Silver Bars: Top Sellers

Buy Silver Bars

Silver has been a popular form of investment due to its intrinsic value. Like gold, it has considerable potential to appreciate in value during economic downturns.

Unlike coins, silver bars don't usually carry collectible value, which means investors can acquire more silver ounces for their money.

Silver bars are minted by private mints, e.g., Sunshine Mint and Scottsdale Mint, or by prominent sovereign mints, including the Royal Canadian Mint and the British Royal Mint.

Types of Silver Bars

A silver bar is a refined version of a silver ingot. It has a standardized silver content, serial number, assay stamp, fineness figure, and manufacturing year on its surface.

The most popular silver bar sizes for sale are 1 oz, 5 oz, 10 oz, Kilo, and 100 oz.

Sizes of Silver Bars

1 oz Silver Bars

Because silver is very affordable, 1 oz silver bars tend to be the smallest size available. This is also the most common option among silver bullion investors. They are easy to transport, store, buy and sell.

SD Bullion's 1 Troy-ounce silver bars for sale are .999 pure.

At SD Bullion, you will find a wide selection of 1 oz silver bars so each investor can meet their needs.

5 oz Silver Bars

The 5 oz silver bars option is another relatively small option for those with a short budget. They might be cheaper than the 10-ounce version.

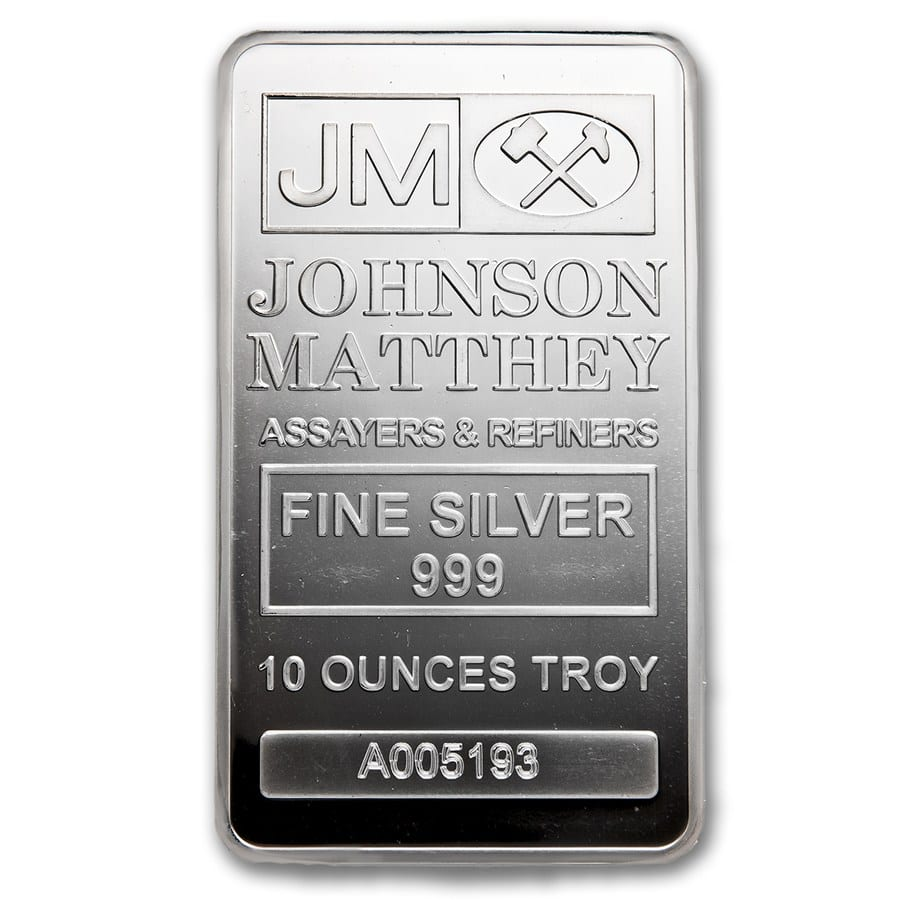

10 oz Silver Bars

If you're a veteran investor, 10 oz silver bars are a great choice to enrich your portfolio. Smaller sizes might be slightly easier to sell, but it might be more convenient to store 10-ounce silver bars, especially if you intend to stack.

SD Bullion's 10-ounce bars are .999+ pure quality and eligible for IRAs, making them a solid choice for precious metal collectors. Whether you're just starting or adding to your collection, these bars can be a valuable addition to your precious metals holdings.

100 oz Silver Bars

If you are looking for a more convenient way to significantly expand your investments at once, 100 oz silver bars could be a great option. While there may be fewer buyers for these bars, there's still a significant demand for them.

SD Bullion's 100 oz silver bars pride themselves on .9999 pure silver (The Royal Canadian Mint—RCM) and many .999 fine bars, such as Scottsdale Mint, SilverTowne, or the Sunshine Mint.

In addition, these bars are a fantastic choice for long-term investing, are relatively easy to store and transport, and are eligible for IRAs.

Kilo Silver Bars

1 Kilo Silver bars might be almost three times lighter than the 100-ounce bars, but they are still an excellent choice for those who want to invest in long-term goals. Our 1 Kilo silver bullion bars weigh 1,000 grams of .999 pure silver.

In reality, kilogram bars are a cheaper investment when bought in bulk. That's because the price-per-oz of one kilo is often lower than purchasing 32 x 1 Tr oz bars. Plus, storing one bigger bar is more accessible than storing 32 individual ones.

1,000 oz Silver Bars

If you want the most bang for your buck, 1,000 oz silver bars have the lowest premium over the spot price.

However, there are a few things you should be aware of before you decide to purchase them. Each bar weighs close to 70 lbs, which makes them hard to handle.

Their weight varies by about 10%. Such large silver bullion bars are difficult and expensive to ship, and they cannot be repurchased outside of LBMA vaults without an initial melting and assaying.

Even if you are an experienced investor who can afford 1,000-ounce bars, we recommend sticking with 100-ounce silver bars, as they are much more liquid.

Minted vs. Cast Bars

The difference between Minted and Cast Bars is their manufacturing process. Below, I explain how the difference in the manufacturing process affects the final look and price of the products.

Minted Bars

Minted silver bars are created by pressing a heated and rolled precious metal blank into dies. This creates a precise shape stamped with designs, weight, purity information, and the name of the issuing mint or refinery.

The intrinsic designs and consistency in weight and purity make them more popular among investors.

Cast Bars

Mints create cast bars with molten silver metal poured into a mold. The process requires less work and allows for bars of oversized sizes. However, they lack the precise purity and weight standards of minted bars. Additionally, cast bars are cheaper due to the more straightforward process.

Notice how less detailed and polished the cast bar is compared to the minted silver bars.

Popular Silver Bar Brands

There are national mints and private mints. Private mint products tend to have lower premiums than government mints due to the lack of government regulations and competition with other private mints.

Top Mints and Refineries

There are numerous silver bar designs available for sale on our website. But if you are looking forward to investing in the most popular mints, we have made it easy for you by enlisting them below:

Royal Canadian Mint: The Royal Canadian Mint is among the few sovereign mints worldwide that can produce silver bars. The design portrays the brand's distinctive maple leaf with gorgeous French inscriptions.

Sunshine Mint: Bars from the Sunshine Mint originate in Idaho and are characterized by superb quality and immaculate design. On the bar's obverse side, you can marvel at their famous Sunshine Mint Eagle design with the rising sun as a backdrop.

Perth Mint: The Perth Mint is a renowned Australian refinery that has earned the respect of investors and collectors for its exceptional bullion catalog of gold and silver coins. One of its alluring products is the Dragon Rectangular Silver Coin, uniquely shaped like a silver bar. These bars hold legal tender status and a face value of AUD 1, fully insured by the Australian Government.

Silver Bars vs. Rounds vs. Coins

Choosing between silver bars, rounds, or coins ultimately depends on your investment goals.

If you plan to buy in bulk, silver bars are a better option because they usually carry lower premiums than silver bullion coins.

However, silver coins are legal tender and will never be worth less than their face value. In other words, silver coins are money. Additionally, they have a semi-numismatic value that draws interest not only from investors but also from collectors. This makes them a more liquid option simply because there’s more demand for legal tender silver bullion coins. However, they usually command the highest premiums among the three options.

Silver rounds are not legal tender and are usually produced by a private manufacturer. You can regard silver rounds as disk-shaped silver bullion bars. They are generally sold because of their pure, precious metal content, but they can also draw a collectible appeal thanks to their distinctive designs.

Buy Silver Bars from SD Bullion

Buying Silver Bars can be a sensible form to protect your wealth against economic instability.

Here, at SD Bullion, you will find a an abundant variety of silver bullion bars in our current inventory. Enjoy our fast delivery process and our fair prices over the current spot price to stock up and save for your future.

SD Bullion CEO Chase Turner's Overview

Silver Bars have been a standard of storing wealth for thousands of years. My personal favorites are 100 oz silver bars because you can obtain a significant amount of silver in one bar and they are very easy to stack and store. But even with smaller sizes, there's something precious about holding a silver bar in your hand. You know by the heaviness it possesses that it's valuable to this world.

FAQs

How can I verify the authenticity of a silver bar before purchasing?

To verify the authenticity of a silver bar, you can take a few tests at home. The magnet test, for instance, helps you identify if your silver bar has any magnetic metals in the composition, such as iron. Note that pure silver is not magnetic. The density test is a mathematical equation in which you divide the mass of your silver bar by its volume. The result should be close to 10.49 g/cm³, which is pure silver’s density. However, these tests are not 100% failproof. To be sure, take your silver bars to a trusted bullion expert. And remember to shop only from trusted dealers.

What are the best practices for safely storing silver bars at home?

To safely store silver bars at home, you can purchase a safe deposit box and conceal it discreetly. If you don’t want to invest in a safe, you can hide your silver bullion in strategic and not obvious locations around your house, such as inside stereo speakers, converted drawers and cupboards, and behind the kickboards of kitchen cabinets. Make sure to keep a sealed inventory of all the hiding spots and include that in your testament.

Are there tax implications when buying or selling silver bars?

Make sure to consult with a tax professional to get a clear understanding of the tax obligations related to buying or selling silver bars in your country, region or specific scenario. It is our understanding that in the U.S., the IRS (Internal Revenue Service) treats silver bars as collectibles. If you sell silver bars after holding them for over a year, any profit made will be subject to long-term capital gains tax, capped at 28%. Selling them within a year will subject the gains as ordinary income, according to your specific tax bracket.What is the difference between secondary market silver bars and new silver bars?

New silver bars were sourced directly from the mint that manufactured them, whereas secondary market silver bars have been previously owned by other private investors and resold to a dealer.Can I include silver bars in my retirement portfolio?

You can include silver bars in your retirement portfolio, as long as you own a self-directed individual retirement account. Your silver bar must be at least 99.9% pure and have been manufactured by a sovereign mint (e.g. Royal Canadian Mint) or by a private mint accredited by COMEX, LME, LBMA, LPPM, TOCOM, NYMEX, NYSE/Liffe/CBOT, and ISO-9000.Are silver bars a good option for emergency preparedness or barter?

Yes, silver bars can be a good option for emergency preparedness or barter. Silver is largely recognized as a valuable item that has been used for bartering for millennia. It is portable and divisible and, unlike fiat currencies, it holds intrinsic value that can be traded for goods and services.What are the benefits of investing in silver bars compared to coins?

Silver bars tend to carry lower premiums over the silver spot price than silver coins. The reason is that the process for producing silver bars is usually simpler than the intricate designs and minting required for sovereign silver coins. Therefore, one of the benefits of investing in silver bars is that, with lower premiums, you are able to purchase more pure silver bullion per dollar invested.Are Silver Bars better than Silver Rounds?

Silver bars are generally available in more size options, up to 1000 oz for larger investors, whereas silver rounds tend to be restricted between 1 oz and 5 oz. On the other hand, silver rounds are minted with more artistic designs, honoring important personalities, historical events, or cultural aspects of a country. That artistic rendering generates a collectible appeal. However, both options usually carry lower premiums than sovereign silver coins. Choosing between silver bars and silver rounds will ultimately depend on your investment goals.What is the difference between a 1 oz, 10 oz, and 100 oz silver bar?

Silver bullion is priced in bulk, therefore you can expect lower premiums the larger the silver bar. However, smaller size options tend to be more liquid. They are more affordable, easier to store and transport. The heavier the bar, the more difficult it becomes to resell.How is the price of silver bars determined?

The price of silver bars is determined by the live silver spot price and a markup price that in the precious metals market is called a “premium”. Thus, the final price for silver bars will be the silver spot price plus a percentage above that to guarantee a profit margin for the dealer and cover business costs.What does "999 fine silver" mean?

.999 fine silver is the same as 99.9% pure silver. The leftover 0.1% is another metal, usually copper. Pure silver is very soft and malleable, so the addition of even the smallest portion of copper helps keep the alloy more resistant and durable. .999 fine silver is considered the highest purity level for bars, coins, and even jewelry. The higher the purity level, the more valuable the silver item will typically be.Is .9999 pure silver more valuable than .999?

Yes, a .9999 silver bullion product can be more expensive than a .999 one, but only by a fraction. However, other factors play an important role when determining the price of a silver bar, such as the manufacturer, weight, design, and others.Is .9999 pure silver more valuable than .999?

Yes, a .9999 silver bullion product can be more expensive than a .999 one, but only by a fraction. However, other factors play an important role when determining the price of a silver bar, such as the manufacturer, weight, design, and others.How do I store silver bars to prevent tarnishing or damage?

To prevent tarnishing or damage, store your silver bars in a cool, dry place. You can keep your silver bars inside plastic bags or zip-top bags, and wrap them in acid-free tissue paper to prevent scratches. Tarnish happens when silver comes into contact with sulfur or other elements in the air, causing a dark or blackish hue on its surface.What are the shipping and insurance options for buying silver bars online?

Everything we ship here from SD Bullion is fully insured no matter what. We offer free shipping on orders above $199. Otherwise, customers can pick their own method of shipment, including the timeline of the shipment (FEDEX 2 Day, USPS Priority, etc)Can I sell silver bars back to a dealer, and how does the process work?

Most online dealers have a buyback process. At SD Bullion you can simply reach out to our customer service at 1-800-294-8732 or through our web chat feature. You will receive an offer for your products and, if you accept, prices will lock-in. Next you will receive a shipping label by email so you can ship us your products. Our inventory team will receive your package and inspect each product for authenticity. Once everything is approved, you will receive your payment within 1-3 business days.How do the bars come packaged (raw, shrink wrapped, etc)?

That depends on the brand of the silver bar. Some are individually shrink wrapped in plastic, some are in loose plastic bags, others are just packed tightly in their boxes. The type of box (cardboard or plastic) depends on the mint. If that information is not stated in the description of the product, please contact our customer service at 1-800-294-8732 for further information.What are the Pros/Cons to buying large format/low premium silver bars?

The upside of buying larger silver bars is precisely the lower premium percentages. Silver is priced in bulk, so the more silver you buy, the last premium you pay. In other words, the larger the silver bar, the more pure silver bullion you are acquiring per dollar invested. The downside is that, the larger the bar, the more difficult it can be to sell it back. Smaller silver bars are easier to liquidate than larger ones.Do imperfections such as tarnish/scratches or patina affect the value of the older silver bars like Englehard or Johnson Matthey?

Tarnish, scratches, or patina should not affect the value of a silver bar because the purity of the silver itself is not affected by such imperfections.Are there any bars that appreciate in value?

Silver bars will appreciate in value according to the silver spot price. If the market price for silver bullion rises, so will the value of silver bars. Silver tends to perform well during times of economic instability. That is why many people invest in silver as a hedge against inflation and fiat currency devaluation.If SD Bullion buys all 10 oz bars back at the same rate, why do some sell on the website at higher premiums?

We do not buy all 10 oz silver bars back at the same rate. Certain bars (especially our exclusive collections, i.e., Una and the Lion, SDB Proclaim Liberty, among others) command a premium on the resale side. Both buyback and reselling prices will mainly depend upon the brand and the condition of the bar.