Palladium is a precious metal associated with the Platinum Group Metals.

Palladium ore deposits can occur as a free non mixed metal, or also alloyed with gold, platinum, and other platinum group metals. Commercially mined palladium is also produced from nickel–copper ore deposits where palladium is also found in small quantities.

Palladium is mostly commonly used in catalytic and automobile related industrial applications with about 80% of its demand derived from specifically car related manufacturing demand.

While the palladium price has outperformed virtually all other precious metals over the last few years, the percentage of investor demand for this physical precious metal remains small in comparison to relative silver or gold investment demand market shares.

Palladium along with other platinum group precious metals are deemed by the US government as being critical to both our national security and our economy.

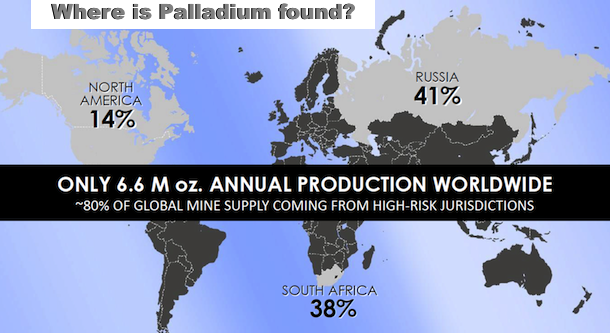

Where is Palladium Mined?

Today over 75% of the world’s new palladium supply is physically sourced from just two nations: The Russian Federation and South Africa. Russia supplies about 40% of all new physical palladium supplies while South Africa accounts for about 36% of new line palladium supplies coming to market.

The remaining 25% of new line palladium supplies come from North America (14%) and other areas such as South America, Zimbabwe, Australia, and other areas of the world (9%).

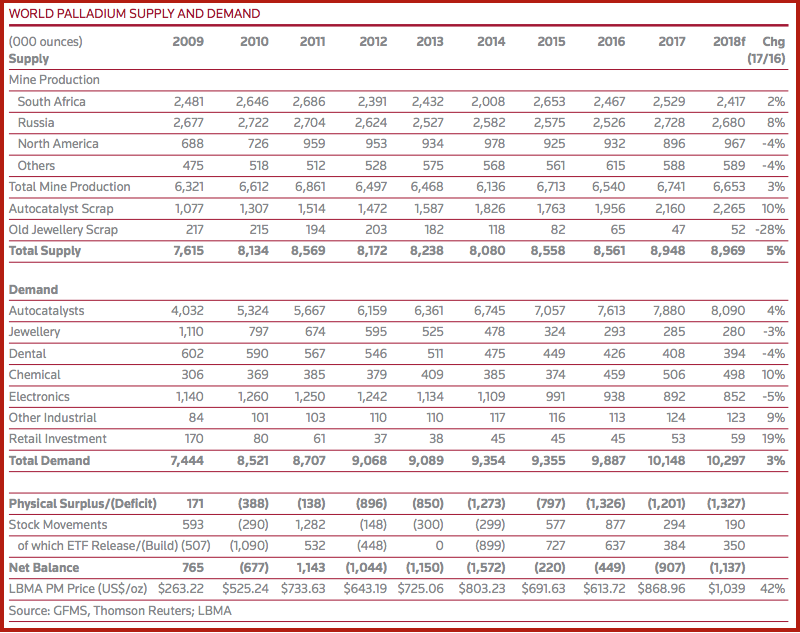

Aside from newly mined physical palladium supplies, about 1/4th of total annual new and recycled palladium supply comes from recycled automobile scrap sources.

Supply disruptions and shortages of physical palladium metal, has often been the catalyst for sharp increases in palladium spot prices.

For example, late in the year 2000, a Russian palladium supply disruption helped incite a then all time palladium price record high of nearly $1,100 USD oz reached in the month of January 2001.

Also in 2014, South African mine strikes and political instability caused palladium supply production totals to drop and as a result palladium prices shot higher.

An ongoing downtrend in palladium bullion inventories is over one decade running. Physical palladium supply deficits have begun showing signs of affecting market liquidity and prices in recent years.

The palladium market may become more and more susceptible to bouts of inventory tightness if palladium supply deficits persist.

There have been moments in time when the price of palladium has been substantially higher than even the gold price (e.g. early 2001).

It is indeed possible that soon, the price of palladium may rise above the price of gold.

As well, the threat of replacing palladium with platinum in catalytic applications remains subdued for now. Palladium simply performs better under new car emission tests than competing platinum applications.

It will likely take several more years to develop, test, and finally adopt a more platinum heavy catalyst to replace palladium as the preferred catalytic platinum group precious metal of choice.