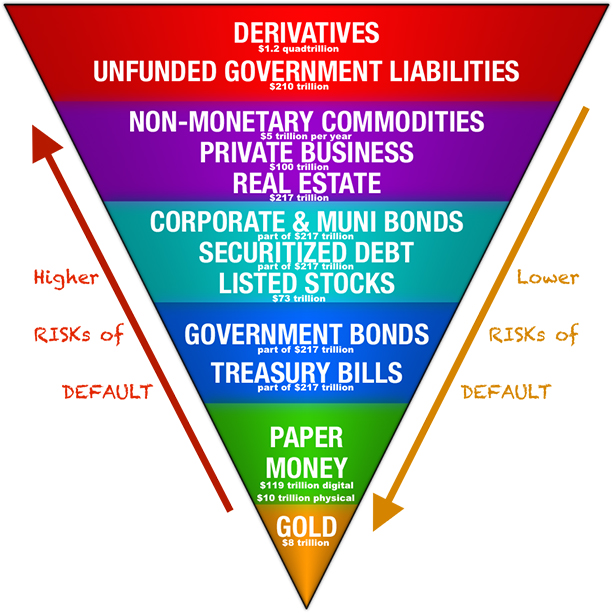

Another week of selloffs in the precious metals derivative-driven spot price complex.

The gold-silver ratio has climbed a bit, likely to close this week around 67 oz of spot to theoretically get 1 oz of spot gold.

The gold spot price has tremendously unskilled below its 200-day moving average. Is it possible we are tiptoeing into 2008 like deleveraging bankruptcy phase event?

If you recall last week, we used late 1978 as an analog to try and surmise how low and long this selloff consolidation could go.

Time will tell of course, but if you are bullish on gold given the seemingly endless fiat currency creation ongoing, now is a good time to be adding to your long-term positions.

The silver spot price is still hovering above its 200-day moving average by over one fiat fed note to close the week.

For bullion holders, the valuation downside is currently limited given the outsized demand and limited available supplies for sale at these current spot price points.

Looking back at the last silver spot price spike to $30 oz just over one month of time ago.

We're reminded that the CFTC is not here to regulate the commercial and foreign central banks they are beholden to.

Rather they have been since that time using scare tactics to try and freeze the #SilverSqueeze movement from buying and holding physical bullion for the long term, while also being so vocal online.

Earlier this week a silver squeeze related Bloomberg Law Article chimed in by trying to scare retail silver bulls. I will leave the link in the show notes.

If you take the time to read the legal requirements there is no case against average silver squeeze bulls acting on their own merit, buying bullion and enjoying the comradery of others who are doing so too.

Silver Price Rigging Now Over Five Decades (Outside NY Trading Hours)

This is the silver price chart spanning from 1970 until now in the year 2021, using all the aggregate trading data outside of New York trading hours.

Perhaps if the CFTC were doing its supposed charge, this chart would not have gone exponential in the last few years.

Outside of NY trading hours the price of silver has now aggregated above $227 oz over the last five decades plus.

Here is that same chart using a logarithmic format.

Silver Price Manipulation Over Five Decades Running (Log)

The red line is the silver price at the start of each NY trading session.

The black line is the intra New York trading silver price data.

We began in 1970 at a silver price of $1.925 oz.

We are now at a cool 21¢ per troy ounce of silver using intra New York trading data over five decades of time.

You could report this to the CFTC if you like. You would literally be shouting into a void, wasting precious seconds of your time.

I say this because many of us know the history.

Wikileaks published US Treasury cables which reveal that the agency and its politically appointed commissioners were born by the COMEX gold futures startup in 1975. Back when the US Treasury was looking to dissuade US citizens from saving soon-to-be re-legalized private gold bullion over consistently devaluing fiat Federal Reserve notes. You can scroll down there for backlinks to these facts - https://sdbullion.com/gold-prices-1974

Not some market neutral referee, rather the CFTC has been doing the fiat financial power's political bidding ever since.

The smarter long term bullion money will just side step leverage and take the lessons from the Hunt Brothers' alleged silver squeeze failure.

Not playing in their soon to fail derivative price discovery game is how to win over the long haul.

Meantime, enjoy the subsidized price suppressed discounts on silver bullion before they end.