Backtesting Bullion Allocation Percentages

In our post-Nixon 1971 full fiat currency era, a recent study backtested bullion allocations vs equities and bonds from 1968 through 2016. The results will likely surprise you.

There is a Potential 10% Gold Allocation Fallacy Ongoing

According to a relatively new study by Jeff Christian and CPM Group, adding physical precious metal bullion products to equity and bond allocations improves the return to risk profile of the entire investment portfolio.

This conclusion was made based on a study of 450 separate investment portfolios, which contained equity, debt, and various combinations and weightings of the 4 precious metals we are covering as well – gold, silver, platinum, and palladium.

Monthly data spanning from January 1968 to December 2016 was used in this backtest study which is a rather important time span as from August 15, 1971 the world has been on a fully floating fiat currency exchange standard. This fact basically ensure physical bullion’s solid performance over the same time frame, even with various potential price suppression ongoing.

In this gold allocation portfolio model study the S&P 500 was used as a proxy for the equity markets and US T-Bills or US T-Bonds were used as a proxy for the debt component of the model portfolios.

The precious metals weightings ranged from 0% to 70% of the various backtested investment portfolios. When more than one precious metal was included in a portfolio they were equally weighted and never exceeded 70% of the portfolio. Total precious metals weightings were raised in increments of 5% per annum. The first backtested investment portfolio had a combination of equity and debt with zero precious metal price exposure. The final of the 450 various backtested investment portfolios contained as high as 70% precious metals allocations.

What they found was from 1968 to 2016. if you took a portfolio of 50% S&P and 50% T-bills and you added gold to it in 5% increments annually, the optimal risk reward allocation was actually about 25% gold depending on whether you used T-bills or T-bonds respectively.

Note that this 25% gold allocation does not take real estate investing nor equity dividend reinvestments into account. A study involving those backtested inputs would be prohibitively more complex and likely lead to a smaller than 25% gold allocation suggestion.

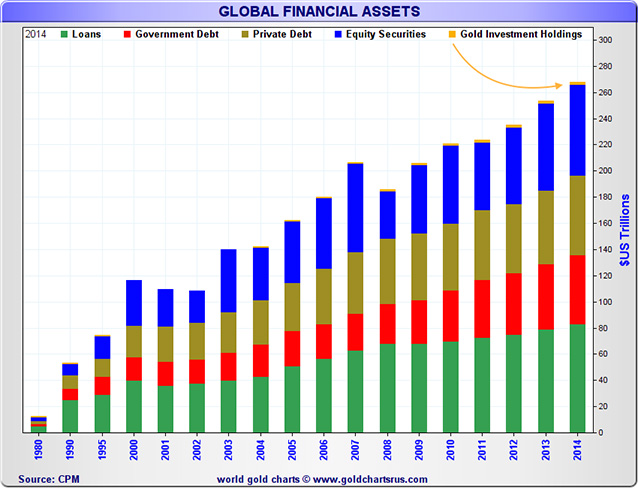

Yet also consider that this study did and currently refers to bond markets of over $100 trillion USD market worldwide (e.g. government, corporate, etc.) and equity or stock markets (an over $80 trillion USD market worldwide) which are and have been easily estimated at about 20 times the size of all the physical silver and gold above ground and their much smaller investment allocations in each respective precious metal currently.

When adding only individual metals to a debt and equity investment portfolio, gold was the best choice for improving the return to risk ratio from 1968 through 2016.

With allocations above 25% precious metals exposure, the risks to the portfolio’s volatility rose faster than the returns from having more precious metal exposure within the portfolio. The benefit of adding each of the other precious metals individually to the portfolio peaked at 5% and the improvement in the return to risk ratio was relatively smaller compared with a portfolio that added only gold price exposure.

Again note that this recent CPM Group study on 25% gold allocations spans almost the entire full fiat currency era in which we have lived under, where all nations states have and continue to only issue paper and digital currencies backed by the full faith, credit, and taxation powers of their respective nation states.

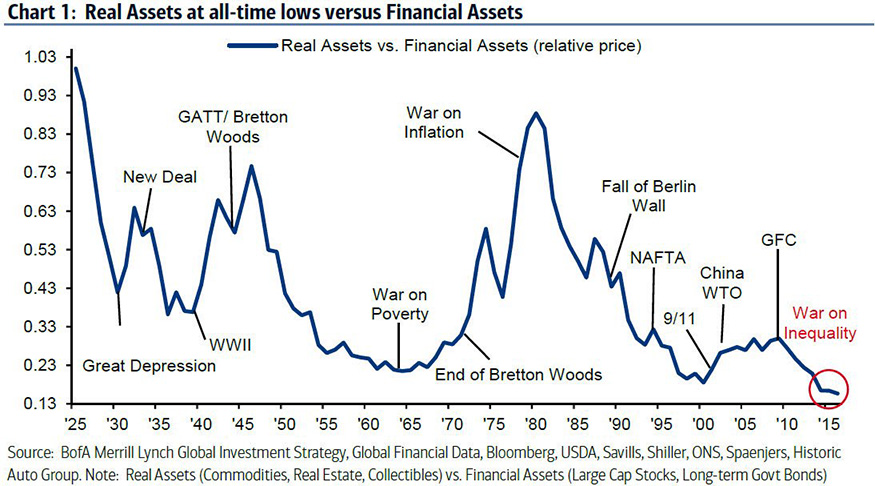

Given where we stand today in terms of outsized financial asset price valuations vs tangible real asset values, perhaps Jeff is not sticking his neck out all that far.

More often than not, if you have studied the gold and precious metal industry, you’ve heard experts asked what percentage people should hold and allocate into precious metals like gold or silver bullion for instance.

Even financially worshiped names when politely making 5 to 10% suggestions for bullion allocations get grief.

This low percentage misnomer according to Jeff Christian, stems from studies produced in the early 1980s back when gold’s investment and physical valuations versus other financial and real estate assets were much larger than they are today. Another reason is also the comparatively small size of $8 trillion gold above ground vs a financial system than has about $1 quadrillion USD in total current valuations.

In short, currently gold is dwarfed by other more illusory financial asset valuations.

How much longer will this remain so?

What might a reversion look like?