Cashless Trends

In an era of rampant privacy invasions, digital hacking, and natural disasters. Physical analog money systems continue to prove their value. Learn how to keep some of your savings private.

The beginning of the USA’s ongoing cashless trend ramped up in earnest with the Bank Secrecy Act of 1970.

This type of legislation gets referred to as ‘Anti-Money Laundering Law’ or AML for short.

The intention of AML legislation is purportedly to thwart and track suspicious activities and capital flows. Sinister cash flows which might signify money laundering, tax evasion, drug dealing, terrorism, and other criminal activities.

Following this 1970 act, there was the inception and subsequent explosion in credit card usage and subsequent accumulating consumer debts. Even though US interest rates precipitously fell from the middle 1980s onward for decades to follow. Credit card loan interest rates did not fall by much if at all. Credit cards became some of the banks most profitable service sectors.

These revolving consumer loan vehicles have become some of the most profitable business models of the US banking and financial system to date. Note the growth in credit card debts from 1980 onward.

As we again eclipse the USD 1 trillion mark for full credit card debts outstanding, this short 3 and half minute video can give you a better understanding as to how US citizens have switched from being savers first and credit consumers second. We are now a more frequent consume via credit cards first, and save later (if at all) culture.

The timing of substantial consumer credit card loans followed shortly after the USA moved from a pseudo-sound money standard (Bretton Woods era) into a full floating fiat currency standard (Petrodollar era).

This mass consumer credit cycle has also undoubtedly contributed overall to global pollution and certainly as well to the growing disparities of wealth between average citizens (creditors) and those in the higher strata of wealth (capital, owners).

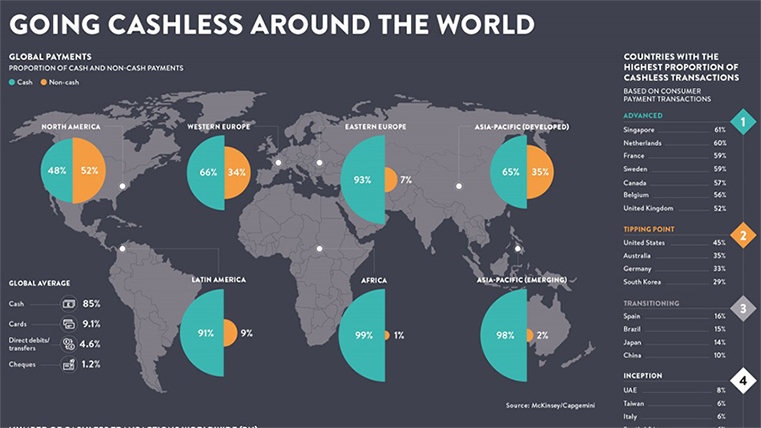

New electronic banking services and digital payments have been growing not only in the USA but also around the world in both developed and emerging markets.

Governments, central banks, large multinational corporations, and even significant endowment funds have been increasingly pushing for a more cashless world economy (mainly concentrating their efforts in high cash usage continents like Africa, throughout Latin America, and in Southwest Asia).

Cashless promoters argue that having a paper trail and digital record for all transactions could help decrease crime, money laundering, terrorism, and tax evasion. There are, of course, various counterpoints against these cashless promotions. Nonetheless, the war on cash is currently getting won by multi-billionaire, government, and corporate sponsors.

For example, in 2015, France lowered the legal limit of cash used in transactions to only 1000 euros or less. Its finance minister at the time stated he would “fight against the use of cash and anonymity in the French economy” to prevent low-cost terrorist acts which he claimed feeds off fraud, money laundering, and petty drug trafficking.

To start the year 2020, Germany will now track any gold or silver bullion cash purchases of over 2,000 euros all in the name of anti-money laundering and enhancing the ability to track criminals.

Of course, tracking bullion like cash is also eventually in the crosshairs of cashless promoters as well. In Europe, the very definition of “cash” is lawfully to include gold, precious stones, precious metals, as well as anonymous prepaid electronic cash cards.

We all want to fight terror, drug dealers, and tax cheaters, right?

India (the 2nd most populated nation in the world) was a recent guinea pig of growing cashless policies. Of course, authorities there cite the usual reasons for recently banning 500 and 1000 rupee notes. Again supposedly to help in fighting terror, tax evasion, drug dealers, etc.

The truth of the matter is much deeper than these face value reasons here and there.

For example, on paper, the Indian banking system is one of the most transparently bankrupt in the world. Hence pushing Indian citizen's currency back into checking and savings accounts helps to bolster bank reserves so Indian banks can eventually potentially bail-in accounts and write off some of their growing non-performing loans.

Image Source

In early 2016, former US Secretary of the Treasury and economist Larry Summers publicly called to kill the U.S. $100 bill.

The now perhaps most widely issued fiat currency note in the world.

Another former chief economist of the International Monetary Fund recently wrote a book on how banning USD 100 cash notes or bills could not only help deter crime and tax evasion but also possibly help central banks fight future financial crisis (e.g., implementing negative-interest rate policies, fees for withdrawing from cash ATMs, etc.).

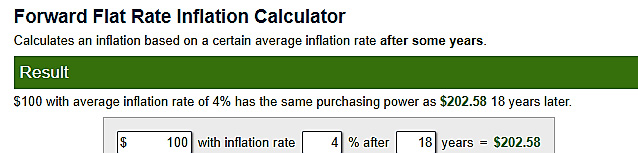

This same ‘thought leading’ author proposes raising current central bank inflation targets from 2 to 4%. Doing this would mathematically halve (-50%) the purchasing power of Federal Reserve Notes in less than 18 years using a forward flat rate inflation calculator.

With annual 4% inflation, add in further possible Negative Real Interest Rate policies (via NIRP and ZIRP) and the numbers to halve currency values get even shorter.

President Trump is now picking a potential 14-year term Federal Reserve Board of Governor who is reportedly anti-cash so that Negative Interest Rate Policies (NIRP) can get more effectively implemented in the next financial crisis.

A potential combination of NIRP, physical cash killing policies, new quantitative easing policies, coupled with higher inflation targets are all possible central bank tactics to help lessen the unfunded liability and debt load overhang of the Federal Government.

Of course, underlying all these points, G20 bank bail-in laws are readied with financial spillover lock-down-laws (e.g., redemption freezes for Money Market funds) are now ready and waiting.

Stagflation 2020s appears very probable.