Gold IRAs

Gold bullion is one of the oldest forms of investment there is. Since ancient times, owning gold has been used as a form of financial stability and security. Nowadays, many investors and precious metal enthusiasts seek physical gold as a way to hedge against inflation, high volatility in the stock market, and the debasement of fiat currencies.

US citizens also have the possibility of using bullion as a retirement investment. They can use precious metals, such as gold, silver, platinum or palladium bullion to fund individual retirement accounts, or IRAs. It is important to point out, though, that not all retirement accounts are eligible to be funded with precious metal bullion resources.

Keep reading to find more about precious metals IRA, its benefits and how you can fund it.

What is a Gold IRA?

IRA stands for individual retirement account, as mentioned above. A Precious Metals IRA can be funded with gold, silver, platinum or palladium bullion. A Gold IRA is, in a nutshell, a retirement account in which an individual chooses to fund with gold.

Every gold IRA is a self-directed retirement account. Contrary to a conventional IRA, the individuals themselves are responsible for managing their own self-directed retirement account. In addition, they are not limited to bonds, stocks, certificates of deposit, ETFs (exchange-traded funds) or mutual funds. For instance, they can use real estate or physical bullion as well.

Types of Bullion IRAs

A self-directed retirement account can be a variation of either a traditional IRA or a Roth IRA.

A traditional IRA is a retirement account in which the IRA holder can fund with pretax income. The investment grows free of capital gains or dividend income taxes until it is withdrawn.

A Roth IRA allows funding with after-tax income. That means both the earnings in the account and the action of withdrawing the funds are tax-free.

Upon retirement age (currently at 59.5 years), both types of account allow the IRA holder to withdraw the funds without any penalty. The main difference between the two is the moment in which the individual pays taxes. With a traditional IRA, taxes are due with the action of withdrawing, whereas with a Roth IRA, taxes are paid even before the funding of the account.

What are the benefits of a Gold IRA?

First of all, many experts believe investing in physical gold to diversify an investment portfolio could be a sensible choice on its own. Gold is a tangible asset that can be easily liquidated, stored and transported. It is resistant to tarnish and corrosion. It is less volatile than stocks and tends to perform well during times of economic crisis.

Moreover, by adding gold to their retirement plan, the investor is entitled to a range of benefits, such as the tax advantages mentioned in the previous section.

To top it off, all 50 american states have creditor exemption to precious metal IRAs to a certain extent. Business owners and self-employers, such as doctors, lawyers and dentists, use IRAs to keep their retirement investment safe from possible liabilities and lawsuits.

Click here to learn more about Gold IRAs protection from lawsuits, bankruptcy and creditors in the 50 states.

What products are IRA approved?

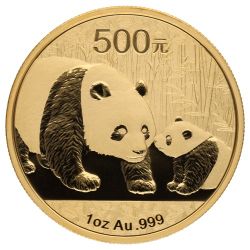

The Internal Revenue Service, or the IRS, is the government department responsible for defining the guidelines for IRA approved precious metals products. For a gold coin or gold bar to be allowed in an IRA, it needs to meet purity criteria. Gold bullion needs to contain .995 or higher purity levels. It is even stricter for other precious metals. Silver has to be .999 or higher, while platinum and palladium require .9995 fineness or higher.

|

Bullion type |

IRA purity criteria |

|

Gold |

.995 purity or higher |

|

Silver |

.999 purity or higher |

|

Platinum |

.9995 purity or higher |

|

Palladium |

.9995 purity or higher |

The American Gold Eagles could be seen as an exception to the .995 purity rule, because they are actually made with 22-karat gold, or .9167 fine. A small amount of copper is added to the alloy for improved resistance. Nevertheless, the copper is added on top of the pure gold content, so the coin is actually guaranteed to contain the amount of pure gold specified on it. In other words, the Gold Eagles are actually slightly heavier than other bullion coins, such as the Gold Buffalos and the Gold Maple Leafs.

Some notable examples of non-approved gold products include pre-1933 gold coins and the gold South African Krugerrand.

SD Bullion offers a variety of gold coins and gold bars that could be used in a retirement fund. This page is a compilation of products from our inventory that are IRA approved.

Popular IRA-approved Gold Bullion

Gold bullion coins are among the most common options to fund a self-directed retirement account. The reason being that a gold coin is issued and backed by a sovereign government. They typically carry a face value and are considered legal tender within the country that issued them.

However, some gold bars from world renowned private and national mints are popular too. Here is a list of some of those products:

Gold Coins:

- American Gold Eagle

- American Gold Buffalo

- Canadian Gold Maple Leaf

- Chinese Gold Panda

- Australian Gold Kangaroo

Gold Bars:

- Royal Canadian Mint Gold Bar

- Perth Mint Gold Bar

- PAMP Suisse Gold Bar

- Valcambi Suisse Gold Bar

How to set up a Gold IRA?

In order to open a self-directed retirement account and start funding it with your bullion assets, you will need to find an IRA Custodian, or IRA Trustee that is qualified and willing to hold the physical precious metal in your name.

As mentioned previously, the responsibility for the asset management in a self-directed retirement account is solely of the holder. So is the burden of research and due diligence.

Check out this page to learn more about Precious Metal IRA and find a list of Bullion IRA custodians.

Once your self directed IRA is ready to go, it is important to find a trusted precious metals dealer. Please consider SD Bullion as your place for bullion products. We have earned an A+ rating from the Best Business Bureau for 8 years and boast over 50,000 positive reviews from our customers. Contact our customer support at 1(800)294-8732 or through our live web chat feature in case you need any assistance. We are also available over email at sales@sdbullion.com.