Silver, Gold & the Truth: A Candid Conversation with SD Bullion’s Founder

Tyler Wall and James Anderson break down precious metals market manipulation, rising industrial demand, and why SD Bullion’s physical-first approach matters now more than ever.

New SD Bullion Podcast: Tyler Wall & James Anderson Break Down the Precious Metals Market

In the latest episode of the SD Podcast, founder Tyler Wall and head market analyst James Anderson team up for an unscripted, honest conversation about the current state of the gold and silver markets. This isn't your typical financial talk—it's a straight-shooting breakdown of how we got here, what’s happening behind the scenes, and where things might be headed next. From the no-nonsense blog’s early days to building one of the largest independent physical precious metals dealers in the U.S., Tyler shares the company’s origin story and why SD Bullion is different by design.

One of the biggest takeaways? The physical silver market is being stretched thin. While Wall Street continues playing games with paper contracts—many of which aren't backed by actual metal—real-world demand is climbing fast. Industrial needs like solar, electric vehicles, and even military applications are soaking up more silver each year. Combine that with global de-dollarization and increasing central bank gold buying, and you've got a setup for a serious price realignment ahead.

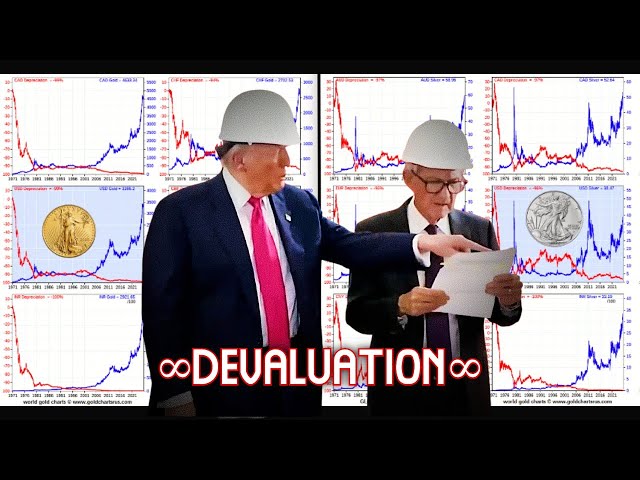

Tyler and James don’t just talk big-picture economics—they back it up with historical gold price charts and long-term precious metals data, showing how undervalued silver is right now compared to gold and stocks. They also highlight the often-overlooked advantage of SD Bullion’s model: only selling metal we physically control. In times of high demand or financial stress, that makes a major difference for customers who want real, deliverable wealth protection—not empty promises.

Whether you’re new to stacking or have been in the game for years, this episode is packed with insights you won’t hear from Wall Street. If you want to understand the deeper forces shaping gold and silver prices—and why now may be a critical time to act—this podcast is a must-watch. Be sure to check out the full conversation and explore even more research and analysis on the SD Bullion Blog and YouTube channel.