There will come a time when the additional stimulus does more harm than good if it can be argued that the stimulus does any good at all. Worse yet, there will come a time when additional stimulus only does harm.

Casting sanctions, geo-politics, and myriad complexities aside, if we need a real-time example of how too much stimulus is actually a bad thing, we can look no further to Venezuela and see that within just this last week, a brand-spankin' new, $1,000,000 Venezuelan Bolivar Bank Note is being printed up and rolled out by the Venezuelan Government.

Tres nuevos billetes serán incorporados al Cono Monetario vigente, como parte de la ampliación de la actual familia de especies monetarias.#BCV ???????? pic.twitter.com/HdUDbrrZ5F

— Banco Central de Venezuela (@BCV_ORG_VE) March 5, 2021

The word is, the new million Bolivar banknote is worth much less than one single US Dollar, and the Bolivar is only really good for public transpiration, which requires payment with the practically worthless currency, but Bolivar's image, the numbers, and lettering are printed vertically on the paper instead of horizontally, so there’s that. The bottom line is that if a nation could just print up money and stimulate the economy, every single nation on earth would be super-duper rich, but in the real world, it doesn’t work that way, and it only works in the United States, up to this point, because of the US dollar’s role of World Reserve Currency and the US military’s use of force to back it up.

Phony wealth and military might are topics of an article for another day, however, for today, we’re talking about the short-term implications of the latest round of US fiscal stimulus.

The latest round of stimulus, the Biden Administration’s first fiscal stimulus package, is making its way through Congress right now. The question is, will this latest round of stimulus be able to keep the stock market elevated and charging higher? Additionally, what can we anticipate in the silver market?

Before answering those questions, however, we need to get a sense of the timeline.

I took this screenshot from Reuters because I think it is important for commentary:

Oh yeah, and I took that screenshot on Monday, March 8!

First of all, notice how the article seems like a seed planted by the mainstream media? While much of the nation, for whatever reason, is distracted by the various Scandals du Jour, it could be easy to get the sense that those $1400 stimulus checks would be hitting eligible US taxpayers’ bank accounts by Friday, just in time for the weekend!

The problem is, however, the so-called ‘relief package' is still making its way through Congress this Wednesday, March 10, 2021. Specifically, last weekend, the Senate passed its own version of the bill, which meant the bill has gone back to the House for a vote on the Senate's version. On March 8, the mainstream media was reporting that the House would vote on the bill yesterday, Tuesday, March 9, although as it stands now, it seems the House is set to vote on the Senate’s version today, Wednesday, March 10. The point is, even if the bill is signed into law this very afternoon by President Biden himself, we are not just "within days" of the free money handout.

Why does the timing matter?

It matters because a trader, investor, or other “market participant” can be right about something, such as the direction of the markets, or a particular stock, or whatever, but if that person’s timing is off, well, let’s just say some refer to blowing-up a trading account as “paying tuition” to the markets, and as we all know, school is not just very expensive, especially in the United States, but it can be quite the financial burden, or ruin, for those people who do not get it exactly right.

This brings me to my first point: If the next round of stimulus does indeed take more than just a few days before it begins to be put into action, wouldn’t the markets experience some anxiety at the very least?

Furthermore, with everybody so absolutely certain that because of all this Federal fiscal stimulus, the markets can only go up, is it not also possible that the markets have been bid up in anticipation of the stimulus, only to experience a sell-off upon its arrival? That is to say, what if this latest stimulus turns out to be a “buy the rumor, sell the news” type of development in the stock market?

If this does turn into a buy the rumor sells the news moment, that would be an indication that the fiscal stimulus is no longer stimulative, but rather, detrimental. I wrote about this yesterday, and it can be thought of in the simple terms of a wild college party. Specifically, if anybody ever went to one of those “party colleges”, for lack of a better term, and went to college parties with alcohol involved, some will not doubt recall, perhaps one or two of those parties became extra wild, with the music pumping, plenty of “beer pong” being played, and everybody generally having quite a rambunctious time, and then all of the sudden, late in the evening, somebody whips out a bottle of cheap tequila and the wild college party turns into an epic pukefest! Please excuse the analogy, but it is very appropriate with the stock market. In other words, it could be argued that the stock market party has been rather wild, and not only that, but it’s now very, very late in the evening, and so the question becomes: What will the effect of even more stimulus be on the stock market?

But wait, there’s more!

That’s right folks, because market participants may be overlooking the fact that even fewer people will be eligible for the $1400 cash handout this time around. The version passed by the Senate includes tighter income thresholds, and the way the bill stands now, if passed as such by the House, individuals making more than $80,000 per year of income will not be getting any stimulus money at all, so not only is the income eligibility more strict in that sense, but also, the rate at which the full $1400 in stimulus money wanes off to zero dollars in stimulus money is much faster.

What does this all mean for spending and the economy?

In my opinion, there are now fewer people who would use their stimulus money in the stock market. I say that because it could be argued that a person making $90,000 per year does not “need” the stimulus money, and as such, the person making nearly six figures would be more likely to trade or invest that money than a person making, say, just half of that amount. Said differently, it is more likely that a person making $45,000 per year, who will be getting the full $1400 in stimulus money, would be using his or her stimulus money to buy food, which everybody sees going up in price, or to buy some durable good, like a smartphone, a laptop, a grill or a washing machine, which are also things everybody sees going up in price, and so instead of taking a chance with the money, or quite simply, gambling, in the stock market, this time around, that money could be spent on food and stuff.

What does all of this mean for silver?

Silver is one of the very best hedges against reckless fiscal policy, reckless monetary policy, and unsustainable debt over time, so this means silver is pretty much the go-to asset if a person is willing and able to save their money, yet that person does not know what to save that money in. Keeping the money in a bank account, or in a savings account, or under the mattress, or in a piggy bank, or wherever, is a guaranteed losing proposition. Also, if less direct stimulus is being doled out by the Federal government to the people, and certainly less money to the people who would theoretically be the most likely to save that money, again, if willing and able, then hopefully we won’t see premiums on silver going stupid crazy, sky-high once again as the real, physical market has disconnected from the paper silver price time and time again, because, at least on paper, no pun intended, there will be less money directly chasing around the same amount of stuff, silver included.

Of course, this is Washington, in general, we’re talking about, and the Federal government specifically, so don’t be surprised if there are any changes, curveballs, delays, or other scenarios which could further exacerbate the potentially market-adverse situations described in this article.

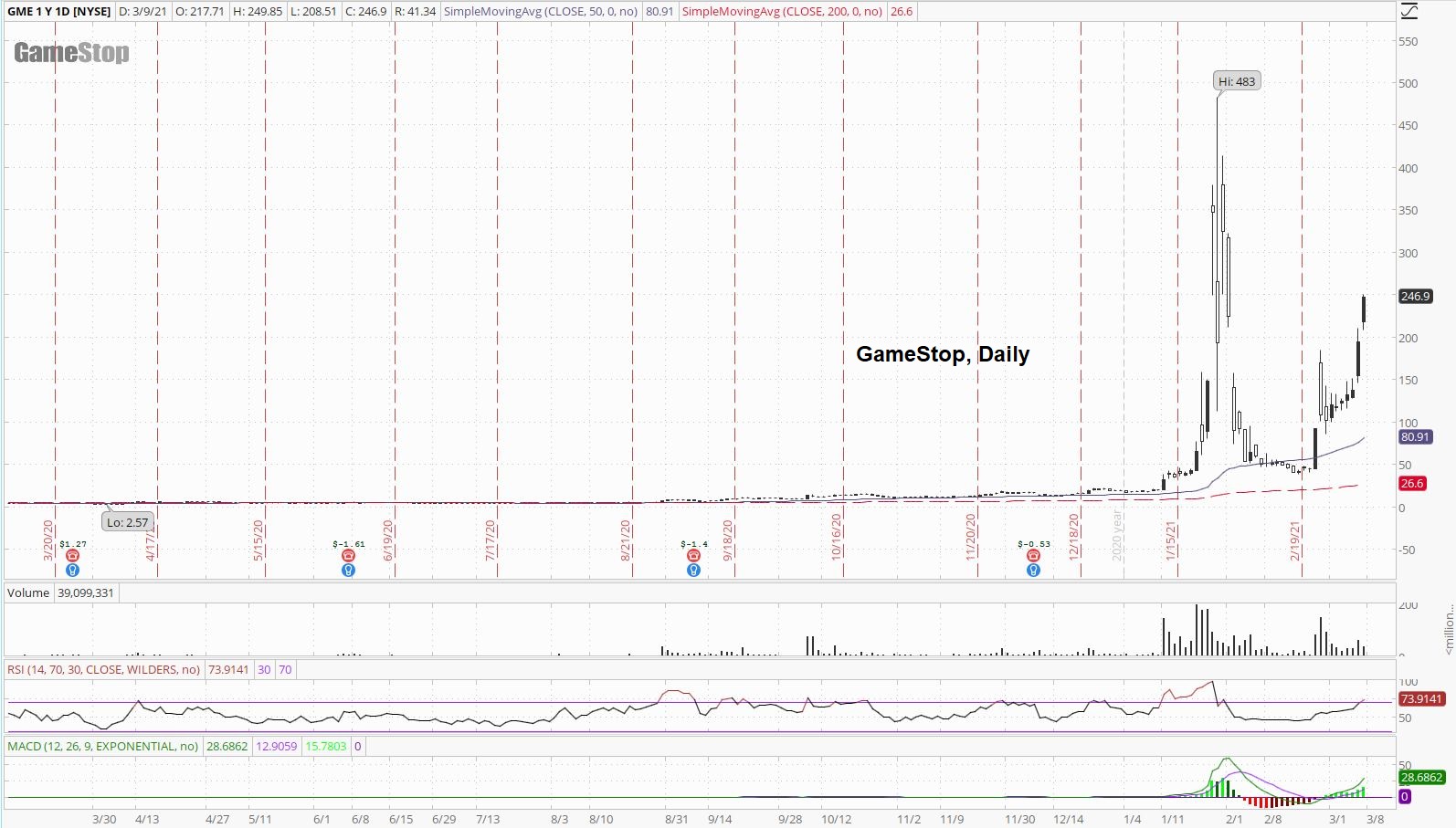

Check out this run-up in GameStop:

GameStop is not the only "meme stock" that could be signaling "buy the rumor, sell the news".

In general, the stock market has certainly bought the rumor:

Record highs, again!

After raising eyebrows recently, market participants are back to their good old-fashioned complacent selves:

All things considered, including the recent volatility in the tech stocks, I need to qualify that statement and say market participants "barely" raised their eyebrows recently.

Yield on the 10-Year Note has pulled back from its recent highs:

Much of the talk in both the mainstream media and in the alternative media over the last week was of "yield curve control", as in, the capping of interest rates, but have yields really risen to a point where the Fed must overtly acknowledge additional interest rate suppression policy?

The US dollar index has seen the strength I've been expecting since I first wrote about it on February 6th:

If the stock market rolls over, or corrects, or plunges, or does something bearish like that, we could see some additional strength in the dollar.

Copper is down over 7.5% from its recent highs:

While I'm quite sure all the technical analysts are hootin' and hollerin' about a "bull wedge", I don't think a trip down to the 50-day moving average would be unexpected, and to the contrary, could be looked at as a healthy "correction", but if copper crashes down to its 200-day moving average, at that point, we'd have broader concerns to deal with about the overall health of the markets and the economy.

At this point, however, it seems like it's a race against time, meaning, how much of an effect is all of the money printing worldwide having on copper's price versus how much copper is being used in the industry right now? While copper is certainly in robust demand because of all the infrastructure plans being discussed around the world, economic depression or recession can put end end to even the best made plans in a hurry.

Rising crude oil prices can also act as a headwind to the "booming economic recovery" narrative:

In the simplest of economic terms, more money being spent on crude oil and crude oil derivatives, such as gasoline, diesel, plastics, and petro-chemicals, means less money being spent on something else.

Palladium has now come down to the support of its sideways choppy channel that we have been following for the better part of a year:

We should continue to watch palladium for clues about the markets and the economy overall, especially because palladium has the sweet dual, industrial-monetary characteristic.

If support doesn't hold in palladium, platnum could lose its current support at its 50-day moving average:

It should be noted, however, that platinum is still in the green, year-to-date, by about a hundred bucks.

One reason I've been bearish on silver in the short term is because of the gold-to-silver ratio:

On the one hand, there has been a bid in the silver market due to newfound interest with newfound money, and that has been adding to silver's bullish price action over the past couple of months, but on the other hand, are we really not to expect silver to follow and ultimately outperform gold to the downside?

It's different this time?

If it is not different this time, then I would expect gold to consolidate here, or possibly fall even a little further:

When I became bearish in the short-term, from February 6th and on, my downside target was $1700 gold, and of course, we overshot it to the downside.

My (most unpopular) downside target for silver has been a spike-low into the teens:

I do not think we'll have to wait all that long to find out, and if that happens, in my opinion, that would absolutely be a "back up the truck" moment.

In fact, you might want to bring two trucks.

Thanks for reading,

Paul Eberhart