Jump to: Why Silver? | Criteria | 12 Most Popular Silver Coins | Low Premium Options | Collectible Coins vs Bullion Coins | How to Store Silver Coins

Silver continues to attract investors heading into 2026 due to rising industrial demand, growing technological use, and its accessibility compared to gold.

This guide explains the characteristics commonly associated with investment-grade silver coins, outlines factors contributing to rising demand, and reviews silver coins that are widely recognized for their liquidity, market presence, and historical performance.

Key Takeaways

- Silver’s appeal is growing amid strong industrial demand, especially in electronics, green energy, and AI, while remaining an accessible entry point for investors;

- When choosing investment-grade silver coins, liquidity is key. High purity (.999+), sovereign backing, and standardized weights ensure easier resale and stronger market acceptance;

- Not all silver coins serve the same purpose. Understanding the differences between bullion, low-premium, and collectible coins helps investors avoid unnecessary premiums and align purchases with their investment goals, whether that is long-term wealth protection or just metal exposure;

- Not all silver coins serve the same purpose. Understanding the difference between bullion, low-premium, and collectible coins helps investors avoid unnecessary premiums and align purchases with their investment goals.

Why Silver Coins Continue to Attract Strong Investment Market Interest

While gold posted strong gains, Silver has drawn increased attention from market participants entering 2026, with prices rising and remaining resilient. Silver’s strength lies in its dual role as both an industrial metal and a store of value. When industrial demand increases and supply tightens, scarcity sentiment supports higher prices.

According to the Silver Institute, global silver demand declined slightly in 2024, but this was largely offset by record industrial demand. Growth has been driven by electronics, electrical applications, and expanding AI technologies, alongside continued demand from solar, automotive, and grid infrastructure.

The end of 2025 and the beginning of 2026 marked a key moment for silver prices, supported by supply concerns, export restrictions from major producers such as China, and heightened global uncertainty.

Beyond fundamentals, silver remains attractive due to its accessibility. Compared to gold, it offers a lower entry point, making it an effective way for investors to gain exposure to precious metals without a significant upfront commitment.

Criteria for Selecting Investment-Grade Silver Coins

To begin with, the primary objective of any investment is to generate profit, or, at a minimum, preserve existing capital.

With this in mind, choosing an investment product should prioritize liquidity, which may contribute to easier resale in active secondary markets, whether to take advantage of favorable prices or to meet an unexpected need.

Market participants often look for the following characteristics when evaluating silver bullion coins, specifically coins, as they are the highest liquid bullion product:

- High purity is essential: Achieving certified purity requires a rigorous refining process that ensures durability while preserving the noble metal content. For silver, the standard for investment and exchange trading is 99.9 percent purity, commonly expressed as .999.

- Weight standardization: Products that follow common weight standards (such as 1 troy ounce, 100 grams, or 1 kilogram) are easier to price and resell.

- Condition and finish: Well-preserved pieces with minimal damage retain better resale value, especially in secondary markets.

- Authenticity: Not all bullion coins come with an authenticity certificate, but the institution itself backs sovereign-minted silver coins.

Each institution adds its anti-counterfeiting measures to its coins. For instance, the Royal Canadian Mint is famous for its Bullion DNA technology, which individually identifies each coin it releases.

12 Most Popular Silver Coins for Investors

Based on the criteria mentioned above, these are the silver coins that best meet market standards and are popular among experienced investors and collectors.

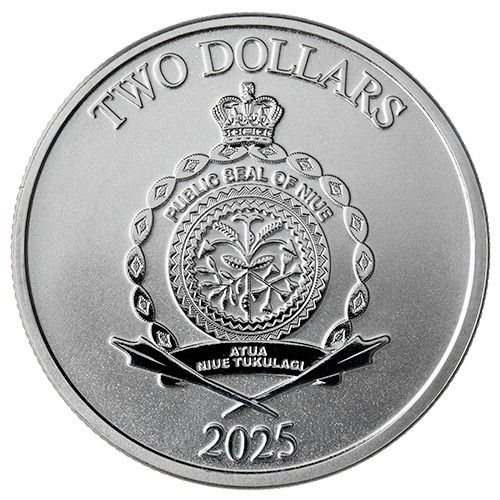

12. Tree of Life Silver Coin

2025 1 oz Tree of Life Silver Coin

The 2025 1 oz Tree of Life Silver Coin contains .9999 fine silver and carries a $2 legal tender denomination backed by Niue. Produced by the Sunshine Mint, it features a limited mintage of 250,000 coins.

Part of the Truth Series, the coin combines high purity with collectible appeal, featuring the Tree of Life design and a micro-engraved Scripture detail. Its exclusivity and limited supply make it appealing to investors seeking silver with substantial thematic and numismatic value.

11. Horse Silver Coin

2026 1 oz Year of the Horse Silver Coin – Lunar Series III

The 2026 Australian Silver Year of the Horse contains one troy ounce of .9999 fine silver and is issued by The Perth Mint as part of the Lunar Series III. It is Australian legal tender and backed by the government, ensuring authenticity and market trust.

Its high purity, strong global recognition, and continued popularity of the Lunar Series make this coin attractive to investors seeking premium silver bullion with added collectible appeal from annually changing designs.

10. Krugerrand Silver Coins

1 oz SA Silver Krugerrand Coin

The South African Silver Krugerrand contains one troy ounce of .999 fine silver and carries a face value of R1. Issued in silver by the South African Mint since 2017, it builds on the legacy of the iconic gold Krugerrand, first introduced in 1967.

Its strong global recognition, government backing, and classic springbok design make the Silver Krugerrand a compelling option for investors seeking trusted sovereign silver from Africa.

9. Australian Silver Kookaburras

2025 1 oz Australian Silver Kookaburra Coin

The Australian Silver Kookaburra is struck in .9999 fine silver and available in multiple sizes, including a one troy ounce coin with a face value of A$1. Issued annually by the Perth Mint since 1990, it is the Mint’s longest-running silver coin program.

Its limited mintages, IRA eligibility, annually changing designs, and high purity make the Silver Kookaburra attractive to investors seeking a blend of bullion exposure and numismatic appeal.

8. Chinese Silver Pandas

2024 30 Gram Chinese Silver Panda Coin

The Chinese Silver Panda contains 30 grams (0.965 troy ounces) of .999 fine silver and carries a face value of ¥10. Issued by the China Mint since 1983, it is one of the longest-running silver bullion coin programs and is IRA-approved.

Its annually changing panda design, intense purity, and broad international recognition make the Silver Panda appealing to investors who value both bullion exposure and collectible potential.

7. Australian Silver Kangaroos

2026 1 oz Australian Silver Kangaroo Coin

The Australian Silver Kangaroo contains one troy ounce of .9999 fine silver and carries a face value of A$1. Issued by the Perth Mint, it was the first Australian silver bullion coin to feature 99.99% purity in regular annual production.

Its exceptional purity, advanced anti-counterfeiting features, strong global recognition, and government backing make the Silver Kangaroo an attractive option for investors seeking high-quality silver bullion.

6. Austrian Silver Philharmonics

1 oz Austrian Silver Philharmonic Coin

The Austrian Silver Philharmonic contains one troy ounce of .999 fine silver and carries a €1.50 face value. Issued by the Austrian Mint, it is legal tender in Austria, and the only major silver bullion coin denominated in euros.

Its strong European market recognition, government backing, and high liquidity make the Silver Philharmonic a solid choice for investors seeking internationally trusted silver exposure.

5. Morgan Silver Dollars

Pre-1921 Morgan Silver Dollar - BU

The Morgan Silver Dollar contains 0.77344 troy ounces of silver and carries a $1 face value. One of the most famous and widely collected U.S. coins, it features iconic depictions of Lady Liberty and the Bald Eagle.

Valued for its historical significance and strong collector demand, the Morgan Silver Dollar appeals to investors seeking silver exposure with added numismatic and heritage value rather than pure bullion efficiency.

4. Mexican Silver Libertads

2024 1 oz Mexican Silver Libertad Coin

The Mexican Silver Libertad contains one troy ounce of .999 fine silver and is fully guaranteed by the Casa de Moneda de México. Although it has no face value, it is legal tender and trades at the silver spot price.

Its limited mintages, intense purity, IRA eligibility, and cultural significance make the Silver Libertad an attractive option for investors seeking diversification beyond traditional sovereign coins.

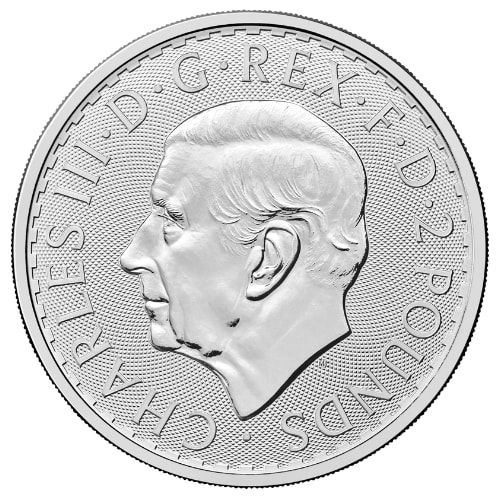

3. British Silver Britannia

2026 1 oz Silver Britannia Coin

The British Silver Britannia contains one troy ounce of .999 fine silver and carries a £2 face value. Issued as the official silver bullion coin of Great Britain, it is backed by the UK government and widely recognized in global markets.

Its strong liquidity, historical significance, and iconic Britannia design make it a solid option for investors seeking trusted sovereign silver coins.

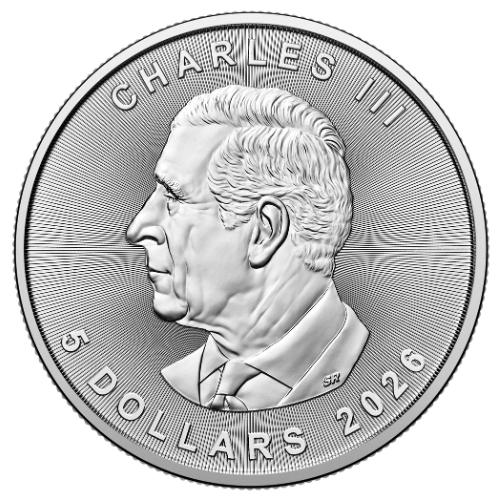

2. Canadian Silver Maple Leaf Coins

2026 1 oz Canadian Silver Maple Leaf Coin

The Canadian Silver Maple Leaf contains one troy ounce of .9999 fine silver and carries a face value of C$5. Issued by the Royal Canadian Mint, the Canadian government backs it and features some of the most advanced security measures in the bullion market.

Its exceptional purity, strong global recognition, IRA eligibility, and high liquidity make the Silver Maple Leaf a leading choice for investors seeking premium silver coins.

1. Silver American Eagle

2026 1 oz American Silver Eagle Coin

The American Silver Eagle contains one troy ounce of .999 fine silver (31.103 grams) and carries a $1 face value.

First issued by the U.S. Mint in 1986, it is the official silver bullion coin of the United States and is fully backed by the U.S. government for weight, purity, and authenticity.

Its global recognition, high liquidity, and IRA eligibility make the American Silver Eagle one of the most popular and trusted silver coins for investors.

Low-Premium Silver Coin Options

90% Silver “Junk.”

Junk silver refers to pre-1965 U.S. dimes, quarters, and half-dollars composed of 90% silver. While still legal tender, their intrinsic silver value far exceeds their face value.

Valued for their recognizability, divisibility, and lower premiums, junk silver coins appeal to investors seeking practical, fractional silver exposure with strong long-term value retention.

Collectible Coins vs Bullion Coins

According to the U.S Mint, the best definition for a bullion coin is a coin whose value lies primarily in its precious metal content.

Unlike commemorative or numismatic coins, which derive value from rarity, age, condition, or limited mintage, bullion coins are purchased by investors as a straightforward way to gain exposure to gold, silver, platinum, and palladium markets.

For someone looking to buy silver coins, this distinction helps avoid overpaying, aligns purchases with financial goals, and clarifies whether the priority is wealth preservation and liquidity or collectibility and long-term appreciation.

How to Store and Protect Silver Coins

The key to preserving value is to minimize moisture, air exposure, and physical contact.

Silver’s primary vulnerability is tarnishing, which accelerates in humid environments. Investors should store silver coins in non-reactive, airtight containers and keep them in a stable, low-humidity environment. Separating coins also helps prevent surface damage.

Another option is using a professional gold and silver depository. For a monthly fee, these facilities provide insured, secure storage, managed by specialists who ensure your metals are properly protected.

Final Words

Silver stands out as an accessible precious metal for investors seeking portfolio diversification, supported by steadily growing industrial demand driven by advancing technology.

When investing in silver coins, the strongest choices are those with broad market recognition and high liquidity, as they are easier to authenticate and resell.

With these factors in mind, the options outlined here aim to help you identify silver coins that align with your investment goals.

Disclaimer: The information provided is for general educational purposes only and should not be interpreted as financial, investment, legal, or tax advice. Because this content does not take into account individual financial goals or circumstances, you should consult a qualified professional before making decisions involving precious metals. All markets carry risk, and past performance is not a guarantee of future results.