Who, how, and what actually determines and discovers the fluctuating price of gold? How is the gold spot price found? Why is there a difference between gold spot prices and gold bullion coin and bar prices? Find out the way the price of gold is set right here.

What and how is the Gold Price Discovered?

Gold Price Discovery - (n) refers to the act of determining the ongoing price of gold by studying market supply and demand and other heavily influencing factors associated with the fluctuating global gold price (e.g. derivatives / gold futures contracts).

This content covers the way the gold price is determined around the world.

21st Century gold price discovery may seem simple yet it is multifaceted and complex in reality.

First and foremost the specific fluctuating gold price you want to understand needs to be very specific. For example the gold spot price is a combination of diverse financial elements, trades, and data forming a more or less coherent whole (the gold spot price). That said gold bullion price discovery can and does heavily diverge from gold spot prices during financial crisis (e.g. in late 2008).

Upon your better understanding of how various gold prices are discovered (both gold spot prices and physical gold bullion prices) you can gain a better ability to discern which entities and financial forces are driving gold price discovery both in the proxy gold derivative and actual physical gold world.

Here we will cover both some ancient and somewhat recent gold price history, this will also include many modern day gold price discovery facts and data (physical gold vs gold derivatives especially).

Gold Futures Contract History

Both common commodities and precious ones like gold (as well as crude oil, palladium, platinum, silver, wheat, coffee, cotton, base metals, and others) have forwards or futures contracts trading on various futures exchanges throughout the world in order to help ascertain their real world prices.

Certain acronyms like the NYMEX, COMEX, TOCOM, CME Group, CBOT, SHFE, SGE etc. represent respective spot, forward, and futures exchanges (or their parent companies) which are purportedly overseen by their national governmental (or semi-governmental) regulatory agencies.

Formal futures contract markets date as far back as ancient laws ever written. Over 3,000 years ago within The Code of Hammurabi, there were laws written pertaining to the delivery or failure to deliver certain commodities. Coincidentally this ancient text also explicitly cites mina or mene (i.e. money) being comprised of gold and silver weights in use for legally required payment.

The original intention of futures contract usage was to give (#1) the producers of real commodities ways or means to respectively manage their price risk (e.g. gold miners), (#2) end users ways to buy and potentially take actual delivery of the real world goods (e.g. gold refiners or gold bullion dealers), and even allow liquidity providing (#3) commodity price speculators a way to make bets on a commodity’s price movement up or down in the near future (those who simply trade on futures contract exchanges for short term gains and make or take no delivery whatsoever). It is this latter third speculator class, that has arguably outgrown real gold producers and end gold users, perverting current gold price discovery in the 21st Century.

You can perhaps, if you will, imagine the 21st Century commodity markets as a pyramid structure.

At the top of the pyramid are the actual physical assets or commodities themselves.

Below are derivatives like over-the-counter (OTC) market forwards and swaps which are executed party to party and not traded on organized commodity exchanges. Forwards and swaps are often financially settled in fiat currency, however; they can and do often allow for physical delivery of the supposed underlying commodity asset(s).

The next level down on this imaginary commodity pyramid is the futures and options contracts that trade on futures exchanges. These contracts allow a wide and diverse group of market participants to have positions long, short (betting prices will go higher or lower) in the price movements of commodities. Real world producers of gold like gold miners often have fixed costs and choose to hedge their gold production with futures contracts in order to fix future delivery profitability.

For further example, in late summer 2011 a gold miner may have found that the gold spot price of then some $1,900 oz USD, was perhaps overbought and unsustainable. Perhaps this gold mines management decided to go short gold (bet the gold spot price would go lower) in the futures markets while delivering physical gold in reality for months to come. Even as the price of the gold ore this miner dug out of the ground was falling in late 2011 and early 2012, the offsetting futures contract bets placed to the downside could have helped offset the sub $1900 oz USD gold price levels.

The next level of the commodity pyramid consists of ETF products designed to mimic price volatility in the assets they purport to represent. The most widely held gold proxy ETF is GLD which charges shareholders 0.4% annually for price mimicry of the gold spot price yet non-Authorized Participants have no ownership nor access to any physical gold the fund purportedly holds.

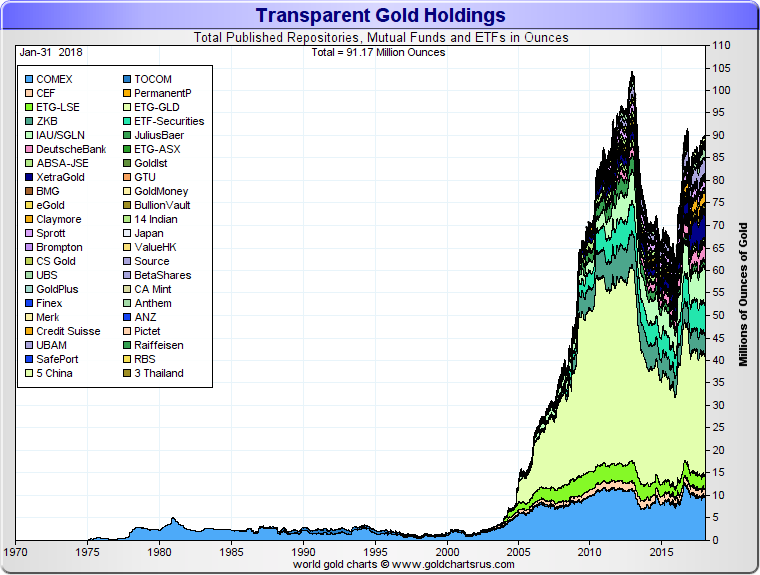

The following chart puts this imaginary gold commodity pyramid into further context with the 187,200 tonnes (just over 6 billion troy ounces) above ground and treasured worldwide.

Transparent Total Physical Gold Holdings in ETFs, COMEX, etc.

Fractional reserve futures markets, electronic gold funds, and private transparent gold bullion holdings in 2018 only represent approximately 1.5% of the gold ever mined above ground to date. For further perspective about 20% of gold is in government central bank vaults, half the gold in the world is in jewelry form, while estimates are about 20% of all world gold resides within India and China combined (respective government bullion reserves plus private gold bullion and jewelry savings).

So what is the Gold Price?

When someone simply looks up, quotes, or does an internet search on the ‘price of silver’ they will be answered with current and often fluctuating gold spot price in fiat currency reciprocals (US dollars, pounds, euros, pesos, yen, yuan, etc.).

Gold Spot Price Definition

Let us first define what the gold spot price is:

Gold Spot Price – (n) the current respective fiat currency price of 1 troy ounce of gold available for immediate delivery before being minted into a gold bullion product (e.g. gold bullion bar or gold bullion coin).

The fluctuating spot price for gold is actively determined by the commodity’s most highly traded futures contract at the time. The mostly traded futures contract for gold can be the current month or it might be two or more months into the future.

Today the gold spot price is a combined indexing using many of the world futures market prices. But based on trading volumes, the gold spot price is currently mostly influenced by the highly fractionally reserved COMEX and London Gold Market.

As back-asswards as it may sound, the price of gold today is mostly found via selling and buying of virtual contracts representing the underlying potentially deliverable physical precious metal (physical gold bullion).

The positive news for physical gold bullion buyers is that the future price discovery for gold appears to be moving back towards physical reality (see China’s Shanghai Gold Exchange with 100% physical delivery required).

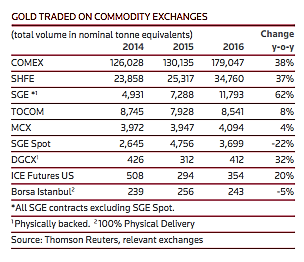

Over 90% of Gold Trade Volumes are Derivatives, not Physical Gold

At present the parties who currently mostly influence today’s gold spot price (e.g. 6 commercial bullion banks specifically) are for the most part not actually exchanging physical gold, but instead trading derivative contracts (in their own account or for other clients) to highly influence what the real world’s physical gold price is and may be in the near term.

Many gold experts, continue to allege and point out that commercial banks aggressively own the short side on COMEX futures exchanges, to profit trading incited short term price swings, but also to ultimately stay solvent themselves. It is in the interest of many central banks and their commercial bank partners to help suppress gold and other commodity values. Allowing the opposite in extreme fashion could render them insolvent and powerless.

Other than the Shanghai Gold Exchange (SGE), all other gold futures markets are highly leveraged fractionally reserved gold exchanges. The vast majority of gold futures exchanges trade many multiples of representative gold ounces via gold futures contracts with only a very small percentage of actual gold bullion physically sitting in warehouses, and ultimately delivered upon in the real world.

There is only about 187,200 tonnes of Gold Above Ground, almost half in gold jewelry form

In the year 2015, the world’s gold futures exchanges traded gold futures contracts representing over 8 times more gold than humans have ever mined throughout history (1,539,690 representative tonnes traded in 2015 vs 187,200 tonnes mined all time to date). In 2014, Bloomberg estimated the gold derivative market totaled $18 USD trillion in notional value.

What are all these people trading?

In reality, far less than 1% of traded gold futures contracts (excluding China’s SGE) are settled in actual physical delivery of gold bullion. Based on the 2015 statistics, nearly 350 times more gold futures contracts were traded that year than actual physical gold supplied to the world’s gold market.

To summarize the situation, understand the following.

The price of gold is mostly influenced by short term price speculators trading futures contracts on western exchanges today.

Political and economic events do have influence on the short term price of gold. But it is dubious and naive to believe that what we are seeing today resembles a real free market price for gold (and other precious metals for that matter).

Yet when a large enough percentage of the world starts demanding physical delivery of their gold bullion (or other precious metals), the current highly leveraged fractionally reserved futures contract markets will be forced to adapt to a situation where deliverable physical gold bullion again indeed drives the price for physical gold.

COMEX futures contract ‘price circuit breakers’ have been recently readied (implemented in late 2015) and are now awaiting unorderly future gold prices and other precious metal futures contract prices. All respectivel have influence over physical gold bullion and or other physical precious metal bullion prices.

Various macroeconomic forces appear to be converging, likely ensuring that this 21st Century Gold Rush has yet to see its highest fiat currency price peaks in all physical precious metal bullion products including gold bullion.

Gold Bullion Prices vs Gold Spot Prices

How come gold bullion prices are different from the fluctuating gold spot price?

The gold spot price is relative benchmark for physical gold bullion prices.

It is similar to brent crude oil spot price where complete transportation, refining, and other all in costs are not completely factored in. Actual price quotes for various crude oil blends in the real world are highly variant to the spot price often quoted in financial media.

For gold, almost all competent online gold bullion dealers host live gold spot price quotations on their website typically based in the local fiat currencies of service provided (e.g. US dollars, Canadian dollars, euros, pounds, pesos, yen, yuan, etc.).

Gold bullion buying and selling is an incredibly competitive industry in the USA and in most industrialized nations without high physical gold import export tariffs or taxes. Typically with US online gold bullion dealers, the gold bullion products available to purchase and take delivery of are priced per troy ounce of gold (although there are smaller fractional troy ounce and gram sized products as well as larger kilo gold bars sold as well).

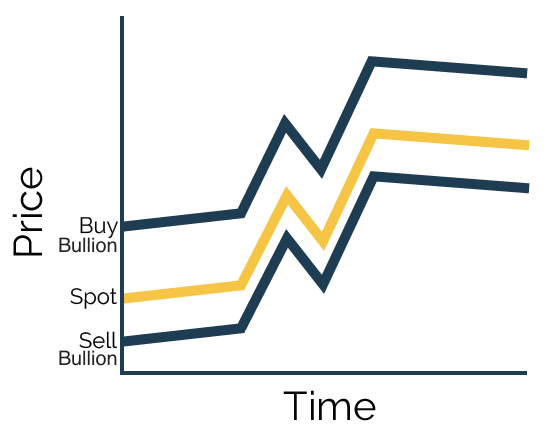

Today in calm market periods, it is often possible to acquire gold bullion at mere basis points or perhaps only a few percentage points above the fluctuating gold spot price. The additional price to acquire investment grade gold bullion product is due to the costs associated with refining, manufacturing, minting, marketing, hedging, and warehousing the respective gold bullion products on sale.

In contrast, when selling gold bullion to online gold bullion dealers, gold bullion products will typically yield a selling or bid price at or just below the fluctuating gold spot price (depending upon the product type and mint hallmark).

How Physical Gold Bullion Prices Work in Calm Markets

In relaxed non-volatile market periods, investment grade gold bullion product prices hover slightly over the fluctuating gold spot price.

For example, if gold’s spot price is $1,300 oz, most physical gold bullion products will be priced slightly above $1,300 per troy ounce of gold bullion. Gold bullion product price differences during calm market conditions range as low as mere basis points (less than 1%) above the gold spot price for large gold bullion bars to a few percentage points above gold’s spot price to buy gold coins guaranteed by governments.

When outsized gold bullion market demand hits (like it did during the Global 2008 Financial Crisis), gold bullion prices for products available for immediate delivery climb higher (often on both the sell and buy side) to levels in which both can hover above the world’s fluctuating gold spot prices.

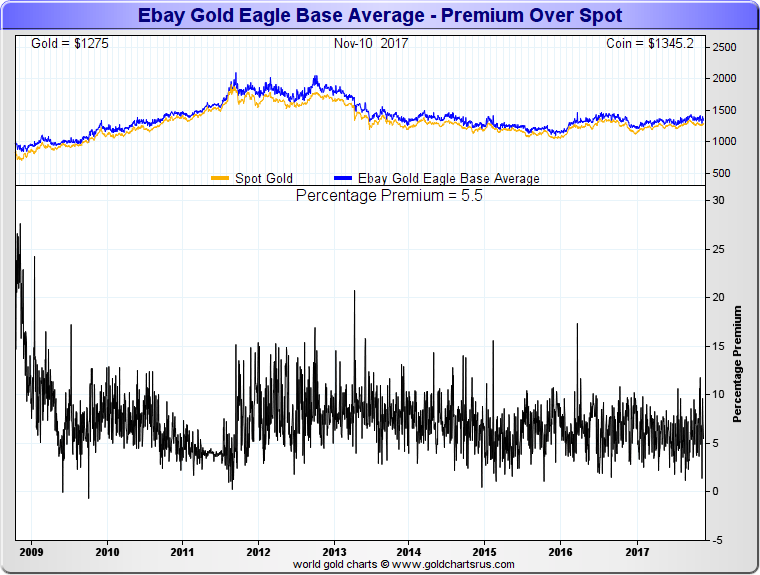

For example, take a look at how the world’s most popular gold bullion coin was priced as high as +25% over the fluctuating gold spot price in the fall of 2008.

Physical Gold Prices for 1 oz American Gold Eagle Coins traded on eBay

1 oz American Gold Eagle Coins where trading about 25% above the gold spot price in the fall of 2008.

For example, gold spot price was at $801 oz USD on October 17, 2008,

meanwhile 1 oz American Gold Eagles were selling at over $1000 oz that same day on eBay.

The following is summation on current gold price discovery.

Gold’s spot price relation to deliverable physical gold bullion currently functions like so:

-

Futures traders buy or sell gold futures contracts on worldwide futures exchanges, this trading’s ‘price discovery’ determines fluctuations in gold spot prices in various fiat currencies.

-

Miners of gold extract and typically sell mixed gold ore and doré bars to gold bullion refiners at prices just below the fluctuating gold spot price.

-

Refiners of gold melt and purify the gold ore into .999+ fine bullion or grain then sell these products to governments, mints, or gold bullion dealers at or just above gold’s spot price.

-

Both government and private mints strike gold bullion coins or manufacture gold bullion bars, selling them to gold dealers or the public at large at prices typically above the gold spot price.

-

Retail and wholesale bullion dealers like us at SDBullion.com produce, procure, and sell gold bullion products for discreet fully insured delivery to door or to professional fully insured segregated non-bank storage facilities at prices just over gold’s fluctuating spot price.

When one learns how fractionally reserved futures markets currently operate and derive the various fluctuating gold spot prices, they often simply choose to bypass electronic gold derivatives and simply elect to buy and take physical delivery of their gold bullion.

In just 2 minutes time you can hear a highly successful hedge fund manager explain why in 2009, a University of Texas trust he serves on as a fiduciary, chose to acquire physical gold bullion over virtual derivatives or futures contracts (i.e. he cites physical gold bullion as being less costly and arguably safer).

Thx for speaking so frankly on the matter.#COMEX circuit breakers are in place

— James Henry Anderson (@jameshenryand) August 30, 2017

for when price solves everything:https://t.co/1Jq2HrRow9 pic.twitter.com/WTGbNWzknb

By acquiring gold bullion physically and owning it directly, you can potentially take advantage of future scenarios when gold bullion premiums spike over fluctuating gold spot prices whilst simultaneously reducing the myriad counterparty risks associated with virtual gold proxies trading during limited market hours like futures contracts, ETFs, mutual funds, etc.

More investors and central banks across the world want to buy and hold gold bullion directly, owning it fully unencumbered, to help insure the fact that they indeed own it outright moving ahead.

The current head of the CME Group, (i.e. COMEX, NYMEX) which represents futures exchanges which have large influence of the fluctuating price of gold and other physical precious metals across the world, had the following to say in the summer of 2017. Welcome to the "cacoon club".

#CME CEO on #Gold price

(fyi he runs #COMEX #NYMEX)

Thx to phony derivative futures' "price discovery" its taking 2.5Xs longer than 1970s pic.twitter.com/QNGekQS5Dk

— James Henry Anderson (@jameshenryand) July 13, 2017