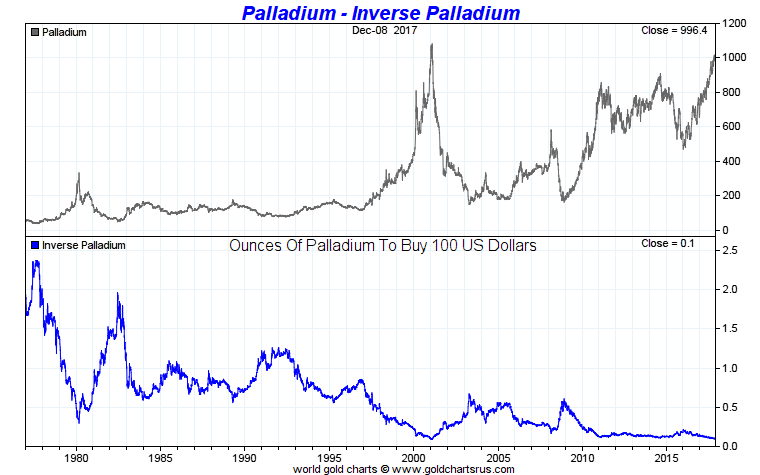

Palladium bullion is most often measured in fiat currencies (US dollars, yen, pounds, euros, pesos, yuan, etc.) or fiat currency indexes (US dollar DXY index, IMF SDRs, etc.).

Although values of fiat currencies vs palladium bullion are constantly fluctuating, growing fiat currency creation ensures the ongoing trend will likely continue. The palladium vs US dollar chart below spans from 1970 - 2017 AD.

Palladium vs US dollar & Ounces of Palladium to buy $100 USD

The final closure of the Bretton Woods agreement by the USA on August 15, 1971 signified a global monetary system transition from a quasi-gold backed rules based standard to one in which various national fiat currency values have fluctuated against one another.

Myriad advances in human ingenuity and technology have helped hide some price inflations for goods and services (e.g. computers, food, clothing), yet the data is clear. In purchasing power and value terms, palladium bullion has substantially outperformed every fiat currency issued over this same timeframe.

Physical precious metals are extremely finite in supply compared to competing fiat currencies, hence over long time spans, palladium bullion tends to gain purchasing power versus rapidly expanding fiat currency supplies.

Palladium bullion as an investment is relatively new phenomenon when compared to the adornment and monetary history of silver or gold.

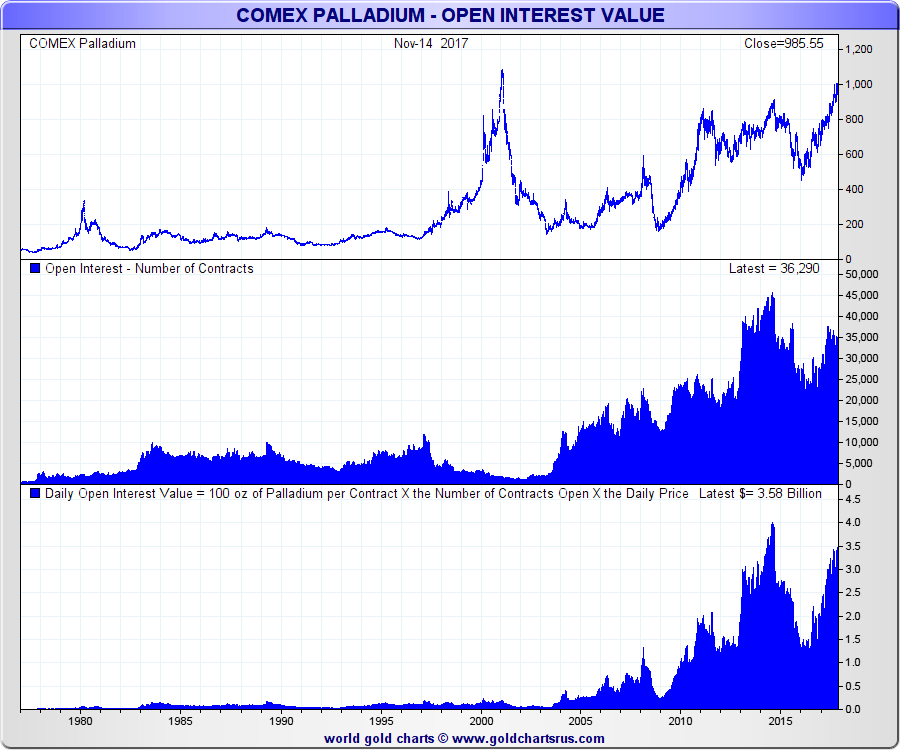

For extended durations of time (e.g. 1997 - 2003) over the last 20 years, palladium has sold at price premiums higher than even gold, and again recently platinum.

On January 26, 2001 palladium’s still all time price record occurred near the end of the Dot-com stock market bubble era. Palladium had a $1,094 oz USD London AM fix price. The same morning palladium was priced more than 4 times the London AM gold fix ($264.50 oz USD), almost 2 times the AM platinum fix ($616 oz USD), and over 225 times that day’s silver price fix ($4.78 oz USD).

Palladium US dollar Price & COMEX Palladium Futures Contract Trading Volumes

Palladium is a highly rare precious metal with even smaller above ground physical supplies than silver, gold, and even platinum.

With an Earth's crust concentration of 0.015 parts per million (ppm), palladium is over five times more rare in the ground than silver (found at 0.075 ppm). Platinum is still three times more rare than palladium in the ground found at 0.005 ppm, while gold is the most rare of the 4 precious metals cover here with an estimated 0.004 ppm in the Earth.

To give you a more understandable perspective of how rare palladium is, if we converted palladium’s parts per million rarity into time, we would find 1 minute of palladium in just over 125 years. For gold it would be more than 450 years, platinum over 380 years, and for silver 25 years to 1 minute of respective precious metal recovery.

Whilst gold is nearly 4 times more rare in the ground than palladium, human beings have been mining gold for many millennia. Palladium was only scientifically discovered somewhat recently in 1802 AD, due to its very high melt point ( 2,831°F / 1,555°C ). Prior alchemists beforehand were not able to achieve fires hot enough to easily melt, refine, and solely isolate palladium and therefore appreciate its unique elemental qualities.

New world explorers of the 15th to 17th centuries regarded palladium (and other high melt point noble precious metals like platinum) at the time as low value annoyances in their quest to find new supplies of silver and gold in the Americas and elsewhere.

Why buy Palladium Jewelry was Often Purchased Over Platinum

Over the past decade, investment funds for palladium as an investment have increased especially since the inception of palladium exchange traded derivatives. Yet still, almost all of today’s palladium demand remains for industrial usage.

We thoroughly examine palladium supply and demand factors in our new 21st Century Gold Rush in a convenient portable digital document format (PDF).

You can get yours right now, absolutely 100% free.

Just click here to get yours.