The question of whether to invest in silver via a silver ETF derivative or directly through buying silver bullion outright is one that requires a few factors of consideration.

Risk tolerance, expenses, and time horizon all play into deciding which silver investment vehicles make the best sense for you between silver bullion and or silver ETF exposure.

Most silver ETF owners have never read the prospectus of equity they own much less understand the annual expenses and risks of such products. For short term trading, silver ETFs may be a viable option.

Here we examine the most significant silver ETF vs. silver bullion investment vehicles and their past performances.

Silver Investing Timeframe

If you are making a shorter trade or looking for a near term investment hedge, buying silver ETF shares may be the most comfortable and cheapest option for a short term trade.

If your time horizon on your silver investment is medium to long term (2 years or longer), due to annual silver ETF fees, myriad counterpart risks, and lacking 24 hour 7 days week liquidity; the more extended term silver speculator will likely benefit most by directly buying silver bullion outright.

Typical physical silver bullion buyers have medium to long term time horizons on their purchases and holding duration expectations. Physical silver bullion owners are most often not simultaneously derivative day-traders.

Most silver bullion buyers have a multitude of common reasons and motivations for their outright silver bullion ownership. Often investor driving forces for buying silver bullion conflict with the vast majority of silver ETFs which are commonly available on equity and stock exchanges.

Below we examine some of the costs associated with holding shares in the most popular silver ETFs versus buying silver bullion outright and holding it first hand and or using a fully insured non-bank silver vault or depository service.

Aside from the hard costs and fees associated, we look at the other features that distinguish silver ETFs from physical silver bullion ownership, such as:

- Can you visit and audit your precious metals?

- Do you know even where your fund's supposed silver bullion backing gets stored for safekeeping?

- Do you as an ETF shareholder even own outright any precious metals underlying the fund?

- Can you easily withdraw your very own physical bullion bars or coins?

- How did your ETF perform in the 2008 financial crisis when many popular physical bullion product premiums reached +80% above the then fluctuating spot price?

Unlike the direct private bullion storage models offered here at SD Bullion, when you examine the overall fees of silver ETFs looking backward, you will inevitably find higher costs associated than even their supposedly simple upfront quoted “management fees.” Commissions and also operating expenses are often added on in arrears, making total expenses for many silver ETFs much higher than what was initially perceived or quoted up front.

Also note that the largest silver ETFs called SLV, only allows “Authorized Participants” to take physical delivery of silver bullion from the fund.

Mostly these participants are only the largest approved commercial banks, billionaire institutional investors, institutional hedge funds, etc.

In other words, most retail investors cannot take physical delivery of any ETF mentioned below. For most, only some ‘approved’ or ‘authorized’ financial insiders can redeem physical bullion from the world’s largest silver ETFs. Choose accordingly.

Most silver bullion buyers believe precious physical metals owned outright offers them:

- A safe haven asset which preserves wealth over the long term and is easy to transfer title to loved ones on an intergenerational basis.

- Additional portfolio diversification which when back-tested in our full fiat currency era is mathematically proven to hedge wealth against many downside risks compared to other non-correlated asset classes (bonds and stocks specifically).

- A currently undervalued asset class compared to equities, bond or t-bills, and even real estate.

- A precious tangible asset which can help defend wealth against both record debt levels worldwide, and potential inflationary or deflationary scenarios.

- Silver bullion can provide some wealth protection from bank failures, bank bailouts, bank bail-ins, bank account freezes, and cash withdrawal rationing for a further digital and cashless society.

- A private asset which cannot go bankrupt with limited counter-party risks.

- A potentially revaluing asset class in a record low real interest rate yielding environment (e.g., ZIRP / NIRP) with other experimental and standard central bank policies which consistently devalue fiat currencies over the long term (e.g., QE, potentially MMT).

- Silver bullion is one of the most liquid, easily tradable asset classes similar to most physical cash notes still accepted in commerce. Virtually all major metro areas have places one can exchange silver bullion for fiat currency in an emergency. You can also quickly sell silver bullion to online dealers and get your funds within a matter of a few business days.

|

Silver Investment Vehicle |

Annual Fee % |

Specific Coins or Bars Allocated? |

Visitation Permitted? |

Home Delivery Possible? |

|

Silver Bullion in Hand |

0.00% |

Yes, in your safekeeping |

Yes |

Yes |

|

Silver Bullion Storage with SD Bullion |

0.39% |

Yes, fully allocated and segregated for each owner |

Yes |

Yes |

|

SLV |

>0.50% |

No, only large Industrial bars |

No |

No, only "Authorized Participants." |

|

SIVR |

>0.45% |

No, only large Industrial bars |

No |

No, only "Authorized Participants." |

|

PSLV |

>0.45% |

No, only large Industrial bars |

No |

Yes, minimum 10,000 oz |

|

ZKB |

>0.60% |

No, only large Industrial bars |

No |

Yes, 30 kilogram minimum with an approximate 9.2% delivery, redemption commission, plus any VAT applied |

Silver Bullion vs Silver ETF Price Performances

Silver bullion has durations in time when price premiums for the highest demanded products.

For instance, the 1 oz American Silver Eagle Coin, for example, can and has outperformed all silver ETF derivatives over the past decade.

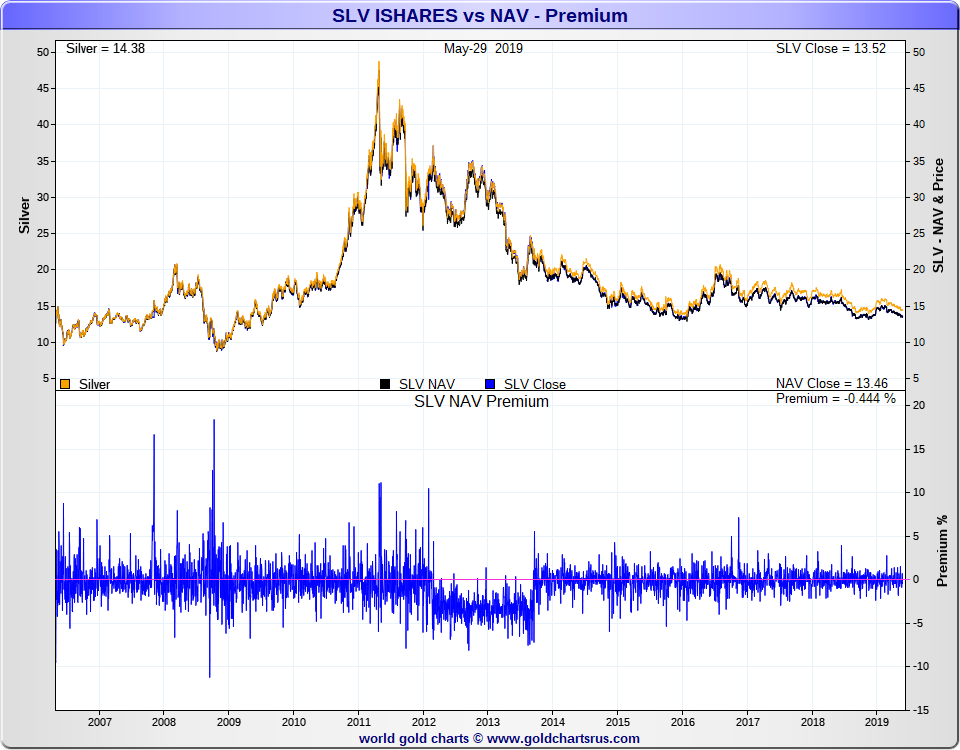

See in the chart above how in the 2008 financial crisis, one ounce American Silver Eagle coins where commonly being sold for over 50% price premiums above the fluctuating silver spot price.

It appears even currently the average prices for these most popular silver bullion coins are again ramping higher.

Indeed, much larger price premiums than SLV shareholders are receiving if they currently go to sell their shares.

The most popular silver ETF trading under ticker symbol SLV only continues to diverge its ongoing price below the silver spot price.

There is no chance for SLV shareholders to make any premiums on the shares they own if the silver price falls under another short squeeze tight supply heavy demand scenario.

Silver ETFs vs Bullion Bottom Line

If you are a day traded and need a silver investment vehicle for short term trading, silver ETFs are likely viable options. Just know the myriad counter-party and annual expenses associated with such silver investments.

If you have a longer-term time horizon with your silver bullishness, give silver bullion the vast majority of your silver allocation. And then hide and safe-keep it for the long haul.

Thanks for visiting us here at SD Bullion.

***