Jump to: Silver Spot Price | What affects the Silver Price? | Silver Historical Data | Technical Outlook from October 2023 | What's Next? | How to Invest in Silver? | Silver Price Prediction 2023 - 2028 | FAQs

Silver has long been an object of desire for the human race. It has served as commodity money for millennia and helped with the foundation of Ancient and Contemporary societies.

Nowadays, the silver industry goes beyond the financial and jewelry markets. Due to its signature characteristics as a noble metal, silver is lustrous, soft, very ductile, malleable, and an excellent conductor of both heat and electricity. As a result, a myriad of cutting-edge technologies now rely on silver for their production, including electric vehicles, solar panels, 5G devices, and many others. That is why silver is considered an industrial metal.

There are many aspects that can influence the silver price, including interest rates, mine supply, industrial demand, Geopolitical tensions, and economic trends.

This blog will tie together all the key information as to how silver prices are determined, the factors that affect price fluctuations, and an analysis of the current global landscape. After considering these aspects, it will offer predictions for silver prices over the next five years based on insights from specialists.

This article, in no way, constitutes investment advice, and we encourage our readers to conduct their own research as well and try to come up with their own silver forecast based on their own experience.

What is the Silver Spot Price?

The silver spot price, in short terms, is the average price at which silver is currently trading in mercantile and futures exchanges, such as NYMEX or the LBMA. It indicates the cost of a Troy ounce of silver at a particular moment in time.

The spot silver price fluctuates during the day based on how much the market trades at a particular time. You can expect to see it slightly rising or falling every other minute.

What factors affect the silver price?

In the short term, the easy answer is that simple supply and demand dynamics influence silver prices. However, there is a deeper understanding of that statement. Various factors can influence the silver market in the long term.

Let's take a look at some of the factors that may affect silver price predictions in the following years.

Industrial Demand

Silver is a highly demanded metal in many industrial sectors, e.g., electronics, solar panels, photography, jewelry, among others.

According to the Silver Institute, silver industrial demand rose by 5%, and investments in physical silver increased by 22%. In total, physical silver demand climbed to a new high of 1.242 billion ounces. It accounts for nearly half the metal's annual demand.

On the other hand, silver production has basically stayed the same in the last two years. The recycling and mining sector produced just over 1,000 million ounces of silver combined, both in 2021 and 2022.

Economic Trends

Silver is a precious metal, and as such, it is a tangible, hard asset that tends to perform well during times of economic downturns. For instance, in times of rising inflation and with low interest rates from the Federal Reserve, analysts predict silver prices to rise as people allocate bigger portions of their investment portfolios into this asset class.

Thus, silver is considered a safe haven against economic turmoil, in other words, people expect silver to retain its value and purchasing power better than paper money (fiat currencies).

Geopolitics

Mexico, China, Peru, and Russia are some of the countries that produce the most amount of silver in metric tons per year. So, any geopolitical tensions involving these countries might deeply affect precious metals price prediction.

More recently, the escalating conflict in the Middle East has once again driven gold and silver prices upward, facing this challenging environment, as reported in the video below:

Strength of the Dollar

Source | Canva

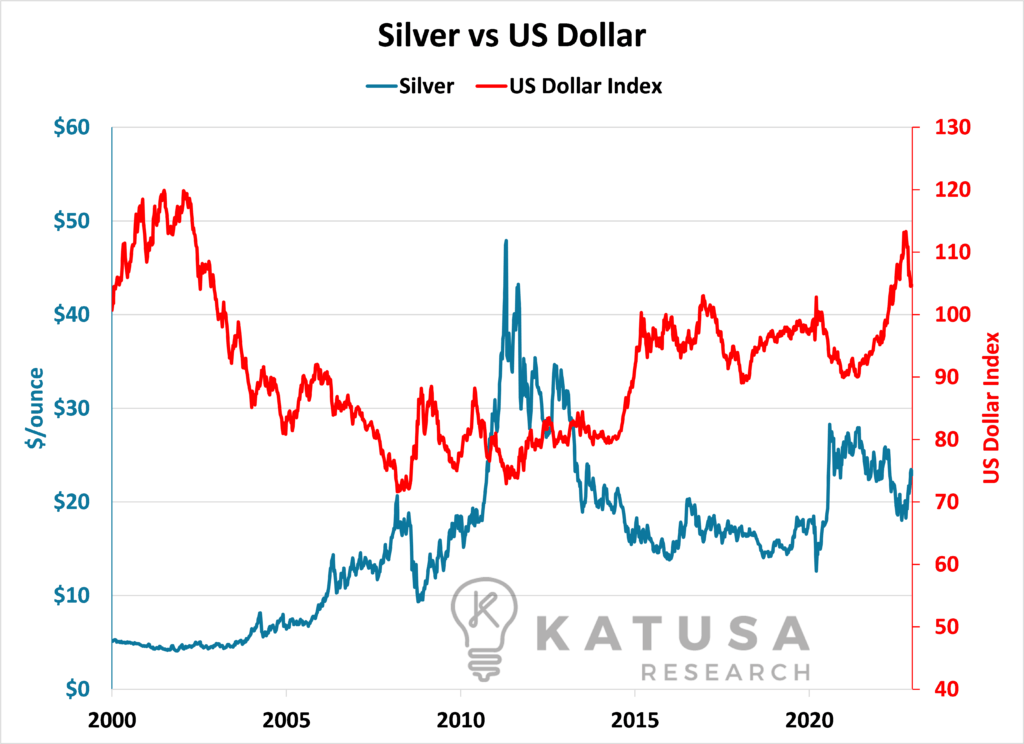

Another major factor influencing silver prices is how strong the US Dollar is performing. Remember that much of silver bullion's investment demand comes from investors trying to hedge fiat currency devaluation, protecting their wealth and purchasing power.

As we can see from the chart above, there is a clear correlation between the US Dollar and the silver price. Therefore, when the US Dollar is underperforming, you will likely see the metal prices rising.

Government Policies

Because gold and silver have been used as a medium of exchange for thousands of years, it is no surprise that the silver market continues to influence government actions and policies. That includes not only the amount of silver bullion central banks purchase as a safety net but also the amount of physical silver demand from the US Mint to produce silver bullion coins and numismatic products such as the American Silver Eagles.

Gold Prices

Traders and investors usually see gold as the more conservative precious metal, while silver as a more speculative investment.

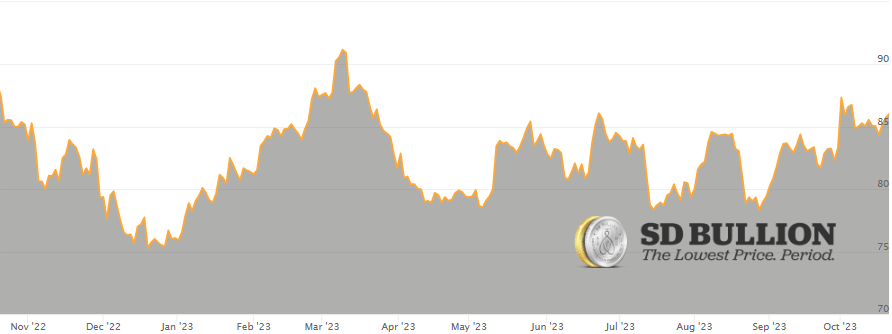

However, there has been a historical relationship between the price of gold and the price of silver since ancient times. So, for instance, when the gold price is rising, you can expect higher silver prices as well, thanks to the strong correlation between these two commodities. The Gold/Silver Ratio keeps track of the proportional difference between them in USD per ounce.

Gold/Silver Ratio 1 Year Overview

Silver Historical Data

Before speculating or forecasting the price of silver for the next five years, it is advisable to study past silver market moves.

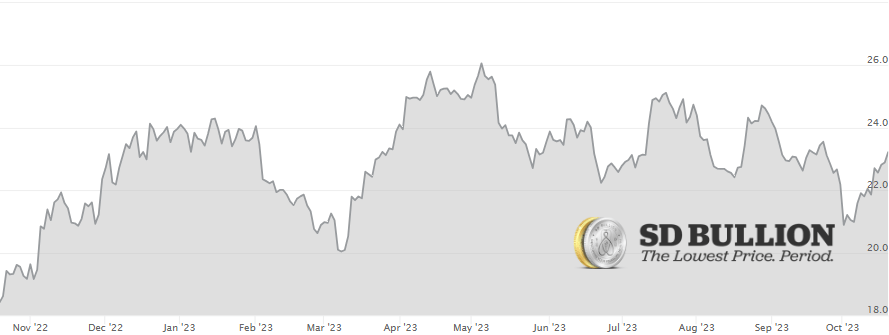

The silver price chart below demonstrates the average silver price from the last 15 years.

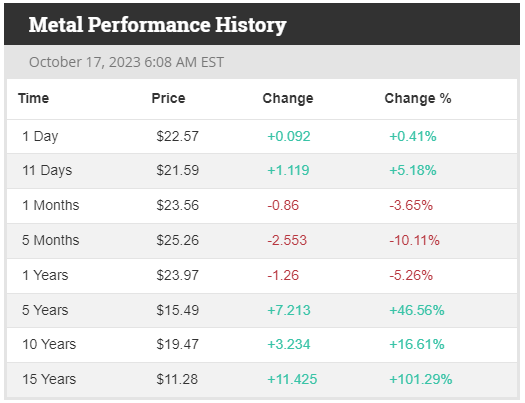

5 years ago, silver traded at $15.49 per ounce on average. Today, silver is trading at $23.54. That represents a growth of almost 50% in relation to the current price.

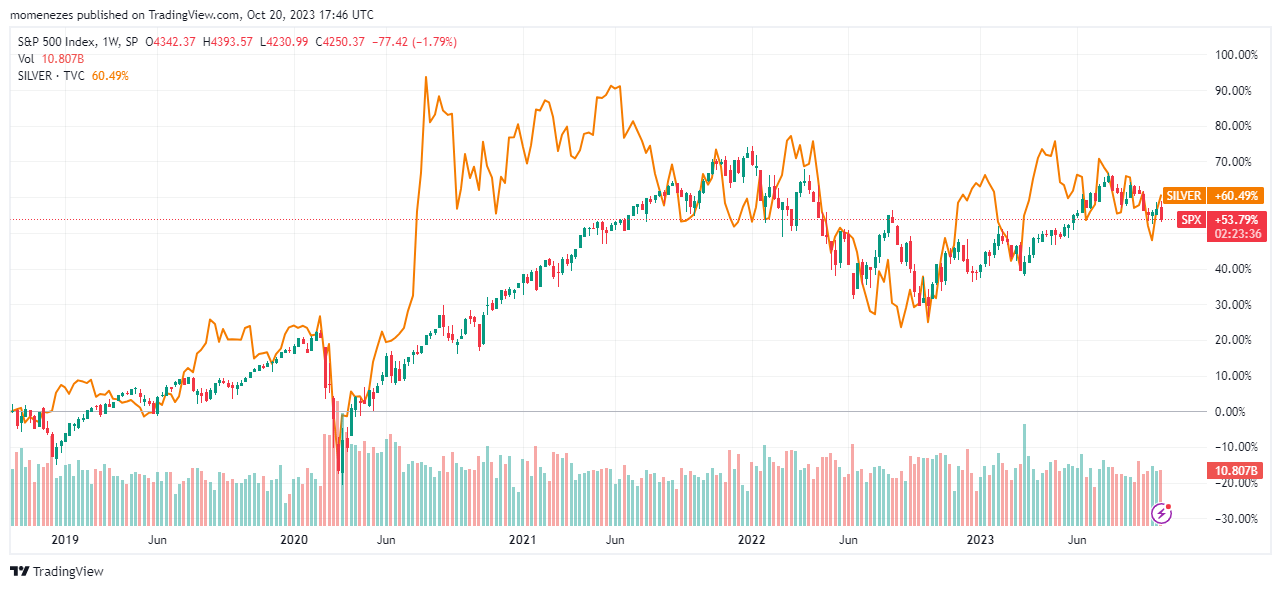

Another sensible way to study historical data is to compare silver prices with the broad US stock market (S&P 500), a strong benchmark for comparison. Here is an overview of the performance of both in the last five years:

As we can see, silver has outperformed SPX in the last five years, though not by much.

Retail investors should keep in mind, though, that this past trajectory does not necessarily mean silver prices will continue on the same path. As we have mentioned above, there are many factors that contribute to the rise and fall of physical silver.

Silver Price History: Macro Volatility is Key

Over the years, silver has helped to convey a broader understanding of the economic landscape. Its price movements are constantly tied to global macroeconomic events and shifts in sentiment, as we have previously stated.

In other words, any attempt at a silver price forecast must take into account the current geopolitical situation. We can see silver prices are intertwined with global economic growth, technological advancements, and fluctuations in manufacturing output.

This complex relationship emphasizes how macroeconomic volatility remains a key factor in silver prices, as it serves as both a harbinger of economic health and a hedge against economic uncertainty.

This fact is clearly visible in how silver prices behaved throughout the entire pandemic alert when many investors bought physical precious metals to hedge against global economic uncertainty.

Silver Price Forecast - Technical Outlook October 2023

The International Monetary Fund has recently published its October issue of the World Economic Outlook, which is a survey conducted by the IMF staff published twice a year. Their study has shown that Global growth is projected to fall from 3.5 percent in 2022 to 3 percent in 2023 and 2024.

The key factor slowing global economic growth is the continued effort from Central Banks to fight inflation with interest rate hike expectations. This scenario of high market volatility makes fiat currencies around the globe struggle, and, as a consequence, it potentially boosts physical precious metals' safe haven demand.

In addition to Central Bank policies affecting silver prices, the current geopolitical state has the potential to vastly affect financial stability. The ongoing economic uncertainty from the Russia-Ukraine war and now the Israel-Palestine war could potentially boost silver demand and other precious metals.

Source | Canva

This silver price trend could eventually spread to all silver markets and increase all forms of silver investment demand, from physical silver bullion to silver futures and silver mining stocks.

What's next for the silver market, according to specialists?

According to Peter Krauth from Silver Stock Investor, we are likely headed for one of the greatest silver bull market of our generation:

Gov Capital Silver Price Forecast, an algorithm-based forecasting service, issued a silver price prediction stating that silver is showing a rising tendency. The platform sees silver rising to surpass the $37 margin by the end of 2024 and maybe even going beyond $40 per ounce in the best possible scenario for the metal's price.

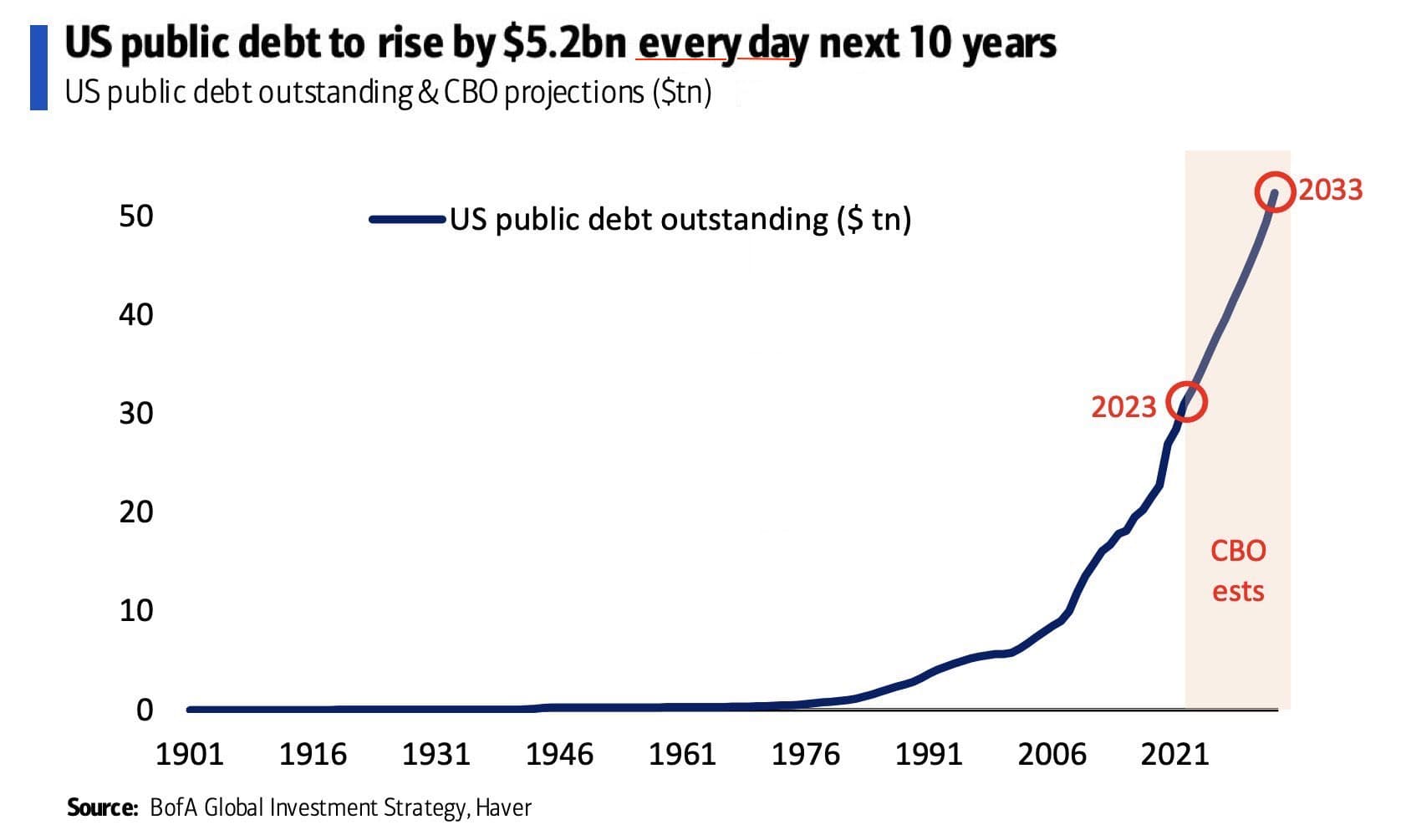

This uptrend should continue with rapidly rising interest rates and the devaluation of the US Dollar if the Feds fail to control the public debt, which is driving investment demand for all precious metal assets.

The Congressional Budget Office anticipates that the United States' public debt will surpass $50 trillion by the beginning of the next decade, likely in the 2030s.

When examining the historical trajectory of nations grappling with substantial debt relative to their GDP, the most probable course of action is to intentionally decrease the value of their official currency.

How To Invest In Silver To Take Advantage Of Its Potential?

The upside of investing in silver is that it works not only as a hedge against economic uncertainty but also shows promising characteristics of a speculative investment.

We have prepared a few overall guidelines for new and seasoned investors to fully take advantage of silver bullion investing.

1. Educate Yourself

This is not a random first item on the list. Conducting your own research is paramount to a successful investment.

If you are a new investor, start by studying the different forms of how to buy silver. Learn about the differences between purchasing physical silver bullion with silver coins and silver bars, for instance, and paper silver (ETFs, mutual funds, futures contracts, and silver mining stocks).

Move on to study historical price data and market trends. That should help develop your investor sentiment and get a better feeling of when to buy and when to sell silver.

2. Set Investment Goals

Setting up your investment goals is basically answering the question, "Why am I investing in silver?"

Are you just allocating a safe percentage of your investment portfolio for the long term to hedge against economic uncertainty, or are you open to short-term trading opportunities?

3. Choose the Right Form of Investment

Once you have learned the different ways in which you can invest in silver and set up your goals, decide on the proper way to achieve those. Physical silver bullion, like silver coins, bars, and rounds, provides a sense of security since you have full control and possession of your assets.

On the other hand, ETFs, silver futures, and mining company stocks provide a more speculative way of investing your money.

4. Look for Reputable Dealers

It is essential that you conduct proper research on precious metal dealers before buying them from questionable sources.

If possible, avoid purchasing them from online marketplaces if you can't be sure about the reputation of the dealer and the quality of the silver item.

Brick-and-mortar shops tend to have higher overhead costs to cover, so you can usually find better prices from online precious metals retailers such as SD Bullion, an Inc. 500 company, which has earned an A+ rating from the Better Business Bureau for over 10 years with more than 125,000 positive reviews from customers.

5. Diversify Your Portfolio

Diversification is key to managing risk. Avoid putting all your investments into a single asset class, whether it's silver or any other investment. Diversifying your portfolio across different asset classes can help spread risk.

6. Understand Market Trends

Keep an eye on market trends and factors that influence the silver price. Economic conditions, inflation rates, geopolitical events, currency movements, and so on.

7. Be Patient

Be aware that the price of silver can be volatile. Be prepared for fluctuations in the short term. Investing in silver often requires a longer-term perspective to take full advantage of its potential.

8. Seek Professional Advice

If you are new to investing or are considering a substantial investment in silver, it's a good idea to consult with a financial advisor who specializes in precious metals. They can provide guidance tailored to your financial goals and risk tolerance.

9. Stay Up-to-date with the Market

Continue to educate yourself about the silver market and any developments that could affect silver prices. Regularly review your investment strategy and adjust it as needed.

Silver Price Prediction - 2023 to 2028

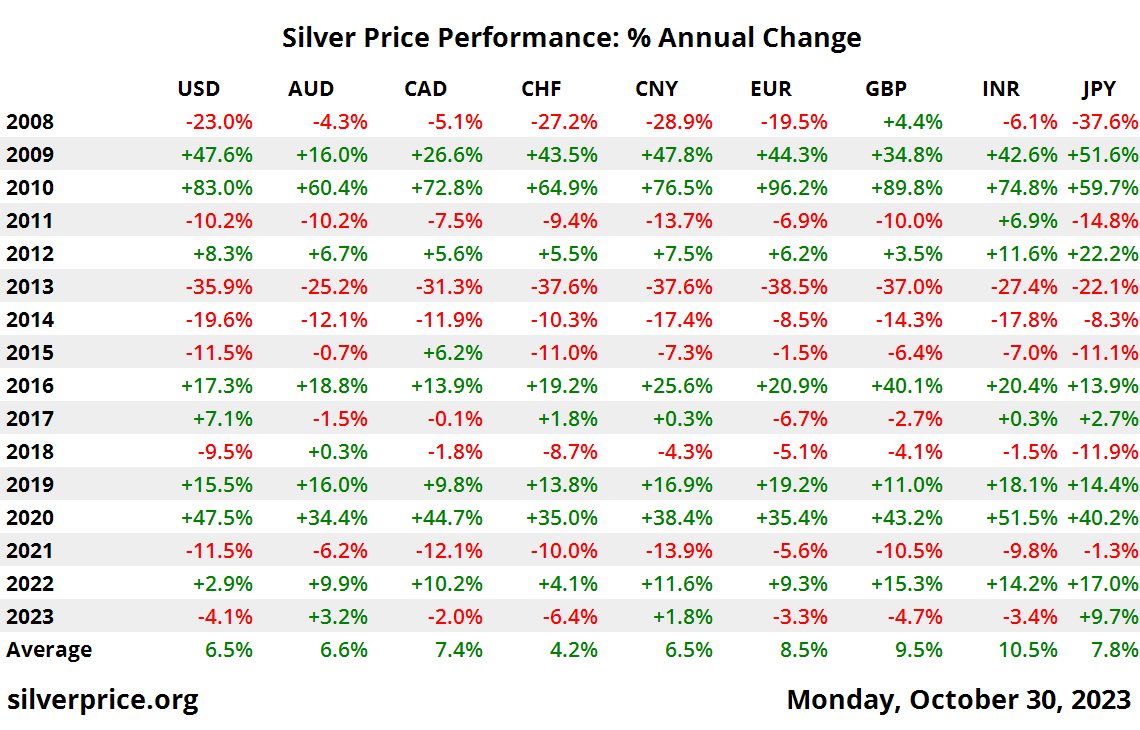

Now that we have established that the price of silver is likely to keep rising in the next 5 years due to global economic factors and geopolitics, we can analyze silver's price performance or its average percentage annual change from the last 15 years.

We can clearly see that the price of silver has risen an average of 6.5% in terms of USD per year since 2008.

As for the current price, in late October 2023, silver traded at around $23.68 per ounce after some outstanding few weeks, a growth of roughly 20% from the same period in 2022.

If we apply the same annual percentage growth to the current price average, this is the silver price prediction we can expect for the next 5 years in USD per ounce:

| 2024 | $23.68 + 6.5% gain | = $25.21 |

| 2025 | $25.21 + 6.5% gain | = $26.84 |

| 2026 | $26.84 + 6.5% gain | = $28.58 |

| 2027 | $28.58 + 6.5% gain | = $30.43 |

| 2028 | $30.43 + 6.5% gain | = $32.40 |

FAQs

Is silver a good investment?

Silver is a tangible, hard asset. That means that when you own silver, you own a real object of value that has been desired by humankind for millennia.

Is silver better than gold?

Not necessarily. As precious metals, both are hard assets that will potentially help hedge against inflation and economic instability. However, gold tends to be considered the more conservative, while silver carries a potential speculative possibility with short-term gains due to its high industrial demand.

What are the risks and opportunities for silver investors in the next few years?

One of the risks investors might face in the coming years is price volatility, influenced by market sentiment and economic shifts. Because silver prices are deeply rooted in these precious metal industrial uses, if the industry sectors underperform, it could affect silver demand and the silver price negatively.

On the other hand, silver offers wealth preservation and diversification, as it serves as a hedge against inflation and a safe haven in uncertain times. Growing industrial demand, historical performance, supply constraints, and concerns about currency devaluation present potential opportunities for silver investors in the coming years.

Will silver prices go up or down in 2023?

Based on the most recent expert forecasts, it is anticipated that silver prices will likely continue their upward trend, potentially approaching $25 in 2023.