-

Silver American Eagles

-

Privy Mark Silver American Eagles

-

Graded Silver American Eagle Coins

-

Silver Eagles Monster Box

-

American Silver Eagle Proof Coins

-

US Mint Commemorative Silver Coins

-

Burnished American Silver Eagle Coins

Silver Eagles: Top Sellers

American Silver Eagle Coins

The American Silver Eagle stands as the world’s most trusted and popular silver bullion coin, widely admired by both investors and collectors. Introduced by the U.S. Mint in 1986, it quickly became a cornerstone of the precious metals market thanks to its enduring design, government backing, and guaranteed silver content of one troy ounce of 99.9% pure silver. Its reputation for quality and authenticity makes it a go-to option for anyone seeking a reliable physical silver asset.

Highlights

-

Official silver bullion coin in the US since 1986;

-

Purity & Weight: Contains a full 1 oz (one troy ounce about 31.1 grams) of .999 pure silver;

-

Backed by the U.S. government with a USD 1 monetary denomination;

-

IRA-eligible precious metals investment;

-

Classic Obverse design by Adolph A. Weinman;

-

Since its inception in 1986, the coin has featured two reverse designs, the first by John Mercanti and the second by Emily Damstra;

-

Recognized worldwide for authenticity and trust;

-

Available in brilliant uncirculated, proof, and burnished versions;

-

Offered in bulk through Monster Boxes of 500 coins;

Each Silver Eagle contains one troy ounce of .999 fine silver, offering a combination of purity, weight, and artistry that has set the standard for modern silver bullion coin. The coin features the iconic Walking Liberty design, symbolizing freedom and American heritage, while its reverse showcases the strength and security associated with U.S. Mint craftsmanship. Backed by the U.S. government for weight, content, and purity, Silver Eagles are also IRA-approved and globally recognized, enhancing their appeal as a long-term investment.

Available in brilliant uncirculated bullion, proof coin, and burnished finishes, Silver Eagles cater to a wide range of buyers—from those seeking an accessible hedge against inflation to collectors looking for certified silver eagles. Their high liquidity, established global demand, and aesthetic appeal make them a preferred choice for diversifying portfolios with tangible silver. Whether for investment security or numismatic enjoyment, American Silver Eagles continue to be one of the most sought-after precious metal products in the world.

The American Silver Eagle Program

Launched in 1986, the American Eagle Coin Program introduced the United States' official gold and silver bullion coins.

It was authorized by two pieces of legislation in 1985: the Liberty Coin Act, which authorized the production of silver samples, and the Gold Bullion Coin Act, which authorized the American Gold Eagle, signed into law by President Ronald Reagan.

The Silver American Eagle quickly became a standout, offering beauty and trusted metal content. Over the decades, it has earned a reputation as the world’s leading silver coin.

The 35th Anniversary

In 2021, the American Silver Eagle celebrated its 35th anniversary with a design update. This landmark event revitalized the series and marked a new era for collectors, making both reverse designs highly sought after.

The Design

The design symbolizes America’s core principles valued by the Founding Fathers.

The Obverse Design

Adolph A. Weinman designed the Walking Liberty for use on half-dollar coins from 1916 to 1947, and it was later revived by the American Eagle Program in 1986.

It depicts Lady Liberty striding confidently toward the rising sun, symbolizing hope and renewal. Draped in the American flag, she carries oak and laurel branches in her left arm, emblems of strength and victory, while her right hand outstretched, embodies peace and the promise of new beginnings.

The obverse side also displays the inscriptions 'LIBERTY,' 'IN GOD WE TRUST,' and the mintage year. This design has become an enduring emblem of U.S. coinage.

The Original Reverse Design

The reverse depicts the Heraldic Eagle beneath the stars, representing the Thirteen Original Colonies. It has the National Shield on its chest, arrows in its right talon and olive branches in the other, and a banner with "E PLURIBUS UNUM" in its beak.

It is inscribed with "UNITED STATES OF AMERICA," "1 OZ FINE SILVER," and "ONE DOLLAR," informing the coin's denomination, weight, metal content, and purity.

The 2021 Reverse Design

Introduced for the 35th anniversary, the design by artist Emily Damstra showcases a contemporary image of a Bald Eagle in mid-flight, clutching an oak branch in its talons.

It emphasizes realism and natural beauty, capturing the strength and resilience of the nation’s symbol.

The inscriptions on the reverse side remain the same.

Technical Specifications

-

Purity: .999 fine silver

-

Weight: 1 troy oz (31.103 grams)

-

Face Value: $1 USD (legal tender)

-

Edges: Reeded

|

Brilliant Uncirculated Silver Eagles |

Proof Silver Eagles |

Burnished Silver Eagles |

|

Standard uncirculated coin. Affordable and widely traded, they are the backbone of the series. |

Special treatment of the dies and planchets results in polished surfaces and frosted design details. Reverse Proof Coins showcase the exact opposite visual effect: frosted surface and mirror-like design elements. |

Blanks are cleaned of all oxides formed during the annealing and rimming process. This way, burnished coins achieve a satin finish and a smooth surface, but with a less reflective luster than Proof American Eagles. |

Mint Marks

Mint marks play a key role in identifying where an American Silver Eagle bullion coin was struck, and they often influence a coin’s desirability among both investors and collectors.

Collector verstions proudly display mintmarks on the reverse, above the eagle's tail, to highlight their origin and authenticity and differentiate them from the bullion version. The San Francisco Mint, for example, issues “S”-marked samples, often reserved for special or limited releases.

The West Point Mint, home to the “W” mint mark, is the primary facility for striking Proof Coin and Burnished samples, which are widely sought after by numismatists. Meanwhile, the Philadelphia Mint occasionally produces commemorative or specialized collector versions, distinguished by the “P” mark.

Commemorative Issues & New Privy Marks

Throughout the centuries since its creation, the United States Mint has released various commemorative coins that celebrate key moments in American history, culture, and achievements. Notable examples include the 1900 Lafayette Dollar and the Apollo 11 50th Anniversary Coin. Additionally, proceeds from some of these issues have helped support national programs and community projects.

The American Silver Eagle Series is also filled with special releases that feature low mintages and are only available for a limited time.

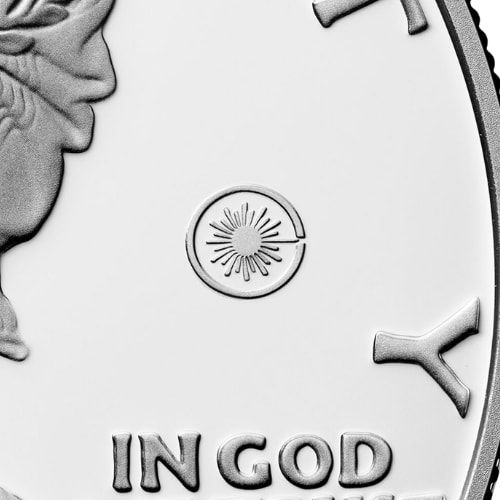

Some issues have also incorporated the use of privy marks: small symbols added to the design to commemorate events, honor military milestones, or engage collectors. The most recent released privy marks celebrated the 250th anniversary of the US military forces.

Others reflect successful partnerships forged by the US Mint, such as the Star Privy. Created in collaboration with the immersive mobile RPG Eight Era by Nice Gang, the Star Privy Mark aims to spark renewed interest in coin collecting among gamers and highlight the Mint’s innovative approach to engaging new audiences.

The Laser Beam Privy celebrates the new laser-engraved master tooling technology used to create dies, enhancing design detail, quality and anti-counterfeiting security measures.

The Monster Box

The Silver Eagle Monster Box comprises 20 sealed tubes, each housing 25 new US Silver Eagle Coins. As each coin weighs 1 oz, the total amount of silver in the monster box corresponds to 500 oz. After being selected and certified at the US Mint branch, the tubes are sealed so they remain protected from undesirable contact during packing.

Individual sealed tubes are also available. They are mintcertified, guaranteeing each coin is in premium uncirculated condition.

The United States Mint

The US Silver Eagle is struck by the US Mint, a historic institution established in 1792.

Known for its exceptional standards of craftsmanship, it produces samples that represent America’s financial security and cultural legacy through its four branches: West Point, Philadelphia, San Francisco, and Denver.

Invest in US Silver Eagles

Start or expand your collection today with American Silver Eagles from SD Bullion. Whether you’re stacking silver for wealth preservation or seeking prized collector editions, we offer a wide selection.

SD Bullion CEO Chase Turner's Overview

Silver Eagle coins are the most popular silver bullion coins in the world. If you're new to buying silver bullion or silver coins, I'd highly recommend getting some for your portfolio. Not only are they likely the most liquid coins in the world, but due to their popularity, they appreciate and hold their value unlike any other silver bullion coin you can invest in, especially if you're buying in bulk and can afford sealed boxes of silver eagles. Buy some, but don't open them. Unopened boxes get more valuable with each year that passes.

FAQs

What is the silver purity/metal content of the American Silver Eagle?

Each Silver Eagle coin contains exactly one troy oz (31.103 grams) of .999 silver. This high purity, combined with a U.S. government guarantee of metal content and authenticity, makes it a trusted option for both investors and collectors. Its intrinsic value, global recognition, and liquidity make it one of the most reliable and sought-after silver coins globally.

What are the specifications (weight, diameter, thickness) of the coin?

The Silver Eagle weighs one troy ounce (31.103 grams), measures 40.6 mm (1.598 inches) in diameter, and has a thickness of approximately 2.98 mm with a reeded edge. These consistent specifications ensure uniformity across editions, making them highly recognizable, easy to handle, and reliable for investment. Collectors and investors can confidently store, trade, or verify them.

When was the coin first minted / what is its legislative history?

The American Silver Eagle was first issued in 1986 to provide investors with a U.S.-backed silver investment while honoring national symbols. Since then, it has become the most recognized silver coin worldwide, combining legal tender status with collectible appeal, bridging the needs of investors seeking physical silver and collectors valuing historic and artistic significance.

Which mint(s) produce the Silver Eagles, and are there mint marks or variations by mint?

Silver Eagles are primarily produced at the West Point Mint (“W”) since 1998, with past production also occurring at the Philadelphia (“P”) and San Francisco (“S”) mints. Bullion coins often lack mint marks, while collector editions display them on the reverse side. The marks indicate the origin and production facility, which can affect rarity or collectibility. They help investors verify authenticity and collectors identify special or limited editions, which can significantly impact a coin’s value.

How can I verify authenticity, or what to look for to avoid counterfeits?

Authentic Silver Eagles should match precise weight, diameter, thickness, and feature a reeded edge. Buyers should work with reputable dealers, check certification when available, and inspect coins for sharp design details, clear inscriptions, and consistent finishes. Grading services like PCGS or NGC provide added security, encapsulating samples to certify authenticity and reduce the risk of counterfeits, ensuring your investment is protected and reliable.

Are American Silver Eagles legal tender?

Silver Eagles carry a denomination of $1 USD and are legal tender under U.S. law. However, their intrinsic metal content and collector value far exceed the nominal face value. They are primarily purchased for investment or numismatic purposes, not for circulation. Legal tender status adds credibility and trust, backed by the U.S. government, making them a secure choice for both investors and collectors.

What is the difference between bullion, proof, and burnished/collectible Silver American Eagle Coins?

Bullion coins are mass-produced for investors, valued mainly for their metal content. Proof versions feature a mirror-like finish and frosted details, made for collectors seeking artistry. Burnished coins are struck on polished blanks, resulting in a satin-like finish and lower mintages, which makes them more exclusive. Each finish serves a distinct audience, from stackers focused on investment to numismatists seeking collectible rarity and beauty.

What is meant by “monster box,” “roll,” and “tube” in relation to Silver Eagles?

A “monster box” contains 500 one-ounce Silver Eagles, packaged in sealed tubes of 20 units each. A “tube” holds them in a protective cylinder, while a “roll” typically contains 20 units individually wrapped. These packaging options make bulk purchases convenient, secure, and easy to store, especially for investors seeking to buy or sell large quantities efficiently.

Are American Silver Eagle coins IRA eligible?

Yes, they are approved for precious metals IRAs. Investors can hold them in self-directed IRAs to diversify retirement portfolios with physical silver. Their government-backed purity, legal tender status, and recognized market value make them ideal for long-term investment, offering both tax advantages and portfolio protection, while providing a tangible hedge against economic volatility.

What should I know about shipping, insurance, and delivery when ordering Silver Eagles?

Always use reputable dealers offering insured, trackable shipping. Packages should be securely wrapped to prevent damage. SD Bullion provides full insurance during transit, ensuring items arrive safely. Delivery times vary by quantity, location, and demand. Proper handling and insurance protect your investment from loss, theft, or damage, giving buyers peace of mind when purchasing physical silver online.

What is the best year to buy Silver Eagles?

The best year depends on your goal. Collectors may prefer low-mintage or special-design years, such as 1986 (the first release), 1995-W Uncirculated, or 2021 (the debut of the reverse redesign). Investors focused on metal content often opt for current-year bullion coins due to their minimal premiums. Mintage numbers, historical significance, and market trends influence which year offers the best value or collectible appeal.