Summary

- Global central banks are on track to buy more gold bullion than ever before in 2023, with 800 metric tonnes purchased in the first three quarters.

- Last year saw the highest amount of gold bullion purchased by central banks in a single year since World War II.

- Central banks have been selling US bonds and increasing their gold reserves, even as US interest rates rise.

- The central bank of Poland is actively increasing its allocation to gold bullion, aiming for 20% of its sovereign wealth.

- Smaller economies like Malaysia are also reallocating sovereign wealth into gold rather than underperforming assets like bonds.

- Russian Federation continues to be a significant buyer of gold bullion, with a promising outlook for further purchases.

- Younger generations, especially Gen-Z, are increasingly buying gold, particularly in China.

- India and China, with growing populations and wealth, are expected to continue robustly bidding on gold.

- Precious metals like gold, silver, and platinum are likely to outperform in the current financial climate.

- Switzerland is bracing for possible bank runs, and UBS is already taking measures to control client withdrawals.

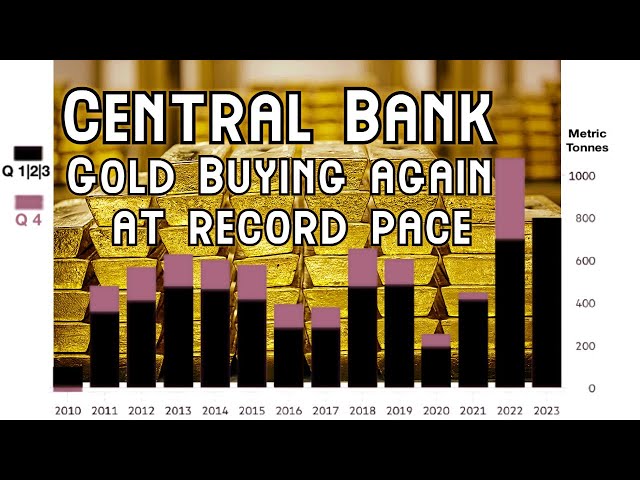

Mainstream financial media this week citing the World Gold Council with semi-transparent and still private information provided by Metals Focus, that through the first three quarters of this year 2023, global central banks are collectively again on trend to buy more gold bullion by tonnage than they ever have in prior years.

Through the first 3 quarters into the year central banks have bought 800 metric tonnes or over 25.7 million ounces. That is more gold bullion than they did through Q3 in last year's record breaking year 2022.

Last year was by far the most gold bullion central banks have bought on record in one year since record keeping began around WW2.

Central Banks have been net sellers of US bonds over the last few years and have been aggressively diversifying on net into more official gold bullion reserves.

Even with the fastest rise in US rates in recent decades gold has consistently outperformed bonds over the past 3 years and this chart suggests that this central bank gold bullion buying trend will continue with institutional investors only following after rising spot gold prices force them too.

One of the largest recent buyers of gold bullion has been the central bank of Poland whose President recently was quoted stating some of the following rationales for why they are aiming to have 20% of their sovereign wealth allocated to gold bullion to come.

Smaller eastern economies like Malaysia have also been aggressively reallocating long term sovereign wealth savings into gold bullion likely over bonds and other underperforming asset classes of late.

The Thai central bank has increased its gold holdings over the past 3 years as it diversified its investments. The head of Malaysia's reserve management stated a few reasons why they have been increasingly stacking more official gold bullion of late.

One of the biggest buyers of gold bullion this 21st Century is the Russian Federation, and judging by proven gold ore in her ground one should suspect they will continue stacking more official gold bullion this decade and perhaps onwards.

While China's central bank has been the number one central bank buyer of official gold bullion for almost a full year now, it is the younger increasingly wealthy generation Z that is surprisingly buying gold at a massive clip.

Most of CHINA's consumer gold in private bullion and high grade gold jewelry is being bought by their young Gen-Z generation.

Chinese citizens aged 18 to 34 years old also collectively possess the most buying power amongst all other Chinese age groups.

Given that through the remainder of this decade the largest sectors in population increases of wealth will be split amongst massive gold buying citizens of India and China. One should expect their collective bid on price climbing gold to remain robust ongoing.

While leveraged electronic derivative gold futures trading during New York hours keeps the current spot gold price in polite check near the eventual support line of $2,000 oz.

We witnessed this week the world's largest debt to GDP nation of Japan launch a $110 billion stimulus and claim it will help fight ongoing fiat Japanese yen inflation and currency debasement ahead.

We are apparently now at the point where politicians just bribe their constituents with stimulus payoffs to try and keep their approval ratings from tanking.

One look at the ongoing runaway price of gold in Japanese Yen should remind silver bulls about how it will likely look once silver eventually begins its manic outperformance of gold later this bullion bull cycle.

Similar can be suggested for platinum, of which Japan is a respectively large buyer of in both bullion and jewelry formats.

Turning now to a supposed safe haven nation in the European continent of Switzerland.

It was announced that regulators there are bracing for further upcoming bank runs.

Of course since Credit Suisse failed and was taken over by UBS, it is likely that UBS is bound to have trouble of its own soon enough.

Surely there will be other Swiss bank failures to come.

At the moment it is reported that UBS is already staggering their client's withdrawals with time delays, exit fees, all to likely slow down the current quiet bank runs.

UBS savings account terms reportedly only allow withdrawals of 50,000 Swiss fiat francs per year, larger amounts require 3 months of notice, with 1/2% fee for any withdrawals beyond the stated 50k limit.

All while offering running for their life UBS clients a paltry 75 basis points on savings accounts under 50k and a pathetic 30 basis points on Swiss savings account holdings beyond 50k.

Sounds like a good zombie bank to be with, no?

One look at how the current year gold price chart in Switzerland is poised to break out and begin running to new highs year after year, and we can see just how much room eventually outperforming silver will have to move eventually to keep and outpace in performance.

Stick around after this brief message we are going to look at more United States specific charts, data, and facts of this building global bullion bull market to come, after this brief message.

Silver and gold markets were mixed through this week's trading.

The spot silver price finished over $23.20 oz bid price while the spot gold price closed just under $2,000 oz bid.

The spot gold silver ratio sank to close at 85 on silver's relative strength over gold this week.

This week the fiat Federal Reserve continued to pause its last few year record-paced rate hike cycle.

In this 21st Century gold bullion bull market, there have already been three prior rate hike pause to cutting cycles. All have led to varying degrees of gold spot price climbs and relative out performances of other asset classes.

It remains to be seen how this next pause to cutting cycle might play out, but we can also examine how rate cutting cycles have not typically been good for stocks often in bear markets at the time. It remains an interesting thought exercise for me at the moment, to wonder by when and what S&P500 price level that spot gold will reach parity with again. By which year and what number?

During Jerome Powell's Q&A with their approved financial media press, he was asked about the current program to help stave off bank runs from earlier this year.

BTFP is preventing a cascade of bank failures that could occur if the current roughly ~$1.5 trillion of unrealized losses in the US Treasury market had to be realized.

The program reportedly ends in March 2024.

The fiat financial powers that be have certainly been thinking about this ongoing covert bank run and appears to be looking to lower the barriers on "Too Big to Fail" labels for failing banks and financial institutions to come.

The US Treasury announced a new record net issuance for a Q4 of $776 billion for Q4 which will inevitably add to the ongoing US Debt quagmire that will be mostly met long term by devaluing the underlying fiat currency of issuance the current fiat US dollar while eventually defaulting on unsaved for promises piles coming due decades upcoming.

Hopefully you understand the basic math that is likely to propel bullion into another eventual mania phase ahead and are prudently allocated accordingly.

That will be all for this week's SD Bullion Market Update.

As always to you out there. Take great care of yourselves and those you love.