-

1 oz Gold Bars

-

10 oz Gold Bars

-

1 Kilo Gold Bars

-

1 Gram Gold Bars

-

2.5 Gram Gold Bars

-

5 Gram Gold Bars

-

10 Gram Gold Bars

-

20 Gram Gold Bars

-

50 Gram Gold Bars

-

100 Gram Gold Bars

-

All Gram Gold Bars

-

5 oz Gold Bars

-

Large Gold Bars

-

Argor Heraeus Gold Bars

-

Valcambi Gold Bars

-

PAMP Suisse Gold Bars

-

Perth Mint Gold Bars

-

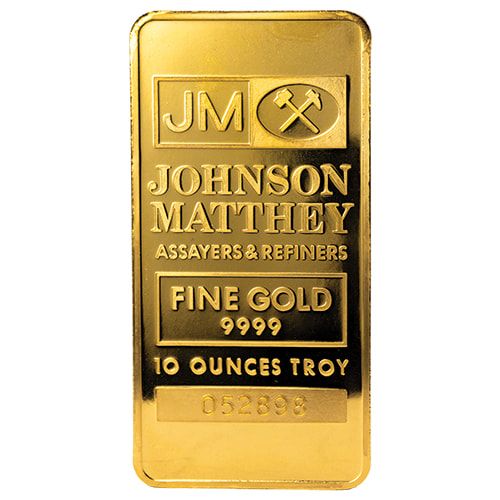

Johnson Matthey Gold Bars

Gold Bars: Top Sellers

Buy Gold Bars Online at the Lowest Price SD Bullion

Gold remains the top choice for investors looking to diversify their portfolios with a hard asset that can help hedge against inflation and protect your wealth in the long run. While gold coins are popular for their creative design and legal tender status, gold bars generally have cheaper premiums, costing less dollars per ounce of pure gold.

If you want to learn more about the potential benefits of investing in gold bars, keep reading below to learn from SD Bullion.

Gold Bullion Bars

A flat bar struck using .999+ (usually) pure gold is known as a gold bullion bar. Gold bars range from small gram sizes to 1 kilo. The wide range of options at SD Bullion empowers our clients to find the perfect products tailored to their unique investment goals.

The 1-gram, 1-oz, 100-gram, and kilo sizes are the most common weights available in the bullion market. While smaller gold bars offer higher liquidity and easy storage, larger bars usually cost less per ounce.

Government Mints vs Private Mints

Gold bullion bars are mainly available from private mints, such as Valcambi and Argor-Heraeus, some of the most regarded mints in the world today.

Nevertheless, some government-owned mints also create gold bars for investment purposes. Some examples include the Royal Canadian Mint, the Australian Perth Mint, and the British Royal Mint.

Gold rounds are similar to gold bars in the sense they they are usually struck by private mints and are devoid of face value. However, they are shaped like a coin, being a popular form of investment among collectors as well.

What to Look for in a Gold Bar?

The Mint

There are many mints in the precious metals industry. You can usually find out the gold bar's manufacturer by looking at the product's obverse, where you will most likely find a logo or the name of the company that minted it.

Why Prominent Manufacturers Matter

Choosing a gold bar can be overwhelming, given the sizes, mints, and designs we offer at SD Bullion. First, you should know that an investment grade gold bar should contain at least .999 fine levels of pure gold content.

It is also true that the more regarded and renowned the gold bar's mint is, the more sought-after it will be by investors and bullion dealers worldwide. In other words, reselling gold bars from trusted, renowned manufacturers should make it easier to secure higher prices.

For instance, a sovereign national mint, such as the Royal Canadian Mint (RCM), is easily recognizable by investors. Their products are known to contain top-notch quality. Therefore, it's possible that a gold bar from the RCM, will be easier to sell back to a gold bullion dealer and get a better price than lesser-known mints.

The same goes for highly praised private mints like Valcambi or Argor-Heraeus. Investors will recognize their logo and fame worldwide and should also obtain slightly better prices.

The bar's assay card

Many bullion products come with some form of assay proof, like the assayer's mark engraved on the bar.

In most cases, gold bars also have a unique serial number issued by the refiner. Smaller bars, for instance, usually come in a sealed assay card that contains all the relevant information for that piece, like the date of the assay, weight, purity, and, sometimes, a serial number.

Likewise, an assay certificate might be included in the purchase. It also proves the authenticity and the origin of that specific bullion bar.

Types of Gold Bars

Since there are different companies that produce gold bars, you might expect different production methods as well, which often result in different prices and different perceived values.

Cast Gold Bars

Cast gold bars are made by pouring the molten metal into a mold. The surface has simple marks, usually the weight, purity, and the manufacturer's logo.

Both hand-poured and cast gold bars begin with gold poured, placed, or injected into a mold. They have a very hand-made look and feel. They may display waffle backs or ripples, as well as pour lines. This is due to the rapid cooling of the gold in the mold and the absence of an enclosed mold.

Mint Gold Bars

A mint gold bar undergoes a more complex process. They are typically made from a cast or a gold ingot rolled to a uniform thickness. Those golden sheets are punched into a die to acquire the desired weight and shape, forming blanks. Later, the blanks are fed into a minting press to imprint the obverse and reverse designs.

How to Choose the Right Gold Bar

The bar's weight and purity

Investment-grade gold bars must be refined to a purity of at least 99.5%. However, most gold bars ranging from 1 gram to 1 kilo are typically refined to 99.9% pure. You can also see this information states as .999 fineness.

As mentioned, bullion bars come in various sizes and weights. The most common one is the one troy-ounce gold bar because it usually has good value, is easy to handle and store, and is highly liquid.

Smaller bars could be a sensible entry point into the precious metals industry. Because prices are based on the bar's weight, small gram gold bars do not require a considerable initial investment, and you can still enjoy the possible benefits of bullion investing.

Overall, smaller gold bars can be a great option for those looking to invest in gold with more flexibility and affordability, though they may come with slightly higher premiums compared to larger bars. On the other hand, seasoned investors might choose larger bars. Because gold is priced in bulk, the more gold you buy at once, the more you save in terms of dollar per ounce of gold.

Here are the sizes of gold bars for sale at SD Bullion:

- 1/100th troy ounce;

- 0.5 gram;

- 1 gram;

- 2 grams;

- 2.5 grams;

- 5 grams;

- 10 grams;

- 20 grams;

- 1 troy ounce;

- 50 grams;

- 100 grams;

- 5 troy ounces;

- 10 troy ounces;

- 1 kilo.

Larger bars could be a savvy choice for clients willing to invest more while enjoying lower premium percentages. 10 oz to 1-kilo gold bars are the go-to choice if you want to allocate a good amount of your portfolio in gold bullion.

However, smaller gold bars, including gram-sized, offer easier storage and higher liquidity.

Popular Brands

Gold bullion bars can come in different designs. Some are so popular that the precious metal industry sees them as symbols of excellence. Others represent only limited-time offers. Below, you'll find the most popular gold bars for sale at SD Bullion:

PAMP Fortuna

PAMP Fortuna bars are the cream of the crop in terms of attention to detail. Many investors see PAMP as arguably the best gold refiner in the world. Every single bar features Fortuna - the Roman Goddess of fortune. PAMP Fortuna bars can weigh as little as 1 gram (0.032 Troy oz) and as big as 1 kilogram (32.15 Troy oz) of 99.99% fine gold content.

Credit Suisse Gold Bar

Credit Suisse bars might have a simple design—just the company's logo on the obverse side—but they are highly regarded by collectors worldwide. Valcambi, one of Switzerland's most well-known precious metals refineries, produces Credit Suisse gold bars.

Valcambi CombiBar

You can't go wrong with Valcambi's CombiBar. The most common option is the 50-gram (1.60 Troy oz), 999.9 purity bar. The rectangular bar is sold as one 50-gram bar but can also be split into 50 individual 1-gram bars. Valcambi's brilliant technology ensures no loss of purity or gold content when separating them.

Royal Canadian Mint Gold Bar

The RCM is one of the few sovereign mints that issue such products. Its .9999 pure gold content is a phenomenal value for savvy gold investors. On the bar, you'll find the mint's maple leaf logo and its name in English and French.

Sunshine Minting Gold Bar

The Sunshine Mint is one of the most prominent private mints in America. The gold bar's obverse side features the firm's famous logo—an American bald eagle in flight, with sunshine behind it.

Perth Mint Gold Bar

As one of the most highly accredited refiners worldwide, the Perth Mint seduces you with an unmatched combination of choice, design, and quality assurance.

It is worth mentioning that the Perth Mint also produces a simple square-shaped, yet awe-striking, .9999 fine 1 oz Gold Perth Mint cast bar.

Argor-Heraeus Gold bar

Argor-Heraeus is another Swiss-based refinery. Known for its dazzling designs, it is a key supplier for some of the most important financial institutions and bullion houses worldwide.

How the Spot Price Affects the Final Value of Gold Bars

Gold bar prices are based on the current spot price of gold, which fluctuates according to live transactions at mercantile markets such as LBMA and COMEX. However, the spot price serves only as a base and usually does not correspond to the final price of a gold bar.

A Precious Metals dealer usually adds a percentage over the spot price to meet business costs and still make a profit. That is called a premium.

Prices on gold bullion bars can range from a couple of dozen dollars for small gram bars to tens of thousands for kilo bars.

Our website constantly updates its prices according to the current gold spot price.

Benefits of Investing in Gold Bars

Diversification

Gold has been a popular option for diversifying a portfolio and hedging against inflation or economic uncertainty.

Its relative stability compared to other precious metals makes gold products a sensible option. It has been used as currency for millennia and is trending as a wealth-preservation asset, including among central banks that store gold bars.

Liquidity and Flexibility

Liquidity concerns the speed and ease with which an asset can be converted into cash.

For example, a 1 Troy oz gold bar is more liquid than a 1 Kilo gold bar. Kilo bars are only accessible by investors with a large portfolio. Additionally, Kilo bars are harder to transport and store, so they are only advisable to larger investors.

Investment Goals

Investment goals can range from wealth accumulation, protection money, retirement planning, or capital appreciation since gold is often seen as a durable store of value and a hedge against inflation, and its price can rise during geopolitical uncertainty or periods of high inflation.

For example, gold prices spiked during the COVID-19 pandemic in 2020, reaching over $2,000 per ounce, a historical landmark.

Another record was set in September 2024, the price of gold per ounce fluctuated above $2,600.

Most importantly, gold is a long-term investment that could potentially outperform stocks. Gold bars are some of the most liquid forms of bullion.

Finally, IRA-eligible bars offer investors the opportunity to fund their self-directed retirement accounts and enjoy the potential benefits of investing in precious metals in the long-run.

Storage and Security

Storage is vital to owning bullion, but it is often overlooked.

For home storage, a safe deposit box that is waterproof, fireproof, and bulletproof offers you the highest security.

However, if you are a small investor and cannot, or does not want to invest in a safe deposit box right not, you can still hide your bullion in different places around your house, such as inside stereo speakers, cushions, a falso-bottom drawer or secret cupboard, and kickboards of kitchen units.

Another option is to hire a segregated storage depository service, especially one that offers customers with bullion insurance, covering the value of your precious metals in case they're stolen, lost, or damaged. This type of insurance is specifically designed to safeguard the total value of your bullion, differing from standard home insurance, which may not fully cover such assets.

SD Depository provides a fully insured precious metals secure storage service, backed by Lloyds of London, up to the melt value of your assets. Once your account is established, you can transfer metals from other locations. Your metals are allocated in your name and kept separate from others' storage.

Purchase Gold Bars at SD Bullion

We hope this page has helped you understand the key aspects of investing in physical gold bars, from their various sizes and advantages to essential considerations regarding storage and security. You learned that generally speaking, smaller bars tend to be more affordable and can guarantee more liquidity for new investors.

Whether used to safeguard wealth or as a tool for capital appreciation, gold bars remain a popular choice for people seeking to diversify their investment portfolios.

In addition to gold bars, SD Bullion offers a vast inventory of gold, silver, platinum and palladium coins and bars, tailored for your needs. Please contact us at 1(800)294-8732 or chat with us through our web chat feature on the bottom right of the page if you would like to talk to our customer service.

SD Bullion CEO Chase Turner's Overview

For thousands of years, gold bars have been used as a store of value and wealth for private citizens and countries. Today, gold bars still provide us protection against ravid inflation and economic uncertainties. When buying gold bars, I personally prefer Argor-Heraeus brand. Why? They're the largest processor of gold in the world. They're one of five referees for the LBMA that grade other's quality to make sure their fineness and purity meets very specific standards. I've been to their facility in Switzerland. They are the best at what they do, there is no comparision.

FAQs

Are Gold Bars as pure as Gold Coins?

Most gold bars and gold coins are 99.9% pure. The format itself does not affect purity. It is the alloy used in the manufacturing process that determines how pure a gold bar or gold coin really is.Why are gold bars less expensive than gold coins?

Gold bars are typically produced by private mints, whereas gold coins by sovereign mints. Therefore, gold coins enjoy legal tender status and a face value. Their purity and authenticity is certified by the issuing government. Additionally, counterfeiting legal tender coins usually comes with greater criminal punishment than regular gold bars. Finally, the minting process involved in the making of the intricate designs of gold coins tends to command higher premiums than gold bars.Is one gold bar better than another?

What determines the intrinsic value of a gold bar is its weight and purity. However, some brands are more recognizable than others. Thus, it might be easier to resell a gold bar from a prominent mint than from a less popular one.Why do Gold bars generally sell back for less than gold coins?

Gold coins carry legal tender status and are guaranteed by a sovereign government. As a result, they tend to be more liquid than gold bars. That translates to more affordable premiums for gold bars than for gold coins, including when selling them back.How do gold bars come packaged?

The Gold Bars sold here at SD Bullion can come in different packaging, depending on the manufacturer. Some bars can come in a tamper-evident box, in assay-cards, sealed in plastic or sheets, in a bag, or loose in a cardboard box. Please consult the description on the product’s page for more information. If not stated, contact our customer service at 1(800)294-8732.What is an Assay?

An assay is a test or analysis performed to determine the purity, composition, and quality of precious metals such as gold and silver, or platinum. For bullion products like bars and coins, an assay certifies the metal's weight and purity, ensuring its authenticity. Often, gold bars come with an assay card, which includes details like the assayer's stamp, weight, and the purity of the metal, giving buyers the peace of mind that they are investing in an authentic product.How do you pronounce Assay?

In American English it is pronounced /æsˈeɪ/, with the stress in the first syllable, and the first “a” pronounced as in “apple”. In British English it is pronounced /əˈseɪ/. The stress is in the second syllable and the first “a” is pronounced like /uh/ (as in “again”).Are there any anti counterfeit properties in gold bars?

Gold bars often include anti-counterfeit features to ensure authenticity, such as holograms, unique serial numbers, tamper-evident assay cards, and micro-engraving. Some bars also come with QR codes for online verification. The best way to avoid buying counterfeit bars is to shop for prominent mints and from respectable dealers only.Do bars in Assay buy back at a higher premium than loose bars?

Yes, gold bars in assay often buy back at a higher premium than loose bars. The assay card certifies the bar’s authenticity, weight, and purity, serving as an anti-counterfeit measure. Bars in assay are generally considered more trustworthy and easier to resell. Consequently, buyers and dealers may be willing to pay a slight premium for bars that remain sealed in their original assay packaging.Is a troy oz the same as a regular oz?

No. A Troy oz is a unit of measure specifically used in the precious metals industry for centuries. It is approximately 10% heavier than a regular oz. The regular ounce, also called avoirdupois ounce, is equivalent to 28.35 grams, whereas a Troy ounce is equivalent to approximately 31.1 grams.What are the Pros/Cons to buying smaller or larger gold bars vs the standard 1 oz bar?

Larger gold bars tend to carry lower premium percentages than smaller bars. In other words, you are able to buy more pure gold bullion content per dollar invested. However, smaller bars are more affordable, easier to transport and store, and tend to be more liquid than larger ones. Nevertheless, bullion bars overall tend to carry lower premiums compared to bullion coins, such as the Silver American Eagle, or Gold American Eagle.Can you buy gold bars at a bank?

Yes, some banks, particularly in countries like Switzerland, Canada, and certain European nations, do sell gold bars. However, in the U.S., it is less common for banks to offer gold bars. Instead, most buyers purchase gold bars from specialized bullion dealers, precious metal exchanges, or online retailers, such as SD Bullion. Make sure to shop only from respectful dealers to assure you are purchasing authentic gold bars.Are gold bars worth buying?

Gold has been used as a store of value for generations. In this fiat currency era, many investors turn to gold in times of economic crisis to hedge against inflation and protect their purchasing power. Gold tends to perform opposite to fiat currencies. For instance, any time the US Dollar is underperforming, you can expect gold prices to rise.How much is a gold bar worth?

A gold bar is priced based on the current gold spot price plus a premium charged by dealers (a markup). The gold spot price fluctuates during the day based on live transactions occurring on mercantile markets, such as COMEX and NYMEX. Thus, a gold bar will be worth the live spot price.How do I verify the authenticity of a gold bar?

LBMA accredited refineries will stamp their gold bars with hallmarks, which are indications of weight, purity and usually a serial number. Additionally, most gold bars come with an assayer's mark, attesting to the product’s authenticity. Some gold bars may be accompanied by a Certificate of Authenticity or an Assay card as well. Ultimately, you can take your bars to a bullion expert for verification. However, the best way to guarantee you are purchasing authentic gold bars is to shop from respected dealers only, such as SD Bullion.What factors influence the price of gold bars?

Mainly two factors influence the price of gold bars: the gold spot price, which is a live index that fluctuates during the day according to deals occurring on mercantile markets, such as COMEX and NYMEX; and premiums, which are markup percentages that bullion dealers charge over the gold spot price to cover business costs and obtain a profit. In the long run, the spot gold price rises or falls according to supply and demand, which, in turn, is affected by several factors, including macroeconomic instability, geopolitical frictions, inflation, interest rates, the strength of the US Dollar, and others.Are gold bars a good hedge against inflation?

Yes. Gold bars are a store of value that help you protect your purchasing power against inflation and fiat currency devaluation. As a hard asset that has been valued by millennia, gold is also a portfolio diversifier.Can I add gold bars to my retirement account (IRA)?

Yes, you can. You need a self-directed retirement plan. Additionally, your gold bar must be held by an authorized custodian. To be approved in a precious metals IRA, gold bars must be 99.5% pure.What are the tax implications of buying or selling gold bars?

In the United States, the Internal Revenue Service (IRS) classifies gold bars as collectibles. When you sell gold bars that you’ve held for more than a year, the profit is subject to long-term capital gains tax, with a maximum rate of 28%. If you sell within a year, any gains are taxed as ordinary income, according to your income tax bracket. It is important to consult with a tax specialist to understand the specific tax implications of buying or selling gold bars in your country or region.What documentation should I receive when buying gold bars?

That depends on the gold bar. Some are shipped without certification, while others carry a Certificate of Authenticity, or an Assay Card. Please consult the description on the product’s page for more information, or contact our customer support at 1(800)294-8732.Can I buy fractional gold bars?

Yes, you can. There are different size options of gold bars available for purchase here at SD Bullion to accommodate any budget. You can buy from small 1 gram gold bars to larger bars. Fractional gold bars include gram gold bars, and any fractional weight of 1 oz, such as 1/2 oz, 1/4 oz and 1/10 oz.What happens if I lose the assay card or certification that comes with the gold bar?

Gold bars with an assay card or certification tend to sell back at slightly higher premiums than the ones without them. The authenticity of your gold bars can still be attested by different tests bullion dealers can take to make sure they are purchasing a legitimate gold bar. However, you might receive a smaller offer than you would if you still had the assay card or certification.