticipate many more palladium-based rounds and bars crowding the market very soon.