Go on and roll in your supposed silver cornering Hunt Brother graves.

Eat your former silver buying hearts Warren Buffett, Charlie Munger, & Berkshire Hathaway.

This current silver trade has taken more than 50 years to formulate fully.

From the end of 90% US silver coin circulation (1965) through the beginning of the global full fiat currency era (1971). Through one bullion bull market and into another.

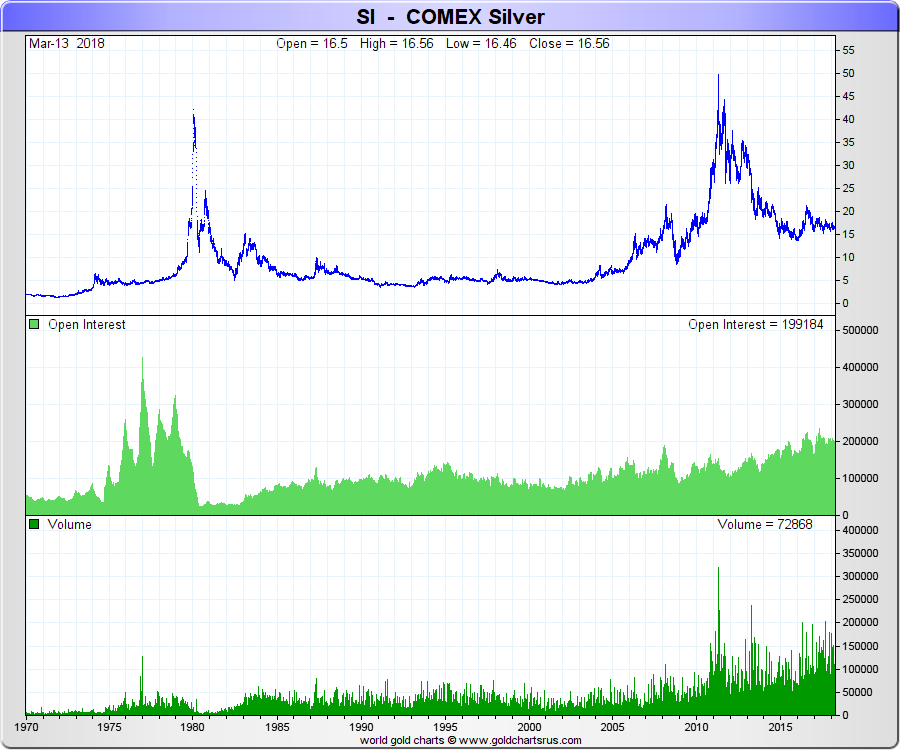

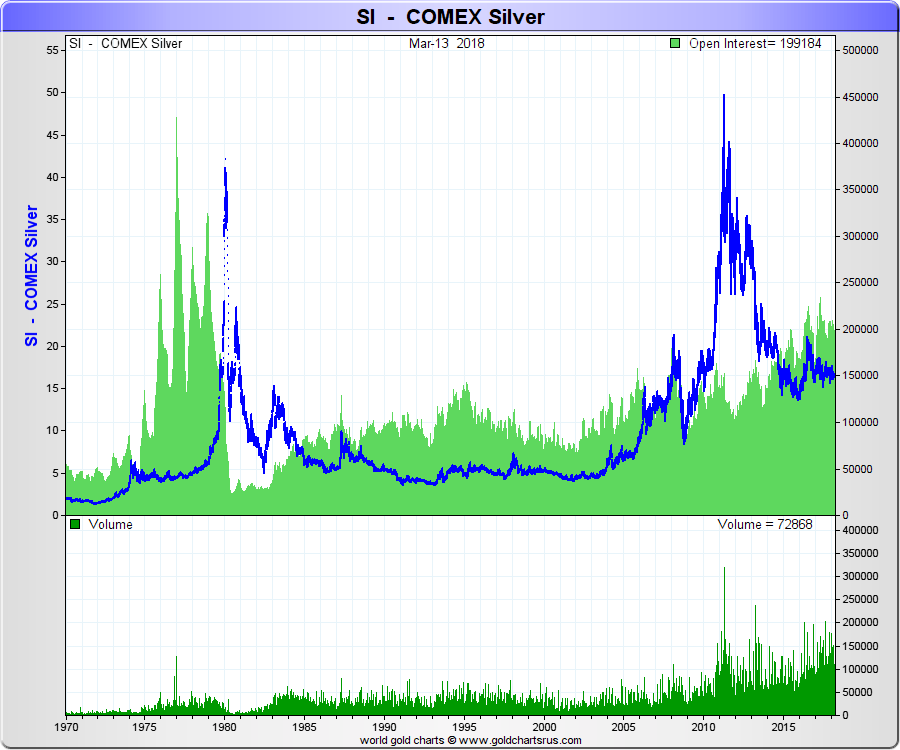

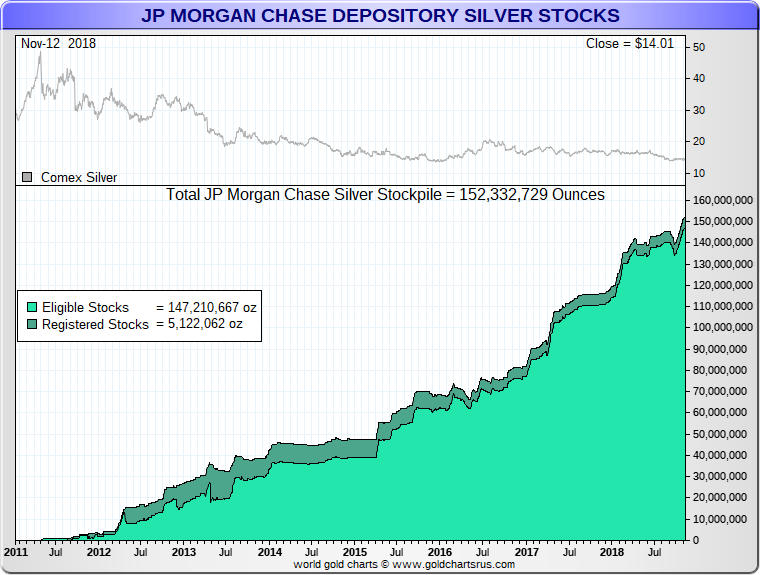

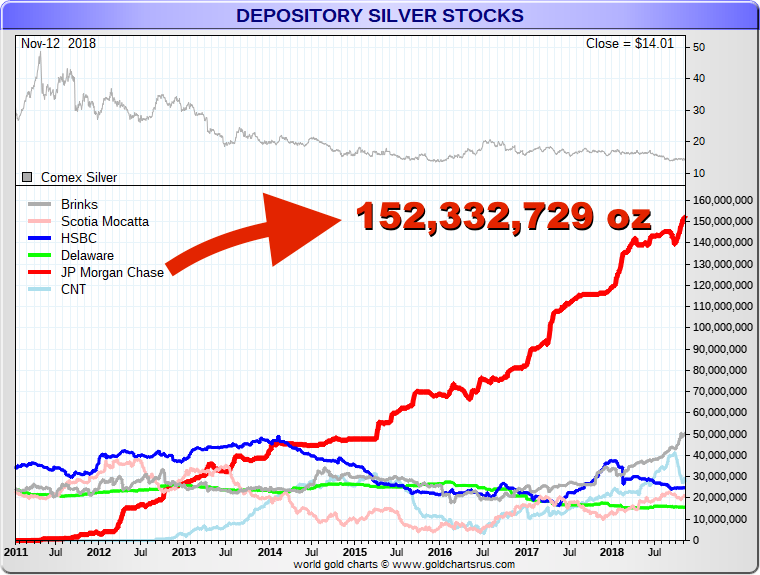

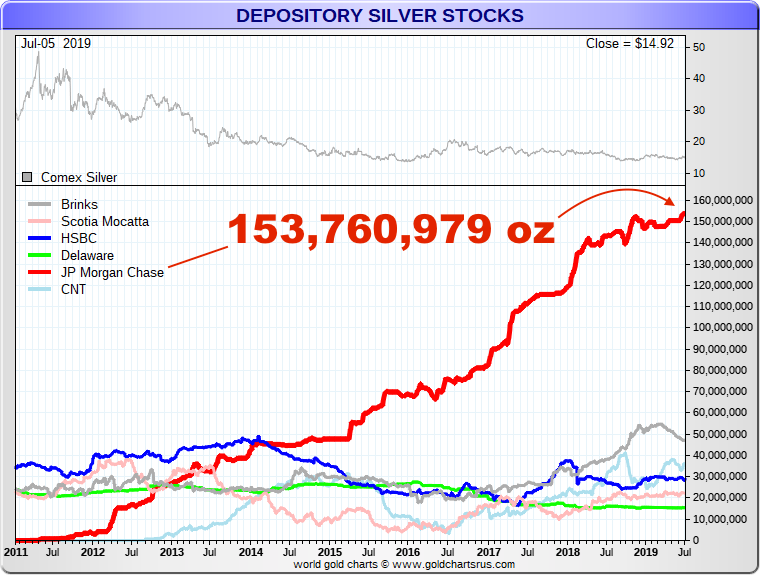

JP Morgan's COMEX silver warehouse now holds the most significant physical silver bullion position of all time (see charts below).

Here we discuss the historical perspectives and how large each of these respective three silver bullion buying entities was, and are currently.

-

[ Article Update Prologue ]

Coincidentally and very recently too, the US Department of Justice implicated perhaps systemic JP Morgan silver market manipulation upon securing a guilty plea from a 13 year, ex-JP Morgan silver and precious metal trader. Prosecutors alleged this trader's supervisors taught him silver and other precious metal spoofing strategies, and these JP Morgan superiors had knowledge and consent of such silver price manipulating practices ongoing for many years.

-

For a perspective note, the current annual new physical silver ore supplies to market amount to about 800 million ounces per year (all of it consistently used up in industrial, jewelry, silverware, and investments).

Some silver industry analysts allege the JP Morgan Chase silver hoard has already reached an almost equivalent amount.

Let us digress to the correct facts as they stand for now and back then.

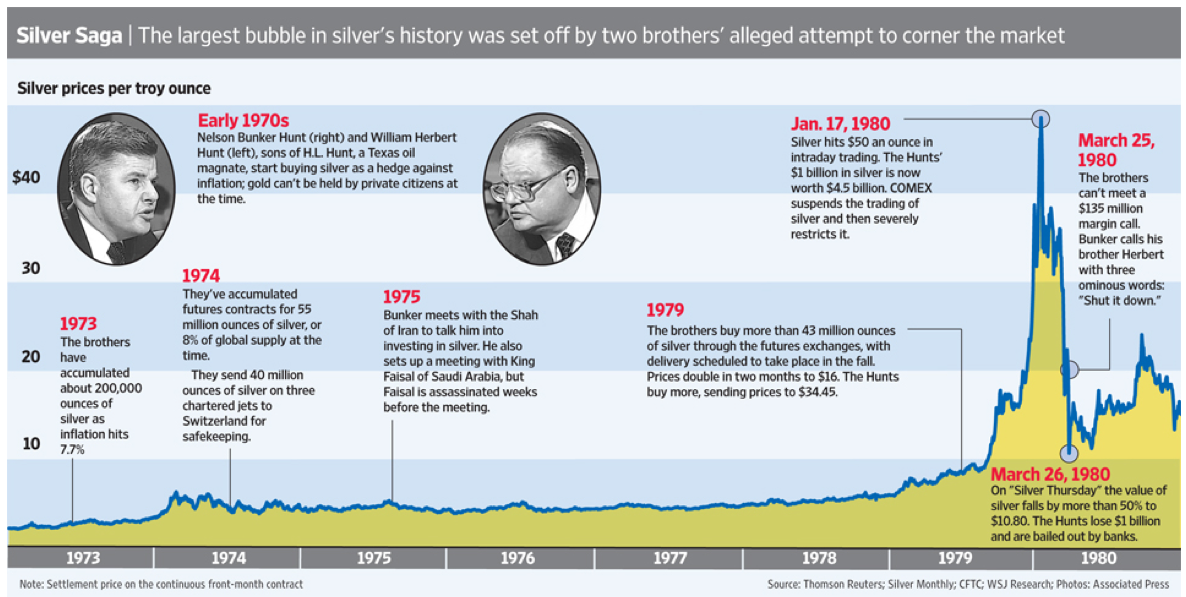

The Hunt Brothers Silver Buying

1973 to 1980: 100 million oz silver bullion (plus 100 million oz of backfiring paper silver leverage)

A few second-generation wealthy trust fund brothers in the 1970s supposedly drove silver to a then-record high price of $50 oz USD. Of course, they were not alone, and the long Hunt Brothers story is much more complex and exciting than that.

Likely mostly driven by inflationary price fears, the facts are that the Hunt Brothers amassed 100 million oz of physical silver bullion holdings throughout the decade.

They combined their relatively safe silver bullion bet with outsized, riskier trades using leveraged derivative betting on the COMEX silver futures contract exchange [an exchange which was likely set up with the intent purpose to help control and likely exacerbate precious metal price volatility (e.g. explicitly setting up the COMEX gold futures contract through 1974 US Treasury cable communications)].

Regardless of these pesky facts, below is the silver Hunt Brothers timeline according to our mainstream financial press:

This more than 1 billion fiat dollar 'silver bailout' was coupled with record-high early 1980s interest rates. The Hunts were later tried in court and fined hundreds of millions of dollars. As well these guys were openly scapegoated by the court of public opinion and are still so to this very day.

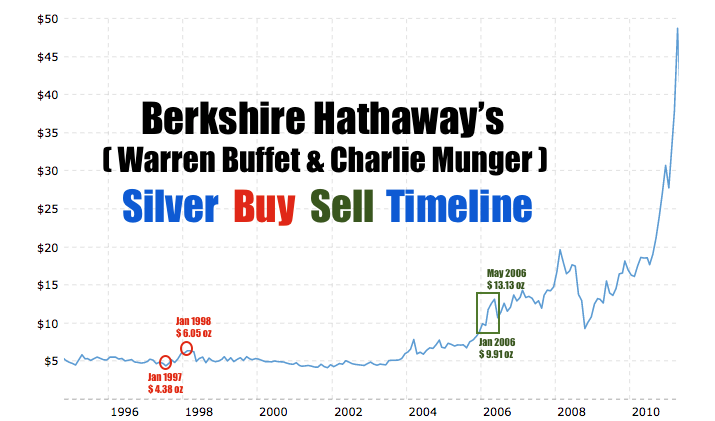

Warren Buffett, Charlie Munger: Berkshire Hathaway Silver Buying

1998 to 2006: 129.7 million oz silver bullion

Berkshire Hathaway (BRK) under the directive of Charlie Munger & Warren Buffett, bought their then record-sized 129.7 million ounce silver stack in 1998.

The most obvious motive for this move was mainly profit-driven and for Buffet's standard MO, market-moat domination (capitalism, by the way, should not pick winners and losers, but in reality, we don't have pure capitalism anyways). We can see that by the blow out of silver lease rates at the moment of market cornering right here, as well as words from Berkshire Hathaway's very own press release.

JP Morgan Silver Buying

2011 to 2018: +152.3 million oz silver bullion

This latest record-sized silver bullion acquisition saga. It stretches its start back to the Global Financial Crisis of 2008.

Anyone paying attention to this matter over the last few decades likely knows, long time silver analyst Ted Butler has been documenting in great public detail, the ongoings within the COMEX silver market.

In March 2008, Bear Stearns (a then large trader in silver futures derivatives) collapsed and was taken over by JP Morgan, perhaps at the request of the then US authorities.

A few years later JP Morgan began adding mass quantities of silver bullion to its silver COMEX warehouse, coincidentally just after the $50 oz price high for silver 2011, in late April.

Indeed we are examining the same firm, whose namesake once testified before the US Congress over a century ago stating, “Money is gold and nothing else."

Well, JP Morgan and its clients think silver is good to buy in bulk the last eight years or so. As of middle 2019, JP Morgans silver COMEX warehouse now has a record-high 153.7 million ounces of physical silver in its COMEX warehouse inventory.

Of course, this all begs the question.

Why?

The start of JP Morgan’s COMEX silver bullion stacking began only a few months removed from outspoken financial commentator Max Keiser's November 2010 public plea to ‘Buy Silver, Crash JP Morgan.’

The following got broadcasted across the world on Russia Today (btw Youtube reminds us that RT is funded in whole or in part by the Russian government).

As a quick aside, the Russian Federation has been actively acquiring bullion slowly over this same timeframe. Here are their pictures to prove it (both Official Russian Federation gold and silver bullion holdings, in large volumes).

Perhaps an early 2009 silver price of $9 oz to a 2011 spring $50 oz high, gave JP Morgan a long silver trade idea which it has since acted upon in record size and amounts.

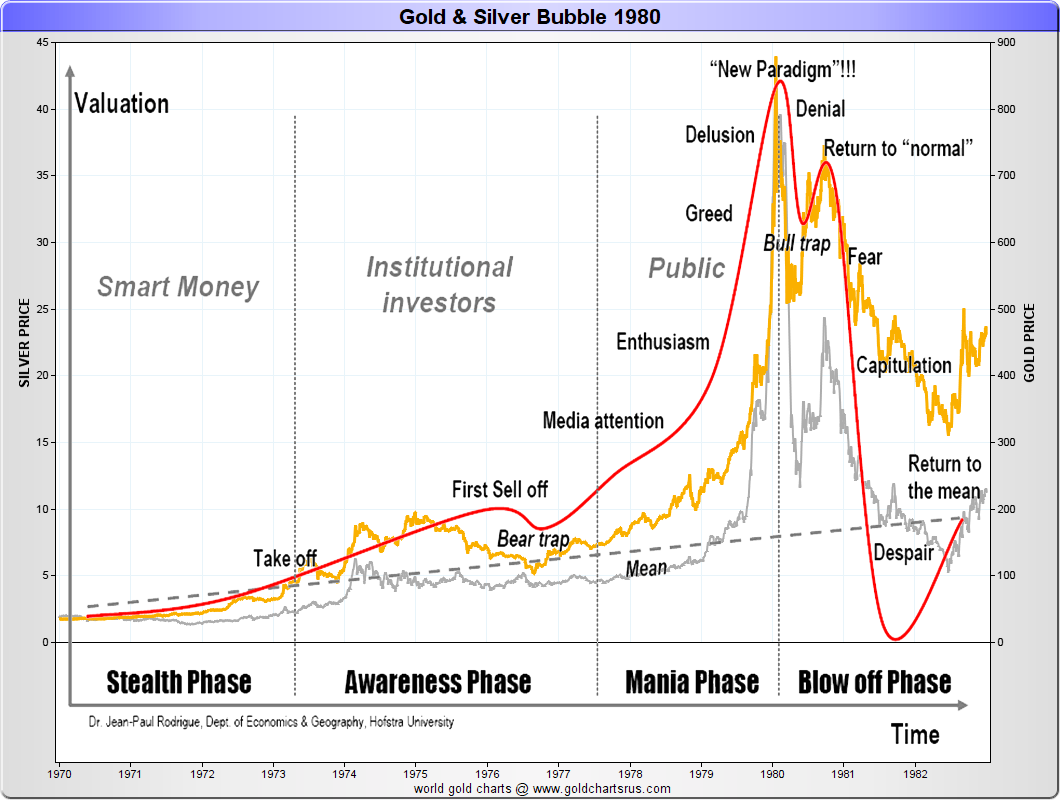

Could they and their silver bullion holders be making a similar play on what the Hunt Brothers were involved in during the last 1970 - 1980 secular bullion bull market?

Today still, the CME Group's COMEX (commodity futures contract exchange) is the most critical price discovery mechanism for world silver bullion and silver ore prices.

Allegations of gold price manipulation on the COMEX statistically stem back to the beginning of this 21st Century Gold Rush (1999 - 2002) and more recently appear to be merely prolonging the inevitable price reversions ahead for bullion.

Even now the COMEX's parent company (CME Group) very own CEO is on record stating current gold, precious metal, and silver bullion prices are too low while simultaneously his organization incentivizes government central banks to trade in their futures market price discovering derivative exchanges actively. UPDATE: high volume trading discounts got again extended in January 2019 allowing for further foreign central bank interventions into critical price discovery markets still today.

Hear for yourself some of CME Group Chairman, COMEX head, Terry Duffy's thoughts on precious metal price from summer 2017 below.

#CME CEO on #Gold price

— James Henry Anderson (@jameshenryand) July 13, 2017

(fyi he runs #COMEX #NYMEX)

Thx to phony derivative futures' "price discovery" its taking 2.5Xs longer than 1970s pic.twitter.com/QNGekQS5Dk

As well, Gold Antii-Trust Action Committee (GATA) response to Terry Duffy's precious metal price comments is here.

So why does JP Morgan guard so much Silver Bullion currently?

The answer currently is somewhat speculative, yet there are some human motivating clues as to perhaps why.

Currently, JP Morgan now holds over 50% of the total COMEX physical silver bullion holdings. Surely there are various reasons for this, at their most base levels are likely a combination of perhaps fear and greed at play.

FEAR: maybe by acquiring significant bullion positions, JP Morgan is hedging higher ‘capital buffer requirements’ mandated by the BIS’ Financial Stability Board. The FSB explicitly cites JP Morgan as the most risk-laden global systemically important bank (G-SIB) today. Well if this is indeed the case, why not buy and own a large amount of a Tier 1 Asset like gold bullion too? Perhaps China, Russia, and other eastern nation gold demand have the physical gold bullion market under enough stress already.

Perhaps the primary motivation for record extensive silver bullion holdings is more straightforward than that. It may be mere future profits as the inevitable upward price pressure for physical bullion items resumes in earnest.

GREED: for years now, hosts of silver market analysts have explicitly defamed JP Morgan’s activities in the world silver markets. They publically allege continued fraud and market manipulation by JP Morgan in silver without any defamation or libel lawsuits as repercussion (perhaps JP Morgan has lawsuit discovery process fears and thus has not engaged). Regardless assertions remain that JP Morgan actively participates in a regular profit-making, silver price suppression scheme (on the COMEX) while simultaneously acquiring physical silver bullion ounces on the cheap (via COMEX and SLV, etc.) for the ultimate bet reversal when the time is right.

And not merely the current record 152.3 million ounces of silver bullion that gets transparently published in JP Morgan’s COMEX silver warehouse data.

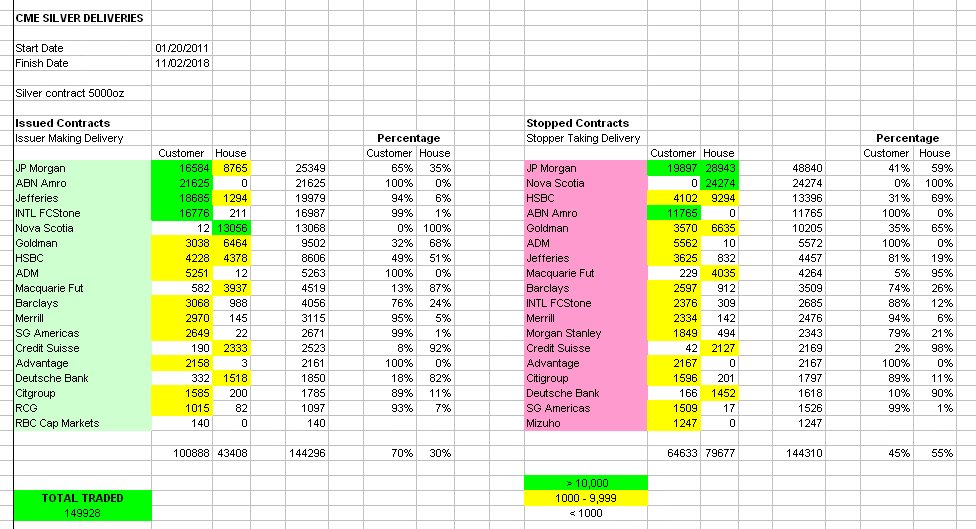

Which could, of course, should have their client interests attached. Judge that statement by the 41% customer vs. 59% house account future contract stop delivery data we have compiled below.

Also alleged are additional 100s of millions of more silver bullion ounces that have gotten withdrawn from SLV holdings.

Even alleged (and we would argue unfounded), some say JP Morgan potentially purchased silver through sovereign silver bullion coin programs. Specific estimates are as high as +675 million ounces in total.

Why allegedly acquire about 75% of a commodity’s annual global mine supply over an 8-year timeframe if not for speculating on substantially higher prices in the medium to long term?

Are short squeeze profits similar to the late 1998 Warren Buffet market corner?

Buy low, sell high perhaps?

Answers to many of these thoughtful questions will likely take years to play out, and still, many will go unanswered formally.

The fact remains that JP Morgan now has a more prominent silver bullion position than any long silver bullion buyer that has existed in the modern age.

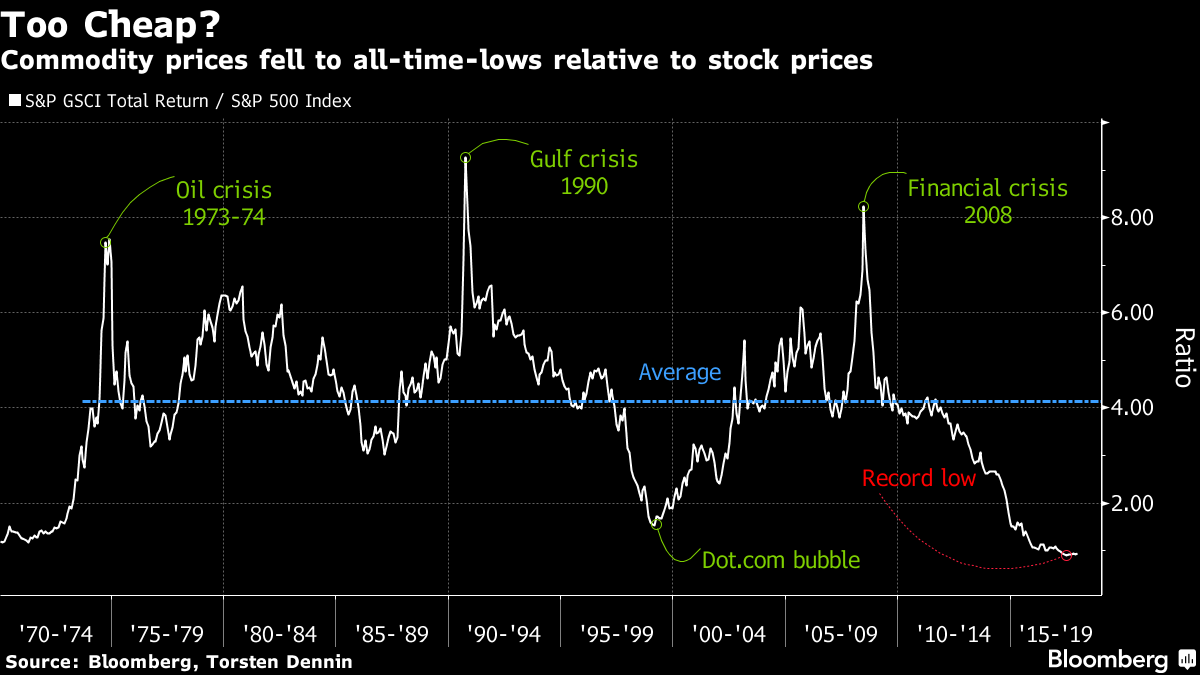

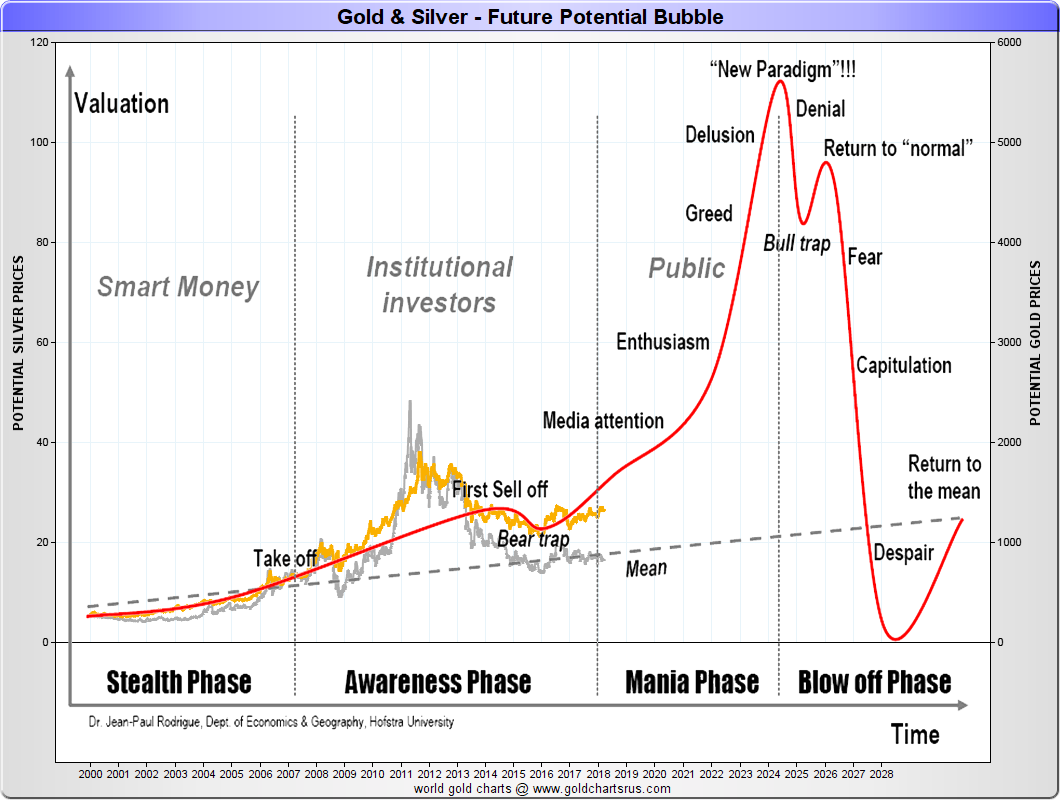

With assistance from record size derivative trading, this 21st Century secular bullion bull market is running about 2.5Xs the length of the last 1970s and 1980 version.

How long and how high precious metal values go this go-round is still an answer no one but perhaps colluding governments might help markets answer someday (especially in terms of gold values).

Even a bond portfolio manager at PIMCO recently called for a sudden $5,000 oz USD gold price revaluation by the Federal Reserve to induce currency inflation to help ease debt and unfunded liability burdens.

We expect a 2020s mania phase is likely peaking silver prices and bullion item values in terms of their real-world goods and service buying powers.

Bullion’s current cyclical price downside appears somewhat limited at today’s paltry fiat price points (i.e., low bullion values compared to today’s ‘everything bubble’ historic valuations).

This current JP Morgan silver stash saga is just one of the most intriguing bullish silver setups ongoing. But there are trillions of other reasons to be betting on physical silver and other physical precious metal bullion products currently. We would argue first and foremost when living in a full fiat currency system. Having a prudent bullion investment allocation always makes common sense. Both data and math prove that statement.

Today though, total global debt levels have now risen +56% above their 2007 starting points (IIF & BIS data). Expect a future combination of write off bankruptcies and currency debasement to service them.

The former head of BIS research is again ringing alarm bells calling for governments to step in to resolve the next financial crisis. Most will not hear or ignore him akin to his last warnings ahead of the 2008 Financial Crisis.

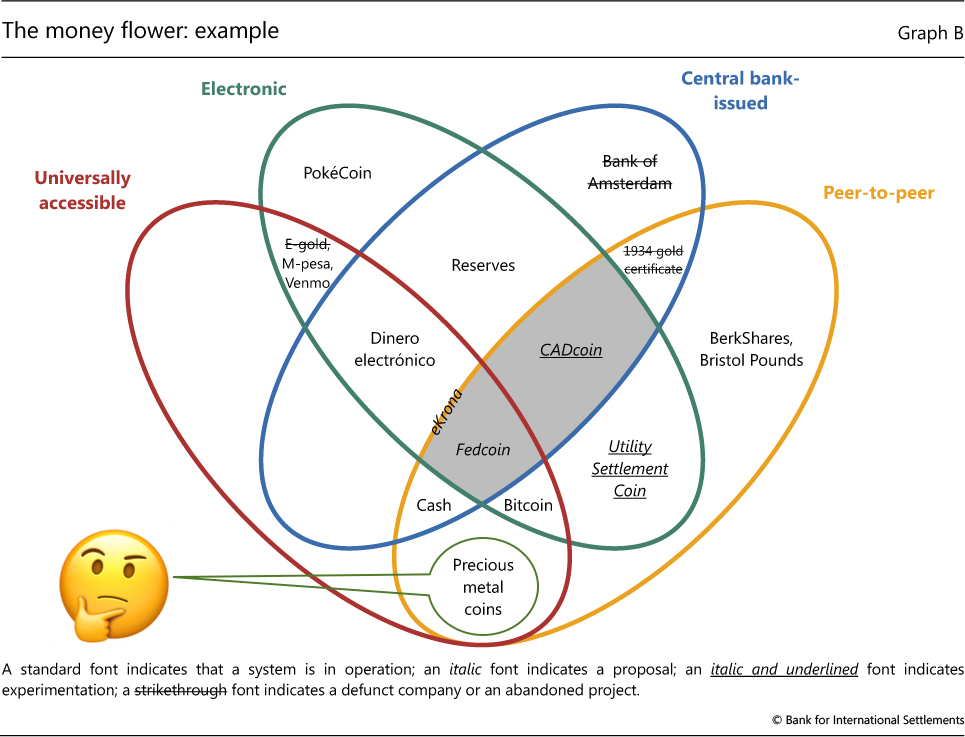

Which among these precious metal or other currency derivatives will endure throughout and beyond our lifetimes?

According to the Bank for International Settlements (BIS) and any monetary historian who knows the facts. All c̶u̶r̶r̶e̶n̶c̶y̶ p̶r̶o̶x̶i̶e̶s̶ fade away in time.

Only precious metals endure and right now (late winter 2018) they are relatively cheap vs. other asset classes.

Hmmm, what to do with all this information?

-

Perhaps if we wait too long, it will be too late to act when answers unfold as to what JP Morgan is actively doing with record silver bullion hoarding.

Maybe now is the time to do as they are doing, and acquire your silver bullion and other physical precious metals for the long term.

Stay tuned for future updates on JP Morgan's current record silver bullion position on the COMEX, and perhaps elsewhere as time unfolds.

Thanks for visiting us at SD Bullion.