Jump to: Silver Value | How to Sell Silver Coins? | Silver Stacking | Mistakes to Avoid | Silver Spot Price | Popular Silver Coins | Where to Sell?

For thousands of years, humankind has used silver coins as a currency. Evidence shows they are the oldest form of mass coinage. In fact, Ancient Greeks and Persians started producing silver coins around the 6th century B.C.

This article will help you understand the value and guide you through where and how to sell your silver coins.

Key Takeaways:

- Silver coins are valued based on their weight, purity, rarity, and condition. It's important to understand the current market value of silver before selling your coins.

- Proper storage of silver coins is crucial to maintain their value. Avoid touching the coins with bare hands, and store them in a dry, dark, and cool place to prevent tarnishing.

- When selling silver coins, it's essential to deal with reputable dealers who have a good track record of fair pricing and transparent transactions.

- Silver coins can be a liquid option for investors looking to sell quickly. They are legal tender within their country of emission and easily recognizable among precious metals investors.

- Consider holding onto your silver coins or having an emergency stack if you believe the market value will increase in the future. Silver is a finite resource, and its value can fluctuate over time.

The Value of Silver

According to reports in 2021, the global silver reserve was 530,000 metric tons. The largest producers of raw silver in the world are ranked below:

- Mexico

- China

- Peru

- Chile

- Russia

This cherished element’s value is not restricted to a financial asset category, but it plays a key role in technology and health as well.

Silver is a great conductor of electricity, making it perfect for wires and microelectronic devices. Due to its electrical and thermal conductivity, it can be used in industrial applications, such as catalysts in chemical reactions and solar panels.

Silver is also a popular precious metal to produce coins, ornaments, jewelry, and silverware.

Being one of the most reflective substances on earth, it has been used to preserve wealth for more than 4,000 years. There was even a time in history, more specifically, between 1780 and 1580 B.C. when silver was more valuable than gold.

You can invest in silver through physical bullion, such as bars, coins, and rounds. Another option is to invest in derivatives, e.g., futures or forward contracts, ETFs, or mutual funds.

How to Sell Silver Coins: “Dos” and “Don'ts”

1. Plan your sales ahead

A great strategy for dealing with silver is knowing how you will sell it even before purchasing it in the first place. Never buy silver without thinking about how to sell it to avoid panic selling.

2. Make conscious decisions

Do not invest emotionally or in the perspective of the ego. Even though there's always a risk, investing in precious assets, overall, is not like gambling in which you trust your fortune. You can always educate yourself on the subject, and you can make predictions based on situation analysis and calculated decisions.

3. Play it safe

Do not consider just the best price. If you must choose, go for a safer and more professional company or a well-known dealer, such as SD Bullion.

4. Don’t make an impulse sale

Never accept the first offer. If you are trying to sell your premium silver at a local pawn shop or at a coin shop, make sure they are making a fair offer, especially considering what you could get from online dealers. Brick-and-mortar shops have greater business costs to cover, so you will usually get better offers from a trusted online bullion dealer.

5. Build a reputation

If possible, try to sell small amounts of silver randomly online to build a reputation, even if you intend to save most of your stack. Keep in touch with buyers you trust so you don't need to rely on strangers during economic or political uncertainty. This way, you will already have someone who trusts you in times of need.

6. Have a back-up plan

Don't wait until crisis times to risk yourself. Make sure to have an exit strategy that makes sense to you. For example, you may never want to sell your entire arsenal simultaneously. The value could increase in the future, and you could lose profit.

Consider having an emergency silver stack, the type of asset that you would like to sell in a difficult time. So you don't sell all of your precious metal in an emotionally overwhelming situation. You don't want to make a decision in the heat of a health or financial emergency and end up selling something you didn't want to.

Best Practices For Silver Stacking

To ensure that your investment in silver bullion is protected and maintained, it's important to follow certain guidelines when stacking your silver.

1. Choose a secure location

When storing your silver bullion, it's important to choose a location that is secure and protected. This could be a safe at home, a safety deposit box at a bank, or a secure storage facility. Make sure that the location you choose is both secure and accessible, so you can easily check on your gold and silver coins or even other precious metals, as well as monitor their condition.

2. Handle with care

When handling your silver bullion, it's important to do so carefully to avoid scratching or damaging the surface. Use cotton gloves or a soft cloth to handle your silver, and avoid touching it with bare hands. This will help prevent oils and fingerprints from leaving marks on the surface of the silver.

As long as you are careful and use the proper materials, it is okay to polish regular silver bars. There are, however, some numismatic old silver coins that, if polished, may lose their vintage look. That antique look on these valuable coins is, sometimes, exactly what attracts coin collectors.

3. Regularly check your silver

It's important to regularly check on your silver stack or coin collection to ensure that it remains in good condition and detect potential issues. This could include checking for tarnishing or discoloration, as well as monitoring the security of the location where your silver is stored.

4. Be organized

Make sure to organize your products by categories, like junk silver and numismatic coins (collectible coins), and have a register of all the products.

Mistakes to avoid when stacking silver:

1. Storing in a high-moisture environment

One of the most common mistakes when stacking silver bullion is storing it in an environment that is prone to moisture or humidity. This can cause tarnishing and damage to the metal over time. Instead, choose a location that is dry and has good ventilation to prevent moisture buildup.

2. Using harsh cleaning materials

Another mistake to avoid when stacking silver bullion is using harsh cleaning materials or abrasive materials to clean silver. This can cause scratches or other damage to the surface, reducing the value of your investment over time. Instead, use a soft cloth and gentle cleaning solutions to clean your silver.

3. Purchasing from unverified sources

Finally, it's important to be cautious when purchasing silver from unverified sources. Counterfeit or low-quality products can be a risk to your investment, so make sure to purchase from reputable dealers and sources. This will help ensure that your investment is protected and that you get high-quality silver. Avoid places like pawn shops or unknown coin dealers when selling your silver coins.

Silver Spot Price

The silver spot price is determined by various factors, including supply and demand, mining and production costs, geopolitical events, and currency fluctuations. It reflects the current market value of silver at any given time and is used as a benchmark for buying and selling the metal.

The spot price of silver is determined through trading in futures markets, where buyers and sellers agree to buy and sell the metal at a certain price for delivery at a set future date.

Long Term Fluctuations

The price of silver can also be impacted by macroeconomic factors such as interest rates, inflation, and economic growth, as well as geopolitical events, including tensions in major silver-producing countries, changes in mining regulations, and natural disasters.

Finally, changes in the value of currencies, particularly the U.S. dollar, can also have a significant impact on the spot price of silver, as the metal is priced in dollars, and the value of the metal in other currencies can be influenced by changes in the value of the dollar.

Even if you already have some experience selling gold, selling silver online can be a totally different experience for a simple reason: silver is more volatile than gold. This can represent a bigger risk but also an opportunity for larger profits.

Interactive Silver Price Chart

You can check out our interactive chart for the live silver spot price per troy ounce, gram, and kilogram.

Most Popular Silver Coins

It is important to mention that the condition of your coins will affect their value. Especially if we consider older silver coins, like Morgan and Peace dollars.

Now, let's talk about the types of silver coins out there in case you are interested in stocking or selling.

Here are some of the most popular government mint silver coins that you should consider adding to your coin collection:

American Silver Eagles

With weight and purity guaranteed by the US mint, the classic American Silver Eagles are among the most beautiful coins ever minted. It was first minted in 1986, but since the year 2021, the reverse features an eagle carrying an oak branch as it approaches a landing.

Year of Issue: 1986 to Present

Purity: 99.9% silver

Face Value: 1$

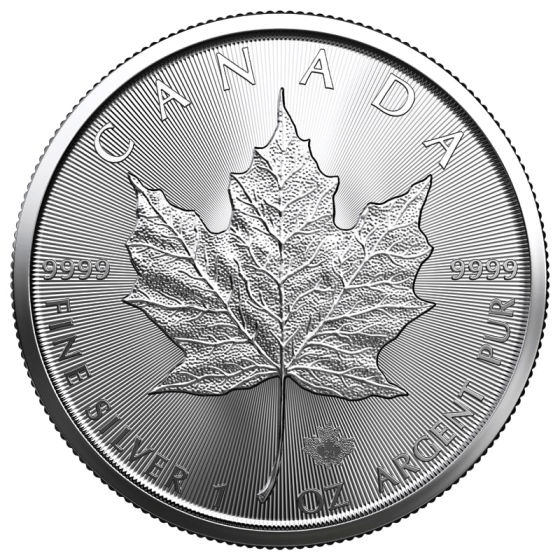

Canadian Silver Maple Leaf Coin

The Canadian Silver Maple Leaf was first issued by the Royal Canadian Mint in 1988. It competes with the American silver eagle in popularity, and the government of Canada guarantees its purity.

Year of minting: 1988 - present

Face value: 5.00 CAD

Purity: 99.99%

Chinese Silver Panda

Since 1987, the Chinese silver panda has been minted at 1 troy of 0.999 silver. In 1989, the Chinese mint issued the Chinese Silver Panda as an investment-grade bullion coin.

The reverse design always depicts the panda as a national symbol of China, and it is changed yearly, making this coin an anticipated item for collectors and stackers.

Year of minting: 1983-present

face value: 10 yuan

purity: 99.9

Great Britain Silver Britannia

This silver coin has its purity and quality backed by the Royal Mint, which has been producing them in gold since 1987, silver since 1997, and platinum since 2018.

The coin patterns feature various representations of Britannia, a female personification of the United Kingdom. The coin's face changed this year with the death of the Queen.

The 2023 Great Britain Silver Britannia coin featuring the new effigy of king Charles will be released in the next few months.

Year of minting: 1997-present

Face value: 2 pounds sterling

Purity: 99.9%

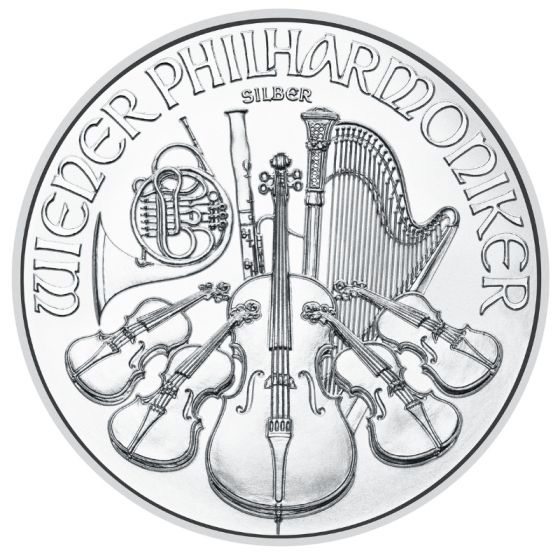

Austrian Silver Philharmonic

The Austrian Philharmonic SIlver Coin is a bullion coin produced by the Austrian Mint. The coin is named after the Vienna Philharmonic orchestra, which inspired the reverse and obverse design.

It was first minted in 1989 and is considered one of the best-selling bullion coins due to its high quality and elegance.

Year of minting: 2008 - present

Face value: 1.5 euros

Purity: 99.9%

Australian Silver Kangaroo

Legal tender in Australia, the Silver Kangaroo is backed by the Royal Australian Mint. This silver coin is special because they not only can change the design yearly but also have a limited annual coin mintage.

Year of minting: 1993 - present

Face value: 1AUD

Purity: 99.99%

Junk silver

Junk silver coins is a term that usually refers to pre-1965 US 90% silver coins with no numismatic value as opposed to collectible coins. They are not from key dates or rare coins, but rather valued by their silver content alone.

In other words, a coin dealer or precious metals buyer will offer to buy them based solely on their melt value.

For instance, Kennedy Half-Dollars, minted from 1965 to 1970, are only 40% silver. This means they cannot be as desirable as the Kennedy Half-Dollar minted in 1964, which contained 90% silver. Important to mention that even if you have a 40% silver coin, there's still a chance that you get a decent price from your local dealer or professional numismatists. Every date is valued at the base silver value in this condition.

For constitutional silver coins, check out our melt value calculator for coin values.

Where to Sell Silver Coins Online

Selling coins does not need to be a stressful process. With more than a decade of experience, SD bullion has an A+ rating from the Better Business Bureau and a solid reputation in the industry. We are committed to providing our customers with fair prices and excellent service. Our buyback process is designed to be secure and transparent, so you can have peace of mind if you decide to sell silver coins to us.

- Contact our team: You can reach us at 1-800-294-8732 or via the web chat feature at the bottom-right of your screen.

- Let us know shortly about what you would like to sell. The weight and purity and mint year if needed.

- We'll make an offer, and the product price will be locked until the end of the transaction.

- You will receive a purchase order. You must send the product to the address on it.

- We'll issue a payment order in your favor once all the product is confirmed to be correct. The payment usually comes in within 1 to 3 business days.

You can get more detailed info about the selling process here.

We also buy platinum, palladium, and gold bullion.