To begin, let us start by defining physical silver for this post.

Physical Silver - (n) actual silver bullion typically in a fine .999 form which an investor take direct possession of either in hand or stored in a non-bank silver bullion depository directly (no middlemen).

Silver Bullion is the Smartest Way to Buy and Own Physical Silver

Most silver bullion buyers choose to take direct delivery of their physical silver bullion purchases through high-volume online silver dealers like us here at SD Bullion.

The reasons are likely many-fold but likely include many of the following points and motivations:

-

Physical silver bullion is a great wealth diversification asset

-

Physical silver protects from both inflation and deflation scenarios

-

Physical silver bullion protects one’s wealth from potential Bank Bail-Ins, Bank Bailouts, or general bank failure threats

-

Superior financial liquidity (easy to buy and sell physical silver)

-

Physical silver bullion is a potentially undervalued asset class (compared to most current financial assets classes like stocks, real estate properties, bonds, and fiat currency values, etc.)

-

Physical silver bullion is a highly private asset an investor can own to counter cashless and digitally trackable trends ongoing

-

Physical silver bullion is and can be a mobile store of value that cannot be hacked nor easily stolen by nefarious third-party counterparties or actors

-

Physical silver bullion can be quickly passed on to heirs and loved ones

-

Physical silver bullion is an excellent defense from both slow and even overnight fiat currency devaluations ahead

-

Physical silver bullion is truly a multi-millennial, inter-generational proven store of buying power with a proven track record as long as physical gold bullion.

Please Note: Silver ETFs are not Physical Silver Bullion

Most silver ETFs or silver exchange-traded-funds you will see quoted in mainstream financial press silver articles or silver trader posts online will cite popular silver ETFs as an option for investors.

Use your head and read their respective lawyer-army written prospectus, if you doubt what we are about to say.

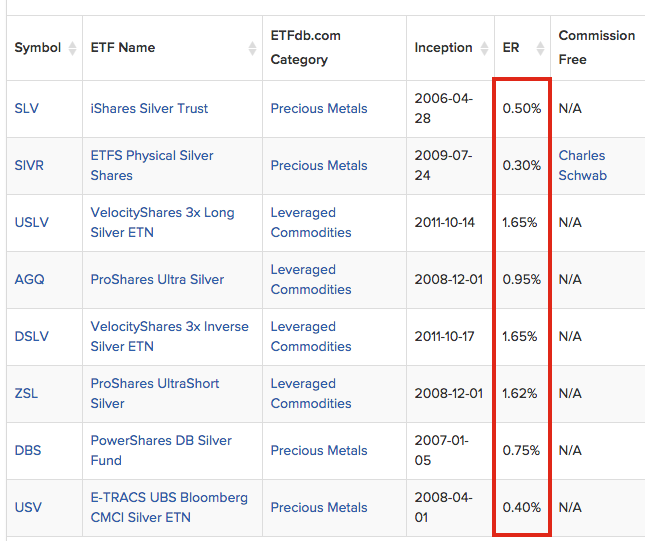

Silver ETF examples often cited include the most popular silver ETF called SLV. Other silver ETFs included in the following list as well as their yearly expense ratios (ER) which all but guarantee your losses will vary from ½ to 1.65% of your annual holdings.

Not one of the following silver ETFs allows average stock shareowners to take delivery of any physical silver bullion at any point in time (for SLV for instance, you have to be an Authorized Participant).

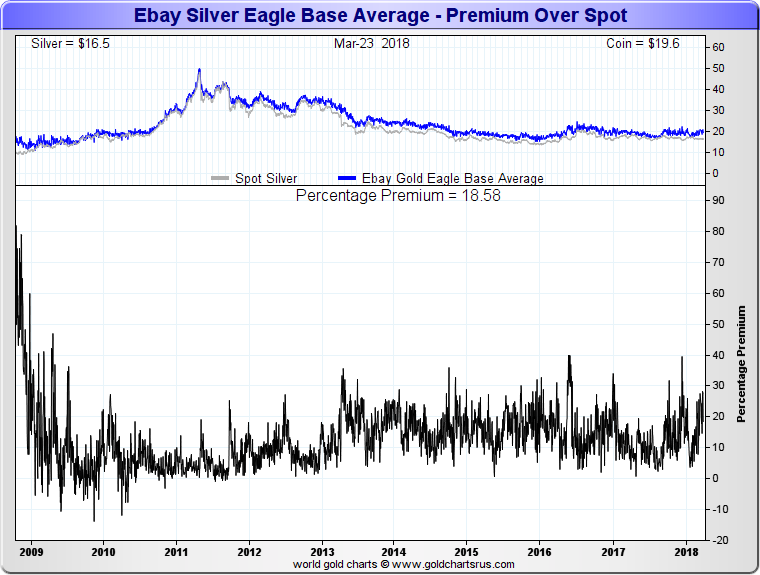

By owning electronic silver derivative equity shares like SLV, an investor is merely getting diverging price exposure to the fluctuating silver spot price (see the chart for proof of that statement) all the while enjoying the ‘privilege’ of paying 50 basis points or a ½% of their holdings every year.

In late March 2018, the silver spot price was $16.53 oz while SLV was trading at $15.58 per share. That is a more than a 5.7% divergence between silver's then fluctuating silver spot price vs. the price per share of supposed price tracking silver derivative SLV.

Perhaps silver ETFs are excellent for day traders, but they are wholly inferior to physical silver bullion for longterm holders and value investors. See for example below how well physical silver bullion product like the most popular 1 oz American Silver Eagle coin performed during the last global bank crisis in the fall of 2008 (+80% price premium above the then fluctuating silver spot price).

What is the best way for buying Physical Silver Bullion?

For US physical silver bullion buyers, we suggest the best lowest price option for acquiring silver bullion is through the online silver bullion dealer industry. Trouble is there are some which are significant while there are others who have proven track records of poor business practices and even bankruptcy.

Buying physical silver bullion items in bulk can be so expensive, even one single failed order could cost you years of hard-earned savings. Thus we don’t care how many times you or others have successfully bought from a specific bullion dealer before. We suggest that you always perform your proper due diligence on recent customer reviews every single time you risk your hard-earned savings when buying physical silver bullion products online.

We suggest bookmarking hard to rig organic (non-affiliate kickback) silver dealer review websites which have already helped many physical silver bullion buyers avoid losing their hard-earned capital to imploding, incompetent, and or potentially crooked physical silver dealers.

The following is but one example of potentially harmful silver dealer business practices exposed by various youtube channels in the silver stacking community currently. Anyone who was involved in the last precious metal and silver bullion bull market in 1980 will likely recognize the name which the lawsuit got filed.

The process for safe physical silver bullion buying and payment options can get further explored in the following posts we have made on this critical topic ( See here, here, here, and here).

Know that the best physical silver bullion prices you will typically find will be with online silver bullion dealers as opposed to any local silver dealers in your area. The reason for this can be easily understood when considering economies of scale.

High volume online silver bullion dealers typically have way larger silver bullion sales volumes and lower overhead costs without having to pay for a retail storefront and the expenses associated. Online physical silver bullion dealers can market to their entire respective countries of silver bullion delivery, and this fact gives them a much larger population of potential silver bullion buying and selling clients.

Do not misunderstand us here, though. Finding a trusted local coin or silver bullion shop is excellent if you require a quick sale for fiat cash. There is also a sensical argument for privacy being stronger in a local coin shop but take note as well.

If you are buying physical silver bullion in bulk (USD 10,000 or more), you will still get a paper trail from either a check or bank wire transfer used in payment (this is due to Anti-Money Laundering policies will cover later, known in short by its acronym AML). The employees, other customers, and even bystanders on the street nearby could begin recognizing your face or worse trail you on your way home for future robbery or home invasion.

Bottom line is all physical silver bullion buying choices online or locally have various risks associated. If you do buy physical silver bullion locally, always, always, still only purchase and take what physical silver bullion the local dealer has on hand. You do not want to end up like this unfortunate soul who will be lucky to even get pennies on her dollars lost, likely only after years of lawsuit battling for them.

Check out our blog on How to Buy Silver Bars

When it comes to physical silver bullion buying, you must always perform proper due diligence and use best practices to ensure you get what you are buying at a fair price and delivered in a reasonable amount of time. We have created various educational resources here to help you do just that.

Thanks for visiting us here at SD Bullion.

***