Jump to: Comparison Chart | Definitions | Silver Coins | Silver Bars | Counterfeit Risks | Tax Considerations | Performance in Financial Crisis | Portfolio Allocation | Where to? | FAQs

Silver coins and silver bars each offer something different to investors. Whereas silver coins are typically more liquid, bars tend to carry lower premiums.

In this article, we explore what sets them apart, not to crown a winner, but to help you understand how each option can fit different needs and preferences.

Key Takeaways

- Silver bars and silver coins serve different purposes. Bars typically offer lower premiums as cost efficiency and more silver per dollar, while coins provide greater liquidity, recognizability, and ease of resale.

- Government-issued silver coins carry added trust. Their legal tender status and mint guarantees make them historically more liquid for resale, especially during periods of uncertainty.

- Premiums and resale dynamics matter. Silver bars are generally commonly used for long-term accumulation at lower cost, whereas coins often command higher premiums due to demand, divisibility, and potential collectibility.

- The best choice depends on individual goals. Different investor goals emphasize different characteristics. Silver bars are often associated with cost efficiency, while silver coins are commonly linked to liquidity, and some investors hold both to reflect these distinctions.

Comparison Chart: What Matters to Investors

|

Silver Bars

|

Silver Coins

|

|

|

Premium over spot |

Lower Per Ounce (oz) |

Higher |

|

Liquidity |

Inversely proportional to size |

Very high |

|

Recognizability |

Moderate (depends on the mint) |

High (usually government-backed) |

|

Numismatic appeal |

None |

Generally High |

|

Investment Strategy |

Long-term wealth preservation |

Ease of resale & trust |

Comparison Pricing: 1 oz Silver Eagle Coin vs 1 oz Silver Bar

Definition of Silver Coins and Silver Bars

The distinction may seem obvious, but it is important. The definitions of each product clearly indicate how they function as bullion assets.

Silver Coins are precious metals wafers struck in a coin format by a government mint, typically stamped with a legal tender face value. Sizes may vary, but a troy ounce is the most common and widely traded unit. They can even be used in individual retirement accounts.

American Silver Eagles are the most popular silver bullion coins, featuring iconic symbols like Lady Liberty and the bald eagle. Their legal tender status and strong numismatic appeal make them highly liquid.

Silver Bars usually come in the shape of a block, struck mostly by private mints, but also by a few select government mints, such as the Royal Canadian Mint. Typically, silver bars do not carry a legal tender face value and cost less per troy ounce than silver coins.

Both products should have a minimum fineness of 999 percent to be IRA-approved.

Silver bars, like gold bars, derive their value primarily from metal purity rather than design, though some, such as the Lady Fortuna, still carry great prestige due to their production quality and security features.

Aside from silver bars, you might also ask yourself which is better: Silver Coins or Silver Rounds?

Silver Coins

Now, how are they fit for each investing profile? Let us start with the coins.

Silver Coins: Struck & Guaranteed by Government Mints

Governments have a monopoly on defining legal tender, and only they can issue silver coins with official face values, meaning a coin will never be worth less than its stated denomination.

Because of this, silver coins are widely recognized and backed by the issuing government, which backs their purity, metal content, measures, and weight, providing strong assurance of authenticity and high liquidity when selling.

In practical terms, this legal tender status means a 1 oz American Silver Eagle could technically be used to make a one-dollar purchase, even though its market value is far higher.

This same government backing is also why many believe legal tender silver coins would be more trusted for bartering than other forms of silver, even in extreme or uncertain scenarios.

National Mints that produce modern silver bullion coins include:

- US Mint

- British Royal Mint

- Chinese Mint

- Austrian Mint

- Canadian Mint

- New Zealand Mint

- Somalian Mint

- Mexican Mint

Numismatic value

The numismatic value of a coin pertains to its rarity, purity, quality, and demand, as well as every aspect that will interfere with the actual price a collector will pay for the numismatic coins.

Most silver bullion coins are valued mainly for their metal content, but numismatic coins derive additional value from scarcity, condition, and collector demand. While they may contain the same amount of silver as bullion coins, their collectible nature often allows them to command higher premiums.

The Morgan Silver Dollars are a good example of how a Silver coin can hold numismatic value.

They were produced at two points in time: first from 1878 to 1904, and then again in 1921. These pieces are 100 years old; they feature George T. Morgan’s rendition of Lady Liberty, a classic design constantly referenced even in modern coins.

They tend to appreciate in value because they aren't readily available in circulation and aren't produced except in special editions.

One piece has 0.7734 Troy Oz of 0.9000 silver. So they don't compare to modern bullion coins in terms of purity and silver amount, so their value relies mainly on their rarity, conserved condition, and historical value.

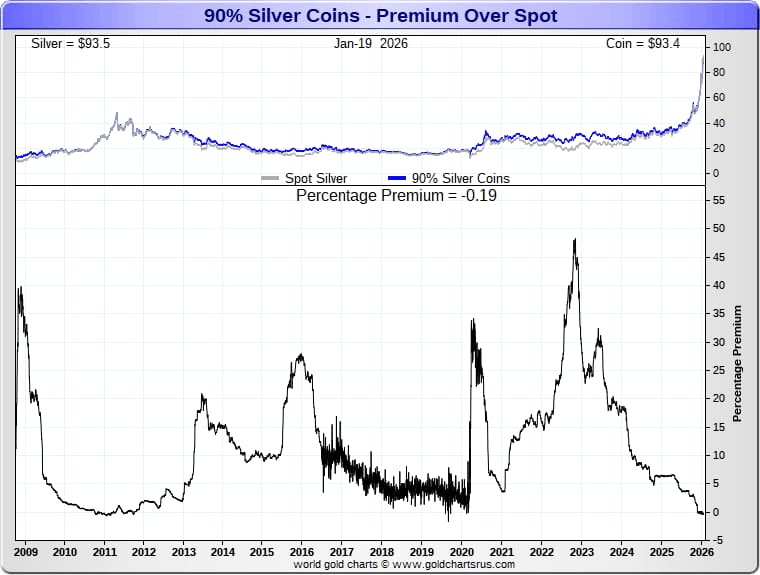

Junk Silver

Contrary to numismatic coins, junk silver refers to pre-1965 coins made of 90% silver that held no collectible value; these include US Dimes, Quarters, and Half Dollars dated before 1965.

Unlike numismatic coins, junk silver coins are valued primarily for their silver content rather than any collectible attributes.

Silver Bars

Not every government mint produces bullion bars. The Royal Canadian Mint and the Perth Mint are examples of governments that produce both silver bars and coins.

Silver in bar form doesn't have the same numismatic potential as coins, but it carries lower premiums over spot because its manufacturing process is cheaper and its designs tend to be simpler, especially in cast silver bars.

Let me explain why:

Silver Bar vs. Cast Bars

Minted Bars: Unlike cast bars, minted bars have a polished and refined appearance. They are made from gold strips cut and stamped with details and designs. They tend to be more liquid, often with security features such as holograms, serial numbers, and assay certificates.

The precise manufacturing, inspection, and polishing make them more visually appealing, frequently leading to higher premiums.

Cast Bars: Cast gold bars are among the most basic forms of bullion, produced by pouring molten gold into molds. The manufacturer's name, weight, and purity are engraved afterward.

They’re simple in design, often available in larger sizes, and offer lower premiums due to their lower production costs.

However, their rough appearance can make them less appealing to buyers, reducing liquidity.

Silver Bars for More Ounces Overall: Low Premiums on silver

Although there are a few exceptions, most silver bars are struck by private mints.

If your highest priority is getting the most silver weight for your money, silver bars and silver rounds could be considered better general options than silver coins. Because premiums are typically lower, you can acquire more pure silver per dollar invested.

You will yield less if you ever decide to sell bars versus silver coins. But the bid-ask spread between silver bars should be slightly tighter than government-issued bullion coins.

When it comes to holding value, however, lower-mintage, limited-edition, high-quality silver coins might be the best option.

Counterfeit Risk & Verification

Counterfeiting is the creation of replicas of products to deceive people, and it is the same as counterfeiting money, which is considered a federal crime.

Silver is more affordable, traded in larger volumes, and more prone to replicas. Mints responds by investing in high-tech features that emphasize physical verification, such as laser-etched details, serial numbers, and specialized finishes, on silver bars and coins.

Let me show you two examples.

The Royal Canadian Mint has developed a unique authentication system for each coin it produces to prevent counterfeiting: Bullion DNA, which stands for Digital Non-Destructive Activation.

During the registration process of the Maple Silver Leaf, each coin receives an encrypted string of codes, which are stored in the RCM’s database. Only specific scanners can read the encrypted code.

The Royal Mint (UK) has also taken measures. One of the anticounterfeiting measures on the Silver Britannia Coin is the micro-text “Decus et Tutamen,” which means “an ornament and a safeguard” in reference to Britannia’s artistry.

As you move the coin, the image on the lower left changes from a padlock to a trident. The movement also brings life to the background waves through the surface animation. Finally, Britannia’s shield is imprinted with tincture lines alternating patterns.

Silver Selling Privacy Concerns: Tax Considerations

Capital Gains

In simple terms, the IRS (Internal Revenue Service) classifies physical silver and other precious metals as collectibles.

As a result, any profit realized upon sale may be subject to capital gains tax, up to a maximum rate of 28%, depending on your tax bracket.

Reporting:

Now, reporting requirements generally apply when transactions involve $10,000 or more in cash.

In summary, silver bullion itself does not generate taxable income while it is held. Tax obligations arise only when the bullion is sold and a gain is realized.

Silver Coin vs Bars Performance During Financial Crisis

To give a more recent example of how silver performs in times of crisis, after a few years of relatively stable prices, silver prices reached as high as $95 per ounce, following gold’s historic price path in the last year of 2025.

Take a look at a screenshot of our Gold-Silver Ratio. The graphs show that currently, one needs more than 50 ounces of silver to purchase one ounce of gold.

And you need to know this, because when prices rise sharply, affordability and divisibility become crucial for investment planning.

Also, check out the Silver Prices Today.

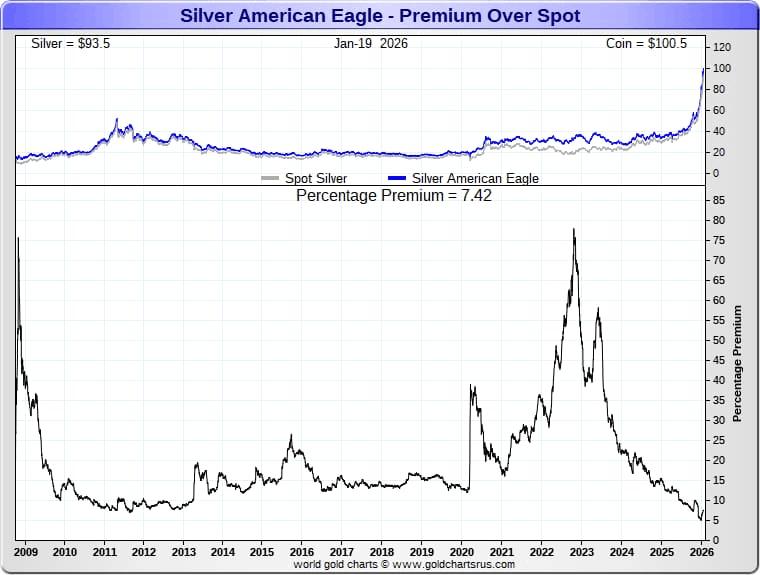

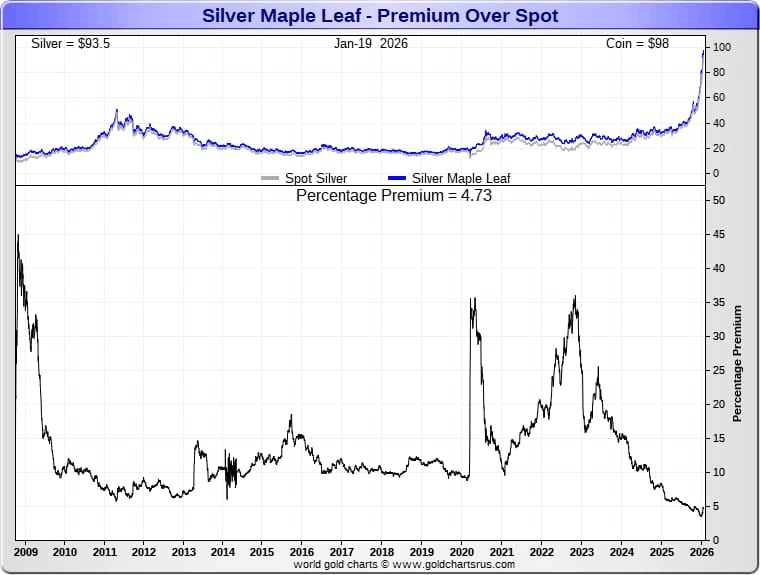

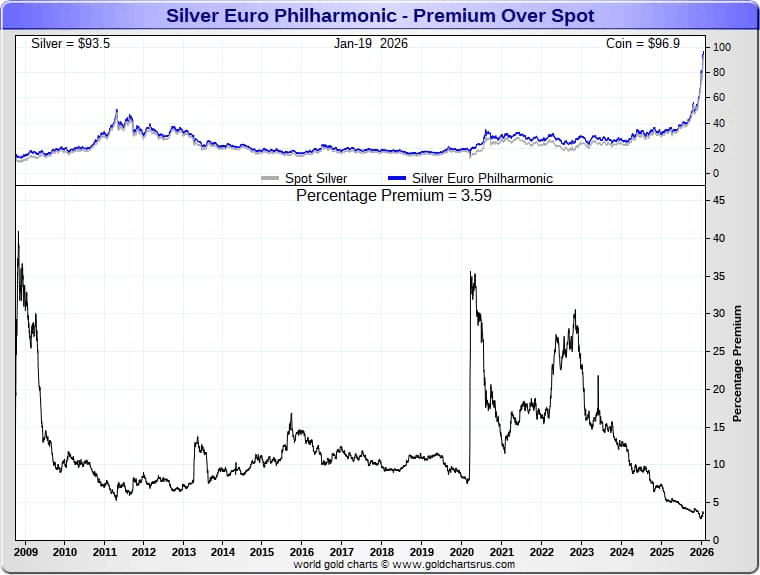

Pay attention to the far left side ← AND on the far right side → of the following Silver Coin price premium charts.

American Silver Eagle Coins

Canadian Maple Leaf Silver Coins

Austrian Silver Philharmonic Coins

90% Silver Coins

Silver entered the first semester of 2026 at above $90. Heightened geopolitical uncertainty, including developments in Latin America and the Middle East, has reinforced safe-haven demand for both gold and silver.

In times of economic uncertainty, government-issued silver coins enjoy the highest demand and the largest pool of potential bidders.

Lack of trust in the future typically attracts new silver bullion buyers to the market due to concerns about further losses in fiat currency savings or other asset classes that have been stricken.

This new pool of silver bullion buyers typically trusts government-issued silver coins first.

Portfolio allocation

A common principle in precious metals investing is portfolio diversification. As the term suggests, investors allocate their savings across different asset classes, such as stocks, bullion, and real estate.

Gold investors often allocate a portion of their wealth to silver as well. Due to its lower price point, silver offers a more accessible entry for new investors while also serving as a practical diversification tool for more experienced ones.

Where to store, buy, and sell silver coins and bars?

The Secondary market tends to be more popular for that kind of sale, as it includes private sellers, local coin shops, and online dealers.

Though it is perfectly possible to find reputable dealers online, make sure to proceed with caution and conduct proper research. Prefer established online bullion dealers to avoid scams and pitfalls. You will usually find lower premiums online than from brick-and-mortar shops.

Regarding storage, as with any investment, purchasing silver comes with drawbacks. Before purchasing silver bars or coins, make sure to have a storage plan. You can store them in a safe deposit box, at home, or at the bank. Or even hire a depository service.

But, if you purchase them to fund an IRA, the IRS commands you to store your silver investment in a secure and licensed third-party depository.

Recap

If we had to summarize the whole discussion in a very simple visual representation, it would look like this:

|

Investor Profile |

Best Silver Product |

|

Cost-focused |

Silver Bars |

|

Liquidity-focused |

Silver Coins |

|

Crisis hedgers |

Government Silver Coins |

|

Long-term accumulators |

Balance of Silver Bars and Coins |

As you have seen, there is no single right answer. Silver bars generally lead in price, while silver coins offer greater liquidity, recognizability, and the potential to retain numismatic value over time.

Stacker POV: 1 oz Silver Eagle vs 1 oz Silver Bar

Both products contain exactly 1 troy ounce of .999 fine silver — but from a pure stacking perspective, bars consistently deliver superior efficiency.

Here’s why experienced stacker buyers lean toward bars:

Lower Premiums: In real-world buying, Silver Eagles frequently carry premiums in the 15–25%+ range over spot, especially during periods of strong retail demand. 1 oz silver bars, by contrast, typically fall in the 5–10% range. That difference compounds quickly when you’re stacking bullion in volume. Paying materially less per ounce means you accumulate more silver over time — period.

More Silver for Your Money: When you buy government coins, you’re paying for legal tender status, branding, and collectability. As a focused stacker, that’s secondary. With bars, a larger percentage of every dollar goes directly into physical silver weight. On a fixed budget, that often translates into meaningfully more total ounces in your vault.

Lower Production Costs = Better Efficiency: Bars are simpler and cheaper to produce than high-detail sovereign coins with advanced security features. Those manufacturing savings are reflected in the lower premiums you pay. From a stacking standpoint, there’s no reason to absorb extra fabrication cost if your goal is bullion weight.

Straightforward Valuation: Bars don’t carry a numismatic angle. Their value tracks almost entirely with spot price and purity. That simplicity makes portfolio tracking cleaner and removes the speculation component that can come with sovereign coins.

If your objective is stacking for long-term wealth preservation and maximizing ounces, bars are the disciplined choice. Eagles have their place — but for a focused stacker, premium efficiency wins.

Ultimately, the more important question is not which product is better, but which investor you are and which option best aligns with your goals.

If you are also interested in buying gold bullion products, check out our article on Gold Coins vs Bars.

FAQs

Silver bullion bars vs silver coins: which is better to buy for investment?

Silver bars are generally the better choice for investors focused on acquiring large quantities of silver at the lowest possible cost, as they carry lower premiums per troy ounce. Silver coins, by contrast, offer greater liquidity and recognizability due to their government-backed minting and legal tender status, making them easier to trade, verify, and sell in smaller increments.

What is the best form of silver to buy?

It depends on your priorities. Buying silver coins can be an interesting option for those seeking a highly recognized, liquid asset. On the other hand, silver bars are priced lower than coins, making them more affordable, as their price is based on the precious metal's content.

Is it cheaper to buy silver bars or coins?

In the bullion market, purchasing silver involves paying a premium over the current spot price. This premium is usually a few dollars above the price of silver per ounce and reflects the costs of manufacturing the silver product. When it comes to prices, silver bars are usually less costly to produce and are a cheaper form of silver investment than silver coins.

Do silver bars hold value?

Yes. The value of a silver bar is primarily based on its silver content. Silver has long been used as a store of value and a portfolio diversifier alongside other precious metals, such as gold. Because of its intrinsic metal value, silver will not become worthless, and neither will silver bars.

Disclaimer: The information presented is for educational purposes only and is not financial, investment, legal, or tax advice. Always seek guidance from a licensed professional before making precious metals decisions. This content is not personalized to your financial situation. Investing in precious metals carries risk, and prior performance does not guarantee future outcomes.

Author James Anderson, Senior Market Analyst

James Anderson is a leading voice in precious metals market analysis and a veteran physical bullion professional. As host of SD Bullion’s weekly market update on YouTube, he reaches more than 90,000 subscribers with timely insights grounded in real-world experience. He also connects with over 30,000 followers on Twitter (@jameshenryand), where he shares commentary on gold, silver, macro trends, and long-term wealth preservation.

A committed bullion buyer before the 2008 Global Financial Crisis, James blends firsthand investor experience with disciplined market research. His work has been featured on Zero Hedge, CNBC, Silver Seek, Investing News Network, the History Channel, and other prominent financial media outlets.

Disclaimer: This content is provided solely for general education and does not constitute financial, investment, legal, or tax advice. Consult a qualified professional regarding your specific circumstances before investing in precious metals. Market risks apply, and historical performance should not be relied upon as a predictor of future results.