Platinum AS AN Investment Fundamentals

Spanish conquistadors could not get fires hot enough to melt it, much less dream up platinum's true rarity and inherent value propositions today.

Learn why platinum is so precious and rare. Born from star explosions, platinum now cleans car exhaust fumes and is even held in long term investment portfolios. Come see why platinum has often been more valuable than even gold.

Why buy Platinum Bullion?

Owning physical platinum bullion as an investment and store of wealth is a relatively new phenomenon when compared to the history of silver bullion or gold bullion usage.

-

-

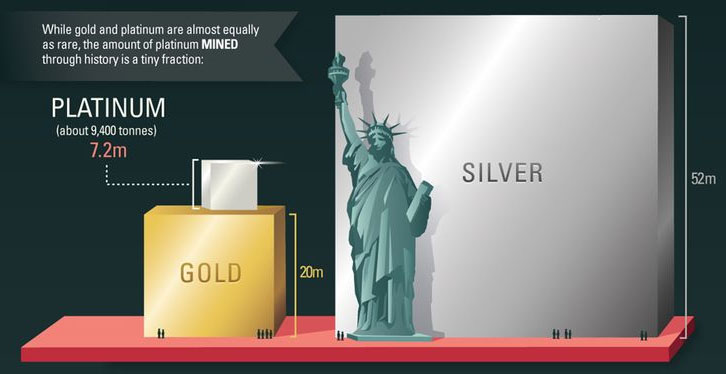

Considering all time historical and even annual mine production, platinum bullion is much rarer than either investment grade gold or silver bullion items.

In fact over the past 50 years, platinum has often sold at prices higher than even gold. Specifically during the precious metal bull markets both in the 1970s and 2000s.

Platinum Price vs Gold Price USD 1970 - 2017

Geologists estimate platinum’s earth crust concentration at 0.005 parts per million (ppm). Silver is about 15 times more abundant, found at 0.075 ppm whilst gold is found at 0.004 ppm in the ground.

For an easier understanding, if we simply convert platinum’s parts per million rarity into time, we would find 1 minute of platinum in just over 380 years of time. For 1 minute gold find analogy would last over 450 years and for 1 minute of silver it would take over 25 years of time.

Even though gold is slightly more rare in the Earth’s crust than platinum, human beings have been mining gold for many more thousands of years than platinum.

In fact platinum was only scientifically discovered a few centuries ago. Today’s above ground supplies of gold bullion dwarf today’s refined and available physical platinum bullion supplies.

Platinum is so rare in the physical world that all the platinum ever mined in human history could fit inside of the average US citizen’s garage. Picture a pure platinum bullion cube with 8 meter sides.

Officially discovered in the year 1735 AD, to date over 18 times more physical gold and about 150 times more physical silver have been mined than platinum. Estimates are that just over 10,000 tonnes of physical platinum have ever been mined by mankind.

The melt point for platinum is very high at 1773°C or 3224°F when compared to other metals and a major reason why platinum was only recently discovered by alchemists. Humans have only recently been able to produce fire conditions hot enough to melt, refine, and identify platinum properly.

In fact platinum’s high melt point caused Spanish new world silver and gold seeking explorers to regard it as well as high melt point palladium as mere nuisances in their quest. Platinum was so looked down upon that it was often used in gold coin counterfeits from the 18th and 19th Century AD.

Platinum has extraordinary resistance to corrosion and tarnish and it is the least reactive metal. Platinum is also perhaps as highly ductile as gold, making those two precious metals most able to be stretched into a thin wire without breaking. Platinum can be drawn and reduced down to a wire with as thin as a 0.0006 mm diameter.

To put this into perspective, If a platinum wire was drawn down from a rod 10 cm long with a 1 cm diameter, a possibly thin 0.0006 mm diameter platinum wire could be achieved being stretched 2,777 km or 1,725 miles. That is a platinum wire long enough to extend from New York City past Denver, CO.

Platinum also has a higher density than either silver and even gold. This means that platinum bullion items simply take up less space when stowed away than either silver and even gold.

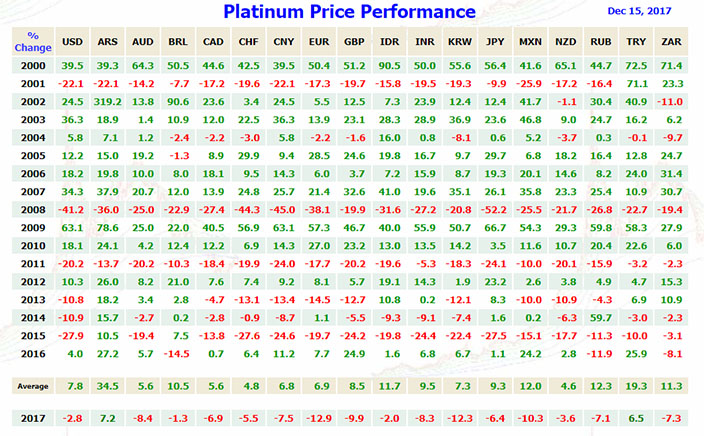

Since the beginning of this 21st Century, the world has witnessed a pronounced general increase in platinum’s value priced in every single national currency issued by any government worldwide.

Compared to gold, platinum price performance vs fiat currencies tends to be more volatile to both the downside and upside.

The majority of platinum price discovery today occurs on the CME Group's NYMEX futures contract exchange, although with the growth in China over the coming decades this may change.

Platinum Supply

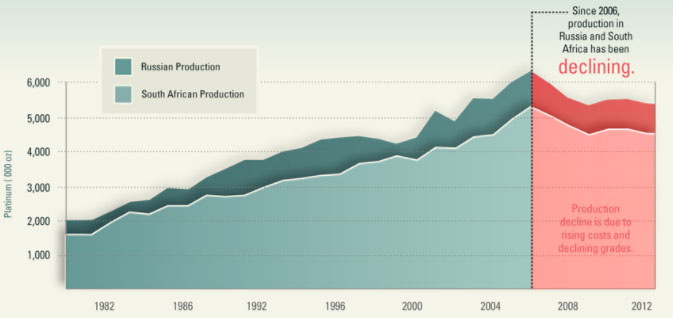

South African mines produce over 70% of the annual world's platinum supply. South Africa also has a long sordid history of mining labor strikes, high multigenerational disparities in wealth, cultural instability, and political turmoil.

Thus the world’s supply of platinum is much more vulnerable to disruption compared to other more widely mined physical precious metals like silver and gold.

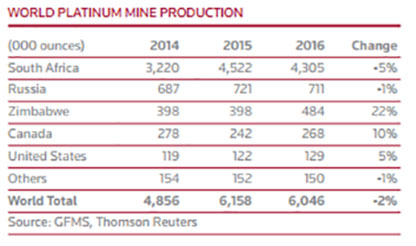

In 2006 the world reached peak platinum production to date with South Africa producing 5.4 million and Russia 948 thousand oz of platinum respectively that year.

Since then, Russian and South African platinum supplies have been declining due to a combination of rising costs and lowering ore grades.

Much higher levels of oncoming platinum recycling supplies over this declining platinum production time frame have helped meet and offset growing physical platinum market demands.

As recently as 2017, platinum industry reports state just under 200 metric tonnes (or 6.3 million oz) of fine .999 platinum remain in above ground stockpiles.

Platinum Demand

Since the beginning of the 21st Century, average yearly worldwide demand for platinum has been just over 7 million troy ounces per year (about 218 tonnes).

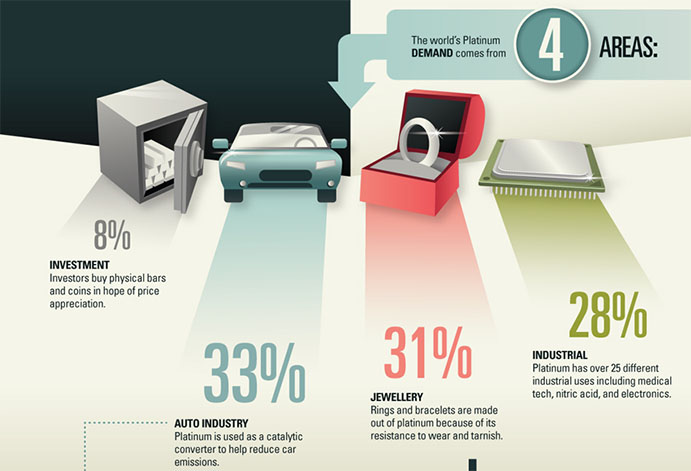

Demand for platinum comes from 4 major sectors with over twenty five applications in industry, for jewelry, in car catalytic converter applications, and through physical investment demand.

In 2016, over 40% of platinum demand came from the car industry’s catalytic converter demand to help reduce combustible car engine emissions.

The next largest sector of platinum demand is for platinum jewelry due to platinum’s high ductility, rarity, and its resilience to tarnishing and warping.

Another major sector of platinum demand comes from over 25 various industrial applications ranging from electronics, medical technology, usage in nitric acid fertilizers, and turbine engines. Platinum is also used in the production of display glass and glass fibre due to platinum’s high melt point and its inert non-reactive nature.

Platinum (and palladium as well) has also relatively become used in photography printing due to the variant coloring it offers artists as well as the image’s improved durability as a result of the precious metal infusion.

The smallest of the four major segments of global platinum demand comes from the platinum investment sector.

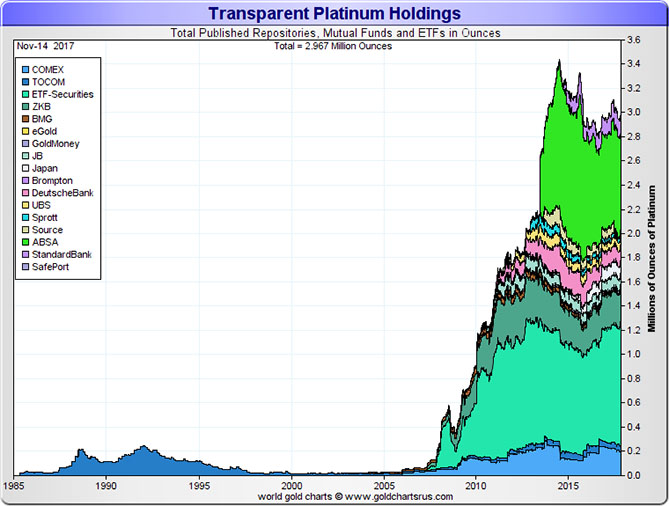

Investment demand for platinum has continued to grow even after its massive price drop from its still all time 2008 record price.

Platinum investments range from derivative electronic shares of Platinum ETFs to actual physical platinum bullion coins and bars you can buy and own outright for the long term which we offer via fully insured discreet delivery at SD Bullion.