Jump to: Which is better? | Price | Guarantee | Purity | Sizes | Other Types of Gold Investments

Both gold coins and gold bars have been popular choices among investors who understand the benefits of a diversified investment portfolio. As a precious metal, these tangible assets help protect your wealth against inflation and economic downturns.

However, which one should you put your money into? Gold bullion coins or bullion bars? The answer requires the potential buyer to weigh in a few factors.

Things like the overall gold price, whether the bullion investment content is guaranteed by a government mint or a private one, gold purity, liquidity, storage, transportation, and more should be considered when you ponder buying either gold coins or gold bars.

In this article, we will highlight the benefits of both buying gold coins and buying gold bars and get the best value for your investment, according to your own tailored goals.

Which is better? Gold Coins vs. Bars?

Let us begin the debate by defining both forms of gold bullion products.

Gold Coins

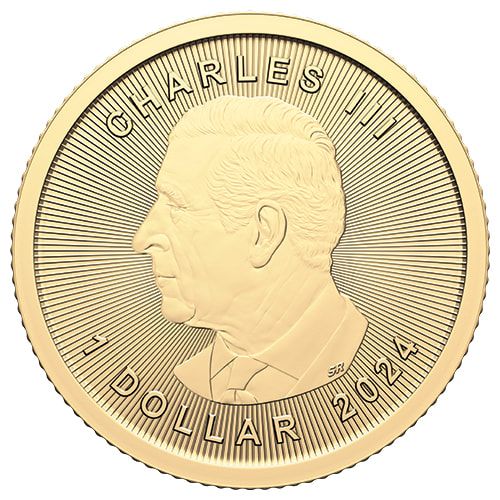

A gold bullion coin is a precious metal wafer struck in a round shape by a government mint typically stamped with a legal tender face value (the most significant exception being the famous South African Krugerrand Coin). Sizes vary from fractional grams to kilos and larger.

Gold Bars

A gold bullion bar is a precious metal lump or ingot struck by both government and private mints. Gold bars are usually not considered legal tender and tend to cost less per troy ounce or gram vs. gold coins.

The 1 oz Argor-Heraeus Gold Kinebars is one of the best-selling gold bars in the market.

The answer on which is better will often be determined by the gold bullion buyers' investment strategy and goals.

We shall discuss whether gold coins or gold bars represent a reliable investment form in the following determinants:

-

Overall Gold Price on Like-Kind Weight between Gold Coins and Gold Bars

-

Government vs. Private Mint Gold Bullion Guarantees

-

Gold Purity Levels of Gold Coins vs. Gold Bars

-

Gold Coin vs. Gold Bullion Bar size variances

PRICE:

Gold Bars vs. Gold Coins

In general, gold bars, even when struck by government mints, enjoy lower premiums, i.e. the price a customer pays over the gold spot price.

This happens because the minting process of gold coins tend to have higher manufacturing costs when compared to gold bars.

Additionally, gold coins are adorned with historically significant designs, full of symbolism that showcase craftsmanship and expertise. In other words, gold coins will, more often than not, enjoy a semi-numismatic value, attracting demand not only from investors but from collectors as well.

For those who enjoy rare coins and collections, buying gold coins would be preferred for their artistic appeal.

The last contributing factor to the difference in price between coins and bars is government backing. Many gold bullion buyers will choose to pay a slightly higher price or premium per ounce or gram of gold to have a government guarantee and government mint hallmark on the product.

If getting the overall lowest price is the most critical factor for your gold bullion buying, try highly respected gold bullion bars from a respected mint like Valcambi Suisse:

1 oz Valcambi Gold Bar - in Assay

If getting a low price yet having some government guarantee is essential to you, try Royal Canadian Mint Gold Bars.

1 oz Royal Canadian Mint Gold Bar

In general, you can expect lower premium percentages on larger gold bars due to lower manufacturing costs. However, smaller gold bars enjoy higher liquidity and are easier to store and transport.

In terms of overall lowest price, gold bars win out as the most cost-effective as they are typically slightly less costly than similar-weight gold coins. Their market value is defined almost entirely by their gold purity and not as much in design and craftsmanship.

TAX ADVANTAGES

In the United States, the IRS classifies metal quantities as "collectibles." This category includes items like coins, art, and bullion (including physical gold), which may be subject to a long-term capital gains tax rate of up to 28%, if they are disposed of later than a year of ownership.

For UK residents, UK coins manufactured by The Royal Mint have the benefit of being exempt from Capital Gains Tax . This includes the gold Britannias, gold Sovereigns, and many more.

For IRS Bullion buying and selling privacy, read more on our dedicated page.

GUARANTEE:

Gold Bars or Gold Coins?

Both private gold mints and government gold mints guarantee the several gold bars and gold coins they strike and issue.

The question concerned gold bullion buyers might ask themselves, perhaps, is who enforces this guarantee and which entity has a longer potential to last.

For example, the US Mint has the US Secret Service helping to ensure that all US Mint gold coins issued never get counterfeited successfully.

The Royal Canadian Mint has the Royal Canadian Mounted Police ensuring its gold coins and gold bars never get forged effectively.

Private gold mints have been fast to respond to fake Chinese gold bars by adding cutting-edge technological applications to many of their products, like Sunshine Minting's MintMark SI technology.

The penalties for counterfeiting government legal tender gold coins, for example, are punished federally, as well as counterfeiting private mint gold bars.

In terms of overall guarantee between gold coins vs. gold bars, the entities with the longer track records and monopoly on violence win this debate; government mints have the edge.

PURITY:

Gold Coins or Gold Bars?

Many government mints still issue 22k gold coins today. They often get traded mainly on their overall gold purity. For example, a 22k, 1 oz American Gold Eagle Coin, which has a 1.09 oz weight overall due to additional copper and silver added, is traded based on its overall one-troy ounce of gold content.

These 22k gold coin issuance typically have additional silver and copper mixed into their alloy to make the gold coins harder and resistant to dents or wear marks.

2024 1 oz American Gold Eagle Coin BU

With either .999 fine gold coins or .999 fine gold bars, one could rather easily make an indentation in them with a fingertip of pressure applied. That is how soft pure gold is.

Purity can matter when moving gold across national or governmental boundaries. For example, .999+ fine gold can go into Canada tax-free, while 22k gold gets slapped with taxes.

Mostly this situation is due to governments setting up laws to give their respective government gold mint an advantage versus other competing government gold mints (i.e., Royal Canadian Mint gets an edge over competitors like the South African Mint and US Mint).

This debate is a draw, dependent upon a gold buyer's overall preference for gold purity hardness and the ability to move gold internationally if desired.

SIZES:

Gold Bars vs. Coins?

In the ongoing battle of which mints can issue the smallest and largest gold bars and coins, both private gold mints and government gold mints have taken their games to new heights.

Gold coins are generally minted in smaller sizes if compared to gold bars, such as the gold Sovereign coins, which are 7.98g with 22-karat purity. The small size of gold sovereigns makes them a great option for a discreet investment than large gold bars.

Currently, the smallest modern gold bullion coins regularly issued are the 1/20 oz Royal Canadian Mint Gold Maple Leaf Coin and the 1 gram Gold Chinese Panda Coins.

2024 1/20 oz Canadian Gold Maple Leaf Coin

Not to be outdone, private gold mints also strike 1-gram gold bars regularly as well.

In larger gold coin and gold bar issuances, both government mints and private mints produce kilo-size gold coins and gold bars, respectively.

In terms of gold coin vs. gold bar sizes, both private and government mints make various-sized gold bars and gold coins, respectively.

The most common gold coin size remains one troy ounce (1 oz), and according to the London Bullion Market Association, recommendations are a range of gold content between 350 fine troy ounces (approximately 10.9 kilograms) and 430 fine troy ounces (approximately 13.4 kilograms).

Smaller gold bars tend to be more liquid than larger ones. That means that it's worth investing in small gold bars over large bars as these smaller gold bars offer more chances to be sold quickly if you need the cash right away.

The Biggest Gold Coin ever: Silly Mint Marketing Wars

For a few years, the Royal Canadian Mint enjoyed all the free marketing that striking the then world's most significant gold coins brought it.

Recently though, one of the various record-setting 100-kilo gold coins was stolen in Berlin, Germany. The suspects have since gotten apprehended.

To date, the world's largest gold coin ever struck is now held by Australia's Perth Mint.

A 1,012-kilogram gold coin oddity has been making world tours mainly in the gold buying eastern world.

In terms of gold coin vs. gold bar sizes, both private and government mints make various sized gold bars and gold coins, respectively.

The most common gold coin size remains one troy ounce (1 oz) while the international exchange standard gold bar is no longer the old 400 oz gold bar central bank standard, but the LBMA approved 1-kilo gold bar exchanged on the Shanghai Gold Exchange (the world's now largest physical gold trading market).

The question of gold coin and gold bar size preferences has to be determined by each gold buyer based on overall costs per troy ounce vs. flexibility in liquidation and the other debates, as mentioned earlier here.

It is more difficult to both buy, sell, or perhaps spend 1 kilo of gold vs. 1 gram of gold. Various factors need to be weighed by gold bullion buyers in making the correct selection per their personal preferences and capital allotments.

Other types of gold investments

To a bullion dealer, the option to invest in gold bars or gold coins represents a tangible safety element, something that holds real value regardless of market volatility or currency devaluation.

However, nowadays, many gold investors seek abstract investments, like stocks or cryptocurrencies, to offer diverse global opportunities, growth potential, and liquidity, complementing the stability of tangible assets.

They provide low transaction costs and require minimal management, making them an essential component for a balanced and resilient gold portfolio.

Besides coins or bars, alternative ways to invest in gold include various financial instruments, offering exposure to gold's value without buying physical gold itself. These options can diversify your investment strategy within the gold market.

Gold ETFs

ETFs, or exchange-traded funds, are collective investment funds that contain an assortment of assets like stocks, bonds, and commodities.

They act as a consolidated set of investments that provide exposure to specific indices, industries, sectors, or commodities. Holding a variety of assets in this manner aids in diversifying your portfolio, reducing the risk of overexposure to any single asset.

For instance, a gold ETF is backed by gold as its primary asset. These ETFs mirror changes in gold prices, meaning that as the price of gold rises, the value of the ETF moves in the same direction.

Gold mutual funds

A mutual fund is an investment pool where funds from various investors are combined to purchase securities like stocks and bonds.

This approach allows investors to access a diversified range of assets, minimizing risk in their portfolios without the need to individually manage multiple investments.

A gold mutual fund specifically focuses on investing in companies involved in gold mining, processing, or sales. These companies may vary in size from large, established corporations, to smaller, specialized firms. The primary objective of a gold mutual fund is to provide investors with exposure to gold prices and the potential for capital appreciation by leveraging the growth of these gold-related companies.

Gold stocks

Gold stocks represent ownership in companies engaged in the exploration, mining, extraction, and production of gold. By investing in gold stocks, you gain a stake in the earnings generated by these mining companies, essentially taking a bet on their success.

The valuation of gold mining stocks is influenced by various factors, such as gold prices, production expenses, market demand, and supply dynamics, and the overall financial health of the company.

Gold futures

Gold futures involve a contractual agreement between a buyer and seller to exchange a specific amount of gold at a predetermined price and date. Investors are drawn to gold futures because they offer the opportunity to speculate on gold prices.

While buyers commit to taking delivery on a specified date, many investors opt to sell their futures before expiration, leveraging price fluctuations without physically possessing the gold.

Given gold's reputation as a stable store of value, investors often use futures contracts as an inflation shelter. Moreover, companies utilizing gold in their products may invest in gold futures to secure prices for the precious metal.

Gold IRAs

Gold IRA stands for an individual retirement account that holds physical precious metals, like gold, rather than traditional stocks and bonds.

Gold IRAs are a rather popular option for gold bullion investment for portfolio diversification and potential protection against inflation in the long term, considering gold's historical and traditional value.

Final Thoughts

A gold investment can serve as a hedge against inflation as well as a form of preserving wealth. Investing in either gold coins or bars means investing in a tangible asset that has served as a store of value for generations. So they offer a sense of security that an abstract asset can't.

They're also universally accepted as currency, which makes it possible to sell your gold anywhere in the world for a fair price.

Besides that, buying physical gold is a process that practically anyone can do. And they can even be easily sold. You can make gold into cash relatively quickly.

There are important logistic and financial aspects that influence one's decision on whether to invest in a gold coin collection and buy gold bars or even a more abstract investment form. There is no right or wrong answer since the decision to buy gold ultimately depends on your goals.