-

Silver Coins

-

American Silver Eagle Coins - US Mint

-

Canadian Silver Coins

-

Silver Bars

-

Silver Rounds

-

90% Junk Silver Coins

-

British Royal Mint Silver Coins

-

Perth Mint Australian Silver Coins

-

Scottsdale Mint Silver

-

Truth Series Silver Coins

-

African Silver Coins

-

Austrian Philharmonic Silver Coins

-

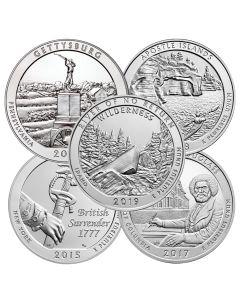

America The Beautiful (5 oz Silver Coins)

-

Chinese Silver Panda Coins

-

Mexican Silver Libertad Coins

-

Other Silver Products

-

IRA Approved Silver

-

Silver Starter Packs

-

Holiday Collection

-

New Zealand Mint Silver

-

Generic Silver Secondary Market

Silver: Top Sellers

Jump To:

Bars | Coins | Rounds | Junk Silver | Mints | Silver IRA | Silver Prices | Silver vs Gold | Factors to Consider

Buy Silver Bullion

Beginner and expert investors alike have many reasons to buy silver bullion online. For one, the price of silver per oz is much lower than the price of other precious metals like gold, platinum, and palladium. The much lower cost appeals to novice investors who are looking to buy silver bullion.

Due to the smaller size of the market, silver prices can be more volatile. The high use of financial leverage on trading exchanges is another contributing factor. But that’s what makes it an exciting commodity.

You can find silver for sale in various forms, including bars, coins, rounds, and even statues. If you’ve been looking to diversifying your precious metal portfolio, browse through our online catalog of silver products today:

Silver Bullion Bars for Sale

A flat bar made up of .999+ (usually) pure silver is known as a silver bullion bar. These products can weigh as low as 1 troy ounce and can go as high as the whopping 1,000 troy ounces. The most typical silver bars that are minted and sold are 1 oz, 5 oz, 10 oz, 1 kilo, and 100 oz.

The value of a silver bar is usually close to its melt value. Private mints produce most of the silver bullion bars in the market. Nevertheless, a few government mints produce them as well. Some examples being the Royal Canadian Mint and the Perth Mint.

At SD Bullion, you can browse through many silver bars for sale. These are our bestsellers:

- 1 oz Silver Bar - Don’t be misled by their small size. The 1 oz Silver Bars among Silver Rounds & Silver Coins are popular a choice of most investors. They are portable, affordable, and easy to buy and sell. On our website, you’ll find only .999+ pure silver bars in eye-catching designs. These include the Aztec Calendar Silver Bar, the Sunshine Mint, and the Perth Mint Dragon Silver Bar.

- 10 oz Silver Bars - Serious investors with smaller budgets could consider buying 10 ounce Silver Bars. You can choose from multiple .999+ fine silver bars. If you’re unsure which one to get, you can’t go wrong with the Sunshine Mint 10 oz Silver Bar, the Proclaim Liberty Silver Bar, or the generic silver bars SKU.

- 100 oz Silver Bars - For true silver fans, the 100 Ounce Silver Bars are your most convenient investment. They might not be as sought after as smaller bars, but they are still in high demand. And their weight of fewer than seven pounds allows for easy storage and transportation. Among your best options here is the 100 oz Royal Canadian Mint (RCM) Silver bar of .9999 pure silver. They are eligible for Silver IRAs as well!

Silver Coins for Sale

Similar to silver rounds, silver coins are flat disk-shaped pieces of .999+ pure silver.

Unlike silver round though, coins carry a face value in their country of origin. They are struck in government mints and have legal tender status. In addition, these instruments typically command the highest premiums among all silver products.

At SD Bullion, you can find many silver coins for sale. The most popular coins are the following:

- US Mint American Silver Eagle Coins - The official silver bullion coin of the United States is, in fact, the American Silver Eagle. It’s issued by the U.S. Mint and is legal tender across the United States with a face value of $1. However, you can trade these coins singly based on their silver content. The usual weight is 1 oz (31.1 grams).

- Royal Canadian Mint Silver Coins - These brilliant coins are among the most guaranteed on the silver market today. Each RCM Silver Maple Leaf coin comes in .9999 pure silver and is 1 troy ounce guaranteed. Look for the “bullion DNA” on each coin. It is a laser mark achieved via micro-engraving, featuring the mintage year.

- Perth Mint Australian Silver Coins - These coins have some of the best designs when it comes to silver coins. Whether you like Star Trek, animals like kangaroos, tigers, goats, or rabbits, or even the 1-oz Australian funnel-web spider, we’re sure you’ll find a design to your liking. Some are available in 0.5 oz weights of .999 purity.

- Mexican Silver Libertad Coins - The United States, Canada, and Australia all have brilliant silver coins. But Mexico is not an exception. In fact, Mexico produces more than 20% of the global silver supply. In Mexico, minting silver coins has been a tradition since the 16th century. We carry Mexican silver coins in various weights. They can range from 1/20 oz, 1/10 oz, ¼ oz, and ½ oz to 1 oz and 2 oz.

At SD Bullion, you can find US Silver, Royal Canadian, Australian Perth Mint, Mexican Libertad, African, British, Chinese, New Zealand silver coins, and many more.

Silver Rounds for Sale

If you like modern silver bullion coins, but you’re not a fan of the more expensive premium prices related to such mints, we have another option for you. Silver rounds come in coin shape, but they originate from private mints in the U.S. and across the globe.

A few differences exist between silver bullion coins and silver rounds. Rounds don’t have a face value and cannot be used as legal-tender currency. In addition, they usually weigh around 1 Troy Ounce (31.1 grams) and are 99.9% silver.

We have various silver rounds available on our website. They are available in 1-oz weights, fractional weights, and larger than 1-oz weights. The most common sizes are:

Fractional Silver Rounds - You can find silver rounds as tiny as 1/10 oz (3.1 grams) of 0.999 pure silver through ¼ oz silver rounds to the bestseller of ½ oz (15.5 grams). The half an ounce option contains twice as much pure silver as the ¼ ounce (7.77 grams) silver rounds.

1 oz Silver Rounds - Despite that the 1 oz silver bullion rounds contain a full ounce of silver, they’re small and portable, making storing them an easy task. The most popular designs are the 1 ounce Silver Buffalo Rounds and the 1 ounce Silver Freedom Rounds.

5 oz Silver Rounds - The Five Ounce Silver Rounds might be much bigger than fractional rounds, but they’re still affordable compared to buying gold. With them, investors can pick gorgeous designs. A few examples are the Aztec Calendar Silver Round, the American Eagle Replica Round, or the SilverTowne Prospector Stackable Silver Round.

Junk Silver

Junk Silver Coins – also known as 90% US Silver Coins – are generally old, U.S. currency coins. Their bullion value actually comes from the silver they contain. Don’t be misled by their name, though. Their contents are 90% silver and the US government minted them before 1965. They include dimes, quarters, half-dollars, and dollars.

In addition, they are still an official US currency. They have a face value, and you can use them as a means of a legal tender coin. However, investors mostly trade them for their overall silver content, not their legal tender face value.

At SD Bullion, you can find many options for old US Silver Dimes, Quarters, Half Dollar coins, and Dollars.

Silver Mints

Bullion mints produce bars, coins, and rounds. There is a close relationship between the history of coins and that of mints. Back in the day, production was slow and challenging because the first coins were hammered. Nowadays, producers are capable of making hundreds of millions of bars, coins, and rounds. Savvy investors use minted silver coins for currency and investment.

At SD Bullion, you can find silver mints from the most recognized institutions in the world, including:

- US Mint

- Austrian Mint

- Chinese Mint

- SilverTowne, Sunshine, Republic Metals

- Engelhard

- Geiger Edelmetalle

- Johnson Matthey

- Mexican Mint

- New Zealand Mint

- Perth Mint

- Royal Canadian Mint

- Royal Mint

Silver for Sale for IRA Investments

Not all silver bullion products are eligible for inclusion in precious metal retirement accounts. Please look for the ✔IRA APPROVED checkmark on the silver product page you are interested in purchasing. If the checkmark is not present, that bullion product is not eligible. If you have any questions regarding setting up or buying silver bullion for your account, please contact our staff at 1-800-294-8732.

Silver Prices

When it comes to purchasing or selling silver bullion, the market value for silver (referred to as "spot price") is the basis for all pricing. View the current spot prices for silver. Almost all silver products on our website operate on a silver spot price plus the product premium formula. That is what will determine the final price. For example, if the market value for silver is X and the product premium is Y, the final silver price would be X+Y=Z. Premium pricing is mostly consistent per product but the market value for silver changes every minute. Our market feed integrates live up-to-the-minute prices from worldwide markets. We offer live and historical market data on our Spot Prices page. You can customize charts to research and find trends in pricing. This allows you to compare silver to other precious metal types.

Silver vs Gold

There are many differences between silver bullion and gold bullion. The first one is that silver is sometimes higher volatility compared to gold in bull vs bear markets. Secondly, silver might be more affordable, but it is also a precious metal like gold. In addition, it has never been defaulted on and has no counterparty risk.

Nonetheless, because it is more affordable, silver requires much more storage space. On top of that, gold is much thinner - pure gold is around 83% smaller than pure silver. Since silver requires more space to store, this can translate into higher fees at depositories.

When comparing silver vs gold, you shouldn’t miss the fact that silver has a much higher industrial use. Around 12% of all gold supply serves for industrial uses. In stark comparison, the industry uses a whopping 56% of the silver supply. That is mainly due to silver's unique features.

The last notable difference is in their stockpiles. Central banks and governments reportedly have a low stockpile of silver. In contrast, they’re constantly buying and holding literal tons of gold.

Some factors to consider while comparing silver bullion investments:

Premium over Spot

This is one of the main parts of the discussion when we talk about any silver bullion instrument. Premium over spot refers to how much more a product is worth (premium charged) over the melt value of silver present in the silver bullion coin, round, or bar. Just as a whole is more than the sum of its parts, the value of some bullion products is higher than their intrinsic worth, depending on the minting source, age, and rarity.

So, even though some bars, coins, and rounds usually command lower premiums over spot, silver coins may warrant a much higher premium because of their collectible value. Also, another reason why coins command a higher premium is the fact that they hold the prestige of being the only government-minted precious metals instruments and thus, enjoy strong demand in the precious metals market.

Purity

Most bars, coins, and rounds manufactured across the world, be it in Austria, the USA, or China, contain 99.9% pure silver. A few mints, like the Royal Canadian Mint, surpass the typical purity levels by using 99.99% pure silver. In other words, those products are .09% purer than the other options in the precious metals market.

Susceptibility to Counterfeit

Counterfeiting is an age-old problem when it comes to investing in precious metals. Because of this, many mints have introduced markers or counterfeit-proof features. A few examples include the Mint Mark SI™ feature by Sunshine Minting or the Geiger Bar UV light-stampings.

Coins are comparably the safest instrument for investing in physical silver. A sovereign mint produces them and their legal tender status ensures that the anti-counterfeit measures are as stringent as possible.

Stackability

After investing in silver bullion, it is important to store them safely and efficiently. This is where the stackability factor comes into play. Value per square inch is most definitely an aspect worth considering when buying silver bullion in bulk quantities. Bullion silver bars are easily the most stackable and store-able precious metal products. They offer way more amounts of silver per square inch. Silver coins and rounds require casings, tubes, or boxes when storing large numbers. This fact can make them an unwieldy option for massive quantities of silver.

Brand and/or Series

The name or series of a bar, round, or coin plays a significant role in the demand for the product. To retain the freedom to invest in or divest out of a particular instrument, as and when the investor wants, it is advisable to stick to famous product names and series like the American Silver Eagles or Canadian Maple Leafs. Hence, at any given time you will be assured of scores of both active buyers and sellers in the market.

New vs. Secondary Market

Another factor to take into account when purchasing silver instruments is whether to buy new, freshly-minted products or to look for relatively cheaper secondary-market silver goods. Like any other product or commodity, everyone automatically prefers shiny and new over "second hand." Moreover, there is a widespread myth among some investors that secondary-market precious metals products have a lower resale value because of their condition and lack of finish. Nonetheless, in reality, brand-new silver bars and rounds in perfect condition sell at the same rates (considering equal silver weight and purity) as their secondary market counterparts do. However, collectors who treasure silver coins for their collectible value will, in most cases, prefer mint condition and near-perfect condition coins.

Playing the Market

For people who want to ‘play the market,’ i.e. buy and sell regularly to earn immediate profits on every transaction, it is essential to invest in silver products that can be moved quickly. Although the strategy (buy low and sell high) is simple, investors who want to take this route need to have complete knowledge regarding silver products and the precious metals market, as well as an appetite for risk. These types of investors usually prefer smaller, portable investment vehicles such as silver coins and rounds.

Smaller Purchases

People with more limited capital to invest in precious metals cannot divest as much as they would desire. Hence, such silver buyers usually prefer less expensive and low-risk silver physical bullion products with lower premiums over spot. They offer a modest appreciation over time – granting them with inflation-proof, financial protection. Financial advisers will usually recommend this strategy as a way to hedge against inflation and a good method of balancing portfolios.

Larger Purchasers

This particular type of bullion buyer is looking to create a hefty fund to hedge inflation. When seeking to establish a substantial fund, silver bars can be an attractive option. They come in weights as high as 1000 troy ounces. As such, they are easier to stack and store when compared to rounds and coins. However, providing adequate safety and security to this massive quantity of silver can be a tedious task. Hence, private, offshore storage depositories, offering top-of-the-line security at reasonable prices, are considered a great option for storage.

Silver Collectors

Some people appreciate the true beauty of a minted silver coin. Take the coins from the famous American Silver Eagle program for example. Their obverses feature Weinman’s beautiful Walking Liberty. The reverses depict Mercanti’s rendition of a Bald Eagle. It includes a shield, symbol of American strength and pride. Collectors buy silver products for their ‘artistic’ or ‘collectible’ value rather than their melt value. For them, there is no right or wrong; they should pick the products that they consider aesthetically appealing.

As you would have probably figured out by now, all forms of silver products have their purpose in an investment portfolio. Hence, a safe and recommended strategy is to allocate a specific ratio (depending on you or the advice of your financial adviser) of every type of silver bullion instrument in your tangible assets. However, it is an entirely personal decision that one must take after careful deliberation.