Economic data points and Fed meetings are going to start mattering again. With regards to the former, we learned just yesterday that retail sales came in weak for the month of February, down 3% from January and clearly showing the effect the Federal government’s fiscal “stimulus” has on consumer spending. That is to say, when the money is flowing, the spending is instant.

When the money is not flowing, however, retail sales seem to suffer:

December was weak for retail sales. Recall that Trump signed off on the second coronavirus fiscal stimulus package the very last week in December, and because of the holidays, that money really only began hitting bank accounts in early January. To nobody’s surprise, or at least it shouldn’t be, the first month of 2021 featured spectacular retail sales, although the sugar high wore off after just one month of robust spending, in part because the economic impact payments were less ($600), and in my opinion, since the Federal government dragged its feet for so long in bringing round two from concept to fruition, also in part because the January stimulus money was most likely already spent, or planned to be spent, long before it was ever handed out.

Fast forward to this month of March, this very week even, and the latest round of economic impact payments are hitting bank accounts once again, so it seems the Great American Consumer is poised for some good old-fashioned spending throughout the rest of the month. Now that the pandemic is for the most part behind us, and now that the election is also behind us, two things which rendered economic data points meaningless for quite some time, the question becomes: What now?

Thankfully, or unfortunately, or whatever, Fed Chair Jerome Powell will be giving a post-FOMC meeting press conference today at 2:30 p.m. EST, in which he answers some derivative of that question and more.

Here is a sampling of some of the things on an arguably anxious Main Street’s mind:

- Are we now in an inflationary environment that is more than just “transitory”?

- What are we to make of rising yields on government bonds, and will the Fed do something about it, like “yield curve control”?

- If the pandemic is for the most part behind us, how much additional “stimulus” do the markets and the economy actually need?

You see, market participants know the Fed is not going to raise interest rates. Powell has made it very clear that any raising of interest rates will be signaled well in advance of the actual “hike”. Of course, the Fed can cut rates any time it likes, with no prior warning given, such as the “emergency” Sunday night rate cut down to zero about one year ago as the markets were crashing, but when it comes to raising interest rates, that’s not happening.

So what will market participants be looking for today?

They’ll be looking to see if Powell, during his press conference, comes off as “hawkish” or “dovish”. If he comes off as hawkish, then that could spell trouble for the markets as they begin to anticipate and price-in less hand-holding and less loose monetary policy from the Fed. If Powell comes off as dovish, meaning the markets and the economy are in need of a Fed boost in one form or another, then that could be music to people’s ears as it means the Fed’s easy money policies will continue to be easy.

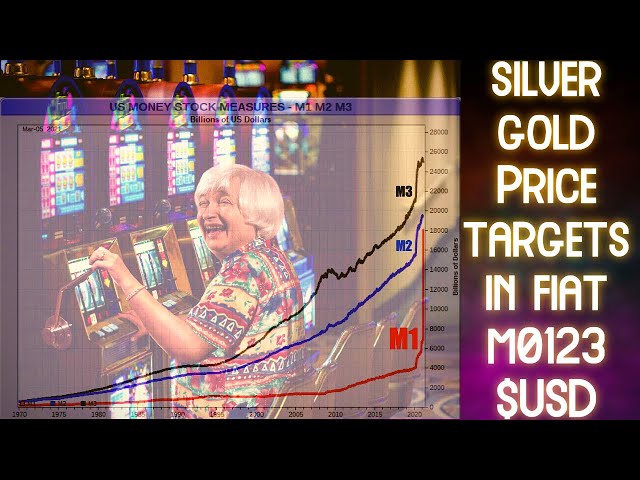

The bottom line is whether Powell is hawkish, or dovish, or something else, the Fed is trapped. That is to say, the Fed can’t raise interest rates because the debt burden is too high and the servicing of the debt would be unmanageable. This means buying any and all bonds needed to keep interest rates artificially suppressed. Yet keeping interest rates low, by brute force, comes at the cost of debasing the dollar, so it’s danged if they do and danged if they don’t.

At best, perhaps Powell and the Fed are trying to crash land this plane? The problem is, however, one of the engines has blown, one of the wings has shredded, the landing gear won’t drop, the downward spiral is disorienting for the pilots and the plane is losing jet fuel very fast, so, um, yeah.

Good luck with that.

And at worst?

At worst is the topic for a different article some other day.

Crude oil nearly hit $68 the other day:

The pullbacks have been very shallow over the last year, haven't they?

Copper's pullbacks have been more dramatic, however:

From peak to trough, we're talking about a more than 12% move to the downside, but overall, the message being sent from the commodities is clear: Inflation is not only here but could quickly become a thorn in the economic recovery's side.

Palladium surged over a hundred bucks yesterday:

Supply chain disruptions continue to be a thing as we move into the Spring of 2021.

Platinum's recent peak to trough is a move of over 17.5% to the downside:

Still, platinum is up over 11%, year-to-date.

The signs of inflation really are everywhere, aren't they?

Everywhere, that is, except for in gold:

Some might say there's a reason gold's daily chart looks the way it does, myself included.

In other words, the ultimate "inflation hedge" is signaling there's nothing to worry about:

If Powell knocks it out of the park today, or, if he fails spectacularly, we could really see some interesting price action in the markets and maybe even a recoupling of gold & silver this very week!

That said, silver is signaling it would like to be the one to catch-down to gold:

Because if the technicals matter, then not being able to punch through the 50-day moving average is concerning, and it's concerning in a bearish kind of way.

The VIX put in new 52-week lows just yesterday:

That's eight straight days of waning fear in the markets!

Of course, it coincides with record high after record high after record high in the stock market:

Everybody is absolutely certain that the stock market can only go up, especially with the latest round of "stimmy checks" being doled out, and even if there is a hiccup in the market, it is generally assumed the "Fed Put" will kick in and save the markets from any significant downside price action.

This propping-up of markets comes at a cost, however, just like the Fed's next move on interest rates will come at a cost:

The $64,000 question is, "at what rate of interest will the Fed spring into action"?

The dollar's short-term strength is still intact:

With economic data points and Fed meetings starting to matter again, those small intra-day moves may soon be a thing of the past.

Thanks for reading,

Paul Eberhart