Summary: Silver Breaks $39: A 14-Year High Signals Major Market Shift

- Silver Hits 14-Year High – Spot silver price surged to $38.41 per oz, with futures nearing $39 per oz, the highest since 2011, driven by a potential short squeeze in London.

- US Dollar Weakness Fuels Metals – The U.S. dollar is having its worst start in 52 years, weakening against bullion and boosting demand for precious metals globally.

- Gold Also Rises Sharply – Spot gold price closed at $3,358 per oz, with its 200-day moving average climbing toward $3,000, signaling a strong bullish trend.

- Short-Term Highs ≠ Long-Term Expensive – Despite high nominal prices, silver and gold remain historically undervalued when measured against the Dow Jones and long-term ratios.

- Trump Copper Tariffs Shock Market – New tariffs on copper imports starting August 1 caused a 12% price jump, revealing signs of market frontrunning before the announcement.

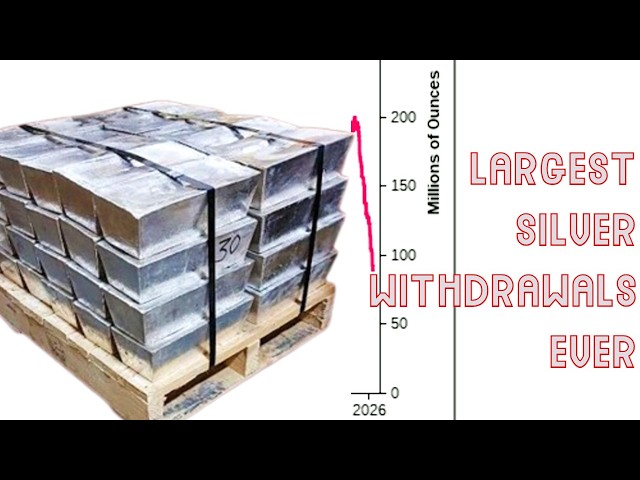

- Physical vs. Paper Risk Grows – Analysts warn of extreme leverage and lack of transparency in paper markets, especially in London OTC silver and platinum trades.

- Massive Fraud in Chinese Gold Market – Over 12,000 investors were defrauded in a $2B gold investment scam involving Yongqin Holdings, now under police investigation.

- London Silver Supply Tightens – Only ~150M oz of silver float remain in London vs. 68M oz already absorbed by ETFs this year, hinting at a looming physical crunch.

- Platinum Transparency Crisis – Lease rates in platinum are highly volatile, and the market suffers from even worse opacity than silver, raising concerns of manipulation.

- Own Physical Gold and Silver Bullion, Not Paper Promises – Experts stress the importance of owning fully allocated metal, warning that unsecured ETFs and proxies could collapse under pressure.

From short squeezes to global currency strain, rising premiums and tightening supply reveal deep cracks in the bullion market’s paper façade.