Jump to: What are Silver Coins? | Why Buy Silver Coins? | Coins vs Bars vs Rounds | vs Other Investments | vs Other Precious Metals | Most Popular Silver Coins | Where to Buy? | How to Buy?

Silver coins have been a popular form of currency since the Ancient Greeks and Persians over two thousand years ago. Ever since then, silver, along with other precious metals, especially gold, has been a prized possession.

Silver was a scarce precious metal with a universal demand. It is not difficult to understand why our ancestors saw it as a well-suited option over bartering goods. In addition, because silver is malleable and ductile, it was relatively easy to work with. And the shiny look was an obvious advantage.

Nowadays, world economics has changed into a fiat currency era. In other words, every form of official currency is government-issued and not backed by any sort of commodities. So why do we still have gold coins nowadays? Why are they so coveted not only by collectors but also by investors as well?

In this article, we will understand the role of physical silver bullion coins and the reason behind their ever-growing popularity and the rising silver prices, even in the digital, technological world we live in the XXI century. We will delve into the silver market and understand why people invest in silver and how to buy silver coins sensibly, not only as a store of value but also to help you establish your own investment strategy.

What are Silver Bullion Coins?

First, we must establish what silver coins are. Silver coins are rounds of physical silver produced by a government-owned mint with legal tender status backed by a sovereign country. Silver coins usually contain .999 fine silver, with the most common weight being 1 troy ounce coins (1 troy oz = 1.09714 oz).

Many manufacturers, like the Mexican Mint, also offer versions of fractional silver coins, such as 1/2 oz & 1/4 oz. Though not as common, you may also find silver coins minted in larger pieces such as 5 oz or 1 kilo (1 kilo = 32.1507 troy oz).

Silver coins and silver rounds are often mistaken for each other, and it is easy to see why. They look very similar. However, silver coins are minted and backed by governments, while silver rounds are minted by private mints and carry no face value nor enjoy legal tender status.

The backing of the governments makes it so that silver coins will traditionally have a higher premium over the silver spot price compared to rounds of similar weight and purity.

Coins carry a face value, meaning they can be used as currency. However, their denomination is usually much lower than the value of their actual silver content. For instance, the 2024 1 oz American Silver Eagle coin has a face value of one US dollar, way lower than the current silver spot price.

Do you know how the silver price is determined?

Why Buy Silver Coins? Is it a Good Investment?

First and foremost, silver is a precious metal. As such it is a tangible asset that has been recognized as a store of value for millennia. Many investors invest in silver as a safe haven against economic downturns.

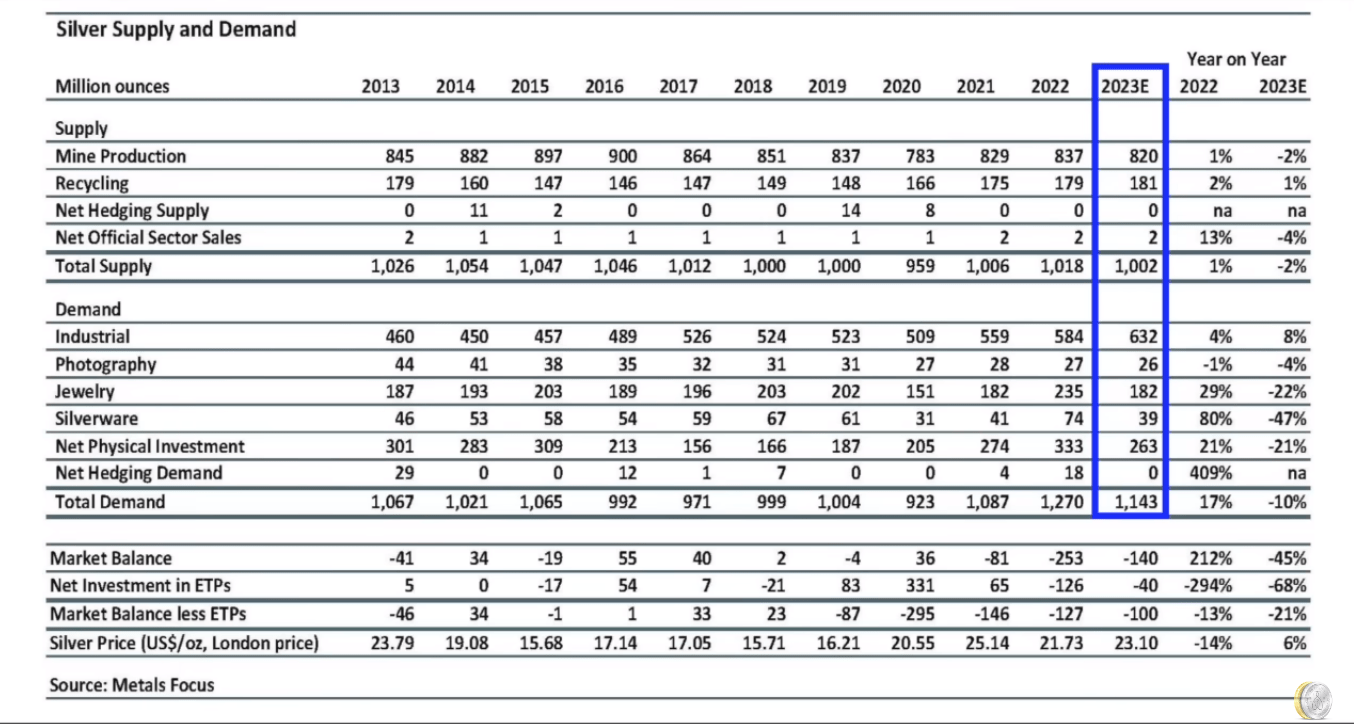

Additionally, physical silver bullion is highly demanded by different industrial sectors. Latest reports have shown that silver industrial demand is expected to grow 8% to achieve the record-breaking 632 million ounces still by the end of 2023.

On the other hand, silver bullion production is set to fall due to lower Mexican and Peruvian output, causing experts to predict silver prices to rise in the short and long term.

Silver Coins vs Silver Bars vs Silver Rounds

Some consider silver coins to be a more sound investment compared to silver bars and silver rounds for a few reasons.

The first reason is that there are much harsher punishments for counterfeiting coins as opposed to rounds or bars.

Another reason is that traditionally, government mints have higher standards than the private mints that produce silver rounds and bars.

Additionally, silver bullion coins have a higher demand than silver rounds or silver bars, which makes coins a highly liquid type of silver bullion.

The downside is that silver coins may carry higher premiums than silver rounds or silver bars due to greater manufacturing costs. A silver bar, for instance, many times, is molten silver hand poured into a cast. Silver coins, on the other hand, undergo a complex process of polishing blanks and preparing the dies before the actual minting.

Silver Coins vs Other Silver Investments

It is possible to invest in silver indirectly without actually owning silver bullion in physical form. These abstract forms of silver investments involve financial instruments or derivatives tied to the movements of the price of silver.

For instance, in the stock market, you can invest in silver mining stocks. The value of these stocks will fluctuate according to the performance of those silver mining companies. That depends on management decisions and the overall health of the mining industry, in addition to the price of silver itself.

Another abstract silver investment is with silver futures contracts, where the buyer agrees to pay a specific price for an amount of silver bullion at a future date, basically speculating that the silver price will fluctuate in their favor. In fact, both parties of futures contracts are called hedgers and speculators.

Other non-physical ways of investing in silver include Silver ETFs, Silver Options, and mutual funds.

However, our experience shows that investing in physical bullion itself, such as buying silver coins, could potentially play a better role as an investment portfolio diversifier. Abstract Silver investments often come with their own set of risks and complexities. The value of these investments may be influenced by factors beyond just the price of silver, such as market conditions, interest rates, and broader economic trends.

Additionally, these investments may involve counterparty risk, as they rely on the financial stability of the entities issuing the financial instruments. Before engaging in abstract silver investments, investors should thoroughly understand the associated risks and conduct proper due diligence.

Silver vs Other Precious Metals

Gold, silver, platinum, and palladium are the four major precious metals, each with distinct characteristics and roles in the global economy.

Gold is widely recognized as a store of value, often sought as a safe-haven asset during economic uncertainties. Platinum and palladium, on the other hand, have significant industrial applications, particularly in the automotive industry for catalytic converters. Their prices can be more sensitive to economic cycles and supply dynamics.

Silver occupies a unique position among precious metals. While valued as a store of wealth and used in jewelry and investment products, it also plays a crucial role in various industries, including electronics, photography, and solar panels. Silver's dual role as both an industrial metal and a precious metal contributes to its higher volatility compared to gold. Additionally, silver is more affordable per ounce, making it accessible to a broader range of investors.

Most Popular Silver Coins

American Silver Eagle Coins

The American Silver Eagle dates back to 1986 and is the official U.S. silver bullion coin. Produced by the United States Mint, Silver Eagles are, without a doubt, the most popular silver coin in the world.

The US Mint sells Silver Eagle coins to authorized dealers, then to retailers like SD Bullion, who make them available for purchase to the general public.

Canadian Silver Maple Leafs

The Silver Maple Leaf is the most popular coin program from the Royal Canadian Mint. The Maple Leaf is second in popularity only to the US Mint's American Silver Eagle.

They have attracted the attention of both collectors and investors since the first Silver Maple Leaf Coin was produced in 1988. The reverse features the current monarch of the British Commonwealth. For many years, it was the bust of Queen Elizabeth II, but as of 2024, it will start depicting the effigy of King Charles III.

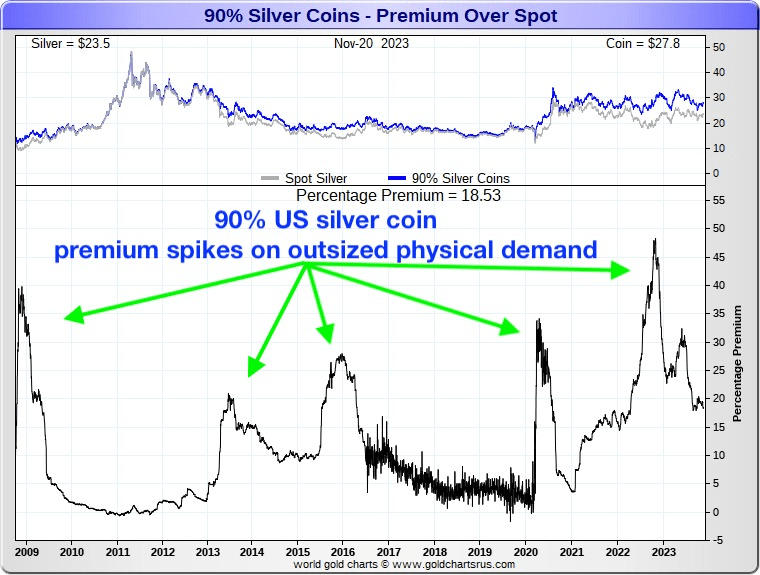

US 90% Junk Silver

Junk Silver Coins, also known as US 90% Constitutional Silver Coins, usually pertain to old US currency whose value is based on the silver content as opposed to the face value. US circulation coins (dimes, quarters, half dollars) were minted using silver up until 1965 when silver was eliminated from US coins by the Coinage Act of 1965.

These coins, however, should not be confused with numismatic rare coins. "Junk silver" is a term that merely means these coins have no, or very few, collectible value. In other words, people invest in silver junk based on their precious metal content alone.

Other Popular Coins

There are many silver bullion coin programs in the world you can choose from. Here is a list of some of the most popular options:

- Silver Britannia Coins from the Royal Mint;

- Silver Kangaroo Coins from the Perth Mint;

- Silver Panda Coins from the Chinese Mint;

- Silver Philharmonics Coins from the Austrian Mint;

- Silver Libertad Coins from the Mexican Mint;

- Silver Krugerrand Coins from the South African Mint.

Where Can You Buy Silver Coins?

Best Option: Reputable Online Dealers

One of the more convenient ways to acquire silver bullion coins is to order them through reputable online bullion dealers such as SD Bullion. Unfortunately, there are people who sell counterfeit coins on the internet, so it is very important that the website you order from is reputable and verified by the Better Business Bureau and/or has a high number of positive reviews on their site.

The main benefit when you buy silver online is that the prices are typically much lower than from brick-and-mortar shops. This is because online dealers operate on a high volume of transactions without having to pay third-party fees (eBay). This high volume allows them to operate on much lower margins than coin dealers or pawn shops typically do due to additional costs these local businesses have to keep their operations running.

Check out also our guide on How to Buy Silver Bars.

How To Buy Silver Coins from SD Bullion?

There are two main ways of purchasing silver coins from SD Bullion, either through the website or over the phone.

The website is open for orders 24/7 while our traders are available to place orders or answer any questions you may have from 8 a.m.-6 p.m. EST Monday through Thursday and from 8 a.m.-5 p.m. EST on Friday.

Online

- Add items to your cart and begin checkout;

- Enter the Billing & Shipping addresses;

- Select Shipping & Payment method;

- Place Order & Receive Confirmation Email;

- Once payment is processed, Shipping Confirmation will be sent within 1-3 Business Days.

Over the Phone

- Call 1-800-294-8732;

- Trader will take your order;

- Order Confirmation will be sent via email;

- Once payment is processed, the shipping confirmation will be sent within 1-3 Business Days.

Final Thoughts

As you build your silver holdings, be aware of the different forms of investment silver you can choose from. For first-time investors, silver coins could be a great option. They are highly liquid and easy to store and transport.

Remember to always keep track of the current market price of silver so you can make an informed decision on if/when to liquidate your precious metals.

If possible, prefer physical silver over owning shares to avoid any counterparty risk involved with abstract silver investments (e.g., future contracts, ETFs, silver mining companies, etc).