Who or what actually sets or discovers the fluctuating price of silver? How is the silver spot price found? Why is there a difference between silver spot prices and silver bullion coin, bar, and round prices? Find the way the price of silver is determined right here.

How is the Silver Price discovered?

Silver Price Discovery - (n) determination of the ongoing price of silver via market supply and demand dynamics and other heavily influencing factors associated with the fluctuating global silver price (e.g. silver derivatives, silver futures contracts).

The following describes how silver prices are found around the world.

Take note that the silver price discovery subject may seem simple yet it is multifaceted and complex in reality.

First and foremost the silver price you want to understand needs to be very specific. For example the silver spot price is a combination of diverse financial elements, trades, and data forming a more or less coherent whole (the silver spot price). That said silver bullion price discovery can and does heavily diverge from silver spot prices during financial crisis.

Upon your better understanding of how various silver prices are discovered (both silver spot prices and physical silver bullion prices) you can gain a better ability to discern which entities and financial forces are driving price discovery both in the derivative and physical world not merely now but also possibly ahead.

Here we will cover both some ancient and somewhat recent silver price history, this will also include many modern day silver price discovery facts and data (physical silver vs silver derivatives especially).

Silver Futures Contract History

Common commodities and precious metals like silver (as well as crude oil, wheat, coffee, cotton, palladium, platinum, gold, base metals, and others) have forwards or futures contracts trading on various futures exchanges throughout the world in order to help ascertain their real world prices.

Certain acronyms like the NYMEX, TOCOM, CME Group, CBOT, SHFE, and COMEX etc. represent respective futures exchanges (or their parent companies) which are purportedly overseen by their national governmental (or semi-governmental) regulatory agencies.

Formal futures contract markets date as far back as ancient laws ever written. Over 3,250 years ago within the text of The Code of Hammurabi, there were laws written pertaining to the delivery or failure to deliver certain commodities. Coincidentally this ancient text also explicitly cites mina or mene (i.e. money) being comprised of gold and silver weights.

The original intention of futures contract usage was to give (#1) the producers of real commodities ways or means to respectively manage their price risk (e.g. silver miners), (#2) end users ways to buy and potentially take actual delivery of the real world goods (e.g. silver refiners or silver bullion dealers), and even allow liquidity providing (#3) commodity price speculators a way to make bets on a commodity’s price movement up or down in the near future (those who simply trade on futures contract exchanges for short term gains and make or take no delivery whatsoever). It is this latter third speculator class, that has arguably outgrown real silver producers and end line physical silver users which has perverted current gold price discovery in the 21st Century.

For discussion, think of commodity markets as a pyramid structure.

At the tiny top are the physical assets or actual commodities themselves.

Below are derivatives like over-the-counter (OTC) market forwards and swaps which are executed party to party and not on organized formal commodity futures exchanges. Forwards and swaps are often financially settled in fiat currency, however; they can and do often allow for physical delivery of the supposed underlying commodity assets.

The next level down on the commodity pyramid structure is the futures and options contracts that trade on exchanges. These contracts allow a wide and diverse group of market participants to have positions long or short (betting prices will go higher or lower) in the price movements of commodities.

Real world producers of silver like silver miners often have fixed overhead costs and choose to hedge their physical silver ore production with futures contracts in order to fix future delivery profitability streams.

For further example, in spring 2011 a silver miner may have found that the silver spot price of then some $50 oz USD, was perhaps overbought and unsustainable. Perhaps this silver mining management decided to go short silver (bet the silver spot price would go lower) in the futures markets while delivering physical silver in reality for months to come. Even as the price of the silver ore this silver miner dug out of the ground was falling into late 2011 and early 2012, the offsetting silver futures contract bets placed to the downside could have helped offset the sub $50 oz USD silver spot price levels.

The next level of the commodity pyramid consists of ETF products designed to mimic price volatility in the assets they purport to represent.

Often though, when someone looks up, quotes, or does an internet search on the ‘price of silver’ they will be answered with current and often fluctuating silver spot price.

Silver Spot Price Definition

Silver Spot Price – (n) the current respective fiat currency price of 1 troy ounce of silver available for immediate delivery before being minted into a bullion product (e.g. silver bullion bar, silver bullion round, or silver bullion coin).

The fluctuating spot price for silver is actively determined by the commodity’s most highly traded futures contract at the time. The mostly traded futures contract for silver can be the current month or it might be two or more months into the future.

Today the silver spot price is a combined index or aggregate using many of the world futures market prices and trading volumes. Based on current silver futures contract trading volumes, the silver spot price is currently mostly influenced by the highly fractionally reserved COMEX and London Bullion Market Association.

As backwards as this may sound, the price of physical silver today is mostly found via the selling and buying of virtual contracts representing the underlying potentially deliverable physical precious metal.

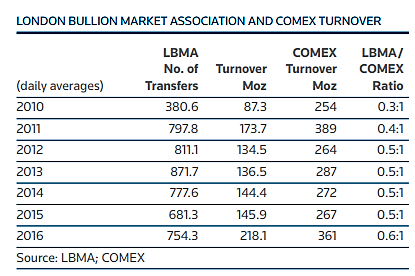

When reading the following futures contract turnover charts, remember that the current annual physical silver supply of the world is about 1 billion troy ounces. Note too that the London Bullion Market Association (LBMA) and COMEX turnover data is daily (thus multiply that data by about 250 trading days per year to understand the leverage silver futures contracts amount to vs real physical annual silver supplies).

Silver Futures Market Trading Volumes (annual silver mine supplies less than 1 billion oz)

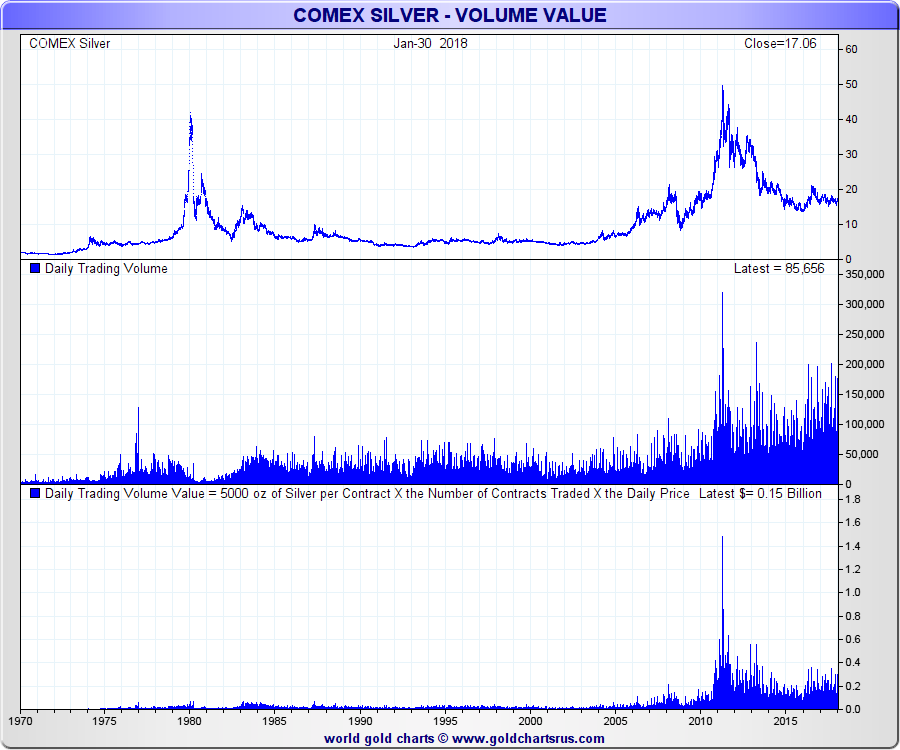

In 2016, the COMEX alone traded over 90.6 billion ounces of representative silver contracts (again the vast majority of which are settled in fiat currency US dollars).

The LBMA averaged over 218 million theoretical silver ounces traded each day in 2016 alone (that is approximately 55 billion ounces of representative silver traded in 2016).

In 2014, Bloomberg estimated the silver derivative market totaled $5 USD trillion in notional value. With only about 3 billion ounces in above ground silver bullion supplies, and an average price of about $20 USD oz in 2014, the derivatives market used an estimated leverage of about 83 oz of silver derivatives vs 1 oz of investment grade bullion in existence.

This may sound kookey to the average layman but the truth in this 21st Century Gold Rush, is that silver price discovery has become perverted and divorced from physical reality.

Silver Price Discovery Leverage: Derivatives Paper vs Physical Silver Supply

We now have unclassified cables (electronic telegrams) from late 1974 between the United Kingdom and the US Department of State and Secretary of State that further fan suspicions that one of the main intentions of the COMEX is to explicitly inject price volatility and thus discourage US citizens from saving (i.e. hoarding) precious metals (e.g. gold, silver, platinum, palladium).

The positive news for physical silver bullion buyers is that future price discovery for silver appears to be moving back towards physical reality as the trend of more and more investors demanding and buying physical investment grade silver bullion products instead of trading futures contract and other silver derivative proxies (e.g. ETFs like SLV) continues.

Silver Spot Price & Silver COMEX Trading Volumes 1970 - 2018

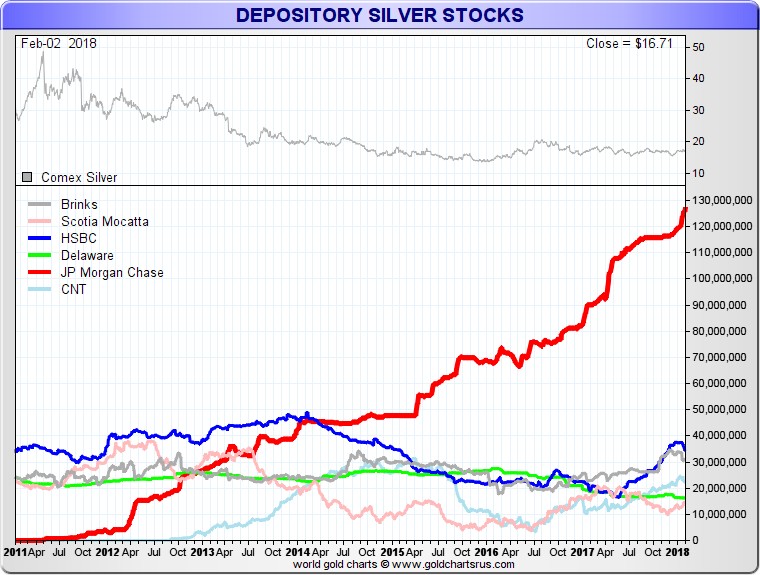

Another point of note in terms of notable fractionally reserved COMEX futures contract trading trends is the mass of silver bullion that JP Morgan has amassed since the near $50 oz USD price high in the spring of 2011.

This now over 125 million oz publicly transparent silver bullion holding of JP Morgan is akin to the amount of physical silver bullion both the Hunt Brothers (1980) and Warren Buffet acquires in the late 1990s via Berkshire Hathaway.

COMEX Silver Bullion Warehouse Holdings

NOTE: JP Morgan COMEX Silver Bullion Holdings post 2011 spring $50 oz silver price high

An outspoken multi-decade silver analyst goes as far as to publically allege JP Morgan has also acquired an even larger undisclosed silver bullion position (outside on their transparent COMEX silver warehouse holdings) with the intention of profiting on the eventual increase in silver prices in the years ahead.

Note that JP Morgan is also both an Authorized Participant (AP) and the actual Custodian of the world’s largest electronic Exchange Traded Fund derivative called SLV. This gives them direct access to acquire off exchange silver bullion held within the trust. Non-Authorized Purchaser investor shareholders of SLV pay 0.5% of their total equity share values annually for the privilege of mere price exposure of the fund (a vehicle perhaps best for small retail day traders). The average SLV shareholder never actually owns physical silver bullion themselves, it is only the various APs which have access to physical silver bullion within the fund itself.

Silver Bullion Prices vs Silver Spot Prices

Virtually all competent online silver bullion dealers host a dynamic silver spot price displayed live on their websites.

Generally silver dealers quote silver spot prices and their respective silver bullion product prices in the fiat currencies of the markets which they serve (US dollars, Canadian dollars, euros, etc.).

Most popular silver bullion products available to purchase on silver bullion dealer websites are priced per troy ounce at a few percentage points (2 to 15%) above the fluctuating silver spot prices. This additional premium for silver bullion products are generally due to the costs associated with silver refining, manufacturing, minting, hedging, warehousing, marketing, buying, and selling various silver bullion products to investors and collectors.

This situation of silver spot prices vs silver bullion prices is somewhat similar to crude oil spot prices vs actual physical crude oil prices which are multifaceted depending upon their origins, purity levels, cost to transport, refine, etc.

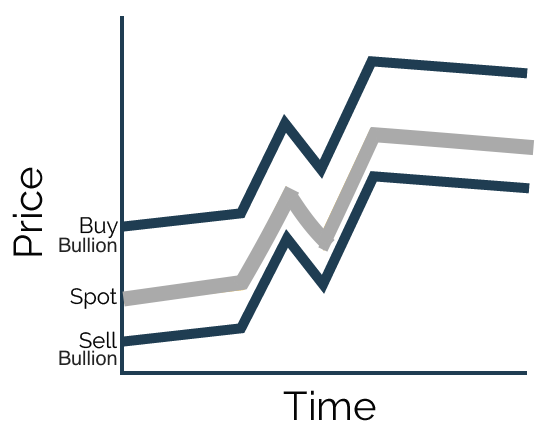

When investors and individual silver bullion owners sell silver bullion to online silver bullion dealers, most silver bullion products will typically yield a sell or bid price either slightly above, even with, or just below the fluctuating silver spot price.

How Silver Bullion Prices Work in Calm Markets

In calm market periods, investment grade silver bullion product prices are set slightly over the fluctuating silver spot price. In other words, if the silver spot price is $20 oz USD, most physical silver bullion products will be priced slightly above $20 USD per troy ounce.

Silver bullion prices range from as low as a few percentage points above the silver spot price for large lots of silver bullion bars or privately minted silver bullion rounds to typically a few percentage points more above the fluctuating silver spot price for government guaranteed and minted silver bullion coins.

When outsized silver bullion market demand hits (like it did during the 2008 Financial Crisis), silver bullion prices for products available for immediate delivery tend to climb exorbitantly higher (often times both on the sell and buy side) to price levels where both can hover above the world’s fluctuating silver spot prices.

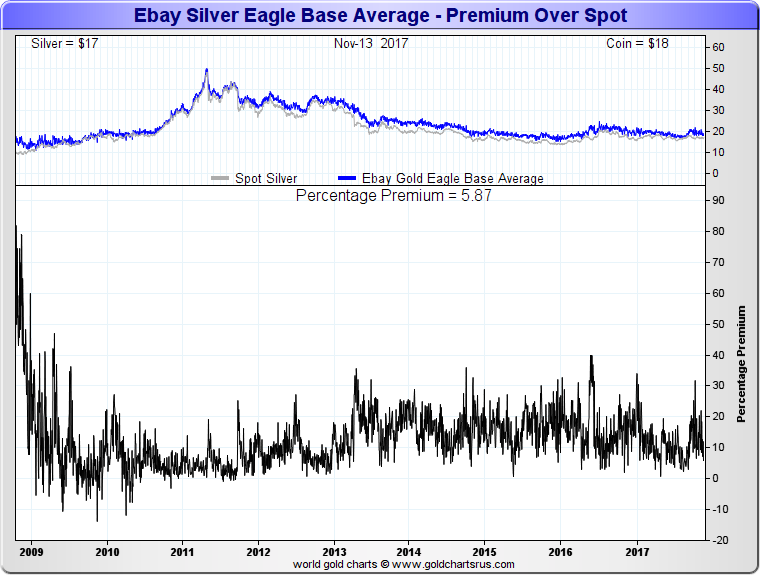

For example, see how the world’s most popular silver bullion coin was priced as high as 80% over the fluctuating silver spot price in the fall of 2008 on the far left side of the following chart.

How Silver Bullion Prices Performed during Financial Crisis (2008)

NOTE: 1 oz American Silver Eagle Coins traded up to 80% above the then silver spot price in late 2008.

In summation on current 21st Century silver price discovery.

Silver spot price relation to deliverable physical silver bullion currently functions like this:

-

Futures Contract traders buy or sell silver futures contracts on worldwide futures exchanges, this trading’s ‘price discovery’ determines fluctuations in global silver spot prices in various fiat currencies.

-

Miners of silver extract and typically sell mixed silver ore and doré bars to silver bullion refiners at prices just below the fluctuating gold spot price.

-

Refiners of silver smelt and purify the silver ore or scrap into .999 fine bullion or grain then sell these products to governments, mints, or silver bullion dealers at or just above the fluctuating silver spot price.

-

Both government and private mints strike silver bullion coins or manufacture silver bullion bars and rounds, selling them to silver dealers or the public at large at prices typically above the silver spot price.

-

Retail and wholesale bullion dealers like us at SDBullion.com procure and sell silver bullion products for discreet fully insured delivery to door or to professional fully insured segregated non-bank storage facilities at prices just over silver’s fluctuating spot price.

When one simply learns how highly leveraged fractionally reserved futures markets currently operate and derive the various fluctuating silver spot prices, they often simply choose to bypass electronic silver derivatives and simply elect to buy and take physical delivery of their silver bullion.

In 2 minutes you can hear a highly successful hedge fund manager explain why his trust chose to acquire physical bullion over virtual derivatives or futures contracts. According to him and common sense we would also argue, today’s futures contract driven silver price may not solve everything someday.

Thx for speaking so frankly on the matter.#COMEX circuit breakers are in place

— James Henry Anderson (@jameshenryand) August 30, 2017

for when price solves everything:https://t.co/1Jq2HrRow9 pic.twitter.com/WTGbNWzknb

By securing silver bullion physically and owning it directly, you can potentially take advantage of future scenarios when silver bullion premiums spike over fluctuating silver spot prices whilst simultaneously reducing the myriad counterparty risks associated with either virtual or indirect silver proxies like futures contracts, ETFs, mining stocks, mutual funds, etc.

Silver industry data proves that more investors across the world want to buy and hold silver bullion directly, own it first hand, fully unencumbered to help insure the fact that they indeed own it moving forward to day when ‘silver price discovery’ is again mostly driven by physical fundamental supply and demand forces as opposed to currently outsized derivative capital flows both long and short many aforementioned virtual precious metal contracts.The current head of the CME Group, (i.e. COMEX, NYMEX) which represents futures exchanges which have large influence of the fluctuating price of silver and other physical precious metals across the world, had the following to say in the summer of 2017. Welcome to the "cacoon club".

#CME CEO on #Gold price

— James Henry Anderson (@jameshenryand) July 13, 2017

(fyi he runs #COMEX #NYMEX)

Thx to phony derivative futures' "price discovery" its taking 2.5Xs longer than 1970s pic.twitter.com/QNGekQS5Dk