If you have been studying commodity markets or buying bullion chances are high you will have come across the acronym COMEX.

Here we discuss what is the Commodity Exchange Inc. (COMEX), its history, and relevance especially to Silver Bullion and Gold Bullion prices at SD Bullion and across the world.

If you want to understand current and recent historic gold and silver price discovery functionality, you must learn what the COMEX is and how it most highly influences the prices of physical gold and silver bullion globally.

What is the COMEX?

The COMEX (Commodity Exchange Inc.) is the primary futures contract and options market for trading derivatives on precious metal prices for gold and silver, as well as for non-ferrous metals like copper and aluminum.

The COMEX merged with the New York Mercantile Exchange (NYMEX) in 1994 and the two combined are most responsible for precious metal price discovery today. Similar to COMEX gold and silver derivative futures contracts, both platinum bullion and palladium bullion prices respectively are heavily influenced by their derivative futures contracts traded under the NYMEX brand name.

The CME Group has owned and operated both the COMEX and NYMEX since acquiring them in 2008.

The CME Group also owns and operates the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT).

While virtually unreported in the mainstream financial media, the CME Group now actively incentivizes government partnered central banks to trade commodity derivatives on all four of its commodity exchanges, all of which can sharply influence the prices of real world goods around the world.

The volumes that various central banks are actually trading commodity derivatives at the moment remains unknown as the CME Group has yet to divulge this data to date.

COMEX Founding (1933)

The COMEX, or more formally the Commodity Exchange Inc., was founded in New York in 1933. The COMEX was formed through the merger of four smaller exchanges based in New York: the National Metal Exchange, the National Raw Silk Exchange, the Rubber Exchange of New York, and the New York Hide Exchange.

The second half of COMEX history is closely linked to the history of the world’s later 20th and 21st Century gold price. And not merely the gold price vs US dollars, but the COMEX has also heavily influenced the gold price vs all fiat currencies issued over the same timeframe.

Coincidentally in the same year the COMEX was founded (1933), the then US President Roosevelt banned private US citizen gold bullion ownership of 5 troy ounces or more. demanded under the threat of fine and prosecution that the vast majority of private physical gold holdings of American citizens be turned in to Federal Reserve bank branches.

This ban of US citizens no being allowed to hold more than 5 troy ounces of gold bullion per US citizen stood in effect for 40 years until the start of 1975. It was then that US citizens were again allowed to buy, own, and save gold bullion in volume. The US dollar price of gold began in 1975 priced at over $185 oz USD.

Gold Futures Contracts (1975 to Today)

Not coincidentally the COMEX gold futures contracts began trading at the start of 1975 as well.

If you ever delve down into today’s physical gold price discovery rabbit hole, you will learn that for the most part the fluctuating price of gold bullion is heavily dictated by the gold spot price which is an amalgamation of gold futures contract price demand on large commodity exchanges like the COMEX.

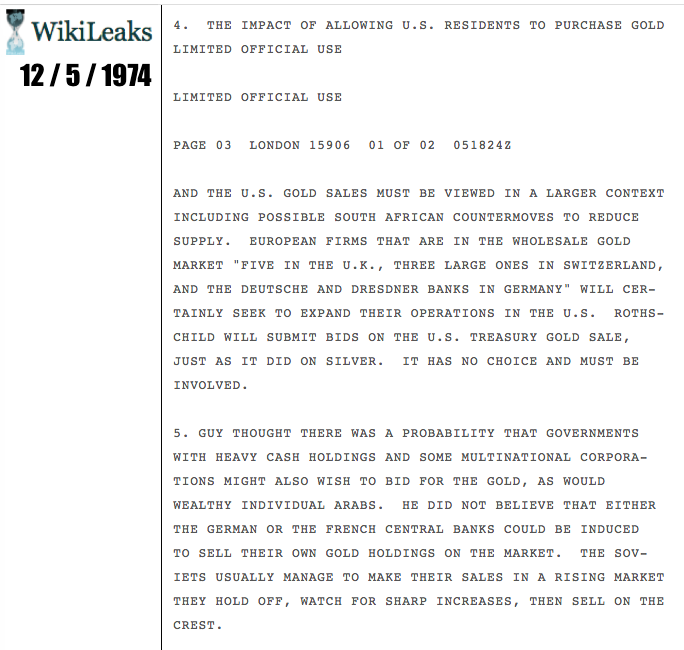

Thanks in large part to recently released Wikileaks US Treasury cables, we have learned that there were official concerns in late 1974 of a possibly surging gold price to $250 oz USD.

This was mainly attributed to increasing bullish gold price expectations due to the ‘re-legalization’ of private US citizens begin allowed to again save (i.e. hoard) in physical gold bullion.

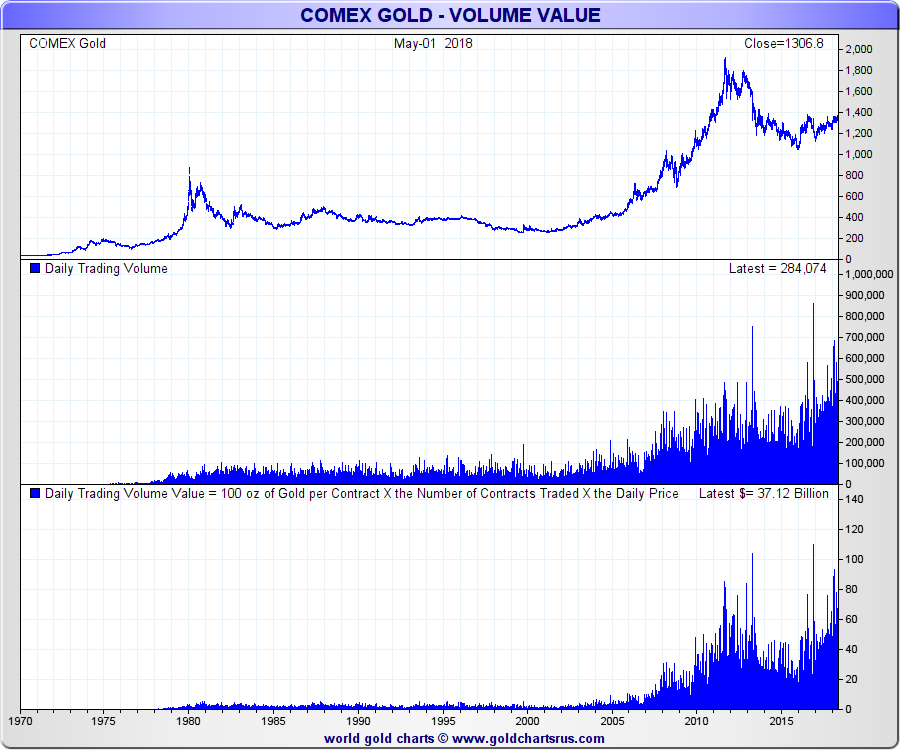

Since then gold derivative trading has grown to dwarf physical gold bullion buying and selling.

Correct in their assumptions according to these aforementioned official US Treasury cables, London gold market experts at the time believed that the formation of a large gold futures market on the COMEX (see point #4) would help create a 'highly volatile' gold price market and all but dissuade large portions of the US citizenry from buying gold bullion en masse.

See below...

COMEX Gold Futures Contracts: Born in Iniquity?

p dir="ltr">

Hindsight being 20/20 these largest London gold dealers where indeed correct in the short term.

Perhaps somewhat incorrect in the medium term (e.g. January 18, 1980 gold price spike to over $850 oz USD, with lines of Gold Krugerrand coin and silver buying and selling at local coin shops wrapping around city blocks).

And yet again proven correct in the long term, as most US citizens do not own any physical gold bullion at all today.

Most astute readers of this content know they are in the minority if they indeed own physical gold bullion outright and in investment grade forms (.999 fine gold bars, gold coins, and highly sought 22k Gold Eagle Coins or Krugerrand Coins.

COMEX Gold Futures Contract Specs in 2018

|

Gold Futures Contract Represents: |

100 troy oz gold |

|

Product Symbol: |

GC |

|

Price Quotation: |

US dollars (USD) |

|

Minimum Price Tick Movement: |

$0.10 per troy ounce |

|

Dollar Value of a $1 Tick: |

$100 US dollars (USD) |

|

USD required per 100 oz contract: |

Varies, currently $ 3,100 USD controls GC currently representing $131,278 USD in proxied gold derivative value |

|

Physical Delivery vs USD Settled: |

Less < 1% of contracts traded, Mostly are USD settled |

Let’s pause and take a short visit back in time, to the COMEX gold trading pit in the year 1981.

This was at a time, well before electronic futures contract trading began to overtake and replace most physical human activity in the COMEX New York city hub and pit.

On the following day October 6, 1981 the gold price swung intraday below $434 oz to above $445 oz priced in US dollars, the same volatile day in which then Egyptian President Anwar Sadat was shot and ultimately confrimed to have been assassinated.

Writing this piece we wondered...

Writing this piece we wondered...

What became of COMEX gold futures contract trader Charlie Federbush?

Today much of modern day US and western world investor ‘gold’ exposure is often parked in derivative forms like ETFs (e.g. GLD, IAU), gold mining stock shares, and even futures and options capital which trades derivative proxies of gold on exchanges like the COMEX or NYSE.

Today the COMEX is the Largest Single Influencer on physical Gold and Silver Prices

COMEX gold futures trading plays a very large part in the pricing of physical gold all over the world.

In fact studies show that the COMEX currently has the most influence over the world’s physical gold price discovery mechanism (more than the London spot market which trades much more in notional gold derivatives annually).

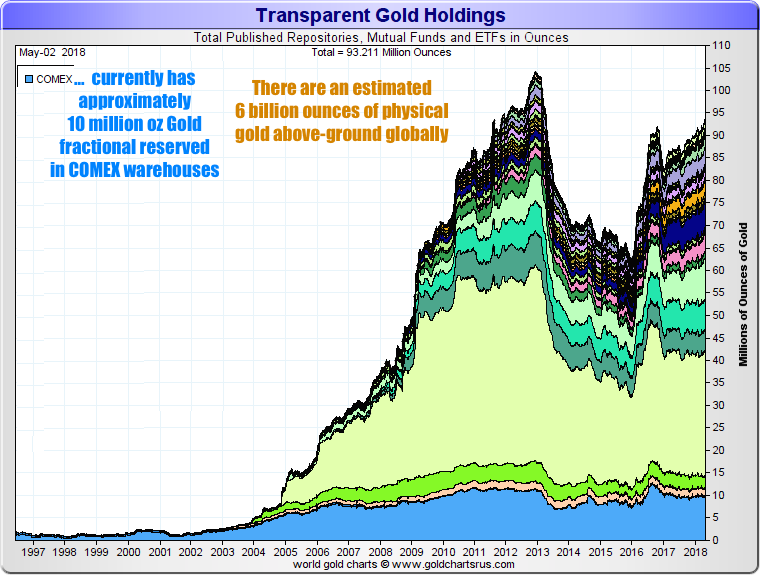

Yet in the deliverable real physical gold world, fractionally reserved COMEX physical gold warehouses combined only account for less than 1 of every 600 oz of all the physical gold in the world.

If only 1 in 600 oz gold physical gold are mostly influencing gold's price, what are the rest of physical Au ounces doing?

Most physical gold bullion reserves reside in government partnered central bank vaults (about 20% of all physical gold) and in gold jewelry forms in the east (especially in India & China, gold jewelry makes up just over 50% of all physical gold in the world).

COMEX Price Ramping Allegations

One of the most blatent examples of modern day gold price intervention on the COMEX was on November 8th and 9th of 2016 the same and following day Donald Trump was shockingly elected as the 45th President of the United States of America.

Within a 24 hour period gold futures prices shot up $50 oz USD only to be batted down $100 oz USD only hours later on record daily COMEX gold futures contract trading volumes.

The gold price technically struggled for about one year's time to rereach similar price levels it was at before Trump was suprsingly elected and various unknown parties decided to dump billions in US dollar notional valued gold futures contracts.

A very similar gold price pop and then smash phenomenon occured following the startling Brexit vote date on June 23, 2016 the small stand out daily volume green bar just prior to the Trump record gold trading day.

Commodity Futures Contract Market Origins

Formal futures contract markets have been active for many millennia (dating as far back as The Code of Hammurabi).

The original intention of futures contracts was to give the producers of food ways to manage crops and food production yields.

The same tennants allegedly apply today in commodity futures markets although many gold industry experts argue that speculation and unlimited naked short positions has perverted modern day COMEX gold (and silver) price discovery.

For example modern physical gold producers (e.g. miners, recyclers, refiners of gold) and end users (e.g. industrial gold sellers, mints that produce gold bullion), and commodity price speculators (e.g. those who simply trade for short term price gains) can use the COMEX gold futures contract trading to respectively (#1) manage their price risk, (#2) buy and potentially take actual delivery of the real world goods, or (#3) simply to make bets on a commodity’s price movement up or down in the near future.

Today a commodity futures contract price is purportedly based on the ongoing 'price discovery' for optional future delivery of that particular commodity.

Yet today the vast majority of precious metal futures contracts on the COMEX (and NYMEX) are settled only in cash (US dollars). While only rarely are precious metal futures contracts actually settled and physically delivered in the real world tangible goods based on the stated contract’s explicit quantity.

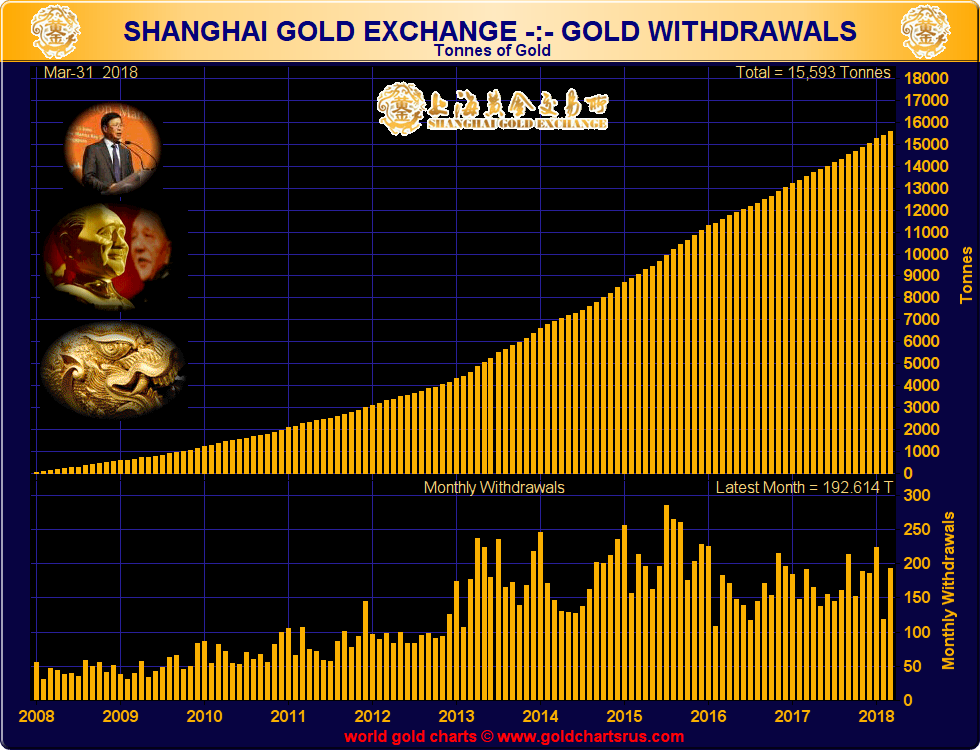

Yet simultaneously outsized physical gold bullion flows are headed east to the largest physical gold exchange now located in China.

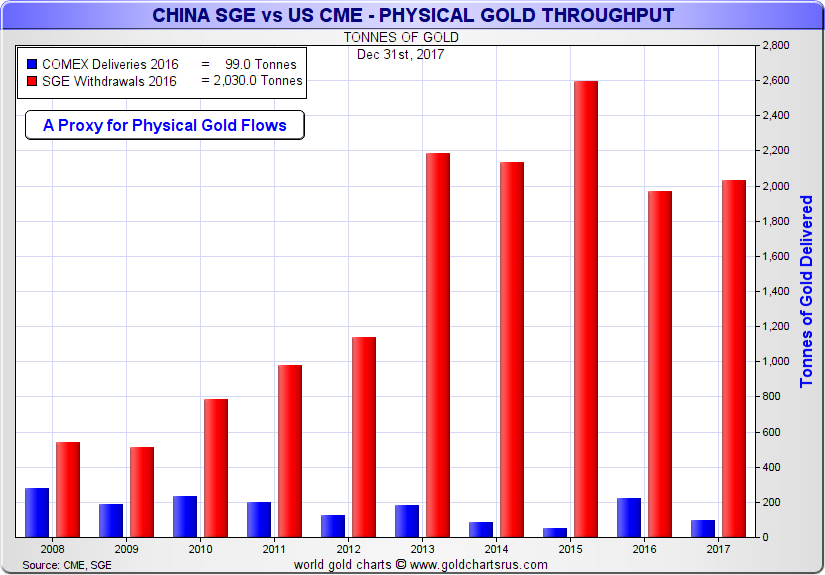

In the following three charts you can see that physical gold deliveries through the COMEX have been pettering out, whilst Shanghai Gold Exchange gold bullion offput has dwarfed its volume over a similar time frame.

1 tonne = 32,150.7 troy ounces

COMEX Silver Futures Contract Specs in 2018

|

Silver Futures Contract Represents: |

5,000 troy oz silver |

|

Product Symbol: |

SI |

|

Price Quotation: |

US dollars (USD) |

|

Minimum Price Tick Movement: |

$0.005 per troy ounce |

|

Dollar Value of One 10¢ Tick: |

$500 US dollars (USD) |

|

USD required per 100 oz contract: |

Varies, currently $ 3,600 USD controls GC currently representing $82,250 USD in proxied silver derivative value |

|

Physical Delivery vs USD Settled: |

Less < 1% of contracts traded, Mostly are USD settled |

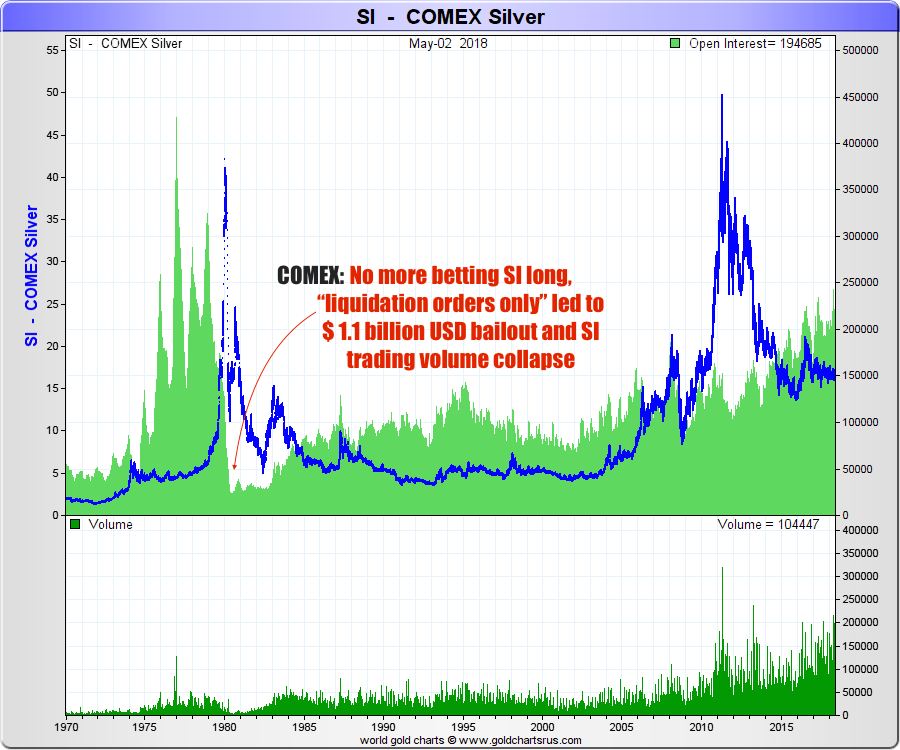

One cannot speak of COMEX silver futures contract trading history without citing the abrupt rule rigging which occured in early 1980 when the Hunt Brothers supposedly cornered the silver market. Somehow these trust-fund silver price ‘gamblers’ forgot who owned the casino and ultimately exactly where the interests of those who allowed it to exist in the first place were.

Most modern financial journalists are too lazy to do real research, so chance is high you have never seen these details. The high ninety percentile often fail to mention that while the prices of silver and gold were hitting record highs on Friday January 18th 1980, the COMEX sprung out the following Monday with drastic rule changes to “liquidation orders only” for silver futures.

That sudden rule change essentially meant silver futures traders could not longer go long silver (bet silver’s price was going higher). These unprecedented actions obviously helped lead to the eventual collapse in silver futures prices and the collapse in trading volumes in silver for many years to follow. Still the COMEX regulatory body, the CFTC, to this day claims their bold actions somehow saved the silver market (March 28, 1980) while only some five years later (February 28, 1985) further tar and feathering the Hunt Brothers as conspiring silver price manipulators.

Former Federal Reserve chairman Paul Volker is on record stating that ‘Gold was the enemy’, we would argue it probably still is in relation to fiat currency values. Pretty convenient to have the Hunt Brothers to make an example of in the COMEX silver pits for those also trading the COMEX gold pits at the time. Only a few months later both platinum and palladium prices traded on the NYMEX reached interim all time price highs as well. Interest rates were driven up over 22% months later, yet this time around this playbook will not work.

Central Banks get COMEX Trading Discounts through 2019

Today, central bank precious metal price intervention policies have likely became well more sophisticated.

The CME Group extends COMEX / NYMEX trading discounts of -15% for central bank commodity price trading through 2019.

Critical commodity price trading by entities who can create currency from thin air sounds like the opposite of true free market 'price discovery'. Indeed that is the world we live in today.

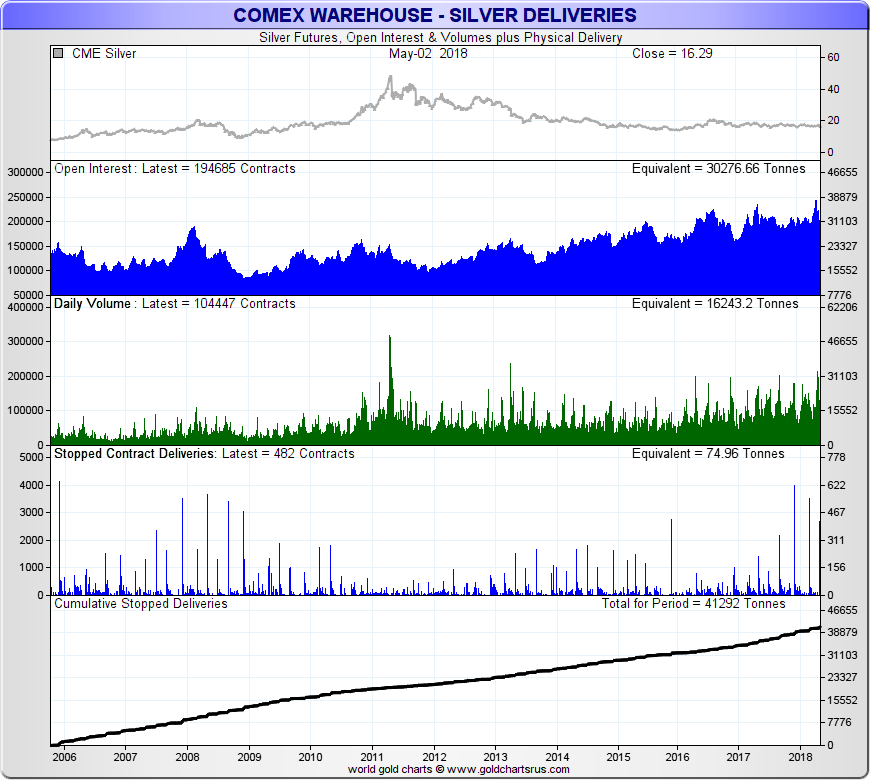

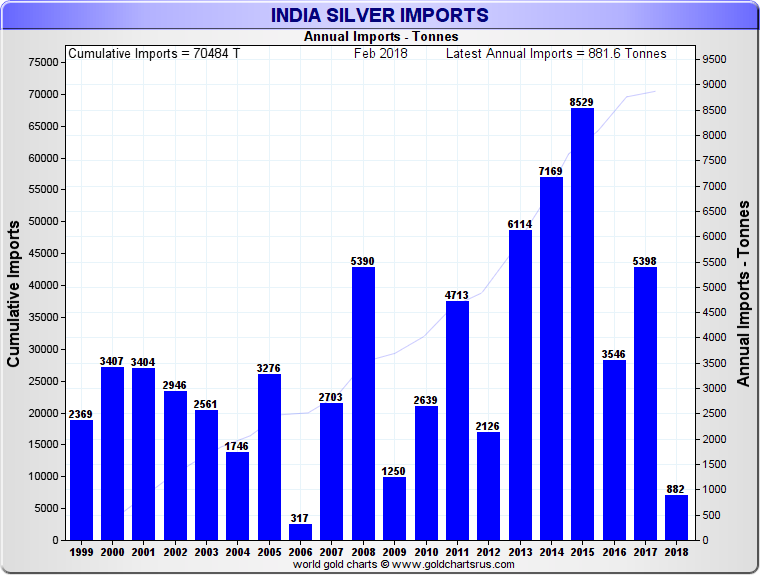

Derivative COMEX silver futures contract trading dwarfs physical silver bullion deliveries from the COMEX warehouse.

The nation of India alone imports more physical silver than the COMEX delivers in physical form on all its trading over the same timeframe.

COMEX Silver Futures Contract Trading Manipulation Allegations 2000s - 2010s

Below is a short look at some more modern COMEX silver trading allegations which remain in effect today.

The list of allegations and the mounting evidence is too long and complex for this general overveiw.

You can start down that rabbit hole here and here.

Most recent COMEX silver futures contract price allegations point to JP Morgan.

After supposedly inheriting bankrupt Bear Sterns’ mostly naked silver short position, JP Morgan has become the main gorilla in COMEX silver futures contract trading arena.

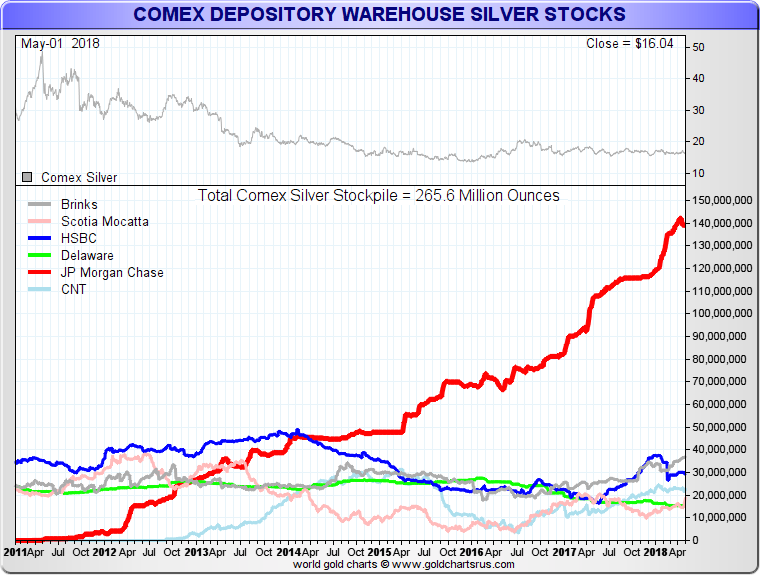

From the spring of 2011 up until now in 2018, JP Morgan's COMEX warhouse has gone from not existing to now having about 140 million ounces of registered and eligble silver bullion holdings.

Even more recently Scotia Mocatta, has failed to sell their precious metal trading desk with reports that they are slimming down their many year silver short position after both 2016 price manipulation lawsuits and losses in that same year’s first half US dollar silver price run from $14 to $21 oz.

Interesting too is the development of JP Morgan’s COMEX silver depository warehouse which was purportedly rushed into existence in the spring of 2011 as silver spot prices again hit $50 oz USD. Again that bank went from have no physical ounces of exchange deliverable silver to now holding over 50% of the entire COMEX fractional reserve silver bullion supply (combined registered and eligible stockpiles).

Of course no one but JP Morgan knows what percentage of this COMEX silver bullion is owned by it versus its clients, yet the underlying motives as to why the custodian and often physical silver withdrawing entity from the largest silver ETF (SLV) may be going long silver bullion likely lie somewhere between motives of greed, price control, and potential bankruptcy fears.

Some Words from the Head of the COMEX / NYMEX and CME Group

Today the NYMEX (and COMEX), operate as designated futures contract markets under the publicly traded CME Group.

The chairman and CEO of the CME group, Mr. Terry Duffy, can be seen below in a video clip discussing precious metal prices from a summer 2017 interview on Fox Business News.

Take a listen to what he explicitly says in terms of precious metal prices versus the following criticisms about his futures contract exchange not merely allowing, but also incentivizing government partnered central banks who now trade commodity futures contracts as well as in ETFs and stock markets.

Rare to have the leader of the most influential bullion 'price discovery' influencer and the world's trading volume leading futures contract exchanges (NYMEX & COMEX) speak so bluntly and bullishly for the long or price appreciating side of any commodity traded within its domains.

Specifically here, all the precious metal futures contracts which are traded on the NYMEX (palladium, platinum) and the COMEX (gold, silver).

Accord to Mr. Duffy in the summer of 2017, depressed bullion prices at that time were not reflecting reality of world news and events. Well we can all perhaps ponder as to why. The allegations are nearly as infinite as the derivative contracts that futures markets trade in.

Perhaps futures contract price circuit breaker rules(introduced late in the year 2014) for both NYMEX and COMEX precious metal futures contracts has some coming relevancy to its Chairman and CEO's summer 2017 pro-precious metal bull market commentary.

In Summation

Some common sense points which cannot by denied about the COMEX and all other futures contract exchanges as well.

Futures contract exchanges have and will again, abruptly alter their futures contract exchange trading rules (e.g. as mentioned in the late days of the Hunt Brothers silver play, COMEX haulted going long silver futures contacts in early 1980).

There are even aforementioned precedents in futures contract defaults in history, one which we explicitly documented here (e.g. NYMEX potatoes 1976).

Margin hikes often accompany rising commodity price markets (e.g. silver margin hikes in the spring of 2011).

And even relatively new NYMEX / COMEX futures contract price 'circuit breaker' rules make it even more questionable whether modern futures market exchanges can even function with large outsized price volatility without potentially freezing or failing to operate at all.

Anyone betting long or short should always know, all commodity futures contract exchanges will arbitrarily and suddenly change their rules according to their best interests (or perhaps even the interests of those who allow them to exist and even operate at all, e.g. governments, banking system).

Now let’s review and get some short term relief, with a classic 1980s comedic movie scene...

Like the London Gold Pool's eventual failure, this more complex gold and precious metal price containment go round appears to simply be stalling the inevitable.

At some point we expect a more aggresive gold bullion accounting of fiat currency debasement. The key questions are how (i.e. human confidence / structural debt write offs / aggresive currency devaluations) and of course exactly when.

Human beings regardless of the sanctimony they carry themselves with, they can and often do fail as documented here.

Their written contracts and arbitrary policies can change abruptly, go unfulfilled, or be renigged upon in the event of unforeseen conditions.

This is precisely why most prudent long term precious metal bulls often skip ever using futures contract exchange trading, using ETFs, or other counter-party laden promises by simply buying and owning the real things outright (bullion coins, bars, rounds).

Sure you could trade derivative proxies if you like, but don't ever confuse their similarity to casino chips subject to casino onwership interests.

If you want to learn more about precious metals, be sure to check out our 21st Century Gold Rush educational section where you can download a free robust PDF eBook packed with educational content.

Thanks for visiting us here at SD Bullion.

***