Silver and Gold rallied today and had positive finishes to this week.

The silver spot price is closing around $15.75 per troy ounce.

While the spot price of gold is finishing around $1,300 per ounce in fiat US dollar terms.

A bit of bad news, good news to begin.

My guest this week had an unforeseen issue come up, and was unable to make the phone call interview we had planned.

We do plan on speaking with this guest next week, and the main matter we will discuss is the building geo-political proxy war heating up in our own backyard here in the United States.

What proxy war am I referring to?

-

-

Well this week, the Trump administration went on a full offensive against the dictatorial Venezuelan Nicolas Maduro regime. Publicly citing the elected Venezuelan National Assembly and opposition leader Juan Guidó, as the now acting interim President of Venezuela.

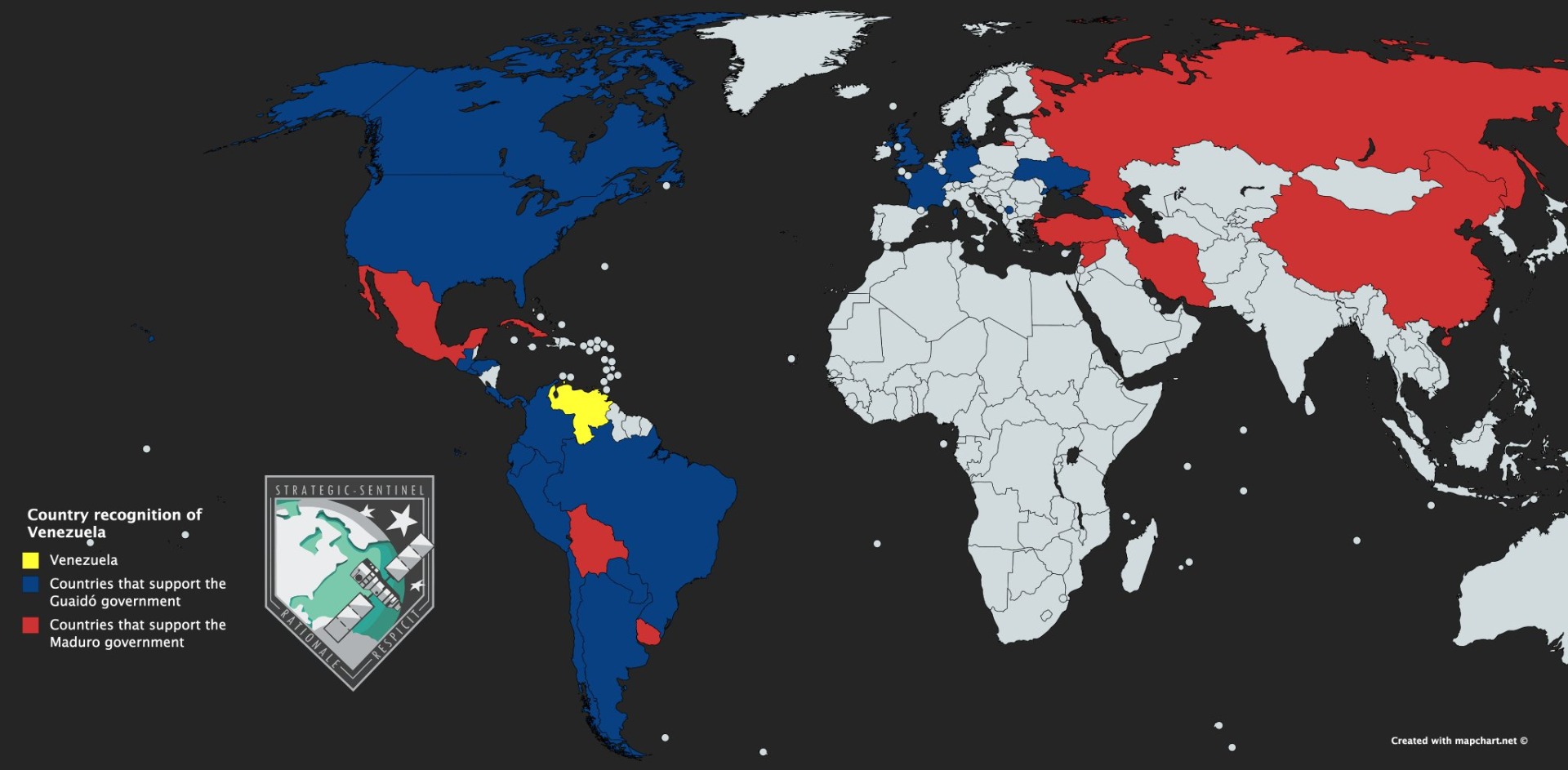

Much can be learned about current geopolitics by simply seeing which side various nations are now acknowledging as the real Venezuelan President.

In the red, you can see Russia - China - Turkey - Syria - Mexico - Cuba - Bolivia - & Uruguay. They all still recognize Maduro.

In the blue, of course the USA, Canada, Colombia, Brazil, much of the EU and other Latin American nations. They are now in the US led Guidó camp.

Remember too that caught in between all of this are a few million recent Venezuelan immigrants now overcrowding cities in Colombia and Brazil. Those two important neighboring nations have taken the side of the Trump administration and are backing the Guidó interim presidency.

Of course underneath all this, the nation of Venezuela has the world’s largest proven oil reserves yet tapped. There is much money to made by which ever parties get the longterm privilege of pulling said oil reserves out of the Venezuelan ground, gulf and sea side.

Will it be Russia and or China who get to siphon some of these crude oil reserves or some western-led oil corporation$?

Next week we’ll have this guest on, he’s a man who spent multiple years in the mid-1990s, consulting the then Venezuelan President, the one who was in power just prior to the Hugo Chavez regime’s takeover in 1999.

As for the good news today... this gives us the chance to go into some detail regarding one of the major proxy war players in this Venezuelan saga: the Russian Federation.

We are going to look at some details regarding building Russian Gold Reserves now having just past the 2,000 tonne gold bullion total.

We are going to cover a bit of background on how this Russian gold buying policy was partially brought about. We’re going to show much gold bullion Russia Officially has compare to other major gold players in the world.

And finally we’re going to look at how “gold backed’ the Russian ruble currency currently is, compared to other major fiat currencies such as the US dollar, euro, yen, British pound, Chinese yuan, and Swiss franc.

This coming story and data, will likely surprise many of you.

If you have spent any time on the internet researching gold silver bullion etc., chances are high you’ve come across this picture and this chart before.

It’s a chart published by Nick Laird over at GoldChartsRUs.com

And it reflects the Official Gold Bullion holdings of the Russian Federation ongoing.

Now having passed 2,000 tonnes… Russia is now arguably but yet “officially” the 4th largest gold bullion holding entity in the world. Only the combined EU, the recent Steve Mnuchin gold audited USA, and the IMF supposedly have more Official Gold.

And of course there is under-declaring China who over the last 4 decades many have surmised may have as much as 20,000 tonnes yet to be revealed. And Lord knows when or if that will happen in our lifetimes.

Back to the mother Russia matter as hand, this chart break down the Official Russian Gold holdings in terms of ounces. You can see that over the past few years Russia has often been stacking over 1 million ounces of gold a month.

To put that into better perspective. The US Mint’s all time gold eagle coin sales records are just over 1.5 million ounces sold over a full year’s timeframe (e.g. 1999, 2009).

Russia is not some deranged gold bug by the way. When you look at the composition of their International Reserves, they hold about 1/5th of their roughly half trillion in national savings in gold bullion.

Now as to some of the major contributing drivers for Vladimir Putin’s Russian Federation acquiring as much gold as they have over the past 13 years or so.

It is well documented that former KGB and Russian nationalist Putin was embarrassed by the downfall of the old Soviet Union and the indebted state of affairs he inherited in the year 1999.

All one has to do is look at Putin has been saying on record for the last decade or so. He has made it clear that neither he nor China are pleased with the global financial order as it stands today. The US petrodollar system is constantly being attacked and threatened by major political and financial movements ongoing in the east.

Russia is just one of the key players in this great game ongoing.

Well before the 2008 financial crisis began, there were a couple of supposed 'gold kooks' who got together and formed an organization you likely know by name, called GATA. That was around the same time Vlad Putin was gaining the top power in Russia (in the year 1999). Only a handful of years later the guys over at GATA held a conference where a major Russian policy maker was also in attendance.

Have a listen to GATA, and then have another look as to what followed their mid 2000s Gold Rush conference.

Yea, I know… the music in and background sounds a bit dramatic and conspiratorial for my taste… but the coincidence is clear… the following shift in Russia’s Official Gold Bullion Reserve policy since 2006 has been dramatic. All we have seen is a really steady increase in Russian Gold Reserves with various allegations and theories as to why they are doing so.

Russia is a nation that has now increased their official gold bullion reserves by more than a factor of 5, in other words a 400% increase in the gold the state holds in its FOREX reserves.

Now ask yourself what has the United State, the European Union, or even China been doing especially since the 2008 financial crisis?

The common thread is they’ve all been adding debt to their financial systems. In China’s case, record, un-before never seen growths in mostly internally owed debts have piled up.

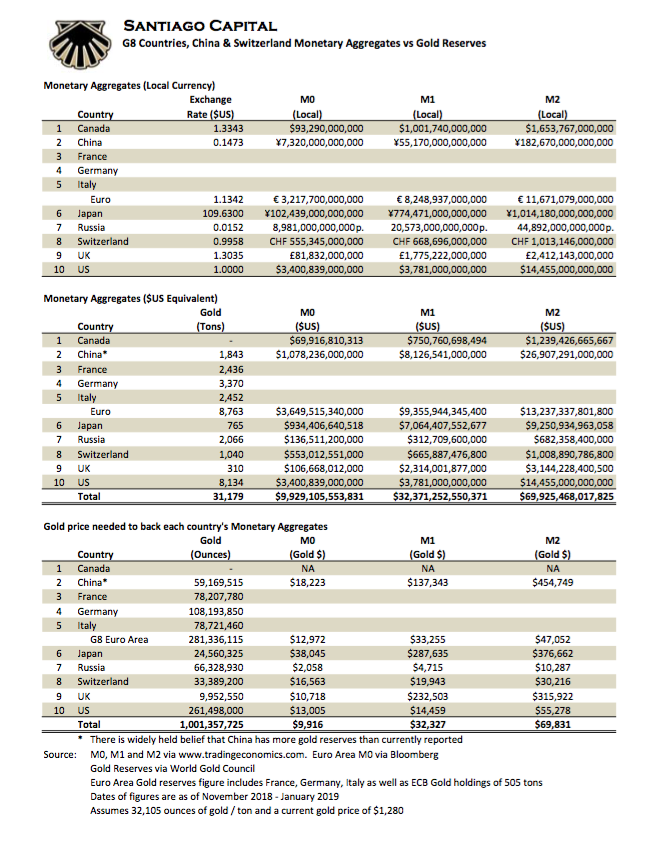

Now remember how I mentioned how we would look at various fiat currencies in relation to their quote unquote gold backing earlier in the show.

Well our friend Brent Johnson over Santiago Capital was kind enough to update the following data so we could again see the extent of fiat currency piles versus the current Official Gold Reserves of various nations and unions.

Well here it is, and we’re going to break down the most critical section of it, in this video.

Russian Gold Reserves vs Other Official Gold Reserves / Monetary Aggregates

The key point to look at here is under the fiat currency note and coin currently outstanding column called M0… in the USA for instance the M0 narrow US dollar supply is simply all the physical cash sitting outside of Federal Reserve Banks and the vaults of depository banking institutions.

Historically when we have currency crisis the outstanding M0 supply gets a full accounting by a much higher gold price(e.g. US gold reserves vs US dollars outstanding). This occurred for years around silver and gold's 1980 high, the 1933 gold confiscation and US dollar devaluation against gold in 1934.

One could even argue this also happened just following the Civil War greenback vs gold era, a time in which the regular $20.67 oz price for gold saw a massive but brief bull market in 1869 where the price of gold touched then $160 US dollars per troy ounce.

When mass confidence in paper currencies goes bad, the price of precious metals rockets higher. Have you ever heard the expression there's no fever like gold fever.

Well, no former nor ongoing gold price manipulation can stop a mass stampede into physical gold buying from driving its price higher.

Key again here is the column M0. This column overlays the fiat currency cash in a nation or currency union's financial system versus their Official Gold holdings held. Canada you have none. China if you do have around 20 tonnes of gold, take a zero off your local price to clear M0.

At the moment, the Russian Ruble is the most 'gold backed currency' in the world. That of course does not mean it is highly traded around the world like Japanese yen, Euros, or US dollars. It simply means they have fiscally been managing their economy on a prudent path for some time now. It would only take a US dollar price of $2,058 per troy ounce for the Russian Federation to have pseudo gold backed currency in terms of the physical cash she has issued to date.

If in the coming decade we do end see a major crisis in fiat currency faith, these are the current US dollar prices for a troy ounce of gold to clear local market consternations.

The idea that $1,900 ounce gold in 2011 was expensive or overpriced. Well this gives some context in a real crisis. When mass confidence in currency goes, the fever for gold will likely take its one troy price to levels many never thought possible.

In the meantime... We still have it Pretty Good

You can swap fiat Federal Reserve notes or other unbacked currencies for real monetary precious metals. And do like the Russian Federation has been doing.

Acquire a prudent allocation to gold bullionor other physical precious metals while values are still disconnected to their competing monetary aggregates outstanding.

If and when a crisis confidence occurs, your Official Reserves should serve you well in maintaining and even enhancing your standard of living, especially versus others who remain oblivious as to the large game afoot.

That is all for this week. I'll be back next week hopefully with our guest to discuss the ongoings in Venezuela and other matters bullion related.

Until then, have a great day.

***