Bullion is a lot less of a common word or term than silver.

The word bullion is based on old Latin 'bullire' which is ‘to boil’.

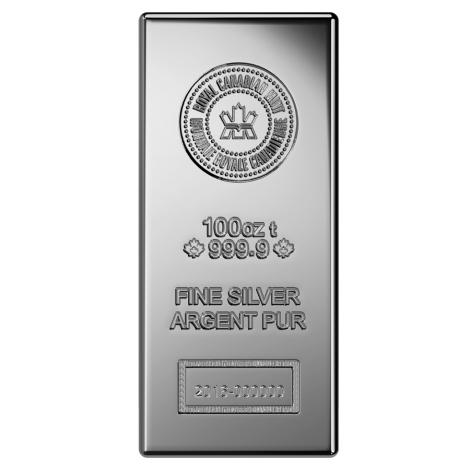

Essentially bullion is a precious metal bar, coin, or round mostly valued by its overall precious metal weight.

Here you can learn more information about what is silver bullion and how it's price is determined today.

Silver Bullion Meaning

Let us begin with some basic definitions of the two terms in question.

Silver - (n) a white precious metal, highly reflective and conductive, chemical element #47, symbol ‘Ag’. Valued since ancient times for adornment, as a dependable store of value, and now for use in abundant industrial applications for 21st Century lifestyles.

Bullion - (n) an item highly valued by the precious metal it contains. Comes in various forms like coins, bars, ingots, wafers, rounds, dust, grain, or shot.

Short Video on physical Silver's Journey into Bullion Stashes

What is Silver Bullion used for?

Typically for long term owners, silver bullion is held in coin or bar form as a dependable store of value and universal purchasing power.

Long term silver bullion owners include a very limited number of national governments and their central banks, commercial banks, hedge funds, pension funds, exchange traded funds, average individual people, and investors.

What is Silver Bullion worth?

Silver bullion is mostly valued by its overall precious metal content and weight. Thus for instance a 1 kilo silver bullion bar (which has just over 32.15 troy ounces of silver) will cost over 32Xs the price of a typical modern day government or private mint issued 1 oz silver bar or a government issued 1 oz silver bullion coin.

Today, globally monitored silver bullion values are mostly measured in financial markets by their reciprocal values in various fiat currencies. For example, in the United States we mostly measure the price of silver bullion based on its fluctuating 1 oz spot price in US dollar terms.

On the other side of the world, one of the world’s largest silver bullion buying nations is India.

Indian citizens have a strong appetite for silver jewelry, silverware, and silver bullion investments.

Indians mostly measure the value of silver bullion based on its fluctuating 1 gram (1 troy ounce of silver bullion is equal to 31.1035 grams of silver bullion) or 1 kilogram spot price (equivalent to 32.1507 troy ounces).

What is the Difference between Silver and Silver Bullion?

Due to heavy silver demonetization, today the word silver for most consumers in the world brings up thoughts of jewelry and silverware first. Secondly perhaps silver bullion coins, bars, rounds, etc. which are often physically bought and held for long term savings.

Most physical silver sold in the world today is bought and delivered in large 1000 oz bar size and done so for production means.

Aside from combined industrial and jewelry demand, physical silver bullion is also highly demanded in smaller coin and bullion bar forms (ranging from 100 oz to as small as 1/10 oz and even 1 gram sizes).

On a yearly basis just over1/2 of the physical silver which comes to the world’s newly mined and recycled scrap silver supplies is used in silver industrial applications.

Silver is second only to crude oil, in the amounts of finished products we use this white precious metal in. Element #47 with abbreviation ‘Ag’ is essential for the world’s increasing modern lifestyle demands.

The vast majority of the silver jewelry sold in the world occurs in eastern Asian nations (e.g. India as mentioned). Yet given the lacking savings held by western millennial generations and younger, it is rather conservative to suggest that cheaper silver jewelry products may continue to bolster silver jewelry demand versus more expensive precious metal jewelry applications (e.g. gold, platinum, and palladium).

Since the global financial crisis of 2008, the segment of silver demand used to produce silver bullion investment grade products has grown and consistently taken more market share since.

What is physical Silver Bullion?

Common sense would presume that silver bullion is by definition physical.

Of course this true.

Yet in our highly financialized world there are way many more synthetic financial derivatives in existence than there are real physical ounces of silver bullion above ground, and even less available to purchase at current prices.

For example in 2014, Bloomberg reported the annual silver derivatives market value to be $5 trillion USD while total physical silver supplies brought to market that same year totaled less than $30 billion USD in value. The leverage of silver derivatives traded on price action vs real physical ounces actually exchanging hands amongst owners likely remains in the triple digits (+100 oz silver proxy derivatives vs 1 oz physical silver).

One of the largest futures markets in the world is the COMEX. There fluctuating price discovery for silver derivatives and ultimately silver bullion too are mostly found via highly leveraged amounts of notional derivative ounces traded (electronic) vs underlying fractionally reserved silver bullion ounces actually held in warehouses for delivery (physical).

The high ninty percentile, or like 99% of silver futures contracts traded on the COMEX, are simply settled in US dollars (fiat currency) not in actual physical silver bullion.

It is this reason that long term gold and silver bullion buyers demand physical delivery and direct ownership as they simply do not trust the idea that ‘price will solve everything’ one day.

When you see the explicit term ‘physical silver bullion’ the writer is likely making a conscious decision to differentiate between actual physical silver bullion vs derivatives.

Derivatives are often used to trade silver spot price action, and they indeed for now dictate silver bullion prices. They include futures contracts on fractionally reserved commodities exchanges (e.g. COMEX), or in ETFs like SLV, or other paper silver machination tradings which far notionally outsize the about 4 billion ounces of silver bullion above ground in existence today.

Is Silver Bullion a Good Investment?

Silver is not like many other investments for first and foremost silver bullion is a precious commodity money which by its very nature can never fail or go bankrupt.

Buying and owning silver bullion is akin to saving fiat currency in a bank (where you get little to no reward and yet face many unkown risks). These days many large bank balance sheets are non-GAAP, dubiously solvent, and possibly insolvent. As well savers make very little interest for US dollars lent to most banks these days.

Under a full floating fiat currency monetary system, like we have currently live under today, silver bullion values tend to appreciate vs fiat currency over the long term.

In other words, an equal amount of silver bullion held vs fiat currency will buy more stuff over time (e.g. On the evening then President Nixon closed the Bretton Woods agreement August 15, 1971, $1.59 USD could buy you 1 oz silver bullion via the Friday’s prior silver fix price).

Of course with silver there has been price volatility (peaking near $50 oz twice since). Even at today’s near $16 oz USD spot prices for silver, there has been more than a 10 multiple in silver bullion values vs US dollars from 1971 to date.

Often today, middle class individual investors pay secure logistics companies to oversee and insure some of their directly owned silver bullion (paying typically 50 to 25 basis point annually).

Large silver bullion buyers often now choose to keep their silver bullion away from the banking and financial system entirely, as a true hedge against the inevitable restructuring ahead and to avert potential frauds.

As well, average US citizens are also taking direct discreet delivery of their silver bullion buys to door for safe long term keeping and savings.

So long as the United States issues Federal Reserve Notes (i.e. fiat currency) as its official currency, silver bullion values will likely be the benefiting reciprocal of lessening US dollar values ahead and over the long term.

Thank you for visiting us here at SD Bullion.