John Exter:

“The U.S. and world economies are on the threshold of a deflationary crash that will make the 1930s look like a boom. Gold will be the single best investment to own. Buy it now while it's still cheap.”

John Exter (1910 - 2006) was an esteemed American economist. A former member of the Board of Governors for the Federal Reserve, founder of the Central Bank of Sri Lanka, and head of the NY Fed during much of the failed London Gold Pool era.

Today John Exter is now mostly known for creating Exter's Pyramid, which he designed and used about 50 years ago.

Further along in this article we will display both his original and now updated illustrations of asset classes in terms of their overall risk of default (potential for bankruptcy) and overall estimated notional values then and today in 2018.

Exter's early adulthood spanned the 1930s Great Depression. A young John Exter saw his Chicago bond trading father lose everything when the US stock market crashed in late 1929. This shocking incident spurred his interest to study and better understand what factors were responsible for the Great Depression of the 1930s.

5 ounces of Gold would have Bought this Car (1929 AD)

Source + Original Car Price 1929

After graduating from the College of Wooster (1928-1932), John Exter went on to study at the Fletcher School of Law and Diplomacy and in 1939, to Harvard for graduate work in economics.

After a stint at MIT during World War II, Mr. Exter began work on the Board of Governors of the Federal Reserve System as an economist. In 1948 he first served as an adviser to the Secretary of Finance of the Philippines, and then as the Minister of Finance of Ceylon (now Sri Lanka) to develop its central bank. He eventually became the first governor of the newly organized Central Bank of Sri Lanka in 1950.

In 1954 the Federal Reserve Bank of New York appointed John Exter as vice president in charge of international banking and gold and silver operations.

While speaking at the Detroit Economic Club in 1980, Mr. Exter stated much about the era when he took charge of physical gold and silver bullion operations at the New York Fed in 1954. Then US gold reserves got valued at USD 24 billion. Gold bullion prices got then valued in the USA at a fixed price of USD 35 oz. How was the gold price fixed, you might wonder?

Historical fact points to a multi-national, agreed-upon attempt to contain gold prices for over a decade during this era (failed London Gold Pool).

In taking part, the USA lost large swaths of gold reserves she had taken in from WWII military-related export gold bullion payments. Under the Bretton Woods Agreement and simultaneously running yearly trade account deficits, the USA had to send gold bullion all over the world year after year to settle up debts. As well she lost hoards of gold taken from US citizens in 1933. As she confiscated private gold coins paying a mere $20.67 oz in 1933-1934 only to devalue in 1934 to $35 oz gold.

London Gold Pool US Gold Reserve Losses (1933 - 1971)

Gold Price History + Nixon's 'temporary' Gold Window Closure 1971

As the western led London Gold Pool price rigging agreement was well underway, US gold reserves had fallen to $16 billion by 1962. And the by 1966, to $13.5 billion (all while gold got valued at a then rigged price of USD 35 oz). Nations like France kept demanding gold bullion from the US and not Federal Reserve notes nor US dollar currency in payment.

The London Gold Pool ultimately failed to control the price of gold as France and other nations continually demanding gold over US dollars in the balance of trade settlements.

-

France and Others Wanted Gold Bullion in Payment, not War Deficit Spending US dollars

-

As a current-day aside. One might argue over the last more than three decades we have been operating in a more sophisticated derivative dominated gold price containment system. You can learn about the discrepancy between COMEX and LBMA led western vs. eastern gold price daily compounding data since the middle 1980s.

Following John Exter’s more than decade long tenure at the Federal Reserve, the Bretton Woods agreement got broken by physical gold market forces.

Learn more about 1968 gold prices, that was the year in which the London Gool Pool's rigging of gold prices ultimately failed to function or be useful.

The US dollar became a full fiat currency without national gold redemption by middle August 1971.

Aside from the Swiss franc at the time (since lost its gold relation too and is now fully fiat), all other 1970s to today fiat currencies by definition, have no official ties to physical gold.

-

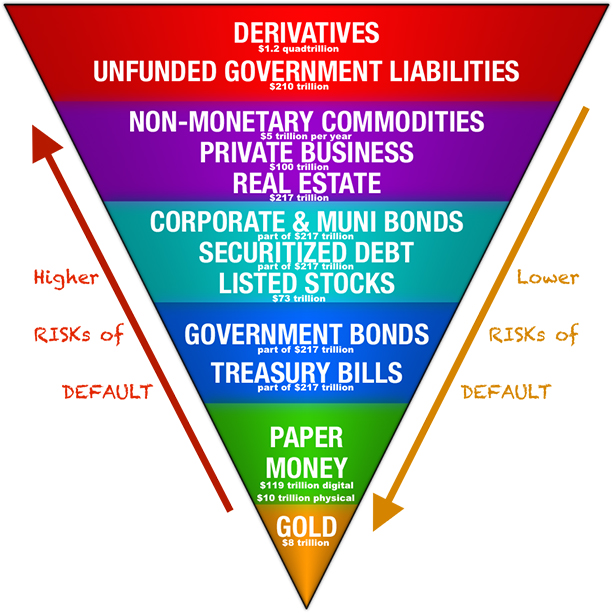

Exter Pyramid - Original Inverted Gold Pyramid

In Exter's original illustration above, gold bullion forms the tiny base as the most reliable asset class. All other asset classes built on higher levels get progressively riskier the higher they are situated.

The larger width of asset classes at higher levels of the inverse pyramid represent their more substantial total worldwide notional value at the time. Exter's original pyramid illustration placed Third World debt at the top.

Today derivatives hold this dubious honor.

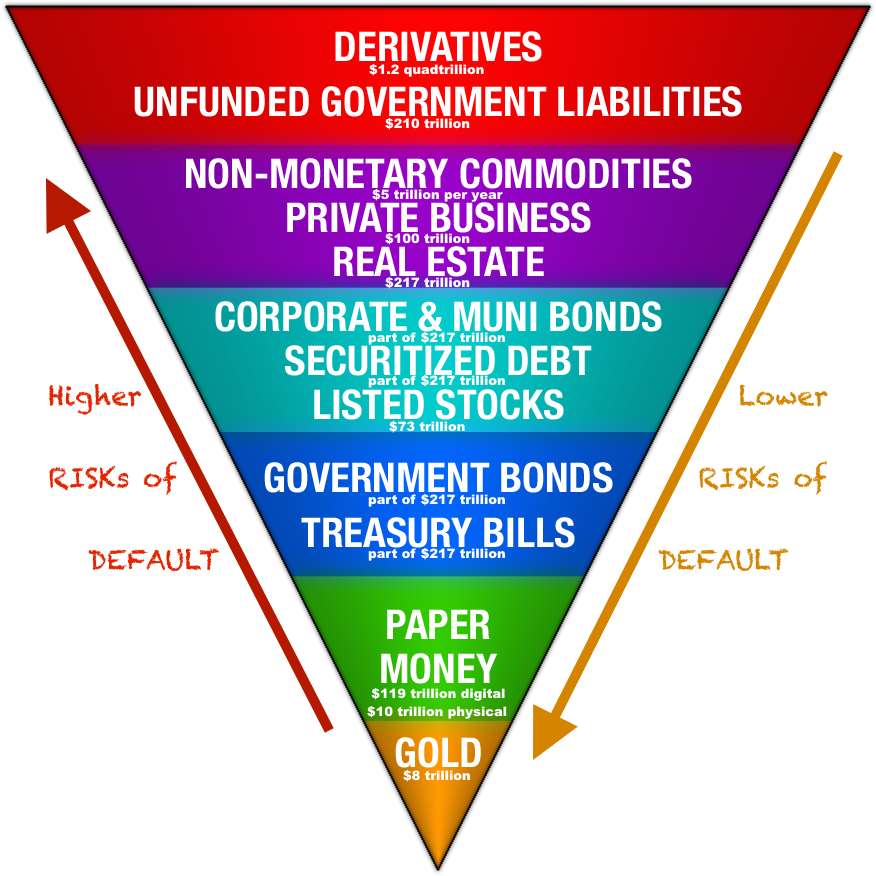

Below is a more modern version.

Exter Pyramid - 2019 Updated Inverted Golden Pyramid

Exter’s debt pyramid has been able to keep expanding as financial innovation, and economic financialization has introduced more leverage than ever before into the global economy.

The mushrooming derivatives market with its credit default swaps, collateralized debt obligations, mortgage-backed securities, etc. have all taken top risky residency in this more modern inverted Exter pyramid.

According to Exter's model, those derivatives with the weakest and furthest links from base money are the first to be rejected and potentially bankrupted. As confidence vanishes and a broad-based liquidation process ensues, the higher risk asset class values cascade into their underlying collateral. Economic and financial spillover effects eventually flow down the inverted pyramid when seemingly everyone in the world at the same time 'wants their money back.' This kind of 'run on the financial system' scenario impacts even the least risky securities, and near the tip of the pyramid, even paper (and now more often digital) fiat currency values.

In almost all financial crisis, physical paper currencies are unlikely to default in the short term within the nation they have legal tender status. Hyperinflations are the lone outlier to this statement for they effectively default by buying one way less day after day (e.g., Venezuela today).

But unlike physical gold bullion, government fiat currencies can be created at will and devalued by mere decree. Measuring and forecasting the masses confidence in fiat currency is difficult to do accurately. Their breaking point is a known, unknown amongst central banks. What is indeed known is that throughout history and without exception, all monetary proxies stemming from physical bullion coins eventually become worthless given enough time.

Gold bullion forms the smallest and soundest base in the inverted pyramid displaying highest to lowest risk asset classes. A significant reason is that physical gold bullion is universally the most recognized default proof asset an investor can own. It is for this reason central banks hold about 1 out of every 5 ounces of gold ever mined within their very own vaults. And about 50% of all the .999 fine gold bullion in the world.

Related to gold bullion, all other physical precious metal bullion items ( silver, platinum, and palladium ) are all similarly default proof.

All physical precious metal bullion items are incredibly scarce by nature and do not require the performance of other parties always to maintain some measure of value in the financial market.

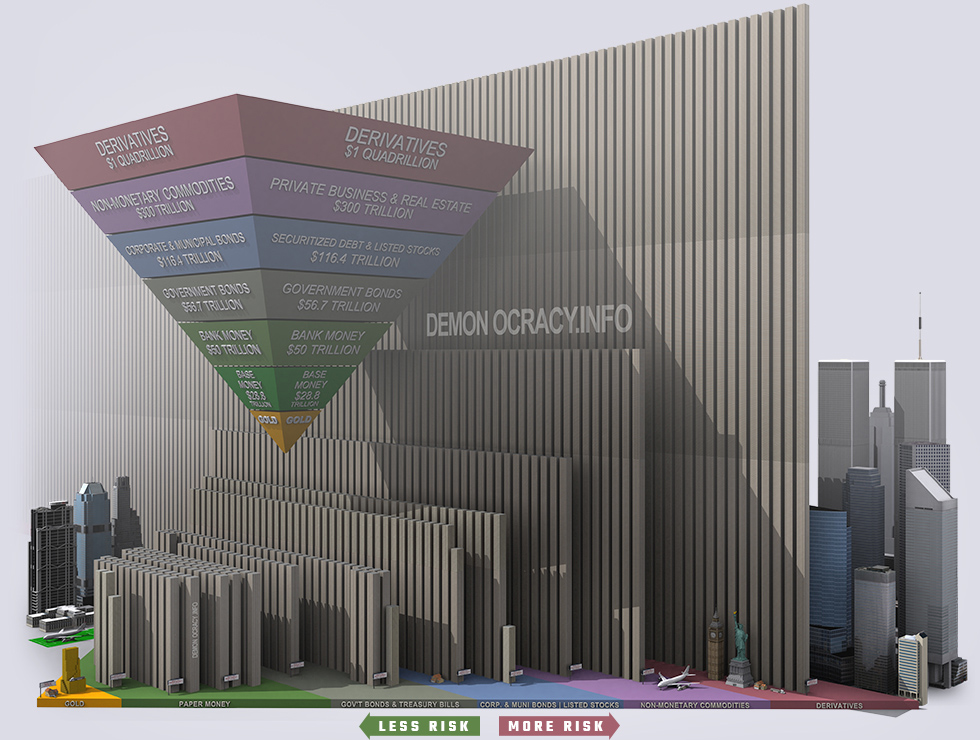

3D Exter Pyramid: Why Gold Bullion is the Safest Haven of All

Finally above, a 3-dimensional rendering of the modern-day Exter Pyramid.

Those giant green walls represent stacked pallets of $100 US dollar bills. It got illustrated to a representative scale. Each division of the inverted pyramid gets drawn respective to the notional size or value of each asset class it respectively represents.

See if you can spot landmarks like the Statue of Liberty, the old World Trade Center Towers, and an illustration of the entire world’s physical gold supply at the tip of the pyramid itself.

These are all reasons as to why John Exter and many in the world agree, gold bullion remains the safest asset to own outright.

Learn more about bullion with our free 21st Century Gold Rush guide here at SD Bullion.

Check out this short video we made on physical

Gold Investment Fundamentals in the 21st Century

***