Bullion Bull Markets Past & Potential

Almost all previous price record discussions on gold and especially silver are full of misinformation and scapegoats which often fail to mention other simultaneously occurring commodity price records.

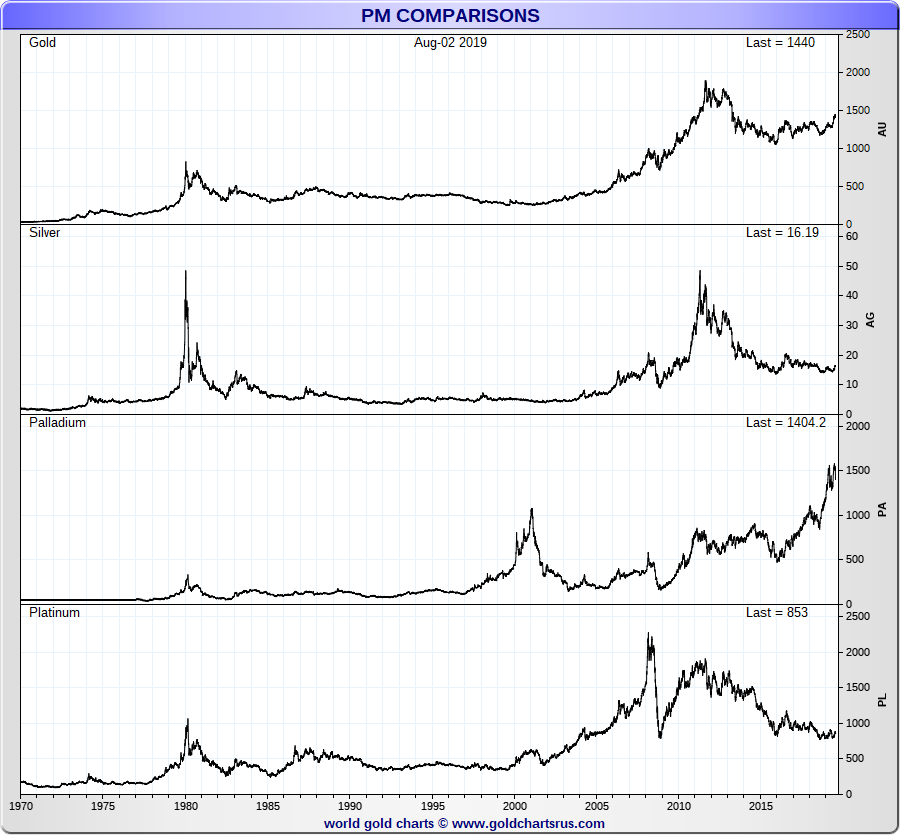

During the western world driven 1980 bullion bull market record price highs, all four precious metals traded on futures exchanges saw huge value gains beginning in the early 1970s up to the first few months of 1980.

The then gold spot price multiplied more than 24 times beginning from 1970, priced at $35 USD oz, ultimately hitting over $850 USD oz by late January 1980. The then silver spot price multiplied more than 38 times, beginning in 1970 at $1.29 USD oz, and finally reaching $50 USD oz the beginning of 1980 all within about a ten-year timeframe.

Platinum began 1970 priced at about $170 USD oz eventually reaching $1050 oz in 1980, a more than six multiple in its freshly fully fiat US dollar value.

Palladium went from $34 USD oz to $320 in this same timeframe, a near ten multiple in fiat US dollar value.

What might we eventually see this go-round?

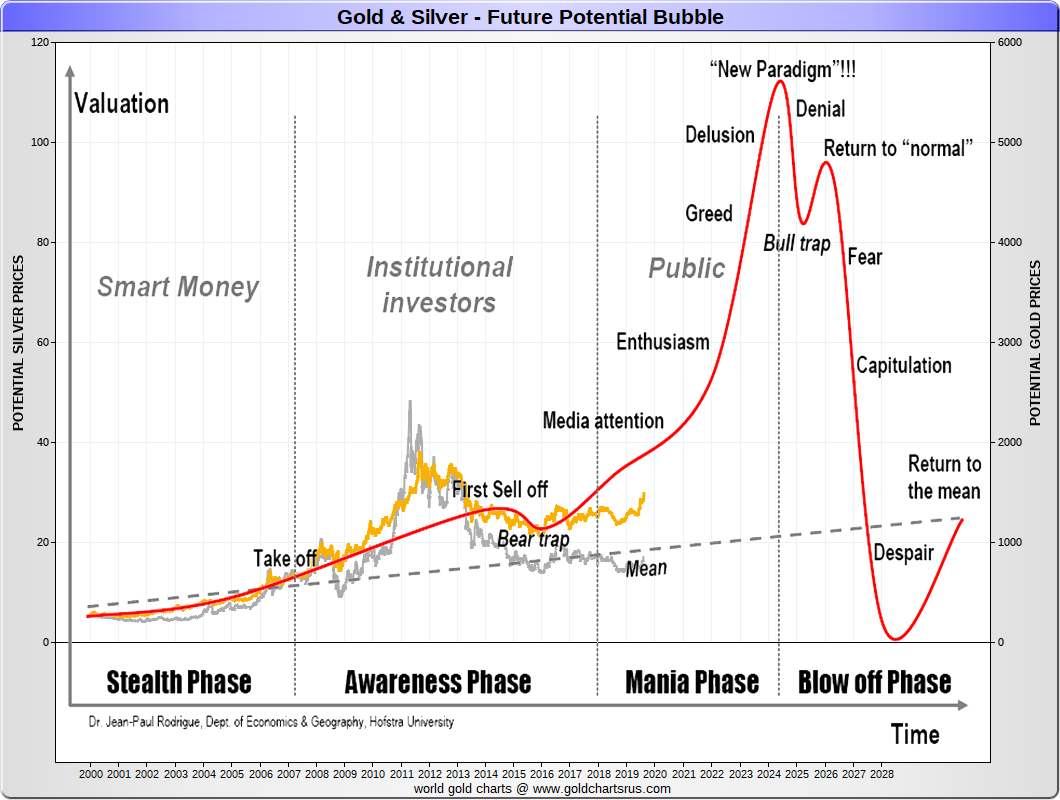

Many secular 21st Century bullion bull market believers (like myself) contend that we are currently nearing the end of a cyclical bear market for bullion values vs other asset classes.

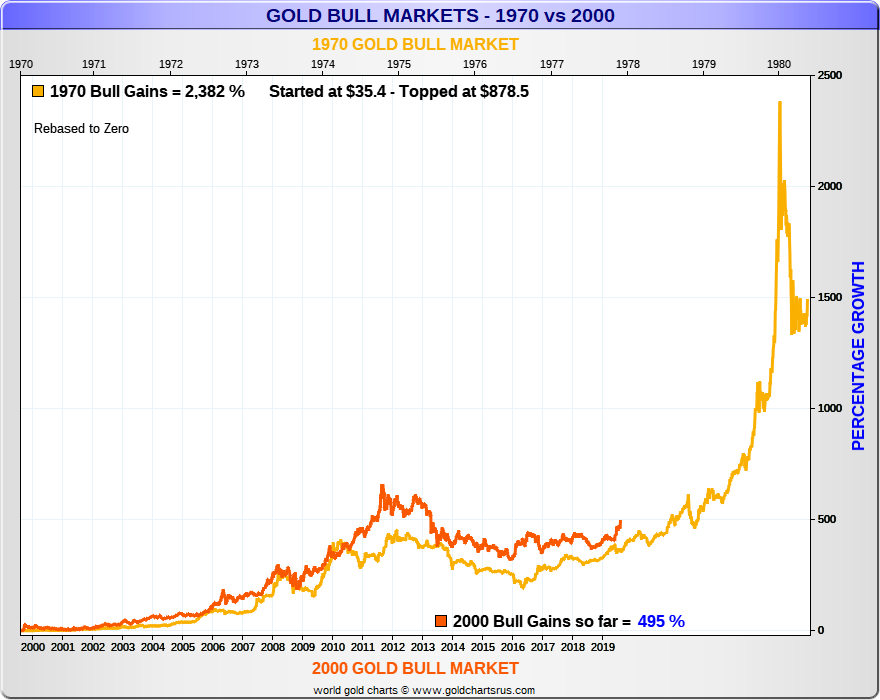

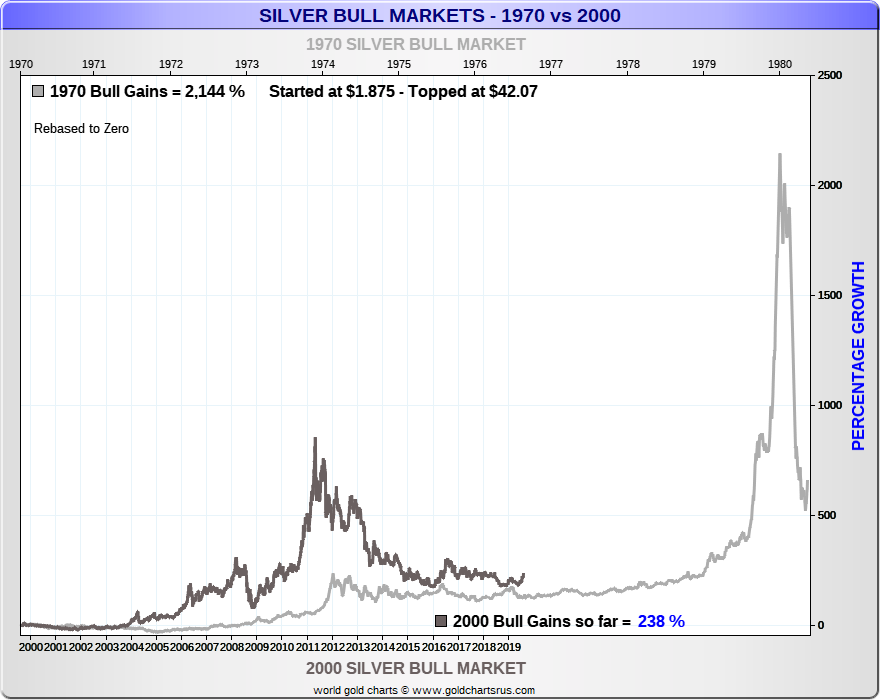

The first bull wave we witnessed for gold and silver specifically was similar to the 1970 - 1974 pattern in the 2001 - 2011 interim price highs (over $1900 USD oz gold and near $50 USD oz silver both prices reached in 2011).

The duration of this 21st Century bull market appears to be taking 2.5Xs the amount of time it took for the 1980 version to play out. By merely measuring notional trading volumes and the amounts of physical ounces that have exchanged hands this go-round, this 21st Century version is already the world’s biggest bullion market to date.

Take a look at the following charts on where we went in the last western nation only bullion bull market to this all world bullion market of the 21st Century.

I believe we have much further to go with gold and silver values higher before this secular bull market trend ultimately ends. For now gold and silver are still what feels like a slow-motion price consolidation ‘Bear Trap’. The conditions currently are simply helping to build energy for their eventual mania phases ahead.

Investors commonly and often mistakenly never count their wealth positions in equivalent troy ounces of more reliable wealth measurements like gold or silver bullion.

Instead, we most often privilege our local fiat currency of choice to do this (in most cases today, the US dollar). Price inflation masks real values given that there are almost always more fiat US dollars in circulation year after year versus other limited finite resources and services.

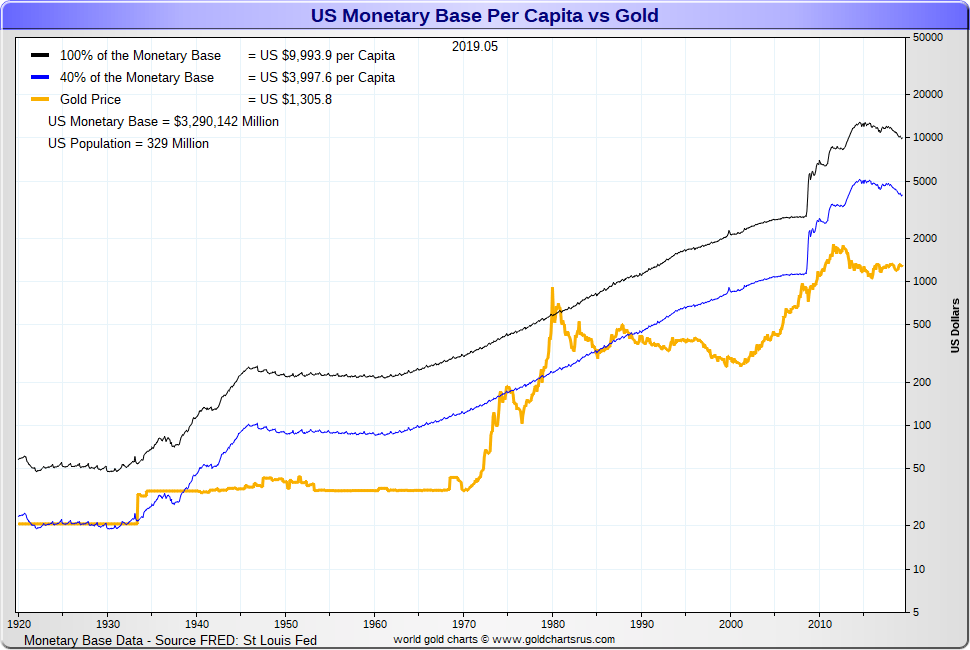

For instance, today there are now more than 20Xs the US dollars in circulation versus that last time US gold reserves were revalued high enough to fully account their value.

Although I am not suggesting this will again reoccur, I personally believe US gold reserves will again revalue high enough to reach the 40% threshold of US dollars in circulation (thus requiring a value near $5,000 USD oz gold).

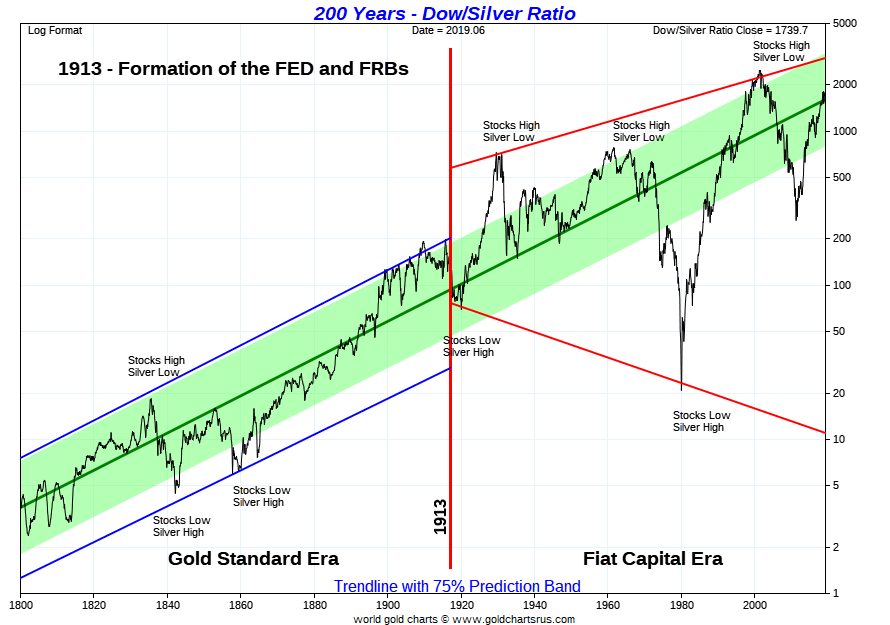

As we await potential revaluations for gold and silver bullion values, we should also note the over 200-year price ratios vs the largest 30 rotating corporation values of the world (DJIA, learn about Dow vs Gold).

Of the current 30 Dow Jones Industrial Average company components, only one corporation has lasted more than 100 years on this particular index (recently underperforming GE). The rest have fallen away, substituted as the rise and fall of corporate profits and growth have a reinvent or decline life cycle.

My expectation is for both precious metal values to strengthen versus equities as the baby boom generation goes to liquidate positions in the hopes of funding their retirements and living standards.

Although when one lives inside the moments, historic over or undervaluations of various assets may appear unending. Yet the ongoing changes in life are really the only thing which is ever constant.

Generally speaking, the longer natural reversions are suppressed (e.g. through artificial stimulus for example), the more vicious and violent become their reversals.

Reversions away eventually move back towards and beyond, it is as cyclical as life itself.

The growing conditions are already in place for the next major global financial crisis.

Simply move now and get ahead of the crowds to come.