Key Takeaways

- Due to the low cost of entry, silver bullion can be a great entry point for new precious metals investors

- Due to silver's high demand from industry, long-term value forecast should remain high

- Silver bullion is priced in bulk. Therefore, the more you buy at one time, the more you save

- Silver bullion is easy to buy, sell, transport and even store

- Silver has been used as currency for thousands of years and tends to perform well during times of economic crisis

- Because silver is more volatile than gold, the percentage points of gains or losses can also be higher

Jump to: Popular Silver Investments | Silver Coins | Silver Rounds | Silver Bars | Junk Silver | Other Silver Products | Bars vs Coins vs Rounds | Silver Prices | Physical Silver vs Stocks | Silver vs Gold | Silver vs Other Metals | Storing Silver | Silver IRAs | Where to Buy? | How to sell? | Planning your Investments

Precious metals are considered one of the safest investments during economic downturns. They are also one of the most popular options to have on your portfolio as tangible assets.

Whether you choose to buy silver rounds, coins, or bars, these types of assets are designed to protect against market turmoil and hedge against inflation. Additionally, due to high industrial demand, silver bullion is constantly seen as a very liquid choice.

Commonly referred to as the “poor man's gold,” silver has been used as a trading metal for millennia. In the contemporary world, its appeal has risen exponentially due to its various uses in growing markets, such as medicine, solar energy, water purification, batteries, electronics, and jewelry.

This guide will take you, step-by-step, on how to buy silver online in a safe, reliable way, for both newbies and experienced investors.

Popular Ways to Invest in Silver

If you are just starting out as a silver investor, you might be overwhelmed by the different methods you can choose.

These include:

- Buying silver from ETFs (exchange-traded funds) or mutual funds

- Buying silver mining companies stocks

- Buying silver futures contracts

- Buying physical silver bullion (such as coins and bars)

When you invest in Silver ETFs, your assets will be held by the funds manager or a custodian, while you only get a certificate.

Similarly, with silver mining stocks, your investments are in the hands of someone else's management. If the silver miners company is poorly managed, their stocks could go down, no matter how high the demand for silver is at that moment.

Futures contracts involve more speculation and as such, higher risk. Silver prices might fluctuate during the period of a trade and an investor could end up losing part of their investment.

Our experience shows that buying physical silver bullion could be the best way to invest in silver for these reasons:

- Owning and storing the silver bullion yourself has virtually no counterparty risk.

- No default risk either.

- During economic downturns, it's important to be liquid. Having physical possession of your bullion will make it quick and easy to liquidate your assets at close to spot silver price.

- Physical silver bullion cannot be depreciated like paper or digital forms.

- Owning physical bullion is owning a real, tangible asset that has been used as money for thousands of years.

Now, there are a variety of ways to invest safely in physical silver.

Let's take a more in-depth look at the options:

Silver Coins

Silver coins have been minted for thousands of years, from the kingdom of Lydia in Asia Minor over 600 years B.C., to ancient Greeks and Persians, and they are still struck around the globe by a variety of mints, forming the backbone of silver investment and collection.

Coins are struck in a variety of forms. One troy ounce 99.9% pure silver coins are the most common, but there are also 10 ounce and even 1 kilo coins available on the market.

Although coins are considered legal tender and carry a face value, their true value comes from their precious metal content (intrinsic value).

That being said, because silver is almost a hundred times cheaper than gold, the modest price of silver coins enables new investors into the market, especially considering they are easy to liquidate, making them a safe choice.

It's also important to point out that numismatic coins appeal to collectors all over the globe. The rarer the coin (or the mint year), the more expensive it may be, in spite of being the same 1 troy ounce of 99.9% pure silver.

You can buy silver coins in singles, in tubes or in monster boxes. Single coins are good purchases for those just starting out, or those just adding a little more diversity to their portfolio. However, tubes of 20 can be an excellent investment option, and a full monster box can be ideal if you want to save money by buying in bulk. Monster boxes are also great for storing and protecting your coins!

Popular Silver Coin Programs

The United States Mint has arguably one of the most successful silver bullion coin programs in the world, which is the American Silver Eagle, easily recognizable by the walking liberty on the obverse and the heraldic eagle on the reverse.

The Royal Mint of the United Kingdom has been in operation for over a thousand years. One of their best selling silver bullion coins is the Silver Britannia coin.

The Perth Mint has a popular Lunar Series and also the Australian Silver Kangaroo, which is one of the top sellers in the industry.

The Silver Maple Leaf is the official bullion coin of the Royal Canadian Mint and is known for its cutting edge security features.

Silver Rounds

As opposed to coins, silver rounds are not considered legal tender and, as such, can be produced by either private or government-owned mints.

Given the fact that rounds derive their prices directly from their silver content, they can make for a great investment if you do not worry about collectible value, thus offering an economical way of owning silver.

Popular Silver Round Sizes

- Fractional Silver Rounds: Any silver bullion round under 1 Troy oz. It is possible to find rounds as small as a 1/10 oz (3.1 grams). 1/4 oz and the top seller 1/2 oz (15.5 grams).

- 1 oz Silver Rounds: these popular rounds contain a full troy ounce of silver, but are still small and easy to store. The 1 ounce Silver Buffalo Rounds and the 1 ounce Silver Freedom Rounds are some of the best-sellers in this category.

- 5 oz Silver Rounds: A good option for those willing to make a larger investment, but still being affordable compared to buying gold. When available, investors can pick gorgeous designs such as the Aztec Calendar Silver Round, the American Silver Eagle Replica Round, or the SilverTowne Prospector Stackable Silver Round.

Silver Bars

Silver bullion bars are also made to the .999 fineness. They are produced in a variety of sizes and shapes, from 1 gram to 5 kg or even larger.

Private mints are responsible for most of the bullion bars on the market, although some government-owned mints produce them as well.

Bullion bars are usually cheaper to buy than legal tender coins, as their value comes directly from their precious metal content, like rounds.

Types of Silver Bars

Silver bars mostly come in two different forms: minted or poured.

Much like coins and rounds, minted bars are printed with a design and are cut from bar stocks, whereas the poured versions are simply made by pouring molten silver into molds, forming ingots.

Popular Silver Bars

Listed below are some of the most popular designs and their mints.

- Royal Canadian Mint Silver Bar: The 100 oz Royal Canadian Mint Silver Bullion Bar is one of the most regarded in the industry. It carries the Mint's maple leaf design along with a stamp of .9999 fineness. Due to its higher level of purity, backed by the Canadian Government, the 100 oz RCM is one of the most liquid options in the market;

- Sunshine Mint Silver Bar: These excellent quality bars are marked with the Sunshine Mint famous design on the obverse, an eagle soaring against a blazing sun. They are also produced on the 100 oz size with .999 fineness.

- Scottsdale Mint Stackable Bar: Minted in the 10 oz size with .999 fine silver, the Scottsdale Mint Stackable Bars depict their majestic lion head logo and the inscription “IN GOD WE TRUST” on the obverse.

- Fortuna from PAMP Suisse: Embellished by the Roman goddess of fortune, these bars are produced by the Swiss refiner PAMP Suisse, considered by many investors as the world's primary bullion brand.

Here you can check our guide on How to Buy Silver Bars.

Junk Silver

Also known as 90% Silver Coins, the term junk silver refers to old circulating coins that have no numismatic value. In other words, they derive value solely from precious metal content.

Usually, silver coins minted prior to 1965 are considered silver junk. Their alloy ranges from 40% to 90% pure silver.

Although junk silver is not considered scrap, they have no appeal to collectors due to their natural wear and the fact that they are not from collectible key dates. However, 90% silver coins are wildly popular with investors for their low premium prices and the fact that they are real money with legal tender status. In other words, even in the case of a widespread economic crisis, they will never be worth less than their face value.

Other Silver Products

If you would like to expand your collection, it is also possible to invest in a variety of products, such as:

- Silver statues, like the Lincoln Memorial 11 oz Sterling Silver Statue.

- Silver banknotes, which are flattened silver foils, designed after official paper banknotes, that also carry a face value.

- Ancient silver numismatic coins, certified by the NGC, guaranteed to have been in circulation during the Roman or Ancient Greek Empire over two millennia ago!

One thing to note: These products tend to carry higher premiums over spot silver prices. They are more based on their numismatic/historical value, their design and the work that has been put on into their minting.

Bars vs Coins vs Rounds

If you're uncertain about which silver bullion products to choose, investing in bullion coins is often considered the ideal approach for most investors looking to enter the precious metals market. This comes from the fact that sovereign coins are easily recognizable, easy to trade and generally sell at higher premiums than bars or rounds.

However, due to the additional quality, artistry and effort that goes into minting a coin, and also its numismatic value, a coin's troy ounce rate is usually higher than that of a bar or round.

On the other hand, silver bars can be better suited for larger investors. If you are planning to make a large investment and have no regard to the numismatic value attached to the product, bars could be the way to go.

Silver rounds are an easy way into the market because they contain a healthy amount of pure silver and are usually sold at lower premiums over the spot price of silver.

So, to sum up:

- Coins are typically preferred for their numismatic value and their government-backed precious metal, making them easy to liquidate.

- Bars are generally preferred by large buyers.

- Rounds could be a good way into the silver market.

How is the Silver Bullion Price Calculated

Like most commodities, the price of silver is usually determined by speculation and supply and demand. However, contrary to gold, one factor that dramatically boosts silver demand is its wider range of uses, especially for industrial production.

Industrial demand for silver has increased over the last years, especially in growing markets, like solar energy, automotive industry, and electronics, causing silver demand to go through the roof.

Needless to say, silver is constantly required by the jewelry industry as well. It's lustrous, not difficult to sculpt and long-lasting.

In addition, precious metals in general are considered a safe haven investment during economic downturns as we have already mentioned. In terms of coins and bars, silver consumption has drastically increased since the pandemic-driven economic uncertainty in 2020.

Silver Spot Price

A spot price is the current price in a marketplace for a given asset (such as commodities) which can be delivered immediately.

Just like gold, silver has a spot price. It is the cost of one troy ounce of silver at that exact moment. Spot silver prices fluctuate during the day, sometimes to the minute, and definitely by the hour.

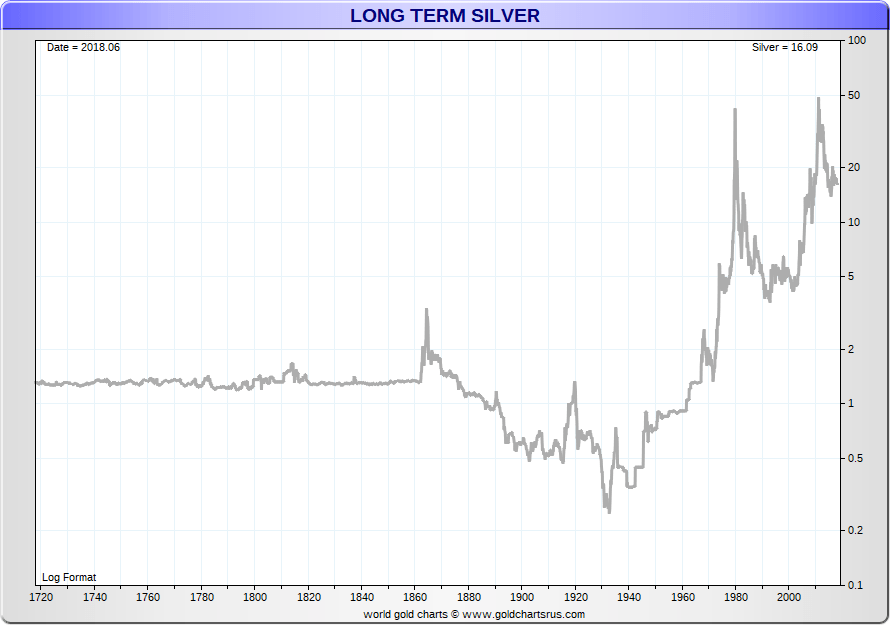

Historic silver spot prices chart up until the second quarter of 2019

However, purchasing silver at the exact spot price is rarely feasible due to dealers applying slight commissions, commonly referred to as premiums, in order to secure a profit. Without premiums, dealers and suppliers would not make a profit.

Buying Physical Silver vs Silver Stocks

According to most personal finance advisors, the best way to invest is to have a diverse portfolio, rather than putting all your money in a single market.

Investing in silver usually means a mid to long-term investment. You should not expect to turn a high profit in a short period of time, as opposed to stocks.

However, silver poses a safer investment, especially in the midst of a bear market.

Most agree the best way to invest in silver is to constantly track its historical and current spot prices with a performance chart and holding on to your bullion until it is the right time to sell and make a profit, without worrying that you will lose your investment overnight. Remember, there are no counterparty or default risks when investing in physical metal.

Key takeaways:

- It's important to have a diverse investment portfolio.

- Our experience shows that silver can outperform stocks in the long run.

- Keep track of the historical and current spot prices to know the right moment to sell.

Buying Silver vs Gold

The reason gold bullion is much more expensive than silver is not because it is yellow and shining hue, but mainly because of its rarity. Each year, the amount of silver mined is almost ten times greater than that of gold.

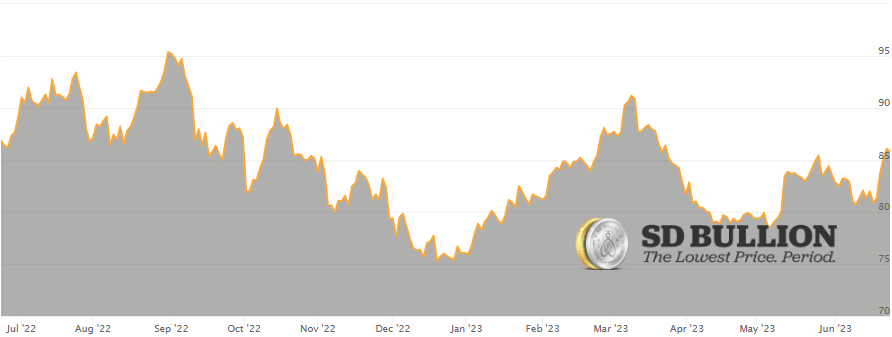

As of 2023, the gold-silver ratio (i.e. the average range between the price of silver and gold) has fluctuated around 80-1. That said, silver prices tend to be more volatile because of its greater use in industrial productions.

When industry production is on the rise, demand for silver also tends to rise. If industry production is low, silver rates also tend to drop.

That means silver is more open to speculation, meaning it can turn a greater profit if sold at the right moment. Gold rates, however, tend to stay more stable over time.

Although both precious metals pose as great options in a bear market, silver tends to be considered a better choice for those who are just starting to dip their toes into the precious metals market simply because of its affordability.

Silver vs Other Precious Metals

Gold and silver are not the only precious metals in which to invest. Let's take a look at a few other options:

Platinum

Platinum is traded as a commodity, just like gold and silver, in the New York Mercantile Exchange (NYMEX) and the London Platinum and Palladium Market.

Like silver, platinum is seen as an industrial metal, especially for the automobile industry. It is used to produce catalysts that reduce harmful gasses to the environment. When auto sales and production are high, so will the prices of platinum.

Arguably the most sought-after platinum bullion coin in the world is the Platinum American Eagle, issued by the U.S. Mint.

Palladium

Again a metal with diverse industrial uses, particularly for automobile and electronics.

Pure palladium is malleable, but it can get harder and more durable than platinum if worked under the right conditions.

Like platinum, palladium demand comes mostly from the automobile industry. It is also used to reduce noxious fumes from vehicles that run on gasoline.

Russia and South Africa account for most of the palladium mining in the world, thus, political instability in those countries might affect palladium prices deeply.

Copper

Usually overlooked by most investors, copper also has a wide variety of uses, from decorative, to industrial production and also for manufacturers.

Lately, it's seen, by a growing number of investors, as a way to diversify their portfolio and increase protection against further currency devaluation.

Storage

Contrary to gold, you might think silver is more difficult to store, given the fact that for the same dollar value, silver requires much more storage space. And, in fact, that would be a correct assumption.

However, it is not impractical to store large amounts of silver at home and, in fact, it is even recommended to have your silver investment (at least part of it) at an easily accessible location. Granted its high liquidity, at a time of crisis (personal or national) you will not have to worry about lack of access to funds.

But having your silver investment readily available, does not necessarily mean keeping it inside your sock drawer.

Storing Silver at Home

If you are planning to keep some silver at home, bear in mind that you should use multiple locations, rather than just stacking all your bullion in the same spot. Make sure to have all location descriptions in a sealed legal will.

Another fine idea is to keep some decoy coins at an obvious place for thieves. That way, if they fall for your trap, you might be able to keep your entire investment.

If you are in need for some ideas on where to hide your silver bullion, check out the video below:

SD Depository

If you would feel more comfortable having your physical silver safely deposited somewhere else, you might be happy to know that SD Bullion has a great and affordable solution for you: SD Depository.

SD Depository is our non-bank, fully-insured segregated storage depository. We offer the lowest price depository for your precious metals. Guaranteed! Storage starts at only $9.99 per month and new customers currently get the first three months for free!

Silver IRAs

If you are planning a retirement plan, you might want to consider a self-directed IRA.

Self-directed IRAs have the same tax advantages as any other IRA with one difference: the investments are managed by yourself. That means you have a broader range of options for investments, including hard assets such as precious metals.

A Silver IRA is, to put it simply, a self-directed IRA in which you decide to include some sort of silver investment. That way, if you choose to sell your silver in the future, your gains will be tax-free, as long as you keep the money in your IRA.

In addition, all 50 American states have either a full or partial exemption from potential creditors' abilities to access your IRA assets.

Where to Buy Silver

When it comes to purchasing silver, there are two main options: brick-and-mortar shops and online dealers. Each has its advantages and considerations for silver investors.

When you purchase silver from brick-and-mortar shops, such as coin stores and pawn shops, you have the advantage of a physical presence. You can see and inspect the products in person before buying them. Additionally, some buyers prefer the face-to-face interaction and immediate gratification of buying from a local shop.

However, it's important to note that local shops often have higher business costs, such as rent and overhead expenses. These costs are reflected in the prices they offer for silver bullion. Consequently, prices online tend to be more competitive and cheaper. Online bullion dealers have lower operating costs, allowing them to pass on savings to customers.

However, when shopping for silver online, it's crucial to choose a reputable dealer. Look for established dealers with positive customer reviews and secure payment options.

Don't forget to take a look at our informative guide on How to Buy Gold Online.

How to Sell Silver

There are a few options available to those who own physical silver and wish to liquidate their holdings.

- Local Brick-and-Mortar Shops: One option is to sell your silver to local coin shops, pawn shops, or bullion dealers. These establishments may be interested in purchasing coins, bars, or rounds directly from you. However, keep in mind that the prices they offer may vary, so it's advisable to shop around and compare offers before making a decision.

- Online Bullion Dealers: Similar to buying, online dealers also provide a platform to sell your products. Many reputable dealers offer a sell-back service where they buy silver bars, coins, and rounds after you submit them for evaluation and receive a competitive offer. This option offers convenience and the ability to reach a wider market of potential buyers.

- Auctions and Marketplaces: Another avenue to sell silver is through auctions or online marketplaces specifically dedicated to precious metals. These platforms allow you to list your silver items for sale and potentially attract interested buyers who are actively seeking to purchase silver.

Planning Your Investment Choices

Before buying or selling silver, it's important to consider a few factors. Monitor the current market price to gauge the potential value of your holdings. Additionally, be aware of any fees or commissions associated with selling through certain channels, as they may impact the overall return on your investment.

If you have rare or collectible silver coins, it may be beneficial to have them appraised by a professional numismatist to determine their potential value beyond their silver content.

Remember: it's essential to research the current market conditions and understand the dynamics of silver investing. Whether you choose to buy or sell locally, online, or through specialized marketplaces, conducting thorough research and evaluating the options available will help you make an informed decision and maximize your returns.

SD Bullion

Since starting operations in 2012, SD Bullion has become one of the largest precious metals retailers in the world. We have been a BBB A+ rated company for 10 straight years with over 100,000 satisfied customers.

We have an array of silver bullion products in our inventory to satisfy the needs of any investor.

Also, if you are willing to liquidate your assets, please do consider selling them to us. Our team is constantly buying silver and will provide you with quick payments at industry-leading rates.

To get more information regarding our buyback process and pricing, click here.