Herd instinct in finance, or in human behavior in general, is a phenomenon where people follow what they perceive other people are doing.

Rather than fully rely on their own judgments or analysis. People who exhibit herding instincts will gravitate toward the same or similar investments based almost solely on the fact that many others are supposedly doing the same thing.

Herd instinct has a history of starting large, unfounded market rallies and sell-offs that are often based on a lack of fundamental support to justify either.

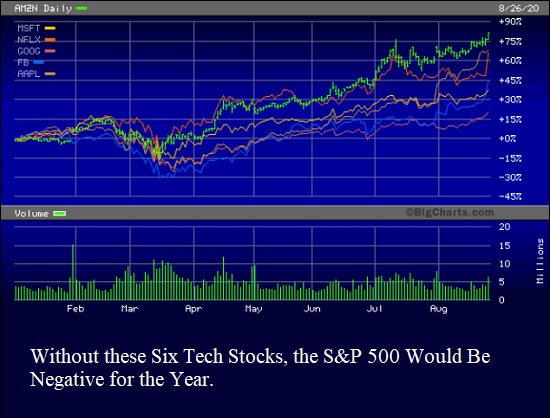

The dotcom bubble of the late 1990s and early 2000s, and this 2020 focused five tech stock mania, is a prime example of the ramifications of both herd instinct and passive investment fund flows, in the growth and eventual bursting of yet another financial bubble.

This week, we're going to look at where some of these investment herds are, and where they are coming and or going.

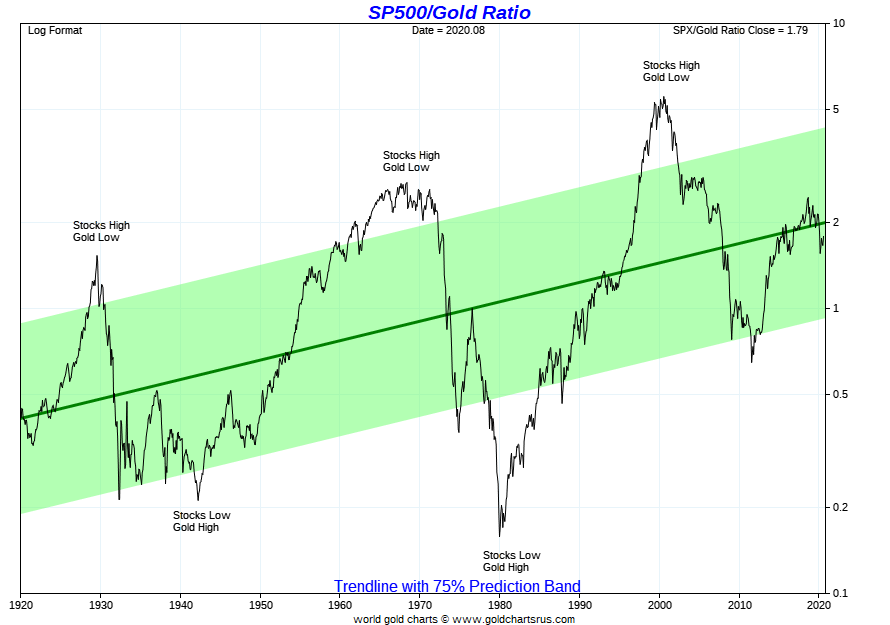

And too, we will delve a bit into the growing institutional investor class push for precious metals allocations. How that herding phenomenon is only just beginning now that $2,000 gold has arrived.

The silver spot price and gold spot price finished slightly lower for the week, as they continue to digest gains made at the start of this summer 2020.

Good news this past month August 2020, the US Mint has been increasingly striking more Silver Eagle coins and thus silver bullion product price premiums appear to be in retreat and slimming down for now.

It appears the US Mint is on pace to issue over 20 million ASEs before shutting down for this year's issuance.

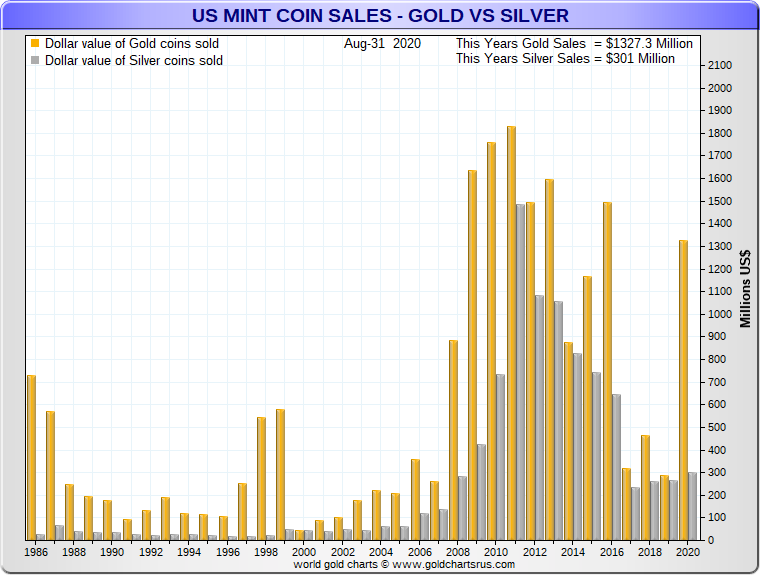

Below is the fiat Federal Reserve note fund flow data into US Mint American Eagle gold and silver bullion coins from 1986 to late August 2020.

Note how only two thirds through this year 2020, the bid for Gold Eagle coins has returned to near its post-2008 Global Financial Crisis levels.

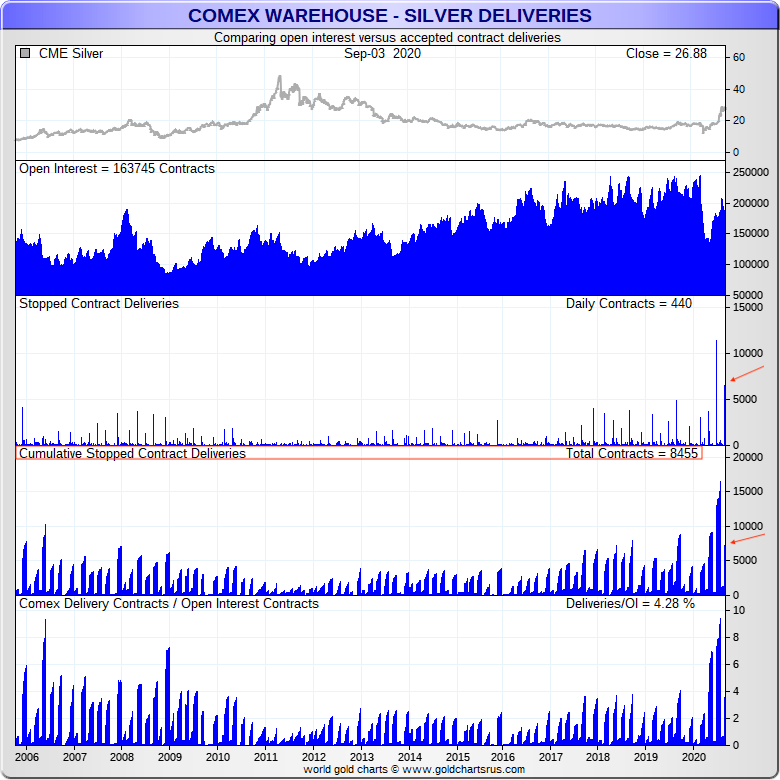

The September stopped Comex silver futures contract figure came in as the second-largest amount over the last decade and a half of time.

As by the end of this month, potentially over 42 million ounces of fractionally reserved silver bullion may swap ownership.

--

Late last week, we were happy to learn, mostly being Ohio natives, that the Ohio Police & Fire Pension Fund has decided to allocate 5% of its nearly $16 billion assets under management investment portfolio, into gold. While around $800 million from this fund chasing just over 12 metric tonnes of gold bullion may not sound like much.

It is the trend that matters.

Silver and gold mining analyst Jeff Clark, published some interesting news this week regarding both potential and already large institutional fund flows into the precious metals investment arena already in the first half of 2020.

The potential of institutional flows to gold in a world of central banks wanting more inflation, while also pinning interest rates at 5,000 year low levels for many years to come.

This trend has the ability to throttle gold and silver spot prices into a herd-driven mania.

On the heels of last week's declaration by the private Federal Reserve chairman, that we need more inflation this decade.

The corporate sector in the USA drowning in debt would likely agree, high inflation is one way they could more easily pay this off in the years upcoming.

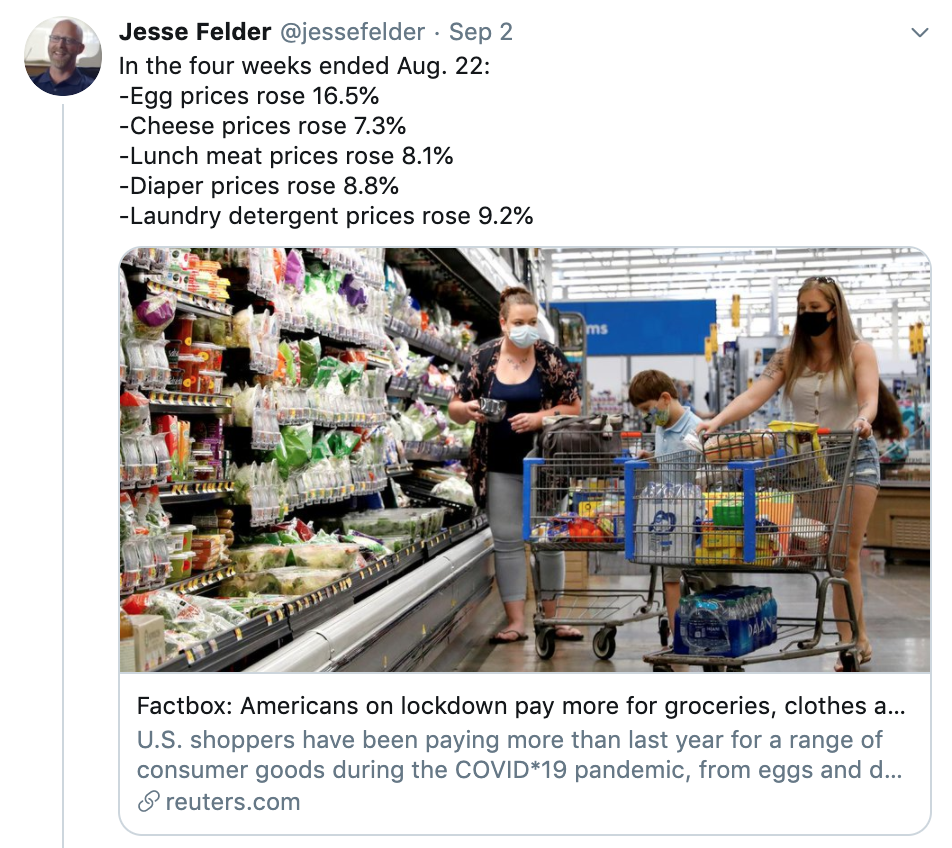

Of note too, Reuters published an article citing just how much prices at grocery stores have been escalating in a mere month of time.

Our friend Jesse Felder tweeted the painful brush strokes you can see here. Congratulations to Jerome Powell, he and his private central bank are off to a hot-inflationary start.

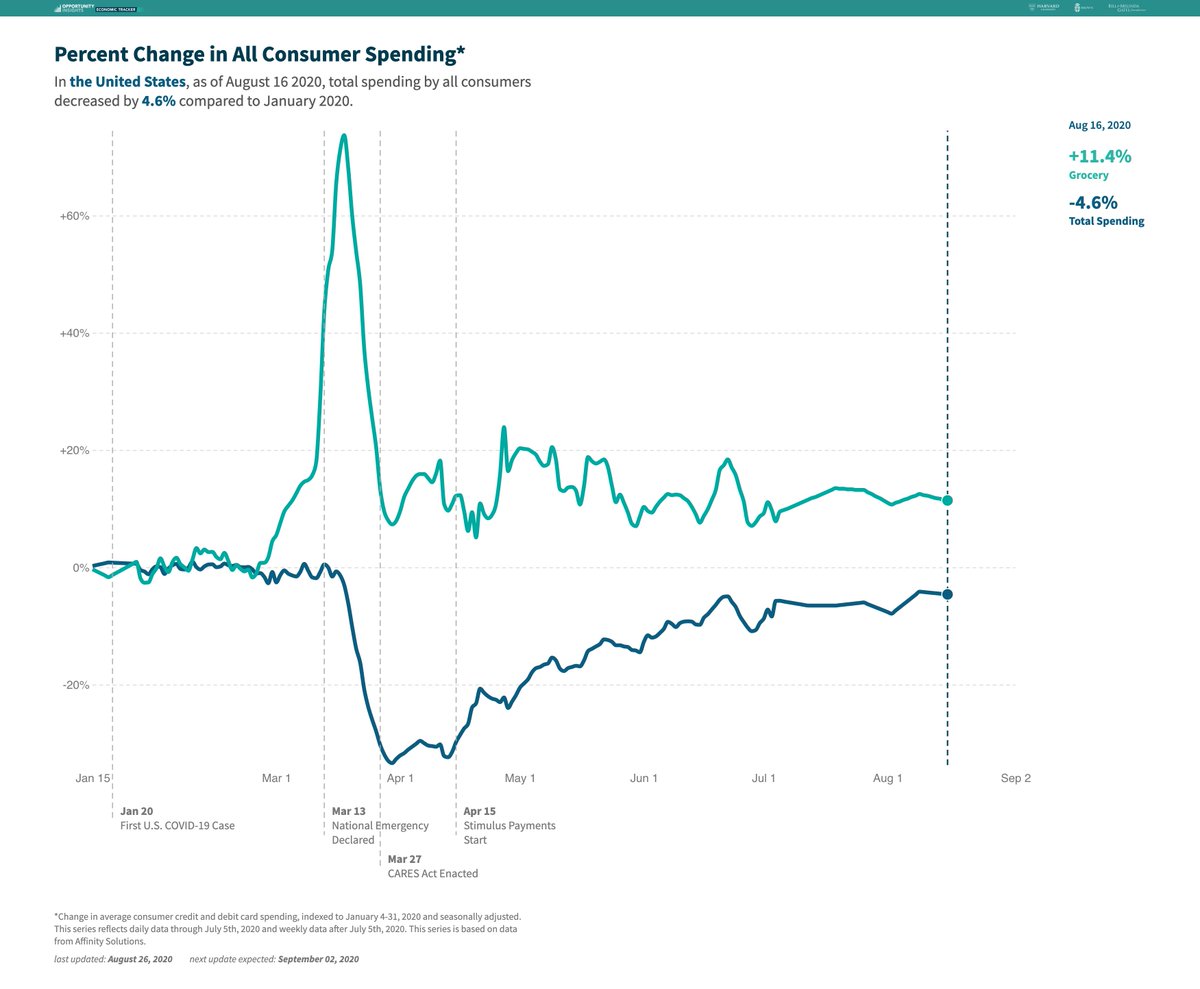

This chart illustrates the change in US consumer spending pre and post-viral economic lockdown. The dark blue line shows that American citizens are nowhere near spending what they once did before the viral crisis. Remember too, the US economic engine is a consumer spending driven affair.

Yet grocery stores are making a mint, given their having more pricing power, and a large increase in consumer spending for home-cooked meals. In other words, Jeff Bezos wins again.

Speaking of expensive stock prices. Now having just recently come off the new nominal S&P 500 record levels.

This chart illustrates that the post-2020 viral crisis rally to just recently hit record high levels have been based on six stocks ramping higher, including Amazon. Without their recent outperformance, the S&P 500 would still be negative for the year.

Stock bulls, given that they are mostly older in age. As in 3/4ths of the US stock market is owned by shareholders aged 55 and older.

They may want to take a look at insider stock sales volumes now near an all-time high for the month of August 2020. Perhaps think it through.

If management who operate these companies are selling at near-record volumes, you might want to consider taking some profits too.

Oh and don't look now, but here comes the antitrust trend on time to begin deflating this 2020s tech bubble versus gold and silver bullion.

Maybe you don't think this chart is going to roll over.

I and many of us here will be on the other side of that bet this decade.

Not that anyone should go all-in on bullion and precious metals. But rotating some profits into prudent bullion positions now is likely going to prove wise.

I'll leave a link in the comments below on why having up to 25% of one's investable net worth held in gold bullion allocations has made mathematical sense the last 50 years of full fiat currency time. That article contains information that could save an investment portfolio in the tumultuous years upcoming.

Information that the Ray Dalio's, Warren Buffett's, Scott Minerd’s, and other billionaires know. The critical setup and driving long view fiat Federal Reserve note debasement thesis and are increasingly allocating their wealth accordingly for both protection and potential asymmetric upside performance to come.

That's all for this week.

In case you missed it, I'll leave our recent Platinum Bullion fundamental video here and so check that out if you like.

And until next week take, great of yourselves and those that you love.