Silver Slips as Trade Talk Rallies Stocks—But Currency Charts Tell a Stark Long-Term Trend

-

Silver and gold both dropped sharply this week, with silver closing at $38.17/oz and gold at $3,338/oz after early-week rallies.

-

Global trade optimism surged following a U.S.-Japan deal, pushing equity markets to new highs and pressuring precious metals.

-

European officials are scrambling to secure their own tariff agreements, adding to the temporary bullish sentiment for stocks.

-

Fiat currency charts show decades of steady decline versus gold and silver, with most major world currencies down over 90% since 1971.

-

The U.S. dollar M2 supply has hit a record high, as stimulus discussions re-emerge ahead of election season.

-

Silver’s current price action mirrors the 1972–1973 breakout, suggesting a potential path toward $50/oz and beyond if history rhymes.

-

Russia is pushing forward with its own gold exchange (SPIMEX) to reduce reliance on the LBMA, amid a broader de-dollarization trend.

-

China’s demand for platinum and Russian bullion remains strong, reinforcing the East’s growing role in precious metals markets.

-

Silver supply remains tight, with mine output below 2016 levels and investment demand expected to be a key driver in the second half of 2025.

Short-term volatility masks the deeper erosion of fiat value against gold and silver—while central banks and investors brace for what's next.

Gold and silver spot prices experienced declines this week, as rumors of progress in U.S. trade negotiations with key partners like Japan and the EU apparently led to price selloffs.

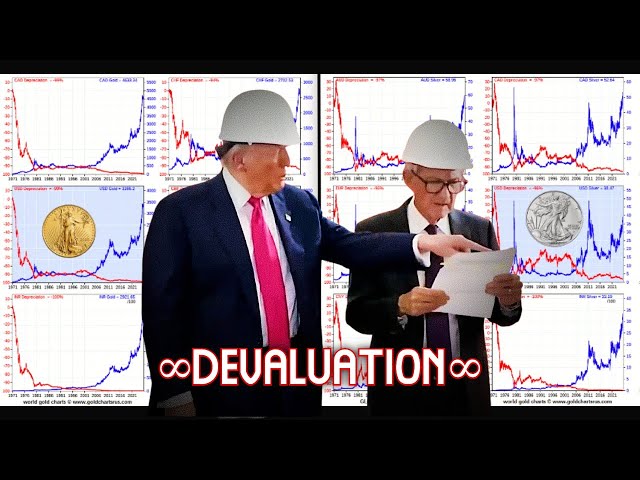

President Donald Trump and fiat Federal Reserve Chairman Jerome Powell also had a tour of new Federal Reserve building constructions that led to this awkward short press conference.

Let's cut through these short term policy pumps and keep our eye on the long term trend.

The ongoing devaluation of fiat currencies versus bullion continues in some of the best charts I saw all week.

In the center is the fiat US dollar since 1971 verse gold bullion ongoing, having lost over -99% of its gold buying power the last 54 years.

Same can be said for the fiat Australian dollar, fiat Canadian dollar, fiat Euro, fiat British pound, even more so for the fiat Indian rupee and fiat Chinese yuan rounding up to near -100% losses vs gold bullion since 1971.

The lone two slower stragglers here are top right the fiat Swiss franc having lost -94% to gold and the bottom right chart the fiat Japanese yen down now -97% to gold bullion since 1971.

Everyone of these by design is heading to -100% losses to gold bullion by fiat currency's inherent design.

The story on these 9 data sets of major fiat currencies versus silver bullion since 1971 is similar in trend, following gold bullion's lead towards -100% in time.

For instance the silver price began 1971 at $1.65 oz so we basically have to see a future price for silver bullion at $165 oz before we can declare the fiat dollar has lost -99% of its buying power versus silver bullion as it already has done so verse gold bullion to date.

Again the largest two laggard outliers on this 9 fiat currencies around the world vs silver bullion remain Switzerland top right and Japan bottom right. Both their respective blue and red lines will be diverging away further from one another as time proceeds akin to gold to date.

Now that the internal US fiat dollar M2 currency supply has hit a new record high, we got President Trump talking about new stimulus checks for citizens of a certain income level, aka the masses.

Of course the Trump Administration wants a weaker relative fiat US dollar as policy and that is what they are getting on a near record low pace down over -10% on the year.

The lone large lower outlier for a worst start to the year to date being 1973.

It just so happens that the closest analog or match of silver's current price action and percentage gains since gold's price breakout to begin 2024, are looking back at the gold and silver price breakouts starting in 1972 into 1973.

This chart by Jordan Roy-Byrne of TheDailyGold.com is startling if silver's past performance rhymes with its future.

The black line arrow is where we were early this week compared to the light blue line from the 1972-1973 run.

These past silver price analogs after gold has broken out and led all suggest that silver will be making a run towards $50 and beyond in the not too distant future be it next year 2026 or later.

As bullion bull markets past and present, gold leads, then silver eventually follows often a frenzied fashion to the upside.

We'll be right back with more bullion related news on the week.

The spot silver and gold markets were up and then down this week.

The spot silver price made a run at $39.50 oz only to selloff today sharply closing the week at $38.17 oz bid.

The spot gold price had a hundred dollar an oz selloff over the last few days of trading to close the week at $3,338 oz bid.

The spot gold silver ratio fell then rose to close again at 87.

In another further sign in the lack of trust central banks have in storing gold reserves offshore, the central bank of Serbia is taking delivery of its lone 10% of gold reserves currently held offshore in Switzerland.

Russia has recently announced plans to launch its own gold exchange in Saint Petersburg with the acronym the SPIMEX with aims to reduce alliance on London's LBMA bullion benchmark pricing which have repeatedly pointed out here is waining in global confidence amongst major gold bullion markets like those largest in both India and China.

It is no surprise being one of the world's largest miners of gold, platinum, and palladium to see Russia exporting more and more bullion to the Chinese market year after year.

Even the blue colored segments representing Russian silver ore and concentrate exports to China have also been growing unsurprisingly.

Platinum imports into China through last month June for now three months in a row are coming in at substantially high levels.

Maria Smirnova of Sprott reminded the world this week of the fundamental drivers likely to lead silver into a good second half for this year 2025.

With both silver supply and mine production levels still down from 2016 levels. Silver supply deficits for the fifth year in a row are mainly currently being driven by silver's industrial demand up over 51% since a decade ago.

The most volatile wildcard for silver supply is almost always silver investment demand. I look for more to silver investment demand to come as silver inevitably begins outperforming US stock market gains specifically since the Covid 2020 bull began.

Interestingly in her past gold silver bull analogs she left the 1972-1973 data out of her set, which as we mentioned nearer the start of this week's Bullion Market Update is the current past silver price analog mostly reflecting silver's current post 2024 run to now.

Finally to close with a condensed clip revolving around our ongoing sleep walk back into a gold-backed world order. I was pleased to see former Bloomberg Intelligence gold market analyst Ken Hoffman appear on the Daniela Cambone Show this week.

He hammers home many of the points we made not merely this week but for years running on this channel.

Have a look and listen.

That is the big picture at play for gold and then silver.

That will be all for this week's SD Bullion Market Update.

And as always, take great care of yourselves and those you love.

References:

Analog CHART Silver currently following its 1972-1973 run:

https://x.com/TheDailyGold/status/1947760674442252726

'We’re sleeping walking into a gold-backed world order' warns Ex-McKinsey & Bloomberg Intelligence's Ken Hoffman

https://www.youtube.com/watch?v=jJOL50YejY4