Gold Coins: Top Sellers

Gold Coins for Sale at SD Bullion

Throughout history, mankind has fought over the possession of gold bullion products since the Middle Ages. Even today, this precious metal is the most sought-after investment option, thanks to its enduring value and global demand.

Gold comes in various forms, making it possible for investors to choose the right type based on their goals. The three primary investment options are coins, rounds, and bars—each displaying distinct advantages and serving different investment strategies.

Gold coins hold a special place in every investor’s portfolio, and for good reason. Unlike rounds or bars, they are typically minted by the government or authorized private mints. They often bear legal tender status and denominations in national currencies.

This official backing enhances their credibility and liquidity. With their historical significance, government guarantee, and ease of trade, gold coins tend to be a safe-haven investment.

Why Gold Coins?

Because of their nature as precious metals, their intrinsic value far exceeds their face value; they are prized even higher due to their unique advantages.

Stronger Counterfeiting Penalties – While counterfeiting bars and rounds is illegal, forging official sovereign currency is a far more serious crime. This acts as a deterrent to counterfeiters and reinforces trust in gold coins as a secure investment.

- Legal Tender Status—Although their monetary denomination is much lower than their gold content, this serves as a government-backed guarantee that the coin will always retain some value, even in extreme economic downturns.

- Exceptional Quality Standards—Government mints hold samples like American Eagles, Maple Leafs, and Britannias to the highest production standards, ensuring superior design, striking appearance, and exceptional finish. While some rounds and bars rival their high craftsmanship, government-minted coins are generally more consistent.

- Long-Standing Coin Programs—Unlike private mints, governments have the financial resources to sustain multi-decade programs, which adds to their reliability and desirability in the numismatic market.

- High Liquidity— Gold is already a highly liquid asset, but gold coins can be even easier to trade and barter, especially in times of crisis, making them a preferred choice because of their flexibility.

Two Key Considerations When Buying Gold Coins

With countless gold coin options available in the precious metals market, investors and collectors rely on specific factors to guide their choices. The importance of these aspects varies from person to person, but two key considerations stand out:

Purity

While most government mints produce gold coins with a 0.999 (99.9%) purity standard, exceptions exist. Some coins contain 0.916 (91.67%) gold—commonly known as 22-karat gold—while others reach 0.9999 (99.99%) purity, also called “four-niner” gold. Always verify a coin’s purity before purchasing, because that may affect whether the coin can be accepted in a precious metals IRA or not.

Weight

Many refineries have transitioned to metric weights, with China’s Mint being a notable example. The coin’s weight is crucial for both investment and collectibility. The most popular options are 1 troy ounce and 30 gram gold coins, offering an optimal balance of affordability, size, and gold content.

Gold Coin Series/Gold Coin Programs

Some of the most renowned refineries produce gold coins to be part of collections, maintaining complete sets of specific coin series. Hence, identifying the program to which a gold coin belongs is paramount.

Famous Gold Coin Series

Our wide selection encompasses products from across the globe – ensuring that we bring the world's best to your doorstep. Here are a few of the most popular series, not only on SD Bullion but also in the world:

American Gold Eagle Coins

As the official gold bullion coin of the United States, the American Gold Eagle has been a cornerstone of the precious metals market since its introduction in 1986. The bullion program also includes silver, platinum, and palladium coins. These coins are struck by the United States Mint, along with the Gold American Buffalos. Its obverse features Augustus Saint-Gaudens’ iconic depiction of Lady Liberty, an emblematic symbol of freedom and strength, originally from the Gold Double Eagle coins.

For 35 years, the Gold American Eagle coins featured Miley Busiek’s reverse design of a bald eagle family. However, in 2021, the reverse design was updated to commemorate the 35th anniversary of the American Eagle Program.

The new design, created by Jennie Norris, presents a striking close-up of a bald eagle’s head, capturing its intense gaze and intricate feather details. This refreshed look enhances the coin’s appeal, reinforcing its reputation as one of the world's most popular and widely recognized gold bullion coins.

The 2025 1 oz American Gold Eagle Coin was a highly anticipated release, marking the 40th anniversary of this beloved gold coin. Along with the 1 oz Gold American Buffalo, these two gold coins are some of the most popular options among investors around the world.

Canadian Gold Maple Leaf Coins

Introduced in 1979, the Canadian Gold Maple Leaf was the second modern gold bullion coin to enter the market, following the Krugerrand. They are struck by the Royal Canadian Mint with an exceptional .9999 purity.

The reverse of the Gold Canadian Maple Leaf displays the country's national emblem, the maple leaf, with remarkable detail that highlights its natural veins and textures. The obverse featured the portrait of Queen Elizabeth II, leader of the British Commonwealth Community, updated periodically with each new effigy used on Canadian currency.

After Her Majesty’s passing in 2022, the Maple Leaf received a new obverse design depicting the effigy of King Charles III, the rising leader. In fact, the 2025 Canadian Gold Maple Leaf is only the second mintage featuring the likeness of the new Monarch.

South African Gold Krugerrand Coins

The Krugerrand, introduced in 1967, was the first modern gold bullion coin and was the only widely available option until the Maple Leaf debuted in 1979.

The South Africa Mint released Krugerrands to promote private gold ownership containing 91.67% (22-karat) gold. However, during the 1970s and 1980s, Western nations imposed sanctions on South Africa, temporarily restricting its circulation.

The reverse features the Springbok antelope, a national symbol, while the obverse showcases a portrait of Paul Kruger, the country’s fifth president and iconic political and military leader in national history.

British Gold Britannia Coins

First released in 1987, just a year after the American Gold Eagle, the Gold Britannia is one of the most established gold coin series worldwide. Originally struck in .917 (22-karat) gold, the Royal Mint upgraded to .9999 pure gold (24-karat gold) in 2013.

The reverse features Britannia, a powerful symbol of strength and protection, standing firm with her trident and shield. On the obverse, it has traditionally depicted the reigning British monarch.

Throughout its history, the Britannia series has showcased several portraits of Queen Elizabeth II, reflecting her reign at different stages. Following Her Majesty’s passing in 2022, the Royal Mint introduced a new effigy of King Charles III, marking a historic transition in the series and continuing its legacy under the new monarch.

The Royal Mint is also responsible for the prestigious Tudor Beasts series.

The Gold Price and Gold Coins

When you purchase gold bullion products, such as gold coins or private mint gold bars, from SD Bullion, your order is locked in at the current spot price of gold. This ensures complete transparency, so you know exactly what you're paying at the time of purchase.

Regardless of market fluctuations after your order is placed, your price remains fixed. Customers love this feature, as it allows them to choose the ideal spot price and confidently secure their investment on the same day.

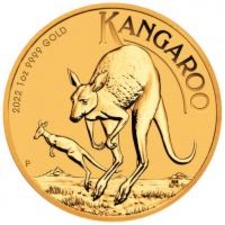

SD Bullion offers a wide range of gold products beyond those listed above. The list includes the Australian Gold Kangaroo coins, Chinese Gold Pandas, Mexican Libertads, along with a varied assortment of gold bullion bars from the most trusted private mints around the world, including Argor-Heraeus and Valcambi Suisse.

FAQs

Can you still buy gold coins from a bank?

Yes, you can buy gold bullion coins and bars from some banks, but it’s not common, and the selection may be limited. You might need to visit a specific branch or bank that offers gold. Alternatively, you can purchase gold coins from online retailers or pawn shops, where you may find a wider variety. Additionally, consider gold-backed securities and other investment options if you're looking for different ways to invest in gold.

Why should I buy gold coins instead of gold bars?

Gold coins offer historical, cultural, and collectible value that gold bars typically lack. They are often tied to unique designs (including some extraordinary high relief gold coins) with national significance, and rich traditions, making them more desirable for collectors. Gold coins are also easier to trade in smaller quantities than bars, providing more flexibility for investors. Gold coins are an excellent choice if you're looking for an investment that combines value and heritage.

What are the most popular gold coins to buy?

The most popular gold coins include the American Gold Eagle, the Canadian Gold Maple Leaf, the South African Krugerrand, and the Gold Britannia. Each is highly regarded for its purity, recognizability, and global demand. These coins are widely traded and offer reliable options, each with its unique design and history, but other exceptional options are available in the market, like the Perth Mint's samples or from the New Zealand Mint. Pre-33 US Mint gold coins, such as the Liberty Gold Coins, are also popular, especially if you are into coin collecting.

How can I be sure the gold coins I buy are authentic?

To ensure the gold coins you buy are authentic, it is wise to purchase from reputable dealers, such as SD Bullion. Look for trusted mints to buy your coins online and verify its weight, size, and design details. You can also request certification or assay reports for added assurance. If unsure, consider getting your coins appraised by a professional to confirm their authenticity and value.

What is the best way to store gold coins?

The best way to store gold coins is in a secure, climate-controlled environment. Options include a safe at home, a bank safety deposit box, or a professional storage service like SD Bullion’s insured depository. For added security, choose a safe with fire and water protection. If using a bank deposit box, ensure it's in a well-protected location. Always consider insurance for added peace of mind in case of theft or damage.

Is there a minimum or maximum amount of gold coins I can buy?

There is no minimum limit on the amount of gold coins you can buy, though some dealers may have physical size limits for coins or bars. However, large purchases may require tax reporting, and you may need to declare holdings for tax purposes. If you hold a significant amount of gold, tax authorities could inquire about your income source, especially if you lack proper documentation.

Do I have to pay taxes on my gold coin purchases?

You may need to pay taxes on gold coin purchases and sales. Some investment gold coins are exempt from VAT, but coins valued over $10,000 must be declared to U.S. Customs. Capital gains tax may apply when selling, and if it happens within a year, ordinary income tax could be due. Additional charges such as tax by state may also apply, depending on where the transaction occurs. Failure to report sales to the IRS can result in penalties or criminal charges. Holding them for over a year can help minimize taxes.

How does SD Bullion ship gold coins?

SD Bullion securely ships gold coins, typically using a padded pack or sturdy box via USPS Registered Mail, the safest method with insurance and tracking. Packages may be sealed with brown paper tape for added security. In some cases, a suitcase or canvas bag may be used. As a trusted dealer, SD Bullion ensures reliable shipping, competitive pricing, and a customer-focused experience.

Does SD Bullion offer discounts on bulk gold coin purchases?

At SD Bullion, customers receive special shopping conditions and discounts on bulk gold purchases. With competitive pricing and low premiums, buyers can access wholesale rates and reduce costs per ounce. Transparent pricing ensures clarity in every transaction. For added security, SD Bullion provides insured storage through top depositories nationwide as a safe and reliable option, making investing in gold easy and secure.

How do I track my gold coin order at SD Bullion?

SD Bullion is your place to buy and sell gold coins. Once your order ships, you can keep checking it at SD Bullion using the tracking number provided. They are delivered directly via USPS, UPS, or FedEx, and a signature may be required upon delivery. To ensure insurance coverage, you must receive the package directly. If your package is lost or damaged, SD Bullion will file a claim, and you must report any issues within three business days. For updates, check your carrier’s tracking system.

Is my gold coin order insured during shipping?

Your gold coin order is insured during shipping with SD Bullion. Products are fully insured, and expedited shipping is available for an additional cost. Customers can track their status and even opt for secure storage through SD Depository, which is insured by Lloyd’s of London. The safest shipping method for gold and silver bullion is USPS Registered Mail, as other USPS services only offer limited coverage. To enhance security, discreet labeling is recommended when shipping precious metals.

How can I contact SD Bullion if I have more questions?

SD Bullion’s customer service operates live during regular business hours to meet customers’ quick response and live shopping demands. Our team answers our service line at 1(800)294-8732 and the web chat feature on our website.

Which Coins are most recognizable worldwide if I wanted to barter with them?

American Gold Eagles are among the most recognizable gold coins in the world. They enjoy the high prestige of the US Mint and the backing of the US Government. Other possible options include Canadian Gold Maple Leafs, British Gold Britannia coins, and Gold Krugerrands. These can be highly liquid options if you want to sell gold coins in the future.