The scale and speed of change that the world is now undergoing is nearly impossible to fully comprehend.

The viral crisis, seemingly endless economic lockdowns, and select infinite bailout programs are ushering in the fastest and largest consolidation in our economic history.

The long term ramifications of changes afoot are yet to be fully understood, and they will surely mark a sea change in our collective history.

Today, we are going to focus on the already realized and burgeoning plans that most central banks around the world have for going direct to citizens, financial institutions, and other trading stakeholders. In doing so, further consolidating the old fractional reserve bank currency issuance models.

And by in doing so, ultimately changing the structure and rules of the monetary games as we have come to know them.

Digital fiat currency is nothing new.

But directly issued and instantly settling Central Bank Digital Fiat Currency accounts are. And they are arriving this decade, whether we like it or not.

This week we look at changes afoot in both our local and global fiat currency payment settlement systems.

--

This past week, the CFTC was out patting itself on the back for wrist-slapping the Bank of Nova Scotia with a $127.4 million fiat Fed note fine ($77.4 million of which goes to their agency).

They cited that the soon to be closing precious metals trading desk subsidiary Scotia Mocatta was involved in "manipulative and deceptive conduct that spanned more than eight years and involved thousands of occasions of attempted manipulation and spoofing in gold and silver futures contracts."

So the CFTC and the Department of Justice Commodities Fraud Group is about a decade late, likely many billions in fines short, and the traders that mostly benefited from these illegal actions get to keep their ill-gotten gains without having to face individual criminal prosecutions nor prison time.

And the cynics are correct yet again. As we collectively witness another defacing of the credibility of our commodity price discovery markets, the supposed agencies and the rules of law are supposed to police them.

Related link 1 - https://sdbullion.com/blog/scotiabank-precious-metals-desk-shutdown-big-gold-price-news

Related line 2 - https://sdbullion.com/blog/another-silver-manipulation-trader-busted-scotia-bear-stearns

Scotiabank’s Precious Metals Trading Division is Still Closing

The silver and gold spot price markets moved mainly sideways this week as consolidations continue.

Positive for silver bulls to see the spot price consolidating above the critical $26 level. As well, gold continues consolidating still above its old 2011 high of just over $1900 oz.

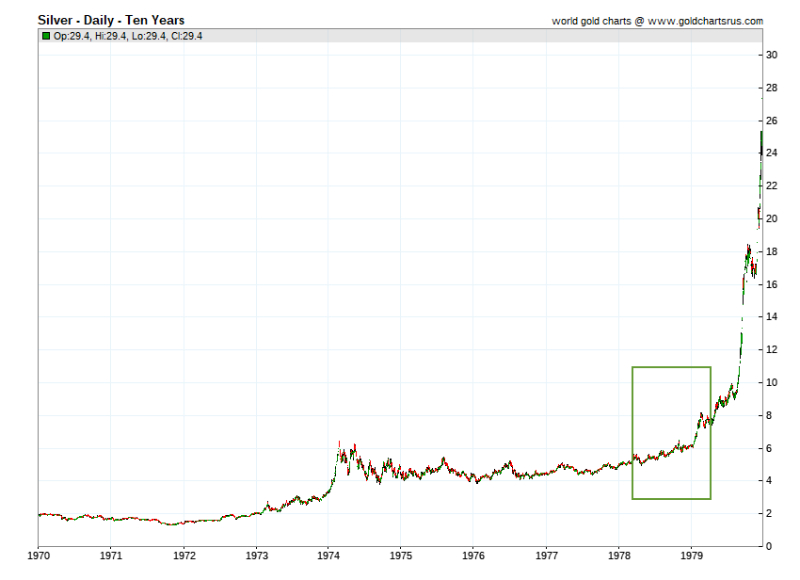

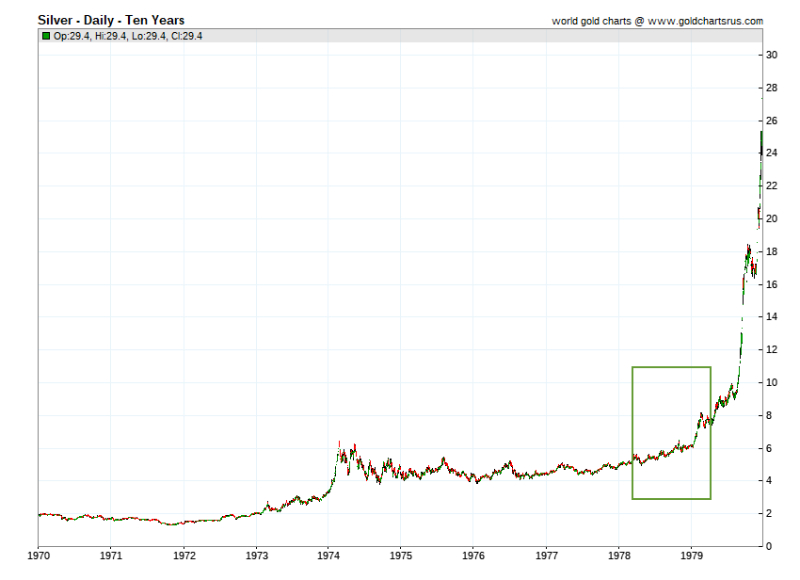

Perhaps the best analog to the wall of worry we are currently climbing in silver and gold charts is the last primary bullion bull market of the 1970s.

Here is how behaved after finally clearing its then $195 oz U cup formation. There were months of price consolidations which eventually led to higher highs. Take note on a percentage basis, some were massive moves which shook out weak hands.

For instance check out that price explosion above $250 oz, only to cascade back down below $200 oz, a roughly -20% loss in gold in a short time frame, followed by a 4x multiple in gold's price within a 14-month timeframe that followed.

Here is how silver behaved over that similar timeframe.

Looking forward to next week, the co-head of the US Treasury Federal Reserve's leveraged buyout of America bailout meld. Jerome Powell will be at Jackson Hole next week, giving his long-awaited dissertation. Explaining how in the world the Federal Reserve is going to supposedly hit their long-stated goal of compounding 2% annual losses in the dominant fiat reserve currency they issue.

So next week, expect more insider plans to be made at this annual central banker and crony corporate capitalist insider symposium.

Akin to the video we released regarding plans made at last year's 2019 Jackson Hole meeting entitled, "Going Direct" BlackRock's Bailout Blueprint 2020s.

If you missed that video, well you yourself and we collectively are living though many of those 2019 plans, right now.

Going Direct | Blackrock’s 2019 Bailout Plans at Jackson Hole

We'll be back next week to report on any significant news disseminating from our financial crony powers that be.

Moving on, the private Federal Reserve central bank recently announced its new FedNow Service offering participating institutions uninterrupted 24x7 all year long instant payment settlements through their depository institution accounts.

This system bypasses the antiquated and slow SWIFT payment system.

And I would argue that this new FedNow system is likely using similar technology that the eventual anticipated fiat FedCoin will, within direct Federal Reserve digital accounts, probably later this decade.

This illustration I got directly from the Federal Reserve’s long-winded FedNow service announcement.

Within that document, they state over 9 times, that the Federal Board does not believe this new system will "create a direct and material adverse effect on the ability of the existing private-sector service to complete effectively with the FedNow Service."

While this new service will hit bank profits under lost bank wire transfer fees, the real threat is that banks are staring at the burgeoning technology in due time, going to take a massive swath of their retail bank customer market shares.

The consolidation of the US banking system will hasten further as a long term result of what is coming. We covered the Federal Reserve's 100% approval of bank consolidations since prior to the 2008 global financial crisis.

Not long after the Glass Steagall Act was repealed in the late 1990s, FDIC insured bank choices in the USA more than halved within a decade of time. As many commercial banks gambling with FDIC insured customer deposits, the world economy exploded and ushered in until then, the worst financial crisis the world had ever seen.

Now just over 5,000 US banks and thrifts exist; about 6 commercial megabanks in the USA dominate, holding about half of the entire bank deposit market share.

Go have a look at this video we made late last year if you are confused as to whether or not you or your business is a secured depositor at your bank of choice.

The anticipated fiat FedCoin system will likely be direct accounts with the Federal Reserve itself.

The anticipated FedCoin launch will probably start by offering MMT-like monthly stipends to supplement American citizens with their month-to-month expenses supposedly. You can think of it as high tech welfare for the disappearing middle and growing underclass.

Problem is about half of the underclass in the United States do not have internet access nor smartphones. So unless we're going to spend some trillion on internet infrastructure, the excuse that Fedcoin is going to increase financial inclusion is still half-cooked. Nor have I heard any serious mentions of bringing back Glass Steagall or Usury Laws both of which used to help protect the underclass from financial predators.

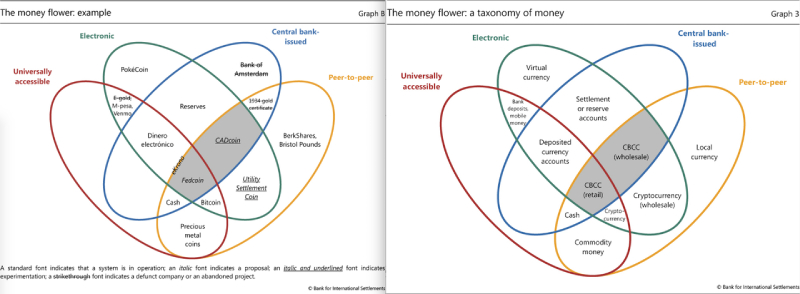

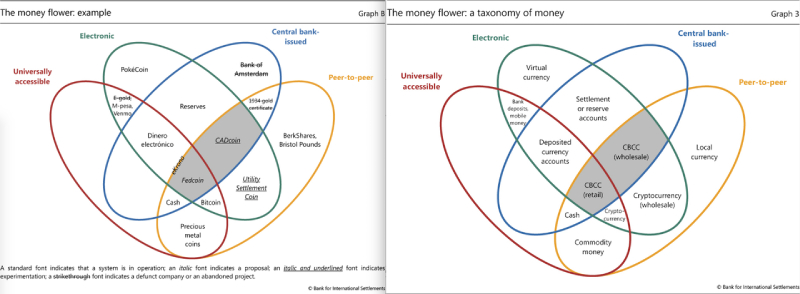

The acronym CBCC used here stands for Central Bank Crypto Currency and is an inadequate description of what central banks have in the works. That was a few years back. They have since begun using a more accurate description of their plans at work, the more accurate acronym is CBDC. These are all the direct central bank-issued digital fiat currencies. The will skip the old fraction reserve bank model for currency expansion and control.

In this BIS report, the following 66 central banks were asked how many were engaged in making their very own CBDC systems. And as of the last year 2019, over 80% or 53 of the 66 central banks responded yes, direct CBDC issuance, here they come.

Now I have yet to hear any thorough nor long term treatise of what burgeoning CBDC across the globe are going to do for fiat Federal Reserve note and eurodollar demand. Still, my educated guess is that it will become a massive net negative force soon enough.

Now, this topic undoubtedly brings up cashless trends ongoing, as headlines continue, and theories circulate about why the US Mint's cupronickel coinage is not flowing well currently.

We've written about this critical and global Cashless Trend topic at SD Bullion before.

And this month the OMFIF's Digital Monetary Institute published a 20-page report on the speed of change and the quickening race to direct central bank-issued digital fiat currency systems.

China is in the lead as younger generations there have next to no understanding of their own often 20th Century currency failure history.

My favorite short-sighted quote of the entire publication was by China's very own governor from a few years back.

The Chinese Governor’s words mainly paint a picture of over 1 billion Chinese people putting all their units of exchange and security eggs in one digitized electronic grid.

Never-mind the ongoing real threats of natural disasters; think of Puerto Rico only a few yrs back after their hurricane. There only physical fiat cash was king. Even credit and debit cards failed inhabitants as the electric grid was down for months on end.

Now think about what over 1 billion Chinese would use for payment settlements after a solar superstorm ruins virtually all electronic and internet-based things. Or some sort of EMP asymmetric warfare designed to overthrow the ruling body by revolutions from within. None of this is science fiction, the technologies and the ongoing threat from the flaming sun in the sky above us exists.

Nation-state powers that want to survive, will never go full cashless unless the lust of greed and control blinds them. In that case, expect a massive historical lesson on why going full cashless is entirely moronic and shortsighted.

For now, we have the option to opt some of our wealth easily with physical precious metal bullion coins, bars, rounds.

No matter what happens with the central banks' lust for more control, or the failure of the fiat currencies, they issue upcoming. Physical precious metals may disappear and go underground further with time. But they'll never go away as the best money for private payments. Regardless of whatever they do, I myself will remain financially redundant by always maintaining a prudent position of my wealth in bullion for life.

That is all for this week. You can expect a platinum fundamental investment video out by middle next week, thanks for your patience.

Until then, you all take care of yourselves and those that you love.