Chris Marcus of Acadia Economics hosts James Anderson of SD Bullion in this final part three of a three-part discussion about the state of precious metals and financial markets.

In this segment, Chris poses the question, “Will The Department Of Justice Stop Silver Manipulation?”

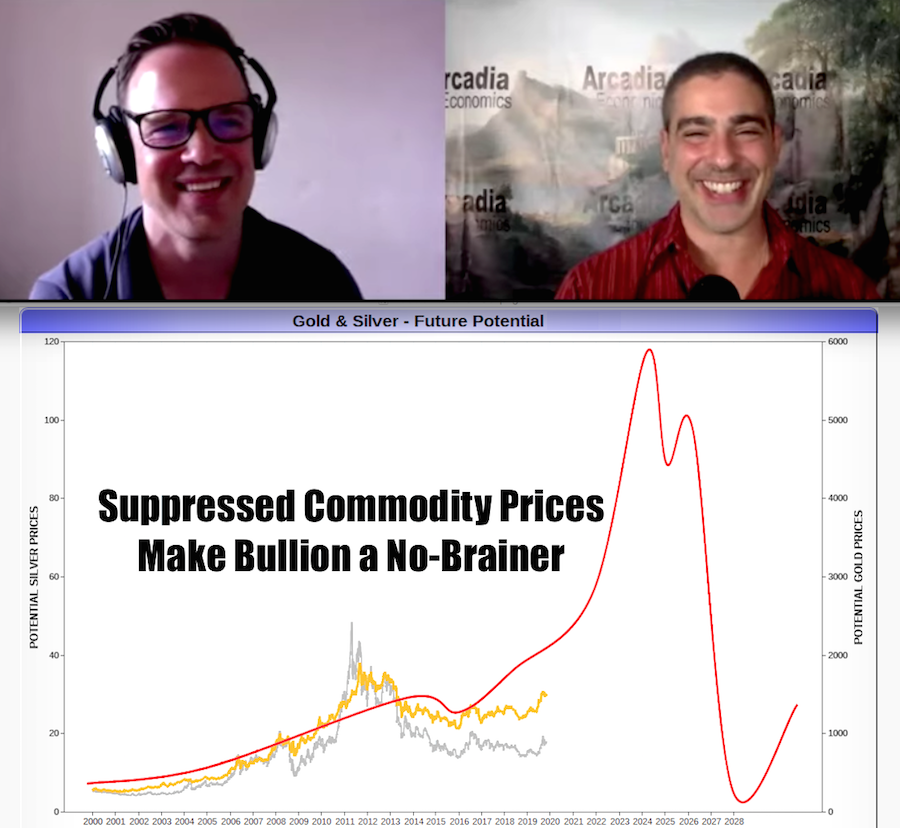

There are larger games afoot than just greedy derivative traders making bonuses, while silver maybe perhaps the tip of the commodity price suppressed sphere. James points out that systematic commodity price suppression and manipulation is a tool of financial warfare and empire.

Allowance of price rigging up and or down via outsized derivative leverage only devalues the underlying faith in our financial markets further. James remains confident the fiat Federal Reserve note and the vastly underfunded promise pile are going to have to be devalued and in many cases defaulted against.

The fiat US Dollar or more accurate, the fiat Federal Reserve note, is not just vastly set up to devalue against all commodity prices in the coming decades, but most sharply devaluing versus escalating precious metal values to come.

Knowing and often documenting much of both the silver price history and gold price history make James very confident that silver and gold bullion at the moment are both great long term value plays.

-

-

You can also find Part 2 (RE: are people buying bullion right now?) and Part 1 of this 3-part discussion here at the SD Bullion blog.

To learn more about best practices when either selling bullion or buying bullion, be sure to pick up our free SD Bullion Guide by email before you go.

When asked by Chris Marcus, which bullion products should US bullion buyers consider, James’ response is multifaceted. Not as simple as just one answer for everyone.

Not long ago he made a youtube playlist series explaining which bullion products are best using SD Bullion customers' wholistic preferences. What bullion products do they spend most of their fiat currency in acquiring?

Number #1 on that list is the American Silver Eagle Coin, followed by 1 oz Silver Rounds, American Gold Eagle Coins, and Canadian Silver Maple Leaf Coins.

Best Silver Gold Coins to Buy? | Go Watch the 11 Part Playlist

This top 10 Best Bullion Product playlist series you can watch here.

-

At some point too, like with any good trade, you may also want to eventually sell some silver for other capital allocations.

Here is a video explaining some tools one can use to better measure when doing so timing-wise may be best.

When to Sell Some Silver?

-

To learn more about best practices when either selling silver bullion or buying silver bullion, be sure to pick up our free SD Bullion Guide by email before you go.

***