Silver Eagles are the official U.S. bullion coins. Legal tender and widely trusted, they are minted in .999 fine silver and backed by the historic U.S. Mint. However, it's not uncommon for investors to ask, “Why is American Eagle so expensive?”

The quick answer would be that they are the best-selling bullion coins in the U.S., favored not only for their quality and reliability but also for their prestigious origin and iconic patriotic designs that resonate deeply with American collectors and investors alike.

That said, this article explores why Silver Eagle Coins are so expensive, highlighting their government backing, high purity, and strong collectible appeal.

Who makes Silver Eagle Coins?

The US Mint has made 1 oz American Silver and Gold Eagle Coins since 1986.

Since its launch, the U.S. Mint has produced more than 600 million of the Silver version.

The Silver American Eagle

Their platinum Coin was released in 1997, and the palladium version only came around in 2017.

The Platinum American Eagle

The Palladium American Eagle

The United States Mint, one of the federal government’s oldest agencies with over 200 years of history, is renowned for producing some of the highest-quality bullion products in the market.

Its longstanding reputation plays a significant role in the strong value of the coins it mints. With production facilities in Philadelphia, Denver, San Francisco, and West Point Mint, the institution employs various advanced technologies and processes.

Behind the American Silver Eagle's smooth design is a reeded edge, a relatively modern anti-counterfeiting feature. Historically, people shaved metal off coin edges for profit, and reeding prevents this.

As one of the largest mints in the world, it produces billions of circulating coins, bullion pieces, national medals, and numismatic products each year. Such a strong reputation attracts many investors and elevates their products' value in the coin collectors' eyes.

Silver Coin Seigniorage Fee

Seigniorage is another key factor in understanding the price of government-minted silver bullion coins. The following is a brief explanation of what this fee entails.

Silver Coin Seigniorage Fee - (n) an additional premium over the fluctuating silver spot price charged by a government mint that issues silver bullion coins. The difference between the melt value of silver coins (essentially the spot price), and the government mint's production costs and profits to be attained by selling their silver coins.

A silver coin seigniorage fee is charged by government mints that produce government-guaranteed physical silver bullion coins. This surcharge helps government silver mints recoup their silver coin production costs, and perhaps make a profit as well.

American Eagle Silver Coins - Value Inputs

Besides mint-related aspects, broader market dynamics play a role in the coin’s price, starting with the silver spot price, reflecting the global silver rate on commodity exchanges.

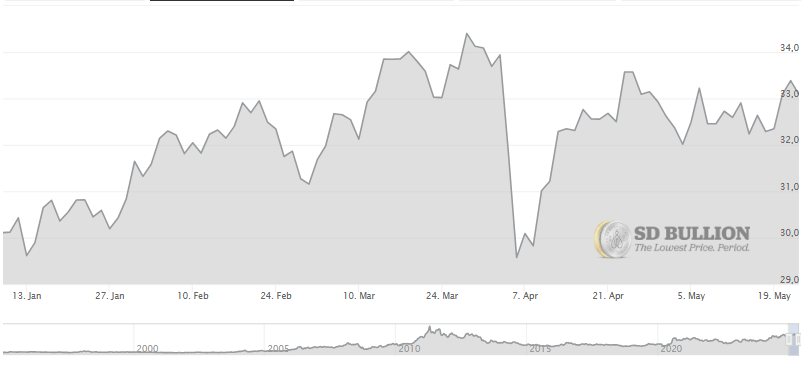

The spot price can also be understood as the price of purchasing a specific asset for immediate delivery. It fluctuates several times in a single day and influences most of the cost of a silver coin. As in May 2025, it fluctuates at around $33,00, so a highly pure silver coin should not be less than that now.

Silver Coin Dealer Premiums

Silver bullion coin dealer supply chains can also add a premium to their silver coin prices to recoup the costs associated with buying, inventorying, hedging, marketing, selling, and safely shipping purchased silver coins to their respective buyers.

Silver coin prices and premiums are influenced by several shifting factors, including current supply and demand, the volume of coins being traded, broader economic conditions, the coin’s condition (new, secondary market, or damaged), the seller’s pricing strategy, and the specific year of mintage, as some years have significantly lower mintages than others.

Silver Eagles As An Investment

Silver, like gold, has been valued for centuries and is often used as a hedge against inflation due to its intrinsic worth. There are various ways to invest in silver, but since we are focusing on coins, two popular methods are Silver IRAs and Silver Stacking.

A Silver IRA functions like a traditional IRA, but the funds are used to purchase silver bullion and other approved precious metals, such as gold, platinum, and palladium. The IRS enforces strict purity standards, but fortunately, the American Silver Eagle meets these requirements and remains one of the most trusted options for this type of investment.

Silver stacking is the practice of accumulating silver through bars, coins, rounds, and other bullion. Each type appeals differently depending on the investor’s goals.

We offer a complete Silver Stacking series covering everything from a comprehensive beginner's guide to the best products to start your stack.

Coins typically carry higher premiums than rounds or bars due to government backing, intricate designs, security features, and higher minting costs.

The 1 oz American Silver Eagle and the Canadian Silver Maple Leaf are two of the most popular silver coins in the market, holding both investment potential and historical significance.

Collectible Appeal: Design

The collectible appeal is key for numismatic coins. Silver Eagles are considered semi-numismatic, combining the traits of both investment and collectible coins, with value tied to rarity and historical significance.

The American Silver Eagle’s design reflects core American values. The obverse, by Adolph A. Weinman, depicts Liberty in stride, draped in the flag, holding laurel and oak branches, inspired by the Walking Liberty half dollar design.

In 1792, Congress mandated that coins represent Liberty, not real people, to honor the nation’s founding ideals. Influenced by classical Greece and Rome, Weinman’s design presents America as powerful, yet peaceful and enlightened.

Obverse Design

The reverse design, updated in 2021, shows a bald eagle landing with an oak branch, symbolizing strength and renewal. The bald eagle, the national bird since 1782, also appears on the U.S. seal.

Reverse Design

The lowest mintage number and highly sought after is the 1996 silver eagle. With a mintage number of around 3 million specimens, according to the professional coin grading service PCGS, this nonproof issue year remains highly sought after because of its rarity.

With a mintage of 3,603,386 and a silver purity of 99.93%, this coin reached an auction record of $21,850 for a perfect MS70 grade in September 2009, at Heritage Auctions.

Options of Purchase

Different finishes can also imply a higher price on the coin. Check below:

Burnished Coins: Burnished coins have a soft, matte finish created by gently polishing the metal blanks before striking. This process gives them a smooth, elegant look, distinct from regular shiny coins.

Proof Coins: Proof Silver Eagles are crafted with exceptional precision, showcasing sharp details on both sides. Known for their superior quality and mirror-like finish, they are highly sought after by collectors.

Brilliant Uncirculated (BU) Coins: These uncirculated coins retain all original features and are a popular choice among Silver Eagle bullion buyers.

Check below from left to right, an example of the Burnished, Proof, and Brilliant Uncirculated Silver Eagles.

Brilliant Uncirculated, Burnished, and Proof versions are identical in terms of purity. The obverse and reverse designs are the same; the finish sets them apart.

Burnished coins have a matte look, Proof coins feature sharper details with a mirror-like effect, and Brilliant Uncirculated coins display the standard luster of a newly minted coin. As you might have already guessed, the proof version is the most expensive, due to the extra work involved in its final look.

Best Silver Coins to Buy?

Premiums for the American Silver Eagle have been rising due to growing demand from investors seeking a hedge against inflation through precious metals like silver. Since the pandemic, gold prices have surged, driving interest in other metals like silver, setting a trend of steadily increasing premiums over time.

The bottom line is that 1 oz American Silver Eagle coins are still one of the world's most highly purchased and sold high-mintage silver bullion products, which is why they are so expensive.

The fact that their premiums tend to increase the most during bullion shortages potentially allows some interesting arbitrage opportunities for American Silver Eagle coin holders during bullion shortage episodes.

Recap

This article set out to answer the question, “Why are Silver Eagles so expensive?” We explored the key factors that influence their cost.

As you learned, the U.S. Mint is the sole Silver Eagle Bullion Coins producer. It guarantees the coin’s weight and purity, and its production capacity affects its value, evident in the higher prices of rarer editions. This quality and trust make Silver Eagles suitable for investment portfolios and IRAs.

The cost of American Silver Eagles is also tied to its iconic design, featuring Walking Liberty and the bald eagle, symbols deeply rooted in American identity. Special editions, proof coins, and uncirculated versions often carry a higher premium, especially among collectors seeking high quality coins.

The U.S. Mint doesn’t sell Silver Eagles directly to the public but distributes them through authorized dealers, who then sell to retailers and collectors. Smaller dealers often add markups to stay profitable, shaping the final price you pay.

We hope this silver eagle's brief overview has helped clarify the main factors behind the price of American Silver Eagles and provided tools to assess the value of any precious metal coin going forward.

FAQs

Is American Eagle considered high-end?

While not an exceptional rarity, the American Silver Eagle holds a significant place in U.S. coinage. Its global recognition, strong collector demand, and the release of limited and commemorative editions make it a highly collectible and respected bullion coin.

What is special about American Eagle?

The American Silver Eagle, produced by the U.S. Mint, is not rare but is highly recognized worldwide. As the top bullion coin in the U.S. and made of 99.9% pure silver, its global reputation, legal tender status, and silver purity make it a premium choice for investors and collectors.

Why do American Silver Eagles have higher premiums compared to other silver coins?

In the bullion market, the premium is based not only on their high purity of .999 silver, but also on their status as the finest example of American bullion coinage. Backed by the U.S. government, they are legal tender for public debts and feature highly symbolic, detailed designs.

What are the differences between American Silver Eagles and other silver bullion coins?

American Silver Eagles share many qualities with other bullion coins like the Canadian Maple Leaf and Silver Britannia: high purity, government backing, and global recognition. However, many investors buy American Silver Eagles because they stand out as the most trusted and preferred option among American buyers in the United States.

How much silver is in an American Silver Eagle coin?

Following the Silver Eagle quality standards, each coin contains 99.9% pure silver, also known as .999 fine silver. Each coin holds exactly one troy ounce of silver, which is approximately 31.1 grams. The value of the American Eagle Silver coins, however, surpasses their value in silver. Besides their silver content, the premiums on American Silver Eagle coins rely mainly on their intrinsic design (resulting from a US Mint artistic sculpting process), their security features, and liquidity.

Why are there additional costs for Proof or Burnished American Silver Eagles?

Proof and Burnished American Silver Eagles cost more because they are produced in smaller quantities and undergo special minting processes. Proof coins by the US are struck at least twice using polished dies and burnished blanks, resulting in sharp detail with a mirror-like background and frosted design. Burnished coins also use polished blanks, but have a single strike, giving them a smooth, matte finish. These extra steps and finishes increase their appeal and collectible value.

Is there a difference in value between older American Silver Eagles and new ones?

Yes, there is a difference in value, as the price of silver fluctuates over time. In addition to premiums, a silver coin’s value is primarily based on the current spot price of silver, which is fluctuating around $33 as of May 2025. Additionally, trends in the silver market, such as the global demand for silver bullion, can affect American silver eagles' prices.

Are there any tax implications when buying or selling American Silver Eagles?

Yes, there are tax implications for both silver and gold coins. But it depends on how long you hold the coins. If you sell them within a year, short-term capital gains apply. For American Silver Eagle bullion coins held for more than a year by collectors or coin dealers, long-term gains are taxed at the collectible rate of 28%.

Why are American Silver Eagles so popular with collectors and investors?

The American Silver Eagle is the most famous of the U.S. Mint coins, and even though it isn’t considered rare, it is widely recognized worldwide. Some of the American Silver Eagle quality aspects are: the leading bullion coin in the United States, composed of 99.9% pure silver, its global reputation, legal tender status, and silver purity make it a top choice for both investors and collectors.