Silver Futures Contracts - (n) legally binding agreements for the potential delivery of physical silver at an agreed-upon price in the future (yet in the vast majority of silver futures contract trades, physical silver is never exchanged between parties, merely fiat currency is used for contract settlement).

Silver futures contracts are standardized on the respective futures exchanges which they are actively traded. Silver futures contracts are explicit in the amount of silver they represent, the silver purity and form they represent, and the time and place of potential physical silver delivery (e.g. approved warehouses, etc.).

On silver futures contract exchanges, only the price changes, all other exchange rules should remain constant (in theory). This was definitely not the case in the peak of the 1980 silver bull market when the Hunt Brothers allegedly ‘cornered’ the world’s silver supply.

Formal futures contract markets have been around and in use for thousands of years. The first known version dates back to The Code of Hammurabi in ancient Egypt.

The beginning intention for futures contracts was to give producers of commodities (e.g. wheat growers), end users (e.g. bread makers), and commodity price speculators (those who simply trade on futures exchanges for short term gains) ways to respectively manage their price risk. Commodity futures contract buyers could potentially take actual delivery of the real world goods, or simply use the contracts to make bets on a commodity’s price movement up or down in the near future.

With silver futures contracts only two distinct positions can be taken: a long position (buy) is an obligation to accept delivery of the physical metal, while a short position (sell) is the obligation to make future delivery if called upon. Yet still today, the great majority (+99%) of silver futures contracts are offset or settled in fiat currency prior to the actual delivery date, thus no physical silver bullion moves anywhere.

Silver Futures Contract Size

On the COMEX for instance, standard silver futures contracts (SI) represent 5,000 troy ounces of fine COMEX approved deliverable silver bullion. There is now also a smaller silver futures contract (SIL) which represents 1,000 troy ounces of fine silver.

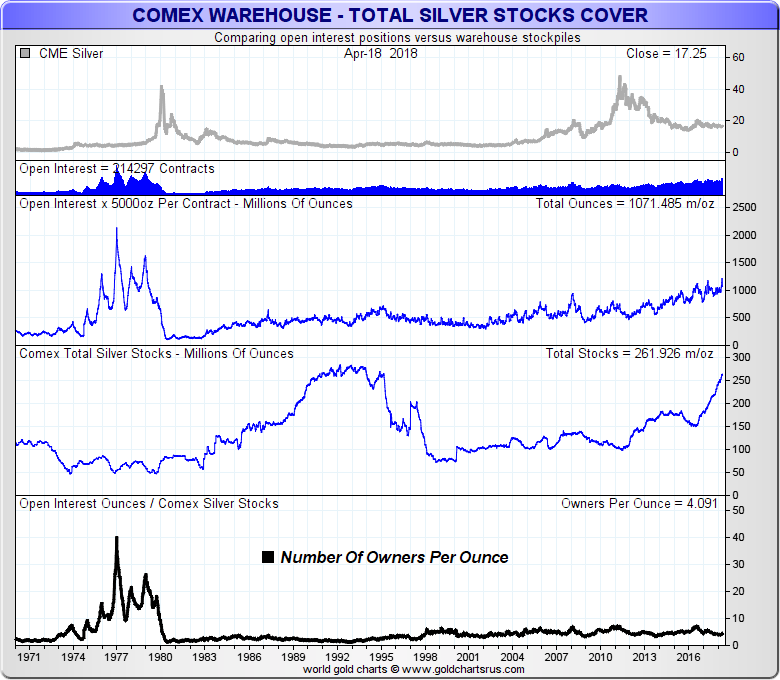

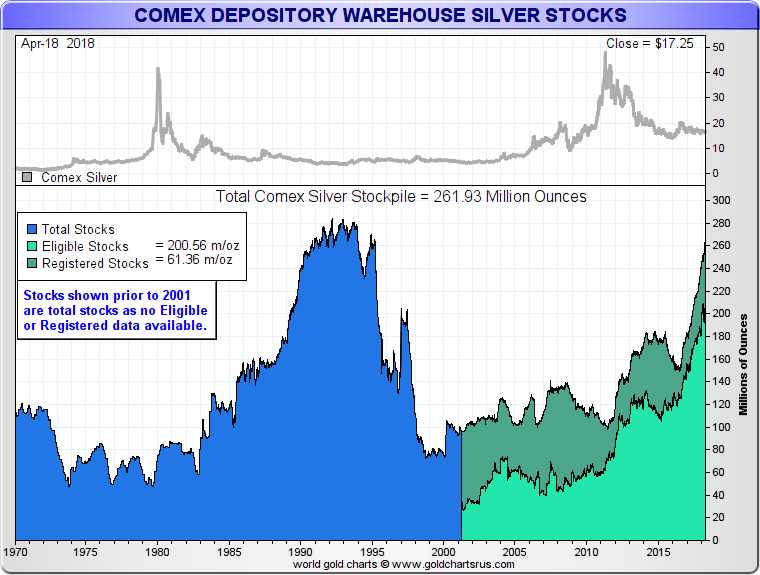

The following charts show the amount of silver bullion held throughout the fractionally reserved silver futures trading COMEX exchange history.

In the year 2017 alone, an average of 98,000 silver futures contracts representing 490 million ounces of silver were traded on a daily basis on the COMEX.

With about 250 trading days in a year, that is 24.5 million silver futures contracts traded in 2017. Or about $2.2 trillion USD in silver futures contracts moving through the COMEX in 2017.

This all occurred with an average of about 225 million ounces of fractionally reserved COMEX silver bullion backing all this trading volume.

Commodities like silver (as well as gold, oil, natural gas, palladium, platinum, coffee, sugar, cotton, wheat, and others) have both privately negotiated forwards contracts and futures exchange standardized futures contracts traded on their fluctuating values.

There are many futures contract exchange market acronyms you have likely come across before. Names like the NYMEX, CME Group, CBOT, SGE, COMEX, and more. Futures contract exchanges are purportedly regulated by their national governmental or semi-governmental regulatory agencies.

Today the silver spot price is a combined indexing using many of the world futures market prices. But based on trading volumes, the silver spot price is currently mostly influenced by the highly fractionally reserved COMEX and London Silver Market.

Silver derivatives (silver futures contract bets) are traded in daily volumes which dwarf the daily physical silver bullion supply. Basically 100s of theoretical silver ounces traded versus 1 real ounce of physical silver brought to market every day.

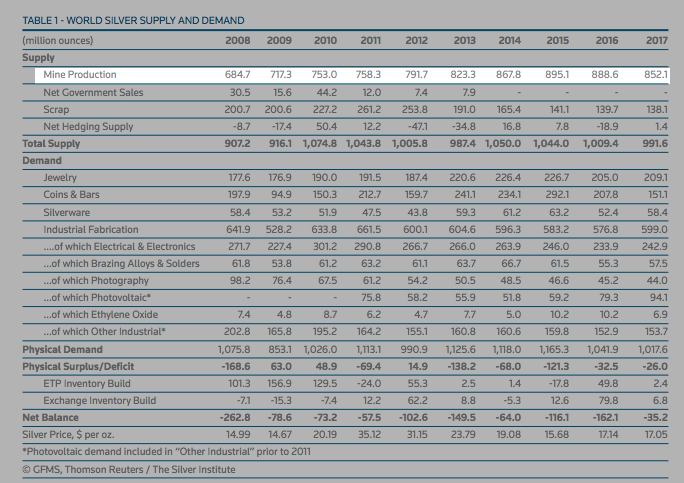

Note that only about 850 million ounces of physical silver are brought to the world markets on a yearly basis. Average silver prices in 2017 was about $17.55 oz. This means about $15 billion USD in new physical silver was brought to the world markets in the entire year.

The following exhibits will give you an idea of how overwhelmingly large various silver futures contract trading volumes are vs yearly physical silver supplies (a few billion US dollars in new physical silver mined vs multi-trillion in notional US dollar silver futures contract trading volumes).

The fluctuating silver spot price of which you often see quoted on silver bullion dealer websites and in the financial media, is actively determined by the most highly traded silver futures contract at the time. The most traded silver futures contract can be the current month or it might be two or more months into the future.

Thus you can think of the silver spot price like so:

Silver Spot Price – (n) the current notional price of 1 troy ounce of fine silver available for immediate delivery before being minted into an investment grade silver bullion product (e.g. silver bar, silver coin, silver round).

As backwards as it may sound, the price of physical silver today is mostly found via the selling and buying of silver futures contracts representing the underlying potentially deliverable physical precious metal itself.

If you want to learn more about silver and other precious metals be sure to visit our 21st Century Gold Rush page where you can pick up a free PDF eBook.

Thanks for visiting us here at SD Bullion.

***