New gold bullion buyers often begin by wondering how they might be able to buy gold at spot as well where can you buy gold bullion at the spot price.

We begin first and foremost, with a word of caution. Please be careful in your buying gold bullion at spot price endeavors.

Many offers for gold at spot price or even for gold under spot price are often the realm of conmen, counterfeits, and dishonesty.

Here we’ll teach you how to buy gold at or near spot safely via proper due diligence and knowing the counterparty is trusted and in fact, delivers on their word or promises.

Where can you buy gold at spot price?

Here at SD Bullion, we often offer customers the opportunity to buy 1 oz Gold Bullion Bars very close to the prevailing gold spot price.

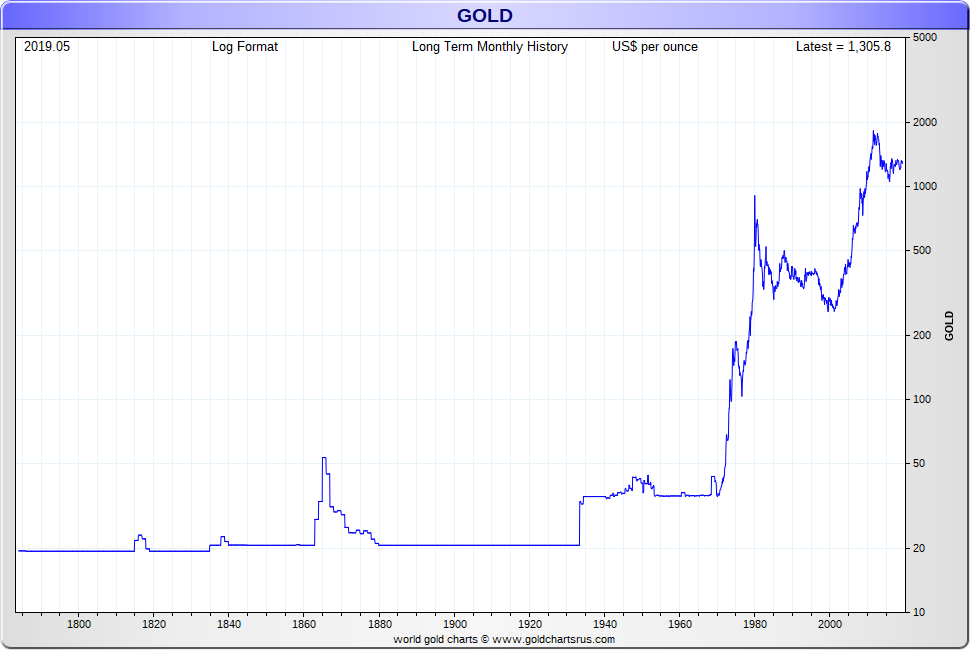

To begin the 21st Century, we experienced about 10-years straight of consistently higher gold prices year after year (from 2001 until later 2011). The still standing nominal price record for fiat US dollar gold price's was touched near $1,900 oz USD in August 2011.

Since that time, the price of gold has consolidated to as low as about $1,050 oz USD in late 2015 but has since rebounded to fiat USD prices over $1,500 oz in the past few months.

Below is an over 200-year chart of gold's US dollar price.

Note in this long term gold price chart, the US dollar gold price per troy ounce started moving exponentially right after the 1971 Nixon Shock which severed the final underlying ties between gold bullion and now every government currency in circulation including the fully fiat US dollar.

Can I buy Gold at Spot Price? - Yes possibly, for Now

Due to lower price premiums currently in the gold bullion industry, various high volume gold bullion dealers (who work on razor-thin profit margins), have at times offered one time buy gold at spot price opportunities for new customers. The buy gold at spot price offer is done as a 'loss leader' mostly to encourage investors to become new customers and to get on their email list for future product promotions.

After all, there is no one easier to sell gold bullion to, then someone who has already bought gold bullion.

Others might even get some cheap debt-fueled sales subsidies by large corporations who may be trying to bolster their top-line revenues and perhaps further gain bullion trading market shares on their platforms.

Physical gold bullion dealers make little to no money in these gold at or next to spot price offers. Most often it is a loss in terms of overall costs associated with such transactions, yet some gold bullion dealers do so in the effort to gain new customers to market products to. They are ultimately hoping to bolster their bullion business growth for the long term.

We strongly suggest that on any gold bullion at spot price deal you may come across, that you perform proper gold buying due diligence on the gold-selling counterparty.

Stick with established high volume gold bullion selling businesses that get highly ranked on hard-to-rig gold dealer review websites.

Pay careful attention to rankings and review volumes. Any gold dealer with poor or mediocre reviews is not worth risking your hard-earned capital.

Also, pay special attention to the kinds of reviews that you read. It is certainly not out of the realm of possibilities that the reviews you find are fake or not genuine.

Can I buy Gold below Spot Price? - Unlikely & Be Very Careful, Scammery Chance is High Here

Typically the only individuals who buy physical gold bullion below spot price are gold scrap refineries, we buy gold stores, and gold bullion dealers who may bid or offer a price slightly lower than the fluctuating gold spot price. Often for gold bullion bars, the bid price given to purchase gold bars from customers is at or just below the gold spot price. Conversely, popular modern gold bullion coins typically yield bid prices at or even slightly above the gold spot price).

Currently, for new .999 fine physical gold bullion products, one should never accept a bid or offer price below 98% of the fluctuating gold spot price.

If an individual tries to buy gold below the spot price, the chances are high that you will run into counterfeit gold bars or coin conmen or con women on websites like Craigslist or unproven gold bullion sellers on eBay.

Be very careful as gold looking Chinese counterfeit products are a real issue in our industry and are used daily to try and take advantage of unknowing or 'lowest price at all cost' would be gold bullion buyers.

More often than not, these counterfeit gold frauds go undetected for years or even go unreported due to the embarrassment it may cause the person who fell for the scam.

For every “I tried to buy gold below spot price” victim and gold fraud story covered on the news or in the media. We could probably multiply that figure by 10X or more in the amounts of times this similar story has gone unreported.

Often those who get low or unbelievable gold price conned, don't even tell their loved ones due to intense feelings of regret and humiliation.

Buying Gold at Spot or Buying Gold below Spot is not Normal

The reason for this is rather simple.

Physical gold bullion’s supply chain calls for physical gold bullion products to be sold above the gold spot price for various parts of this industry and value-added-chain, to remain solvent, and out of bankruptcy proceedings.

If selling gold bullion in large volumes at the gold spot price was a legitimate business model, people in business would have done so long ago.

Take a look at how gold bullion typically gets to the end-user below.

Gold Bullion's Supply Chain from Origin to Sales Above Spot

Star explosions produce precious metal elements

↓

Gold laced asteroids crossed the universe, formed and collided with Earth

↓

We, humans, mine Gold + Recover Gold Scrap ( mostly below gold spot prices )

↓

Gold Refiners purify physical gold (often selling .999 gold at the gold spot price to large gold mints/gold dealers)

↓

Gold Bullion Mints create bullion products ( bars and coins then are sold above spot )

↓

Gold Bullion Dealers like us here at SD Bullion, we trade gold bullion products

( gold bought or gold sold online, then nondescriptly mailed fully insured, or done so locally)

↕

Customers buy, own, sell, trade their physical gold (above, at, or slightly below the prevailing gold spot price)

Unless you own a physical gold bullion or gold scrap related business in this supply chain illustrated above, it will be risky and difficult ever to procure physical gold below fluctuating gold spot prices.

Paramount to any gold bullion purchasing is that you indeed get what you have paid to receive. There are decades of allegations and frauds which prove this is often not the case for some would-be gold buyers and or sellers.

Reputable high volume gold bullion businesses typically operate on super slim profit margins ranging between mere basis points (100ths of 1%) to low percentage points on various trades.

Gold dealers are not in business to go bankrupt. Many former gold dealers have gone bust over the years due to sheer incompetence or worse, avarice and rationalizations along the way to bankruptcy.

If you are attempting to buy gold at the gold spot price, please make well sure the counterparty is indeed trustworthy, solvent, and reliable.

If you found this content informative, be sure to pick up our 100% free SD Bullion Guide before you go.

Within that document, you will find many helpful tips and related information which may help you become a more successful long term bullion buyer and potential seller someday.

Thanks for visiting us here at SD Bullion.

***