Jump To: What is a Gold Coins? | Gold Market Price | The Value of a Gold Coin | Gold Coins by Weight | Popular Gold Coin Programs | Selling and Buying Gold Coins | FAQs

For as long as civilization has established itself, gold has been a valued metal by most people and an esteemed acquisition. It has been used for jewelry, art, and coinage throughout history as a symbol of wealth and status.

Thus, a single gold coin represents far more than its face value. In this article, we will discuss crucial details for those who are interested in purchasing gold coins. We will learn what a precious metal's spot price is, how the design and historical significance can contribute to its numismatic value, and, therefore, its price.

What is a Gold Coin?

A gold coin is, by definition, a form of currency made of gold (or from an alloy containing gold) that comes in a flat disk shape. These coins are typically minted by governments or authorized institutions and bear a specific denomination and design. They also carry a legal tender status.

These are some of the reasons a gold coin is more valuable than just its precious metal content or its face value.

Understanding the Market Price of Gold

The market price or (market value) refers to the amount you can pay or sell an asset or service at a given moment.

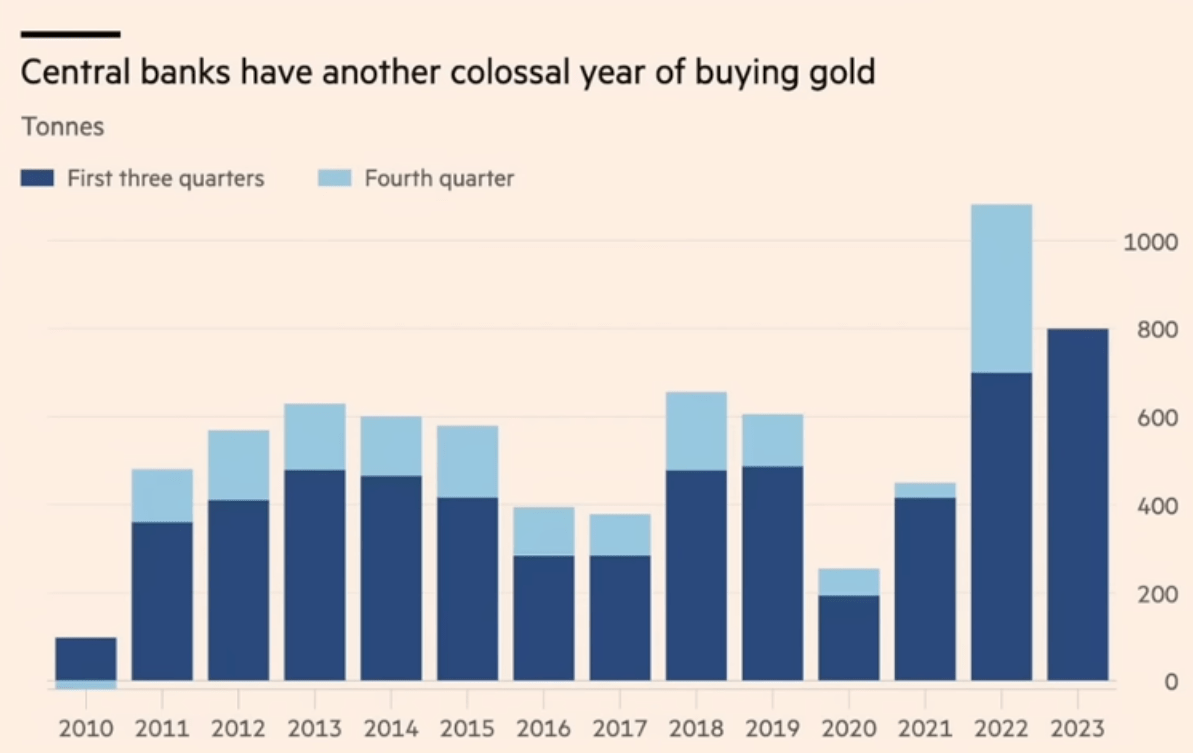

As our main focus is the market price of gold, factors like political changes, universal supply and demand, currency devaluation, and even the amount of gold in central bank reserves can impact a single gold bullion coin price.

Gold has always been a form of preserving wealth, so in times of uncertainty, many investors, and in fact, governments, look for gold as a hedge against inflation.

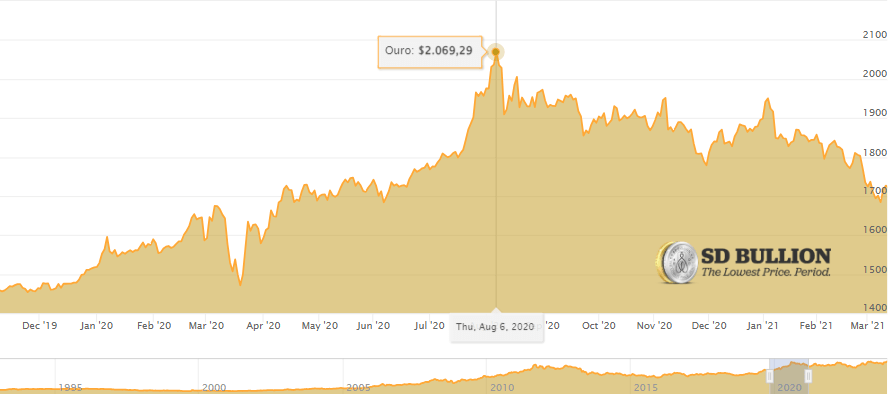

As proof, in 2020, still, at the beginning of the pandemic, the fear of a global collapse made people turn to gold, which increased demand and sale for the asset. So the prices skyrocket. On August 6, it reached an impressive $2.069 per ounce.

This proves that gold does tend to perform well in times of crisis.

Since then, the gold price has been through significant growth. Only in 2023, it has shown a growth of 5%. And will most likely keep growing.

See our Gold Price Prediction for the next five years.

Gold is used in many fields, such as medicine, dentistry, the beauty industry, etc. But will respond more in the face of financial or political risks.

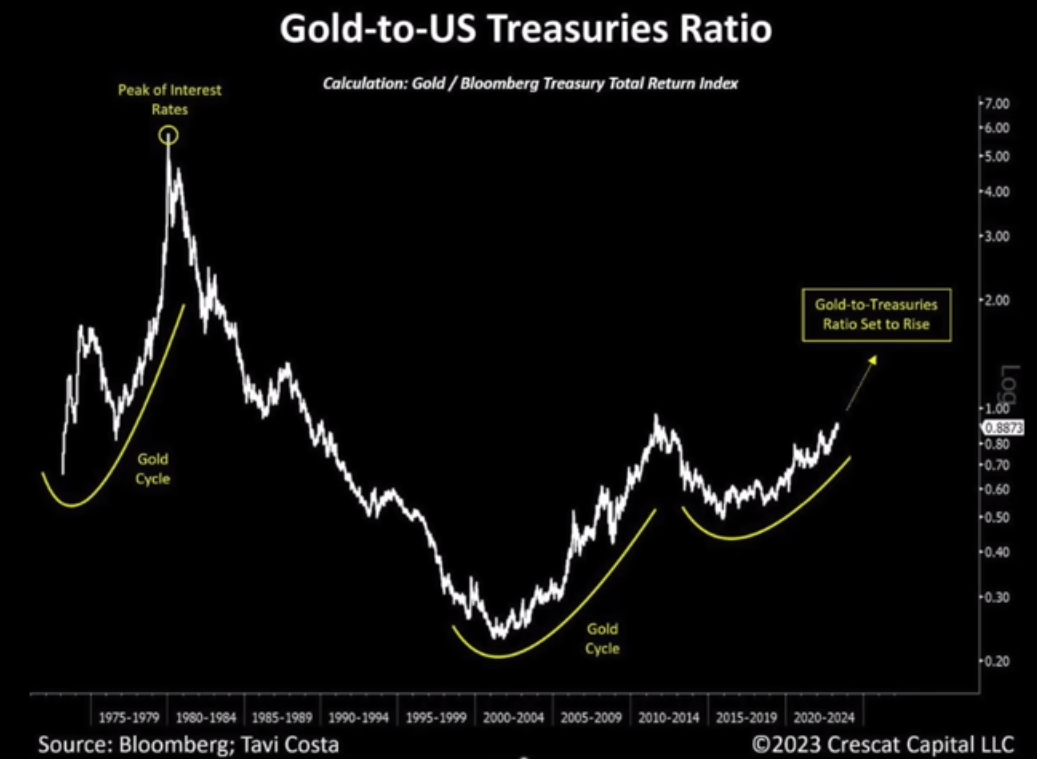

Even with the fastest rise in US rates in recent decades, gold has outperformed bonds over and over again for the past 3 years. The chart below suggests that this central bank gold bullion buying trend will continue, with institutional investors only following after rising spot gold prices force them to.

Determining the Value of a Gold Coin

Spot & Premium Price

Understanding how a particular gold coin gets its value is paramount when making a purchase. Be that as it may, the first step is to look up the Gold Price Today. The so-called spot price is the current price of a single troy ounce of physical gold bullion based on trades occurring live during the business day on mercantile and derivative markets.

On top of the gold spot price, precious metals dealers charge a percentage called a “premium.” The premium may vary from one dealer to another. They ensure dealers are able to cover business costs and turn a profit.

Weight & Purity

Product details such as weight and purity are also considered when assessing a coin, bar, or round's value. Different weights and purity levels, on top of the previous factors, will determine the price of a gold bullion coin piece.

The most popular gold coin's size is 1 troy ounce. However, many mints produce coins in other sizes to adjust to each customer's needs and demands. The US Mint produces American Gold Eagle coins, for instance, not only in 1-ounce size but also 1/2 ounce, 1/4 ounce, and even 1/10 ounce.

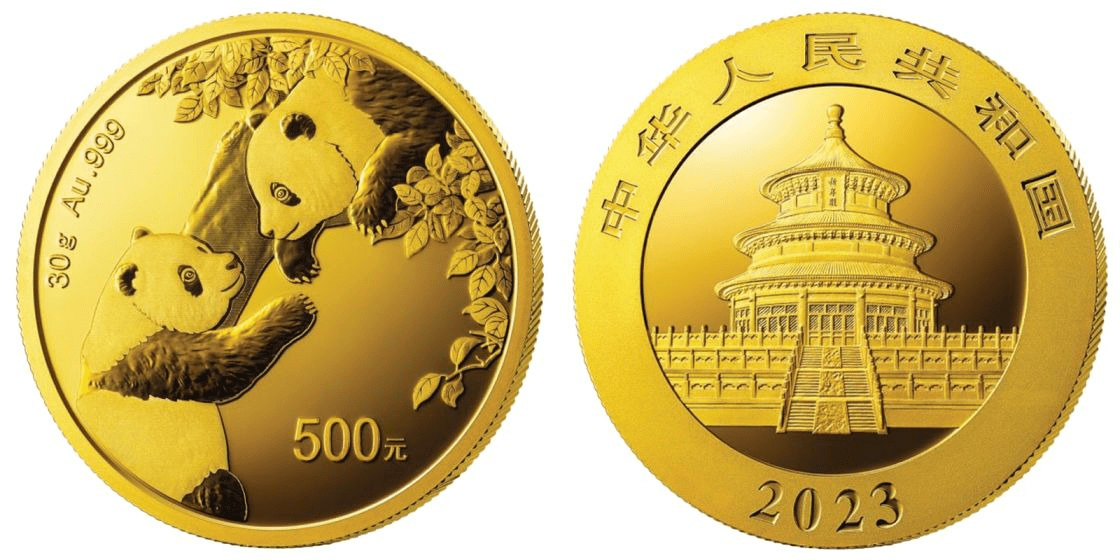

Though the Troy ounce system is the standard measurement system in the precious metals market, some mints, most notably the Chinese Mint, are now adopting the International Measurement System (or Metric System) and issuing coins in grams, such as the Chinese Gold Pandas below.

Do you know how many grams are in an ounce of gold?

Rarity & Demand

When compared to bars, gold coins tend to present a higher premium due to their manufacturing costs. As with any other collectible item, the rarer a coin is, the more valuable it will be. Rare numismatic coins tend to reach thousands of dollars in auctions.

The rarity of a coin comes from low mintage, high demand, or age. For example, the most valuable penny to exist is the 1958 Doubled Die Obverse Lincoln Penny, which has only three specimens known to exist.

Due to a mistake during the striking process, these rare coins were double-struck. On January 22, 2023, Great Collections Auctions sold a PCGS MS65 Red exemplar for an impressive $1,136,250.

Gold Coins Worth By Weight

- 1 oz - It stands for One ounce. Usually the biggest size manufactured by most mints. Arguably the most popular size among investors as well. The 1-ounce gold coin is an industry-standard and might be a primary choice for serious gold investment.

- 1/2 oz - A great way to invest in gold bullion, by also balancing the amount invested, the 1/2 ounce option may be optimal for boosting one's portfolio, even if on a budget.

- 1/4 oz - Budget-friendly, a beginner investor may look up to it when finding their way into gold bullion investing.

- 1/10 oz - One of the smallest weights available, they are one of the easiest options for one to start benefiting from gold investments.

A few programs include smaller sizes, such as 1/20 oz or even 1 gram.

The expression "1 oz gold" refers to the weight of pure gold in a coin or bar, specifically denoting one troy ounce of gold, which is approximately 31.1 grams.

When discussing the gross weight of a gold coin, it encompasses both the weight of the actual gold content (1 oz) and any additional metals, such as alloy metals (usually copper and/or silver), resulting in the total weight of the coin.

Popular Gold Coin Programs and Series

Over time, many coin series have held their respective positions in the industry, the most outstanding of them being the American Eagle Gold Coins. The American eagles, as they are more commonly called, are likely the most famous gold bullion coins in the world.

American Gold Eagle Coin

Based on their popularity among coin buyers only, one might just assume that every collector owns or has had one of these American gold eagle coins in their collection.

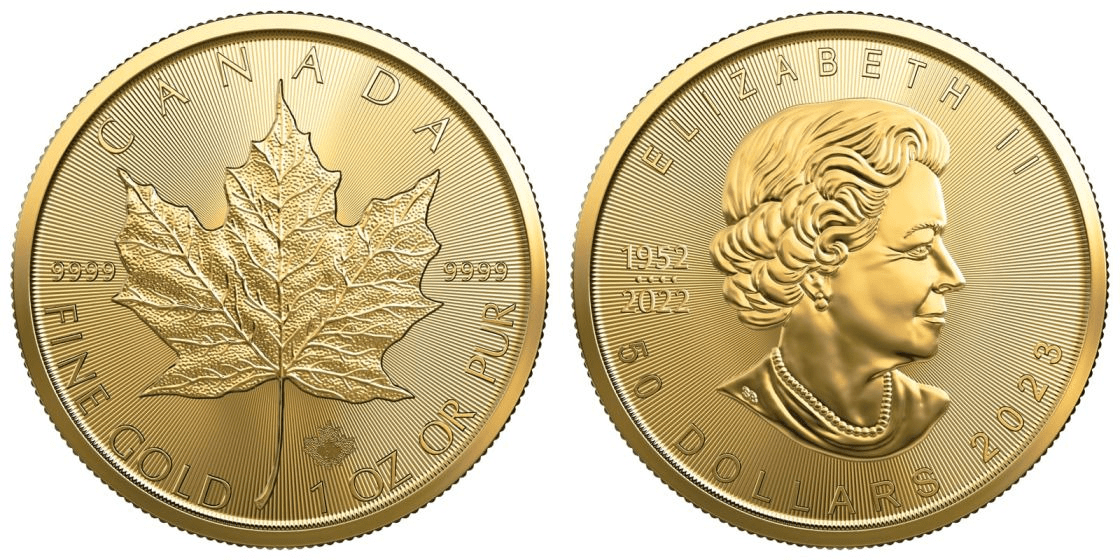

Not straying far from the latter, the Canadian Gold Maple Leaf is also on the list of popular gold coins. The Canadian Mint has definitely earned its spot in the industry with its wide range of high-quality products.

Other Popular Gold Coin Programs

- Canadian Gold Maple Leaf coin - Having a rich history that spans decades, these iconic Canadian coins bear their notoriety along with a beautiful maple leaf design;

- American Gold Buffalo coin - With one of the most iconic designs in the American and world, the gold buffalo coin withstands its' .9999 24K fine gold purity and amazes every eye it meets;

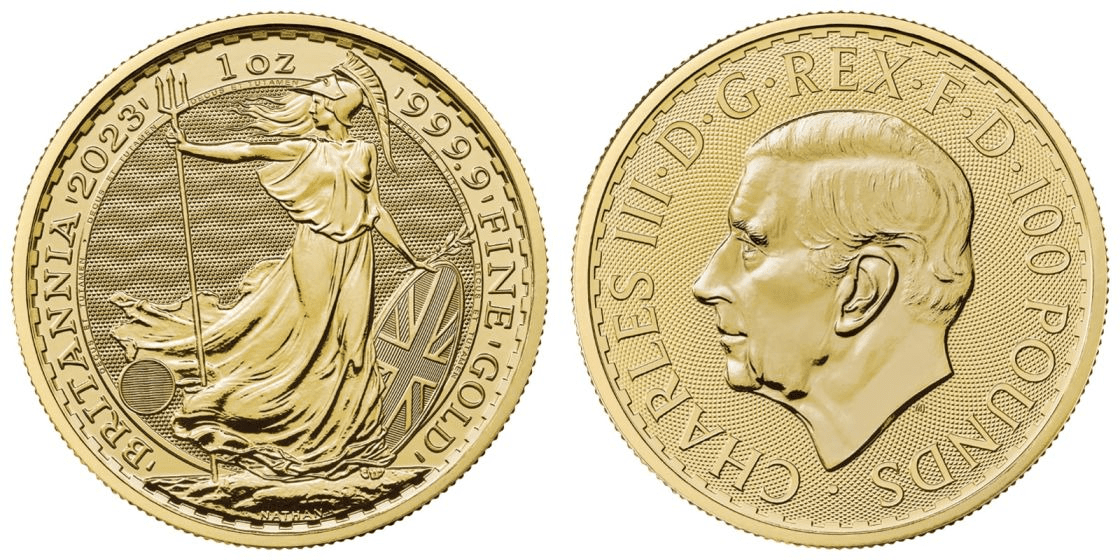

- British Gold Britannia coin - One of the oldest series in the world, these pure gold sovereign coins consolidate the British Royal Mint's high standards and vast history in one prominent product;

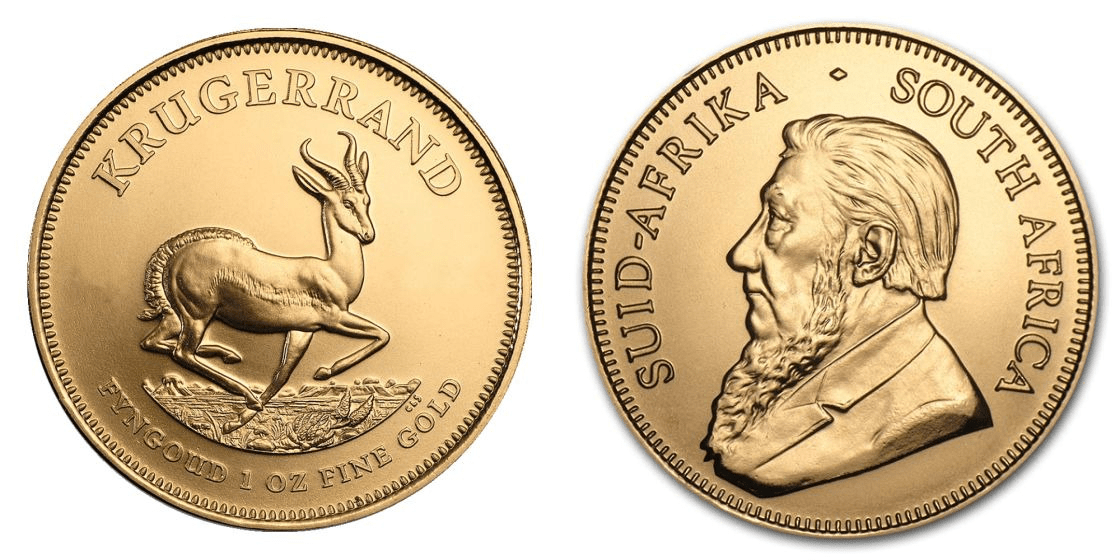

- South African Gold Krugerrand coin - Perhaps a product that helped create the gold bullion coin's trend, the gold Krugerrand was the first coin series created and continues to amaze the bullion industry with its premium 22K gold craftsmanship;

- Chinese Gold Panda coin - The Gold Pandas combines a lighthearted striking design with the industry's best quality and purity. Their obverse design portraying one or more giant pandas in their natural environment changes every year, making them a good choice for those interested in coin collecting;

- Mexican Gold Libertad coin - These incredibly history-rich coins bear a close relationship with the bullion industry's origins, along with its utmost best standards.

Check out our complete melt value calculator.

Selling and Buying Gold Coins

The decision to buy gold coins should go through careful thought. Here are some differences to consider:

When Selling: some factors to consider when selling gold coins are the weight, purity, and current market price. Above all, the moment of selling is crucial since the spot price changes several times a day. Also, consider finding reputable coin dealers in order to secure a risk-free transaction.

Prefer reputable online dealers, such as SD Bullion, rather than online marketplaces to avoid possible scams.

When Buying: consider the physical aspects of the coin, such as purity, weight, and condition. Also, check the authenticity. A smart way to avoid buying fake gold coins is to buy only certified coins. There is a wide selection of places that offer this service.

Consider the premium to make sure you get a fair price. Be suspicious when prices are too low. It is technically impossible to order online a piece of gold at the spot price due to manufacturing costs. Lastly, have the safety and storage of your acquisition planned beforehand.

Final Thoughts

Gold coins are arguably one of the most popular choices when it comes to physical gold investing. Understanding their value encompasses evaluating factors like rarity, weight, purity, and historical significance.

Continuously being aware of their worth ensures informed decision-making, enabling individuals to navigate the nuances of this market and leverage the enduring value that gold coins represent in the realm of investments and collections.

FAQs

How much is a gold dollar coin worth?

The US Mint produced the Gold Dollar Coin from 1849 to 1889. They were made of 10 % copper and 90% gold (for a total of 0.04837 Troy ounces of gold content). Therefore, as of November 29th, with the gold spot price fluctuating at around $2,050, these coins' melt value is slightly above $99. However, most of these coins were around during the Civil War, and many of them can be found in fairly good condition, so they also carry high numismatic value. According to the PCGS Price Guide, some of these coins should be worth 5 to 6 figures. A Type I 1849-C specimen, evaluated in MS63 condition, with an Open Wreath on the reverse design, holds the auction record. It sold in July of 2004 for $690,000!

How much is a 1 oz gold coin worth today?

With the gold spot price fluctuating around $2,050 as of November 29th of 2023, that is precisely how much a 1 oz gold coin should be worth before premiums.

Is a $1 gold coin rare?

From 1849 to 1889, the US Mint produced 19,499,337 $1 gold coins, most of them at the Philadelphia Mint. It sounds like a big number, but many of them were surrendered to the government and melted down in 1933 due to Executive Order 6102. So $1 gold coins are indeed considered rare. The scarcest is the 1855-D variation. In this case, the "D" mint mark does not stand for the Denver Mint but rather for the Dahlonega Mint, a facility in Lumpkin County, Georgia, which was authorized by Congress in 1835 to ease the minting of gold coins in that area after the Georgia Gold Rush. Only 1,811 $1 gold coins were produced in that branch in 1855, and about 80 are known to have survived.

Is a $20 gold coin real?

A $20 gold coin is officially known as a Double Eagle. The US Mint issued these coins from 1849 to 1932 with two different design variations: the Liberty Head (1849 to 1907) and the Saint Gaudens design (1907 to 1932). In 1933, the US Mint started producing Double Eagle coins, but Executive Order 6102 halted the production of all gold coins and made it illegal to own them. However, some of those coins got stolen before being melted down. One of them sold in 2021 for the record price of $18,872,250!!

Can I buy a gold coin for $100?

As the price of gold is currently fluctuating around $2000, you will hardly find a gold coin to buy for as low as $100. One possibility is to purchase a fractional gold coin. Even 1/10 oz American Gold Eagle coins are going for over $200, but you can currently purchase a 1/20 oz Canadian Gold Maple Leaf from the Royal Canadian Mint for just over $100.