When it comes to investing in gold, liquidity is everything. Whether you’re a seasoned investor or a new collector, having coins that are easily recognized, widely traded, and simple to sell can make all the difference.

Disclaimer: The information provided is for educational and general informational purposes only and should not be interpreted as financial or investment advice. Always consult a qualified professional before making decisions involving precious metals.

Pre-1933 U.S. gold coins are particularly prized not only for their intrinsic gold value but also for their historical significance, rarity, and ease of exchange.

In this guide, we’ll break down the most liquid pre-1933 gold coins on the market today, so you can better understand the characteristics and market history of these coins.

Key Takeaways

- Liquidity: Pre-1933 gold coins are widely recognized among collectors and dealers, which often makes them easier to sell.

- Widely traded pre-1933 gold coin types: $20 Saint-Gaudens, $10 Indian Head, $5 Half Eagles.

- Grade matters: Higher-graded coins (MS-60 and above) are generally associated with stronger market interest and higher premiums, and they often tend to sell more quickly in the marketplace.

- Smaller denominations: $2.50 Quarter Eagles and $1 coins provide fractional gold exposure.

- Dealer verification: Always buy and sell through reputable dealers, preferably with PCGS or NGC certification.

Why Liquidity Matters in Gold Investing

Liquidity refers to how easily an asset can be converted into cash without affecting its price. In the precious metals market, some coins are far easier to sell than others. Pre-1933 coins benefit from several advantages:

- Recognition: Coins like the $20 Saint-Gaudens or $10 Eagles are instantly recognized by dealers and collectors alike.

- Legal Tender History: Most pre-1933 gold coins are official U.S. currency, which enhances trust.

- Market Demand: High collector and investor demand often allows you to sell quickly at fair market value.

Understanding which coins have strong market recognition can help collectors better understand historical trading patterns.

Top Pre-1933 Gold Coins by Liquidity

Here’s a rundown of the most liquid gold coins that collectors and investors should know:

1. $20 Saint-Gaudens Double Eagle (1907–1933)

Widely regarded as one of the most beautiful U.S. coins ever minted, the Saint-Gaudens Double Eagle is widely regarded as one of the most frequently traded Pre-1933 U.S. Gold Coins.

Its high gold content (0.9675 oz) and iconic design make it a favorite among investors. Dealers rarely hesitate to buy or sell these coins, especially in common dates.

$20 Saint Gaudens Double Eagle Gold Coin (BU) - Random Year

Key Points:

- Gold Weight: 0.9675 oz

- Designer: Augustus Saint-Gaudens

- Liquidity: Very high; recognized globally

2. $10 Indian Head Eagle (1907–1933)

The $10 Indian Head Eagle is another highly liquid pre-1933 coin. Its smaller size compared to the $20 Double Eagle provides fractional exposure to gold, and it is also a popular option among collectors interested in smaller-denomination historical gold coins.

$10 Indian Eagle Gold Coin BU - Random Year

Key Points:

- Gold Weight: 0.48375 oz

- Designer: Augustus Saint-Gaudens (reverse by Miley)

- Liquidity: High; frequently bought and sold

3. $5 Liberty Head Half Eagle (1839–1908)

The Liberty Head Half Eagle offers a lower-cost entry point into gold investment while maintaining strong liquidity. These coins were struck between 1839 and 1908, so they enjoy strong collector demand.

$5 Liberty Half Eagle Gold Coin (BU) - Random Year

Key Points:

- Gold Weight: 0.24187 oz

- Designer: Christian Gobrecht

- Liquidity: Moderate to high

4. $2.50 Quarter Eagle (1908–1929)

Though smaller and less frequently traded than the Eagles, the Indian Head Quarter Eagles still maintain liquidity among collectors. They’re ideal for fractional investing or diversifying a gold portfolio. They are also unique in this list for featuring a distinctive incuse design, a rare characteristic in U.S. coinage History.

$2.50 Indian Quarter Eagle Gold Coin (BU) - Random Year

Key Points:

- Gold Weight: 0.12094 oz

- Designer: Bela Lyon Pratt

- Liquidity: Moderate; slightly more niche

5. $1 Gold Coins (1908–1933)

Gold Dollar coins are the smallest denomination and generally have lower premiums. While less liquid than the Eagles, they’re still recognized and commonly traded to reputable dealers.

$1 Indian Princess Liberty Head Gold Coin Type III BU - Random Year

Key Points:

- Gold Weight: 0.04837 oz

- Designer: Various

- Liquidity: Moderate; easier to sell in bundles

Most Liquid Pre-1933 Gold Coins

Here’s a concise list of coins that are easiest to trade:

|

Coin |

Gold Weight |

Designer |

Market Liquidity, Recognition, and Trading Activity |

|

$20 Saint-Gaudens Double Eagle |

0.9675 oz |

Augustus Saint-Gaudens |

Very High |

|

$10 Indian Head Eagle |

0.48375 oz |

Augustus Saint-Gaudens / Miley |

High |

|

$5 Liberty Head Half Eagle |

0.24187 oz |

Christian Gobrecht |

Moderate–High |

|

$2.50 Quarter Eagle |

0.12094 oz |

Bela Lyon Pratt |

Moderate |

|

$1 Gold Coin |

0.04837 oz |

Various |

Moderate |

Factors That Influence Coin Liquidity

$20 MS-65 St. Gaudens Double Eagle Gold Coin (NGC or PCGS) - Random Year

While these coins are historically liquid, several factors can impact their marketability:

- Condition and Grading – Coins with higher grades (MS-60+) can be associated with higher premiums and stronger buyer interest.

- Scarcity and Rarity – Rare dates or mint marks may increase demand but limit immediate buyers.

- Dealer Network – Collectors often favor reputable dealers for authentication, clear grading, and market trust, and coins sourced this way tend to be easier to resell.

- Historical Popularity – Coins with iconic designs or notable provenance tend to retain liquidity.

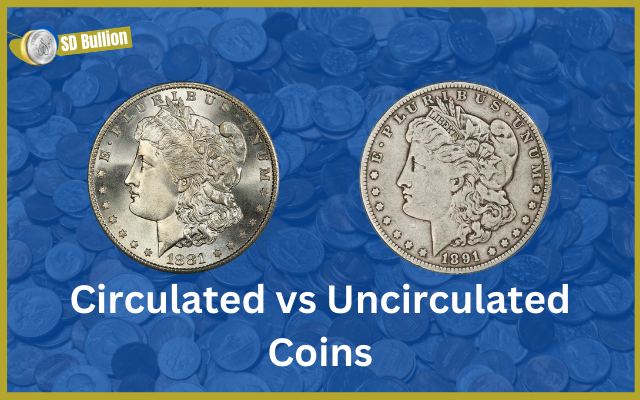

What is Coin Grading?

Coin grading is the process of evaluating a coin’s condition, quality, and visual appeal, which directly affects its market value and liquidity. Grading allows buyers and sellers to:

- Assess a coin’s worth accurately;

- Compare coins reliably;

- Facilitate faster sales through standardized evaluation.

The Sheldon Grading System

The Sheldon Grading System, developed in 1949 by Dr. William Sheldon, is the most widely used method in the U.S. It assigns a numeric grade from 1 to 70:

Tips for Buying and Selling Pre-1933 Gold Coins

- Commonly Collected and Widely Recognized Coins: Many collectors focus on $20 Double Eagles, $10 Eagles, or $5 Half Eagles for maximum liquidity.

- Check Grading and Authentication: Collectors commonly rely on PCGS or NGC certification for authentication and grading clarity.

- How Premiums Are Determined: Prices fluctuate based on condition, rarity, and market demand.

- Variety in Denominations: Mix denominations to provide flexibility for future sales.

Final Thoughts

Investing in pre-1933 gold coins offers the perfect blend of historical significance and market liquidity. By focusing on widely recognized coins like the $20 Saint-Gaudens or $10 Indian Head Eagle, this supports both value retention and smoother resale, since many collectors favor coins with broad market familiarity for selling back or trading exchange.

At SD Bullion, we believe in educating our customers so they can make informed decisions about gold investing. Pre-1933 gold coins are widely regarded as foundational pieces among collectors and investors, offering a blend of historical appeal, aesthetic interest, and strong historical market recognition. Their longstanding popularity contributes to consistent market activity for value retention, resale, and trading exchange.

Disclaimer: The information provided is for educational and general informational purposes only and should not be interpreted as financial or investment advice. Always consult a qualified professional before making decisions involving precious metals.