We start the brief video below with some tell-a-vision from January 3, 1980.

The local Indianapolis news clip played moments before the late-night Johnny Carson show came on to put us collectively asleep.

Eighteen days later, the fiat Federal Reserve note hit a then-record gold price of over $850 oz and a futures silver price high peak of over $50 oz which still somehow stands forty-one years later.

This recent video update below is the 4th continuous version of a long-term gold silver price forecast that we have been doing at SD Bullion.

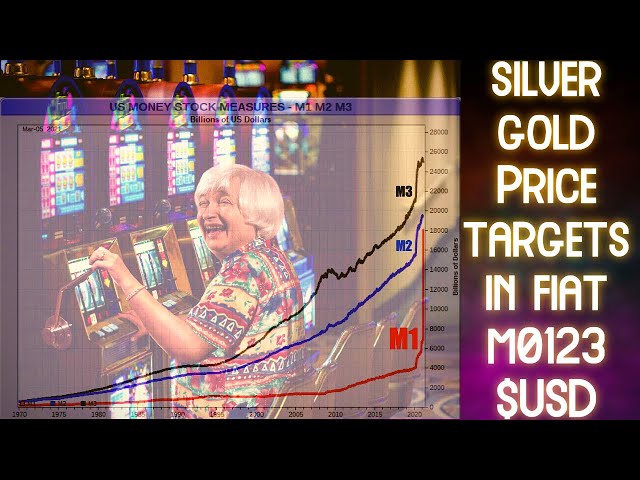

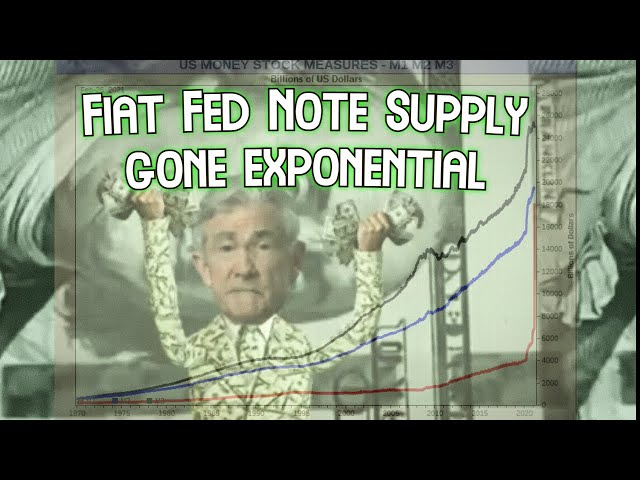

Just last week, we broke news to our viewers that the private Federal Reserve central bank of the USA has effectively bastardized the old M1 fiat Federal Reserve note measurement.

The good news is, we still have the ballooning M0 fiat monetary base figures to look at.

It’s becoming more and more probable that collectively, enough people around the world, are going to freak out and buy bullion in mass. That by the way will help usher in the massive currency inflation record indebted governments and private sector players are going to need to exit the holes they have dug.

And in that, the upcoming #GoldSqueeze will force the historical gold price to ramp exponentially yet again.

At the end of this video, be sure to check out how apparently overnight the silver price trading data has already gone exponential.

ADDITIONAL RELATED Links:

Update #3 - Dec 4, 2020 - https://youtu.be/2-qpaB7te9A

Update #2 - June 26, 2020 - https://youtu.be/q4WgHTJ94pc

Update #1 - April 22, 2020 - https://youtu.be/T2hmYG5IiqI

GOOGLE DOC with four tabs of sources, related data, and price charts.

They’re not gonna stop creating fiat currency, so subscribe and we’ll reconvene in a few months to see how much higher things have moved since.

That’s it for this fourth price target update. Take great care of yourselves, and those you love.