Jump to: Price Chart | Morgan Dollar History | Understanding the Value | Grading and Condition | Design | Rare and Valuable Morgan Dollars | Modern Silver Dollars | Investing in Morgan Dollars

Morgan Silver Dollars can be worth anywhere from nearly $40 to $2 million. Its large mintage and appealing design make it both accessible and desirable.

Key Takeaways

-

Morgan Silver Dollars can be relatively affordable in lower grades, averaging around $40, while well-preserved Mint State examples can climb into the thousands.

-

Exceptional condition rarities, however, such as the 1893-S Silver Dollar, may command prices well beyond a million dollars.

-

The historical significance of Morgan Silver Dollars lies in their reflection of the Second Industrial Revolution and Westward Expansion, symbolically embodying a period of rapid U.S. growth, innovation, and national values.

-

Each Morgan Silver Dollar contains 0.773 troy ounces of silver, giving it intrinsic value beyond collectibility and reinforcing its appeal as a precious metal investment.

-

The value of a Morgan Silver Dollar is best assessed by professional grading (such as PCGS and NGC), which verifies authenticity, condition, and rarity, ensuring accurate pricing in today’s market.

Silver Morgan Dollar Price Chart (Mint State)

The price guide includes values for every Morgan dollar minted from 1878 to 1904 and 1921 in Mint State. Please note that actual market prices may vary slightly when selling coins, depending on their condition.

|

Year-Mint |

MS65 |

MS66 |

MS67 |

MS68 |

|---|---|---|---|---|

|

1878 8TF |

2,700 |

6,000 |

72,500 |

110,000 |

|

1878 7/8TF Strong |

2,600 |

10,500 |

- |

- |

|

1878 7TF Reverse of 1878 |

750 |

3,000 |

35,000 |

- |

|

1878 7TF Reverse of 1879 |

2,150 |

7,000 |

60,000 |

- |

|

1878-CC |

2,400 |

6,000 |

68,000 |

- |

|

1878-S |

400 |

1,150 |

10,750 |

47,500 |

|

1879 |

575 |

1,700 |

37,500 |

- |

|

1879-CC |

26,000 |

125,000 |

- |

- |

|

1879-CC Capped Die |

52,500 |

- |

- |

- |

|

1879-S |

185 |

450 |

1,200 |

7,500 |

|

1879-S Reverse of 1878 |

10,500 |

52,500 |

- |

- |

|

1879-O |

2,750 |

12,000 |

- |

- |

|

1880 |

500 |

2,000 |

60,000 |

- |

|

1880 VAM 6 8/7 Spikes |

8,500 |

- |

- |

- |

|

1880 VAM 9 8/7 Stem |

1,500 |

12,500 |

- |

- |

|

1880 VAM 11 Checkmark |

600 |

2,300 |

- |

- |

|

1880/79 |

5,750 |

15,000 |

- |

- |

|

1880-CC |

1,500 |

2,800 |

20,000 |

300,000 |

|

1880/79-CC Reverse of 1878 |

3,250 |

6,000 |

- |

- |

|

1880-CC 8/High 7 |

1,650 |

3,850 |

26,500 |

- |

|

1880-CC 8/Low 7 |

1,550 |

3,750 |

28,500 |

- |

|

1880-CC 8/7 Reverse of 1878 |

3,000 |

5,500 |

35,000 |

- |

|

1880-S |

185 |

385 |

1,100 |

5,500 |

|

1880/79-S |

450 |

750 |

2,500 |

31,500 |

|

1880-S 8/7 |

400 |

1,050 |

2,500 |

- |

|

1880/9-S |

315 |

750 |

2,450 |

17,500 |

|

1880-O |

14,000 |

200,000 |

- |

- |

|

1880/79-O |

22,500 |

- |

- |

- |

|

1881 |

450 |

1,600 |

20,000 |

- |

|

1881-CC |

1,200 |

1,750 |

6,000 |

65,000 |

|

1881-S |

185 |

385 |

1,100 |

6,500 |

|

1881-O |

1,050 |

7,500 |

75,000 |

- |

|

1882 |

400 |

1,250 |

20,000 |

100,000 |

|

1882-CC |

650 |

1,250 |

8,000 |

60,000 |

|

1882-S |

250 |

400 |

1,100 |

7,500 |

|

1882-O |

650 |

4,150 |

36,500 |

65,000 |

|

1882-O/S Strong |

52,500 |

- |

-- |

- |

|

1882-O/S Weak |

7,250 |

- |

- |

- |

|

1882-O VAM 5, O/S Broken |

6,000 |

-- |

- |

- |

|

1883 |

260 |

650 |

2,700 |

28,000 |

|

1883-CC |

575 |

1,250 |

4,750 |

72,500 |

|

1883-S |

65,000 |

95,000 |

225,000 |

- |

|

1883-O |

185 |

475 |

3,500 |

65,000 |

|

1884 |

325 |

775 |

4,250 |

62,500 |

|

1884-CC |

575 |

1,250 |

4,500 |

46,500 |

|

1884-S |

295,000 |

- |

750,000 |

900,000 |

|

1884-O |

185 |

450 |

2,500 |

12,500 |

|

1885 |

240 |

435 |

2,100 |

36,000 |

|

1885-CC |

1,450 |

2,600 |

10,250 |

80,000 |

|

1885-CC VAM 4 Doubled Dash GSA Hoard |

3,000 |

8,500 |

- |

- |

|

1885-S |

2,000 |

5,500 |

60,000 |

- |

|

1885-O |

185 |

450 |

1,550 |

30,000 |

|

1886 |

185 |

475 |

1,400 |

18,500 |

|

1886-S |

2,150 |

8,500 |

63,500 |

- |

|

1886-O |

285,000 |

- |

-- |

- |

|

1887 |

185 |

425 |

1,700 |

30,000 |

|

1887/6 |

2,600 |

8,000 |

- |

- |

|

1887-S |

1,750 |

10,500 |

75,000 |

- |

|

1887-O |

2,500 |

28,000 |

- |

- |

|

1887/6-O |

47,500 |

- |

- |

- |

|

1888 |

260 |

700 |

7,250 |

- |

|

1888-S |

2,500 |

6,500 |

50,000 |

- |

|

1888-O |

400 |

1,800 |

18,500 |

- |

|

1889 |

300 |

1,000 |

15,000 |

37,500 |

|

1889-CC |

375,000 |

750,000 |

850,000 |

1,000,000 |

|

1889-S |

1,800 |

4,500 |

65,000 |

- |

|

1889-O |

3,000 |

18,500 |

- |

- |

|

1890 |

950 |

20,000 |

- |

- |

|

1890-CC |

5,500 |

34,000 |

- |

- |

|

1890-CC Tailbar |

32,500 |

- |

- |

- |

|

1890-S |

900 |

2,400 |

20,000 |

- |

|

1890-O |

1,100 |

11,750 |

- |

- |

|

1891 |

2,400 |

14,500 |

47,500 |

- |

|

1891-CC |

4,500 |

19,000 |

65,000 |

- |

|

1891-S |

1,650 |

5,150 |

18,000 |

- |

|

1891-O |

5,500 |

120,000 |

- |

- |

|

1892 |

3,150 |

55,000 |

- |

- |

|

1892-CC |

8,750 |

23,000 |

110,000 |

- |

|

1892-S |

285,000 |

375,000 |

550,000 |

900,000 |

|

1892-O |

4,000 |

27,000 |

250,000 |

- |

|

1893 |

6,500 |

67,500 |

- |

- |

|

1893-CC |

110,000 |

235,000 |

- |

- |

|

1893-S |

775,000 |

- |

2,250,000 |

- |

|

1893-O |

180,000 |

- |

- |

- |

|

1894 |

33,500 |

150,000 |

235,000 |

- |

|

1894-S |

6,500 |

17,500 |

77,500 |

- |

|

1894-O |

56,500 |

- |

- |

- |

|

1895-S |

22,500 |

100,000 |

225,000 |

- |

|

1895-O |

325,000 |

425,000 |

650,000 |

- |

|

1896 |

260 |

450 |

1,600 |

- |

|

1896-S |

11,750 |

85,000 |

150,000 |

- |

|

1896-O |

200,000 |

585,000 |

- |

- |

|

1897 |

325 |

1,050 |

5,750 |

80,000 |

|

1897-S |

600 |

1,650 |

8,000 |

38,500 |

|

1897-O |

75,000 |

240,000 |

385,000 |

- |

|

1898 |

265 |

575 |

3,300 |

- |

|

1898-S |

2,400 |

6,000 |

32,500 |

150,000 |

|

1898-O |

225 |

425 |

2,000 |

27,500 |

|

1899 |

1,000 |

2,600 |

10,000 |

- |

|

1899-S |

2,350 |

5,850 |

18,000 |

- |

|

1899-O |

225 |

450 |

3,200 |

40,000 |

|

1899-O Micro O |

55,000 |

92,500 |

- |

- |

|

1900 |

260 |

575 |

5,000 |

- |

|

1900-S |

1,600 |

2,700 |

38,500 |

- |

|

1900-O |

185 |

575 |

3,250 |

- |

|

1900-O/CC |

2,700 |

6,250 |

45,000 |

- |

|

1901 |

325,000 |

700,000 |

- |

- |

|

1901-S |

3,500 |

11,500 |

32,500 |

- |

|

1901-O |

240 |

775 |

15,500 |

75,000 |

|

1902 |

450 |

1,000 |

7,000 |

- |

|

1902-S |

2,500 |

7,000 |

90,000 |

- |

|

1902-O |

250 |

550 |

7,000 |

- |

|

1903 |

350 |

675 |

3,750 |

36,000 |

|

1903-S |

17,500 |

28,000 |

120,000 |

- |

|

1903-O |

1,150 |

1,650 |

5,750 |

- |

|

1904 |

1,900 |

5,750 |

40,000 |

- |

|

1904-S |

8,750 |

28,500 |

87,500 |

- |

|

1904-O |

185 |

450 |

4,500 |

- |

|

1921 |

175 |

725 |

11,500 |

- |

|

1921-D |

575 |

1,050 |

17,500 |

- |

|

1921-S |

875 |

3,250 |

32,500 |

- |

Data from PCGS Price Guide.

The true value of these coins, however, cannot be fully appreciated without looking back at the historical moment that shaped them into the enduring symbol they represent for collectors and numismatists today.

History and Importance of Morgan Silver Dollars

Given the unstable economic conditions in the U.S., silver miners and other agricultural owners believed that expanding the money supply would benefit the economy. So, Congress passed the Bland-Allison Act in 1878. A law that required the Treasury to buy millions of ounces of silver monthly and strike them into silver dollars.

This led to the introduction of the Morgan Dollar, which replaced the earlier Trade Dollars. A bit later, the Sherman Silver Purchase Act (1890) increased the country's purchase of silver, allowing for the larger production of silver dollars.

However, when silver reserves were depleted in 1904, the striking of Morgan silver dollars ceased. And during this hiatus, the Pittman Act led to the melting down of millions of silver dollar coins to sell silver overseas during the First World War.

Finally, the Act also required the government to replace these melted coins by purchasing domestic silver and minting new silver dollars. This mandate led to the revival of the Morgan Dollar and a massive one-year mintage in 1921, before it was replaced by the Peace Dollar.

The Morgan Dollar is more than just currency; each issue reflects key moments in U.S. economic policy, legislation, and the silver industry, lending the coin a rich historical legacy.

Understanding Morgan Silver Dollar Value

Beyond their historical significance, the value of Morgan Dollars also depends on key numismatic factors, including the year of issue, mint marks, rarity, and condition.

Factors Affecting Value: Year, Mint Marks, Scarcity, and Condition

As mentioned before, the Morgan Dollars were minted continuously from 1878 to 1904 and again in 1921.

They were struck at several U.S. Branch Mints, including the Carson City Mint (CC), the Philadelphia (No Mint Marks), the New Orleans (O), the San Francisco (S), and the Denver Mint (D). Except for the Philadelphia Mint, each facility placed its mintmark on the reverse of the coin, just below the ribbon bow of the wreath.

In general, the value of a Morgan Silver Dollar is determined less by its mintage rarity and more by how well-preserved it is, since the coin was produced in very large quantities. This factor is especially important in defining the desirability of the key dates.

How to Determine the Morgan Silver Dollar Values

Some people have their coins appraised just to determine how much they could sell them for in the market, while others have their coins appraised for collectible purposes, such as verifying their authenticity, composition, and quality, as well as their preservation status.

Services like PCGS and NGC, both on the market since the 1980s, authenticate, grade, and encapsulate coins in protective holders, guaranteeing their authenticity and assigned grade on a 1-70 numerical scale.

This process protects collectors from fraud, ensures market acceptance, and enhances the value of the coins they certify.

Grading and Condition of Morgan Dollars

Judging Condition: Identify Grade and Determine Value

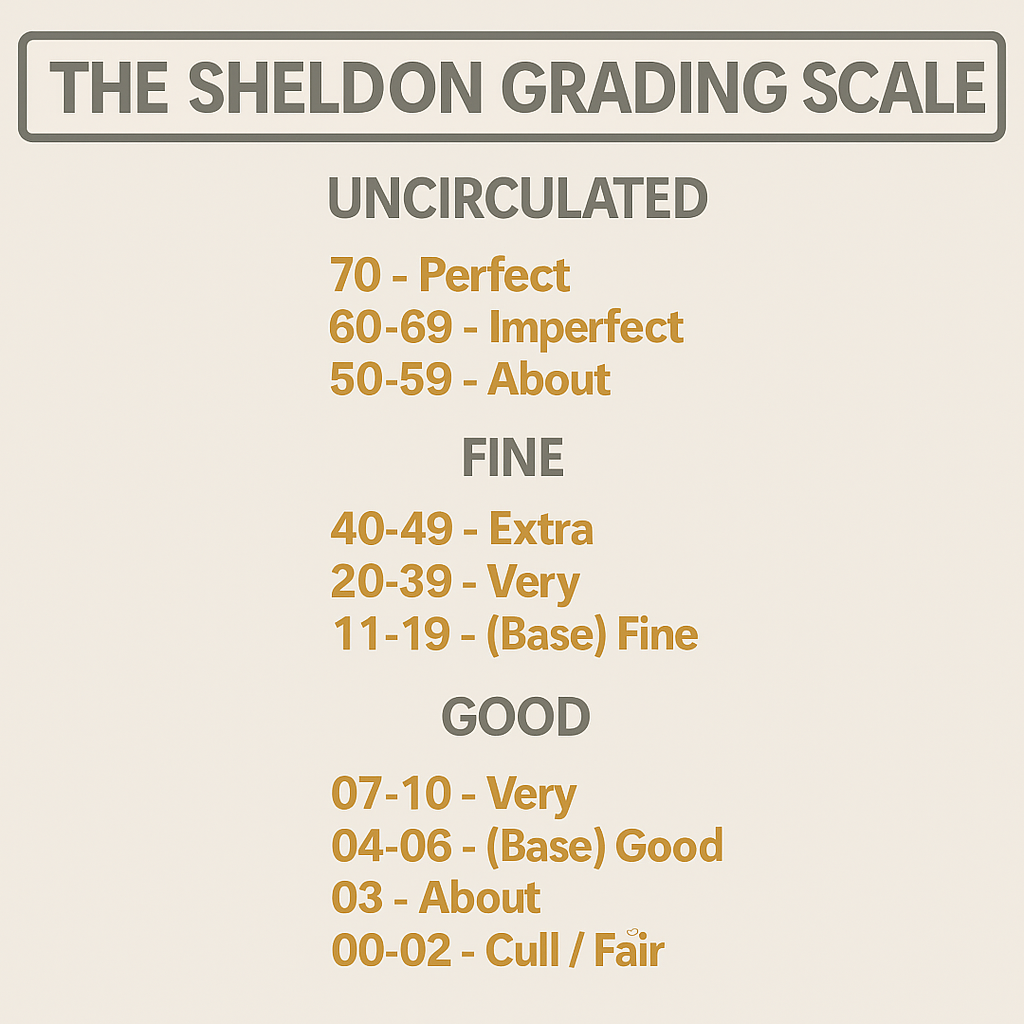

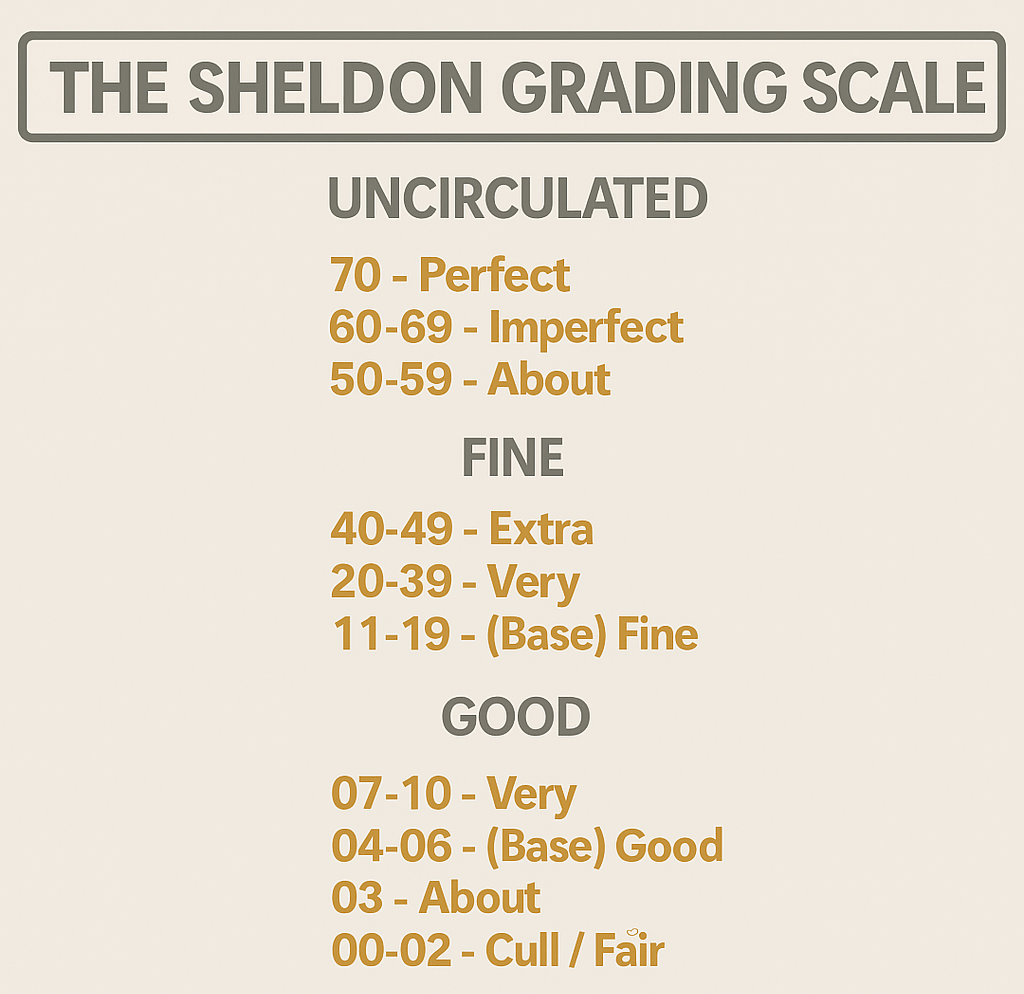

The more respected grading agencies, like the NGC and PCGS, use the Sheldon Scale to assign standardized grades to all coin specimens. The scale ranges from 1 (heavily worn) to 70 (virtually perfect) and is preceded by letters that indicate the strike type of the coin in question. While the Sheldon Scale used by these companies remains consistent, the designations and letters used to denote strike type often vary.

Uncirculated coins are assigned a number between 60 and 70 to indicate their condition. A grade of 70 is considered flawless because it doesn’t display any surface imperfections, even when inspected by experts under magnification. And because of that, collectors and investors are quite willing to bear the premiums they command.

MS (Mint State): Uncirculated coins graded 60–70 on the Sheldon Scale.

PF/PR (Proof): Coins struck for collectors, graded 60–70. “PF” is used by NGC, “PR” by PCGS; both mean proof coins.

Consider obtaining a free, no-pressure online appraisal to determine the value of your Morgan silver dollars.

Morgan Silver Dollar Design

Much of the Morgan Dollar’s allure also comes from its silver content and iconic design, which embodies traditional American values, freedom, and the spirit of resilience.

Weight and Silver Content of Morgan Silver Dollars

Morgan Silver Dollars weigh 26.73 grams and are composed of 90% silver and 10% copper, giving them 0.773 troy ounces of pure silver. In the precious metals industry, the quantity of gold or silver is typically expressed in troy ounces (with one troy ounce equal to 31.103 grams).

This silver content not only provides intrinsic value based on bullion prices, but also adds to the appeal of Morgan Dollars as both collectible coins and tangible assets.

The Morgan Silver Dollar Creator, Design, and Features

The iconic Morgan Dollar design was created by Chief Engraver George T. Morgan of the Mint. He studied at the Birmingham art school in England before moving to the United States to work at the U.S. Mint in Philadelphia. He served as the assistant engraver to Chief Charles Barber and then succeeded him in the role in 1917 following Barber's death.

On the obverse, Lady Liberty, a longstanding symbol of freedom and democracy on U.S. coinage, appears in profile. She wears a cap adorned with flora and a crown inscribed with the word 'LIBERTY.' Surrounding her are 13 stars, the motto 'E PLURIBUS UNUM,' and the year of issue.

A 1878-S $1 Regular Strike Morgan Silver Dollar

The reverse design features a bald eagle with outstretched wings, clutching an arrow in one talon and an olive branch in the other, framed by a wreath. This is one of the most enduring images in American coinage, embodying the nation’s strength and courage at a time of rapid transformation.

The arrows symbolize readiness for conflict, reflecting the challenges of protecting a growing nation, while the olive branch conveys the enduring desire for peace. The wreath signifies honor and achievement, referring to the progress of westward expansion at that time, and the industrial advances of the Second Industrial Revolution that were reshaping the country.

Rare and Valuable Morgan Silver Dollars

Now that we have covered the coin’s background and composition, here are the Morgan Dollars that command the highest value.

1878 Morgan Silver Dollar, 8-Tail Feathers (Regular Strike)

In discussions of the Morgan Silver Dollar, there are few minting errors as significant as the condition rarities highlighted here. Still, no article on the series would be complete without mentioning the 1878 8-Tail Feathers, which is a design error that inaccurately depicted the eagle.

The first 1878 Morgan Dollars showed eight tail feathers, though bald eagles have only seven. Compare the differences below:

According to Ron Guth, a specialist Numismatist, nearly 750,000 were struck before the correction. Collectors, however, note variations in the number of wing feathers, adding interest to the issue. While common in Uncirculated grades, they are scarce in Gem condition.

Some coins exhibit unusually reflective, mirror-like surfaces, known as Prooflike (PL) or the even deeper Deep Mirror Prooflike (DMPL). These are much harder to find, and in grades of MS-64 or higher, DMPLs are especially rare.

The coin depicted earlier was sold for $55,813 at Legend Rare Coin Auctions in 2015, and it is currently worth around $85,000.

1896-S Morgan Silver Dollar (Regular Strike)

While the 1896-S Morgan dollar is relatively accessible in lower grades, in Mint State it becomes significantly scarce.

The coin pictured above is an exceptionally well-preserved example that has passed through the hands of several renowned coin collectors, making it a true sought-after condition rarity.

PCGS has certified only a single specimen at MS69, which set an auction record of $720,000 at Stack’s Bowers in 2020.

1884-S Morgan Silver Dollar (Regular Strike)

This coin stands as a true condition rarity, while thousands exist in lower grades, examples in exceptional preservation are almost never encountered. Its allure lies in the fact that collectors may spend years searching for a specimen of this caliber, as it rarely comes to market.

The auction record was set at $750,000 for an MS68 sold by Stack’s Bowers in 2020. Today, such a coin could easily command close to $900,000, reflecting both its enduring desirability among serious collectors.

1886-O Morgan Silver Dollar, Deep Mirror Proof Like (Regular Strike)

The 1886 from the New Orleans Mint is extremely rare in Gem or higher grades, and this example stands out as virtually pristine. It is brilliant, mark-free surfaces display a remarkable deep cameo finish, with mirrored fields that provide a striking contrast to the frosted design.

The sharp strike suggests it was struck from an early die state, before most others. Given the rarity of Mint State survivors, especially Prooflike and Deep Mirror Prooflike pieces, few collectors will ever encounter such a specimen, making this coin’s exceptional preservation all the more extraordinary.

The Deep Mirror Proof Like coins are struck the same way as those intended for circulation, but have unusually clean mirror-like fields and frosted devices that are very similar to a Proof Coin finish. Unlike Proof-Like (PL) coins, DMPLs have more pronounced frosted devices.

The auction record for this coin stands at $780,000 for an MS67DMPL sold in 2020, at Stack’s Bowers; today, PCGS experts estimate it could easily reach $1,000,000.

1889-CC Morgan Silver Dollar (Regular Strike)

Among Carson City Mint issues, the 1889-CC, featuring the Carson City mint mark, is considered the crown jewel of the series.

Once held in a single private collection for 55 years, this coin is one that seldom appears on the market, adding to its mystique. The last public auction record was set in 2013 at Stack’s Bowers, where an MS68 example achieved $881,250.

For collectors fortunate enough to encounter an 1889-CC in MS68, the piece represents not only the pinnacle of condition but also a trophy coin that could command around $ 1 million if brought to auction today.

1893-S (Regular Strike) The Most Valuable Morgan Silver Dollar: A Closer Look

David Hall, one of the founders of PCGS, has noted that in Mint State condition, the 1893-S Silver Dollar is the rarest of all Morgan dollars. In Gem condition (MS65 or higher), it is considered a true rarity, with perhaps only six or seven known examples. With the lowest mintage of the entire Morgan dollar series, the 1893-S holds a near-legendary status among collectors.

Because counterfeiting is common, often involving the simple addition of an “S” mintmark to a Philadelphia 1893 issue, any example not already certified requires the utmost scrutiny and authentication.

The most recent record sale took place at GreatCollections, where an MS coin sold for $2,086,875 after spirited bidding. Today, PCGS experts estimate that, if offered at auction, this 1983 San Francisco Mint could command around $2.25 million.

According to their sale description, the coin’s pristine fields and sharp strike suggest it likely never spent time in a Morgan dollar bag or even in a paper bankroll.

Modern Morgan Silver dollars

With its strong eye appeal and historical significance, the US Mint decided to celebrate the history of the Modern Silver Dollar in 2021.

Honoring the last minting and the first minting of the Morgan and Peace silver dollars, the mint released collectors' versions of both in 2021.

Since the purposes of the coins differ, some details and a few modifications vary: one was historic and intended for circulation, while the modern silver dollars are designed for investment or coin collection.

Now, how much silver is in a Morgan silver dollar depends on the year that you have:

From 1878 to 1904 and 1921, Morgan silver dollars contained 0.7734 Troy oz of 90% silver with a balance of 10% copper for added resistance. On the other hand, Modern silver dollars contain 0.859 Troy oz of 0.999 pure silver.

While silver bars are favored for bulk investment due to their lower premiums, silver coins remain popular among investors for their liquidity, collectibility, and global recognition.

Selling, Collecting, or Investing in Morgan Silver Dollars

Where to sell or buy

The best place to sell coins depends on their value. Auction houses, such as Heritage Auctions or Stack's Bowers Galleries, are popular options for high-value items. Online or local coin dealers are suitable for a straightforward process, while eBay offers broad exposure to collectors.

For precious metals, such as gold or silver bullion coins, specialized dealers are a good choice. In contrast, auction houses are ideal for rare coins, as they can create bidding wars that drive prices higher.

Silver as an Investment

Recently, gold has performed strongly amid economic downturns and geopolitical uncertainty, with prices expected to climb as investors continue to view it as a hedge against inflation.

While silver’s value is more closely tied to industrial demand, it also holds an important role as a precious metal, offering a more affordable alternative to gold while serving as a hedge in its own right.

In fact, silver is an even better conductor of electricity than copper, making it the preferred metal for many high-end electronic applications.

This vital industrial role, combined with its status as a precious metal, has led some specialists to argue that silver is uniquely positioned as a dual-purpose asset, serving both as a strategic material in modern technology and as a reliable hedge for investors.

Final Takeaway

Morgan Silver Dollars remain one of the most popular U.S. coin series, valued not only for their silver content but also for their condition rarities, which can bring millions at auction. While lower-grade examples are common, well-preserved pieces are true treasures.

Beyond their melt value for silver stacking, professional grading is essential to confirm authenticity and historical significance. Whether collecting, selling, or investing, the Morgan series continues to hold a lasting legacy and relevance today.