You will likely be surprised to learn what gold’s price performance over the next five years will be if it simply keeps increasing at the average it has been increasing since the year 2000.

For a shorter-term example, the gold price in US dollar terms has grown by +60% in the last five years – quite praiseworthy for the precious metal that is considered the most stable in value and a safe haven asset for long-term liquid wealth investment portfolio allocations.

But what about the next five years for gold price performance?

In this article, we will make an attempt at a gold price prediction for the next five years considering the historical data of this precious metal. Needless to say, commodity markets remain volatile. Thus this forecast is susceptible to change due to the global economy, supply and demand factors and even economic, and geopolitical events.

This article does not constitute investment advice, and we highly recommend that investors conduct their own research before deciding to buy gold for the long term.

What is the Gold Spot Price?

If you are a new gold investor, it is of utmost importance that you understand the definition of the term "gold spot price" and how it is formed. In short, financial markets use the term the spot price to refer to the current price for a given financial instrument, such as a commodity, security, or currency.

The term "spot" is a reference to the expression "on the spot", meaning the transaction is to be settled with immediate payment and delivery, as opposed to future contracts, for instance.

The gold spot price fluctuates during the day due to supply and demand dynamics, but in the long run, it is influenced by geopolitical tensions, economic conditions, and fiat currency movements, e.g. the US Dollar's performance.

Investors tend to see gold as a safe haven asset during times of economic downturn, especially when there is high money printing and low interest rates.

Nearly half of the gold consumption in the world is in gold jewelry. Central banks also play a key role in the gold rate prediction as they hold nearly one-fifth of all gold ever mined in the crust of the earth.

Analyzing the Current Gold Market Situation

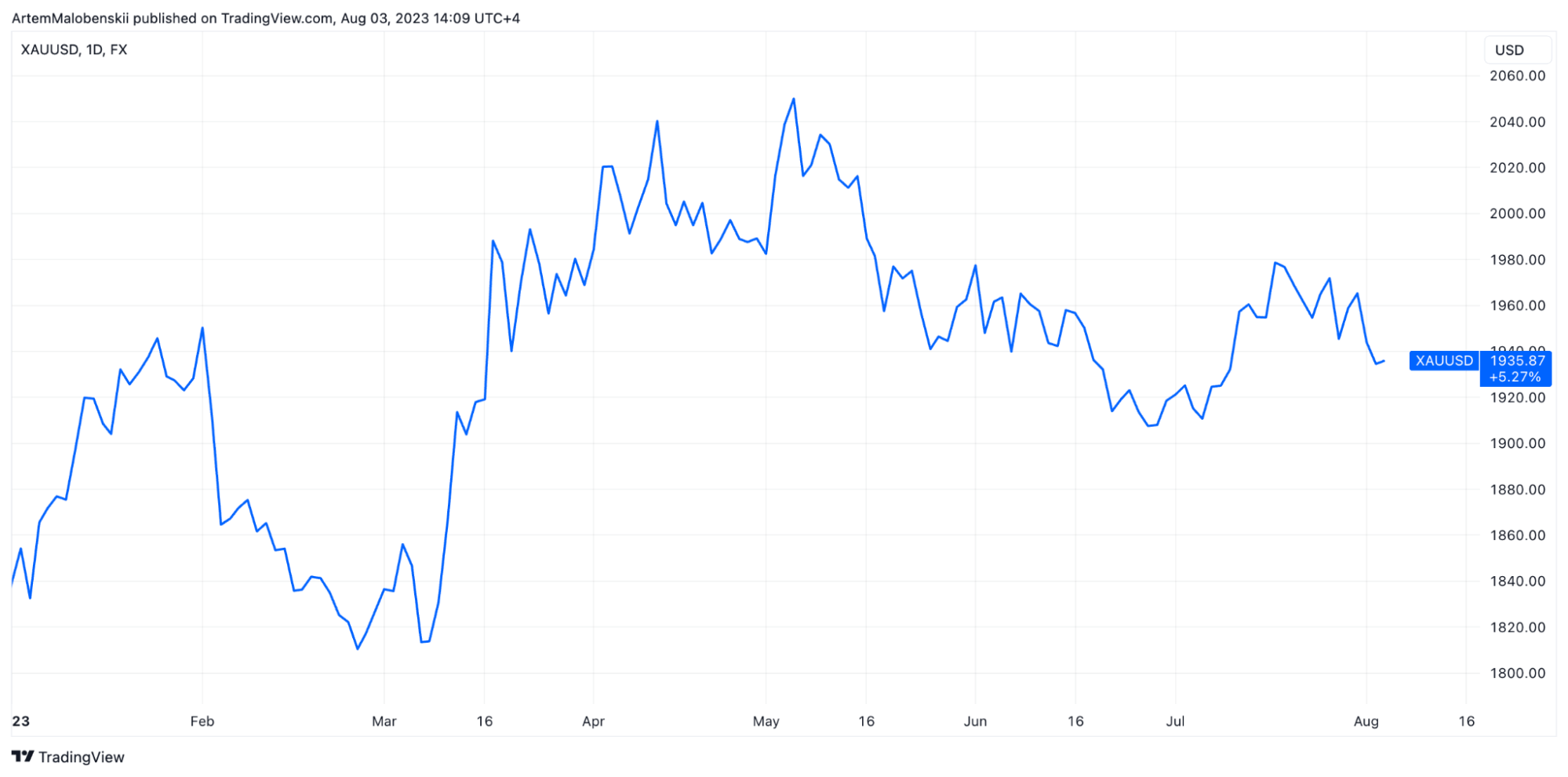

To grasp the current situation, let's take a look at the XAUUSD price movements in 2023. As you can see, gold has shown more than 5% growth this year, with peak moments reaching above the $2,040 per troy ounce mark.

Half a year of time is too short a period to get a bird's-eye view of how an asset class or commodity has been performing.

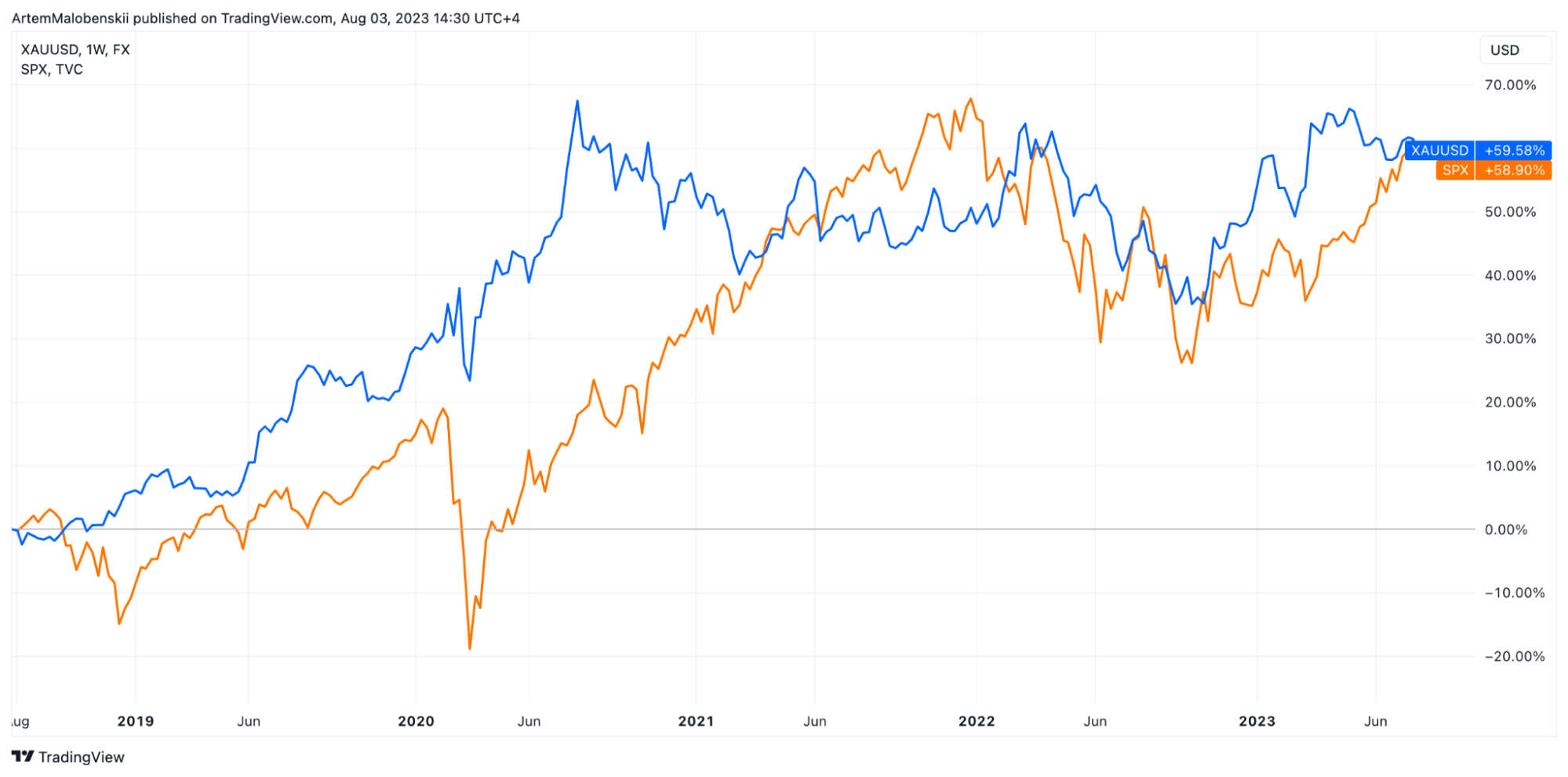

Let us look at the following five-year gold price chart below comparing XAUUSD with the broad US stock market (S&P 500), a powerful benchmark for comparison.

Being less risky and volatile, gold bullion has outperformed one of the leading world stock indices (albeit not by much) over the last handful of years.

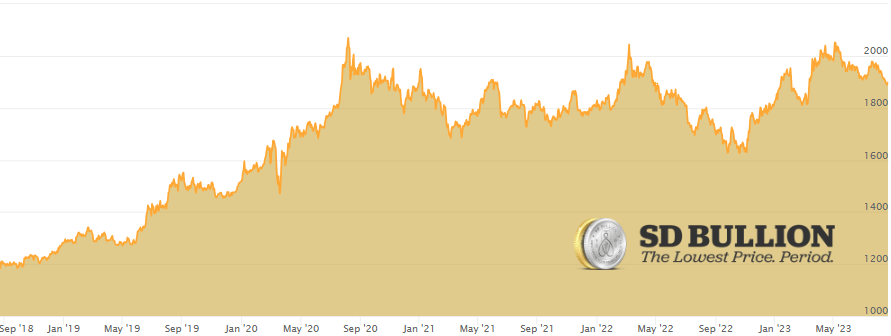

Gold Prices - 2018 to 2023

The last five years have been challenging and tumultuous times – consider our living through the 2020 Covid pandemic and rolling economic shutdowns, and then the recent ongoing military conflict between Russia and Ukraine. Both have heavily pushed investors and central banks alike to look for safe-haven assets, with gold bullion being amongst their top choices.

Secondly, in 2023, gold prices witnessed a rise due to a relative weakening of the USD vs other major competing fiat currencies overall.

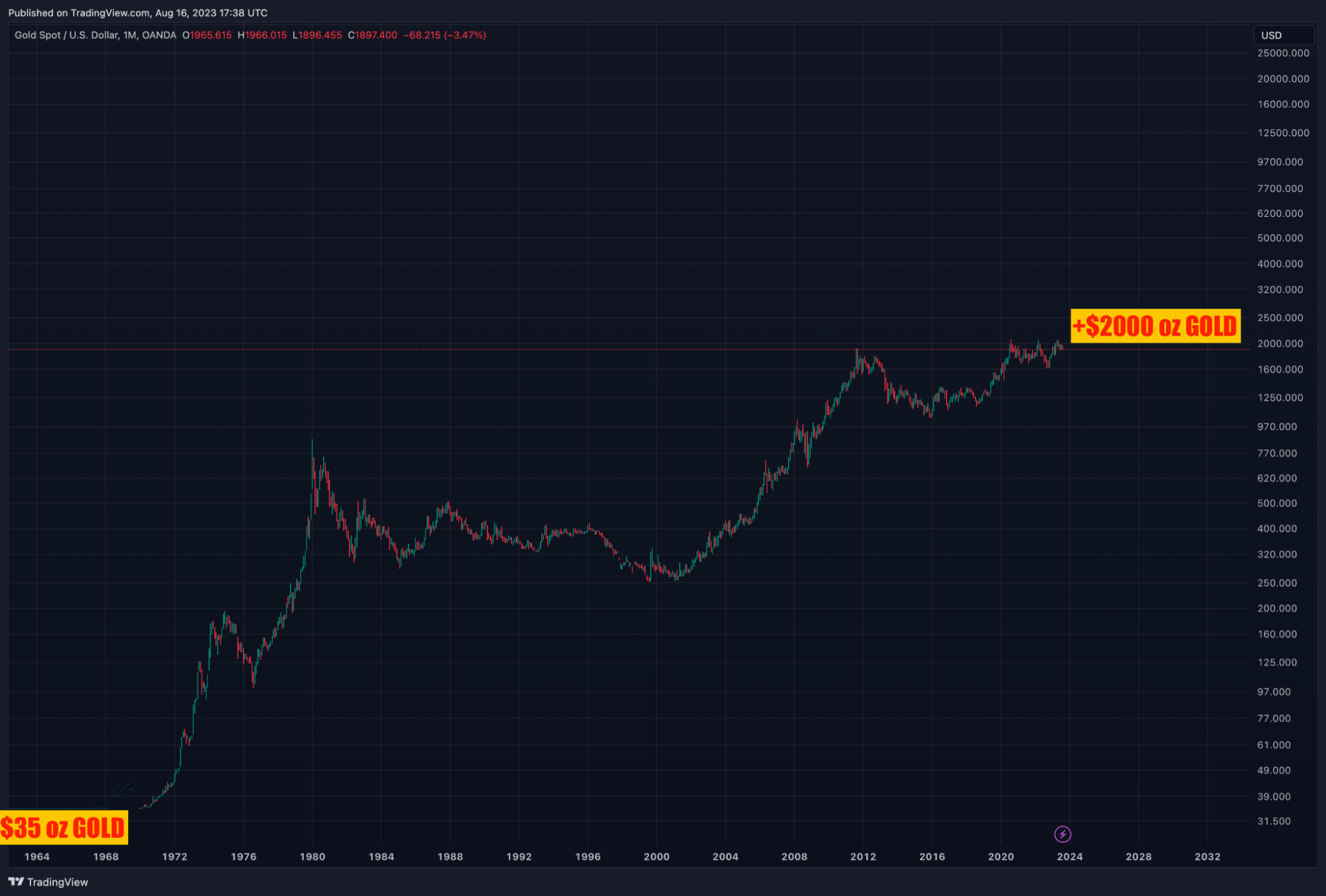

Thirdly, gold is an asset that has a proven historical growth in value and price overall during its free market trading history. Once fixed at a price of merely $35 oz gold is likely to see $2,000 oz becoming a longterm price support level for far higher prices in time. Gold bullion remains an asset individual investors and central banks alike can own outright reducing building counterparty and payment sanctions risks.

Many respected analysts forecast gold will continue its upward trend over the next five years.

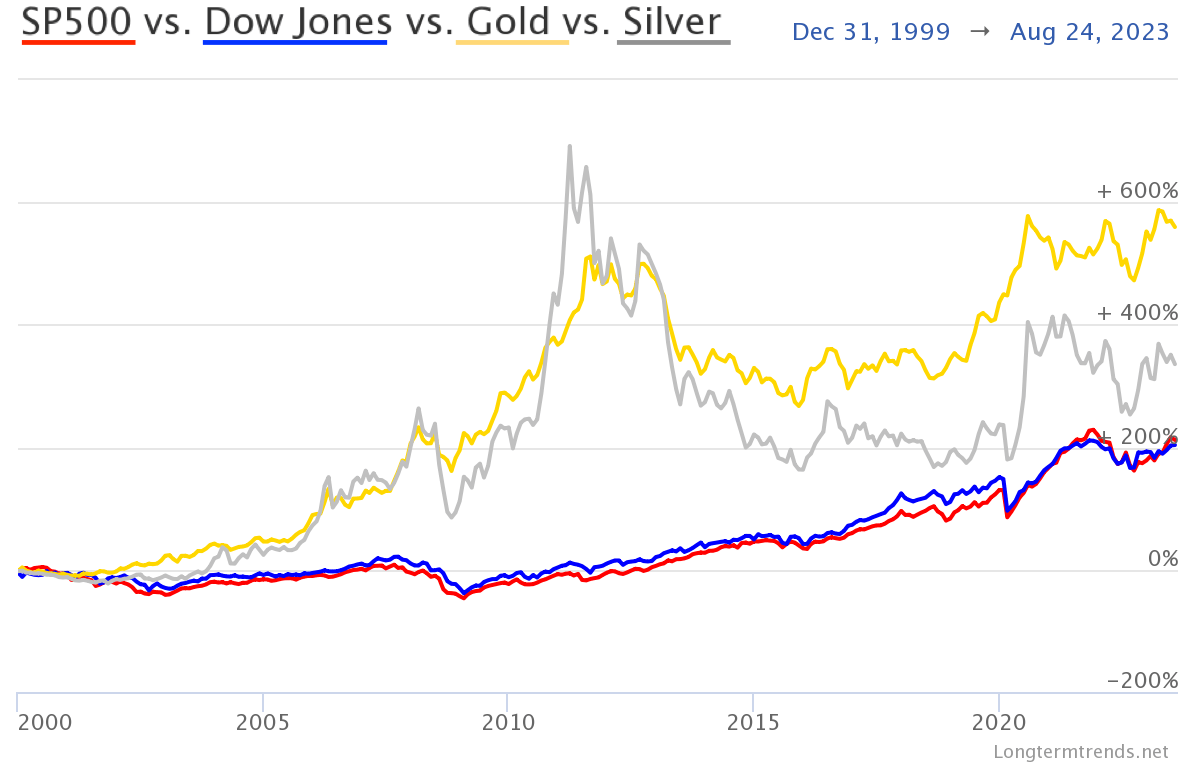

There are a multitude of factors why we believe both gold and silver bullion will likely continue outperforming the S&P 500 stock market index as we move further along in this 21st Century.

Gold Demand and Debt Ceiling Concerns

Given that often XAU and the US dollar secular bull and bear markets tend to move in opposite directions. Many believe the USD is set to begin a new secular bear market once the Federal Reserve stops raising interest rates and eventually begins cutting them. Likely heading into some form of fiscal dominance in order to finance the US government’s runaway debt and unfunded liabilities coming due this decade into next. When US government bond yields decline, the likelihood is that gold will trend upwards.

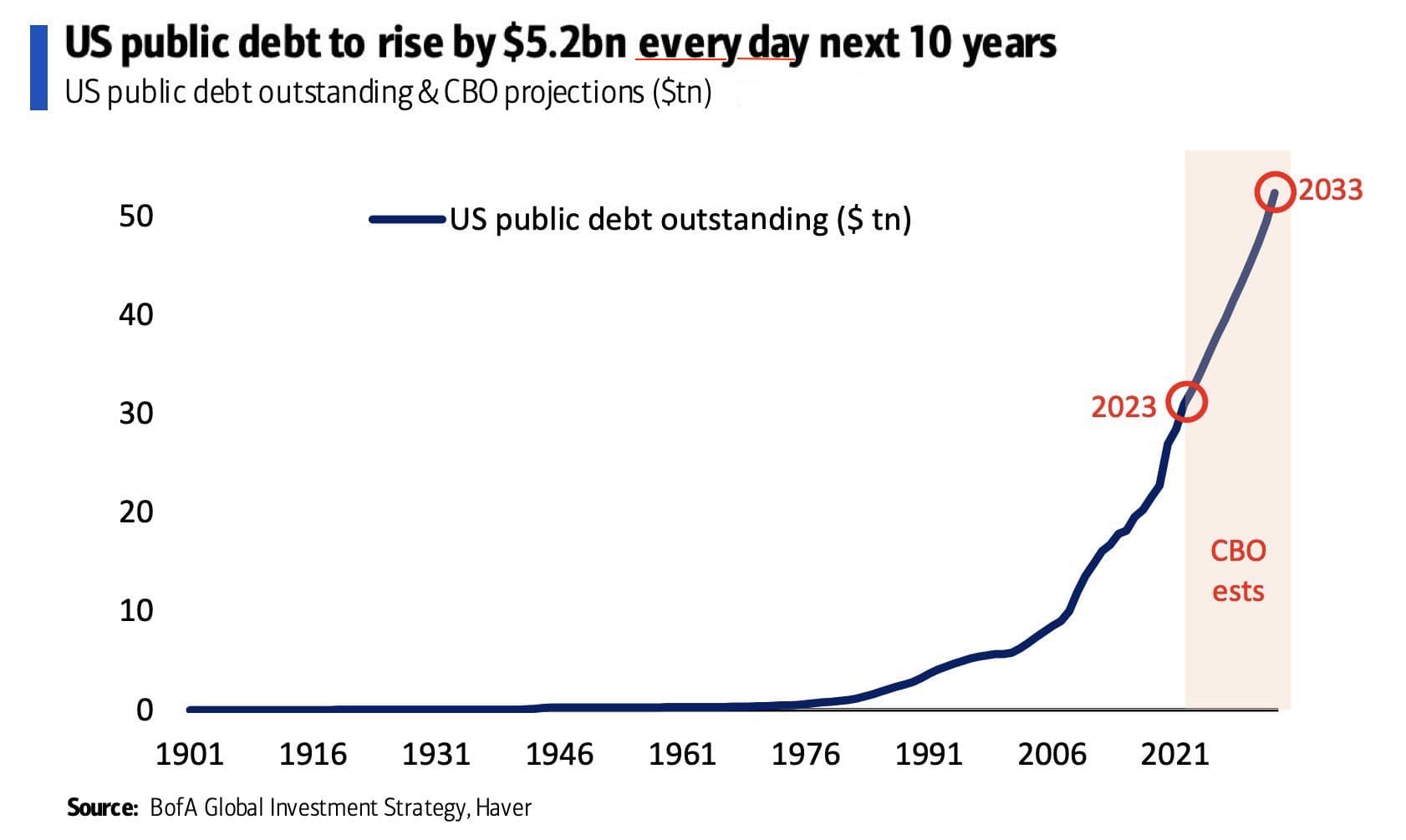

The government’s own Congressional Budget Office has US public debt projected to go above $50 trillion by early next decade (2030s). The likeliest historical path fornations in massive debt to GDP quagmires is to further devalue their issuing currency, in this case, the fiat US dollar, in the decades to come.

Gold eventually accounts for debts that cannot and will not be paid in real value terms by a rapidly escalating spot price and relative value. It would not surprise most gold experts to see a substantially higher gold price as a result of projected coming further US debt escalations.

A long-term secular bear market in the fiat US dollar’s relative value is also likely to support gold moving to much higher price levels in the coming five years.

Moreover, the US economy will likely have to go through a recession and a manufacturing base retooling to increase its overall competitiveness globally (both will likely prove to contribute to further secular price inflationary pressures to come).

Other Factors in the Global Economy

The coming problems for US dollar demand don't end there. The BRICS+ countries and the Bank for International Settlements (BIS) are both separately but simultaneously working on new direct bilateral payment settlement systems as coming alternatives to the often typical USD being used as the currency intermediary in many global trading settlements. Alternative payment settlement system growth could help topple key foundational planks for ongoing and future US dollar demand.

Having enjoyed a secular bull market from 2013 into 2023, the USD may eventually turn over to then weaken even faster in relation to gold and other major fiat currencies in the next ten-year time span.

While a secular commodity bull market gains momentum globally. Gold tends to perform very well during commodity bull markets, like during decades of the 1970s or 2000s.

Simultaneously, other major central banks are expected to cease their hawkish policies, causing those currencies to lose support and further gold-buying pressure to increase around the world simultaneously.

All while the general geopolitical and economic situation worldwide increasingly grows further unstable, unlikely to favor risky asset classes that have been priced to perfection by the early part of this decade (US stocks and the bond market, for instance, both are likely to experience lengthy extended secular bear markets in real value terms).

Gold Historical Data and Market Expectations

All the above-mentioned factors are just a portion of a whole basket of advantages for gold. According to the World Gold Council, investment demand for the precious metal was extremely high in the first quarter of 2023, contributing to over 228 tonnes to global reserves.

But take a look back in time since gold has been freely traded as an investment asset to understand how far gold has already come over time.

And while many analysts firmly believe that the XAU will be able to scale new heights year by year. Some even suggest gold price mania figures higher than $10,000 oz by 2030.

Read about the Top 10 Gold Price Market Moves here.

Such a performance for gold would basically rhyme with past performances as recent as 1970-1980 where gold prices ran from just over $35 oz to begin 1970 to nearly $850 oz by late January 1980.

And while this ongoing secular gold bull market will have likely taken three times or more as long to play out. On a numerical and global notional trading volume basis, this 2000s version will prove to have been many multiples larger in virtually all measurable factors compared to the 1970s gold bullion mania version.

Turbulence in the Banking Sector

Another factor contributing to the yellow metal bullish trend is the recent collapse of the Silicon Valley Bank and the acquisition of Credit Suisse by UBS.

The economic uncertainty involving the banking sector drives the precious metal's price higher as investors turn to gold to avoid losing money. Gold, and other precious metals, have been a store of value and purchasing power for millennia.

Gold Price Forecast - 2023 to 2028

Conservatively speaking over the next five years plus, through the end of the year 2028.

If we simply take gold’s recent past price performance average having gained an average of +9.3% per year over the last +23 years we can give a simple price projection as follows.

If the precious metal continued on this trend, this is what we might expect from the coming years:

|

2023 |

$1809.05 + 9.3% gain |

$1,977.29 oz |

|

2024 |

$1977.29 + 9.3% gain |

$2,161.18 oz |

|

2025 |

$2161.18 + 9.3% gain |

$2,362.17 oz |

|

2026 |

$2362.17 + 9.3% gain |

$2,581.85 oz |

|

2027 |

$2581.85 + 9.3% gain |

$2,821.96 oz |

|

2028 |

$2821.96 + 9.3% gain |

$3,084.41 oz |

Final Thoughts

Seeing the Gold spot price go above $3,000 oz within the next five years of time is in line with the running average annual increases for gold’s price throughout this century and millennium.

Given all the fundamental drives, geopolitical volatility, and structural financial changes coming in the next five years. This conservative gold price prediction target may end up being too conservative and low given the annual rates of returns gold enjoyed during the 1970s and 2000s decade.

To get an even broader and deeper backtested understanding of how gold has performed versus other major asset classes like US stocks and US bonds / notes. Consider the backtested price and asset class performance data going back over the last 50 years to better understand what might be a prudent ongoing allocation of one’s liquid net worth held in bullion.

So long as the currencies we are coerced to use in day-to-day commerce are merely fiat by decree, it will continue making common proven backtested sense in having an investment allocation of some portion of one’s wealth held directly in physical gold and other precious metal bullion products.

The next five years are very likely to benefit prudent gold bullion owners.