Gold coins have played a major role in defining societies throughout the centuries. And even in the era of fiat currencies, they continue to be a predominant form of investment. Savvy investors, who understand the benefits of portfolio diversification, often allocate part of their savings into gold bullion. And bullion gold coins are among the most popular options to do so.

But why is physical gold bullion so valuable and desired? Gold is a tangible asset, which means you can physically carry it around or barter it. It poses no risk of default. And its value is not determined by a government or a third party, but rather by simple laws of supply and demand. Needless to say, the supply is short and the demand is high.

Gold is a scarce material on the crust of the Earth. And yet, it is highly desired not only as a store of wealth for investors but as an essential metal across a variety of industries. Gold is an excellent conductor and corrosion-resistant. Not to mention its beauty is paramount to the jewelry sector.

However, as it is with different forms of investment assets, like stocks and real estate, there is a time to buy and a time to sell. You might want to liquidate your bullion gold coins because you are planning a big purchase, like a house or even college tuition. Or you just realized the gold price is fluctuating in your favor and you see an opportunity to turn in a nice profit.

Be it as it may, we have prepared this article in order to help you through the process of liquidating your gold investment.

How much are gold coins worth?

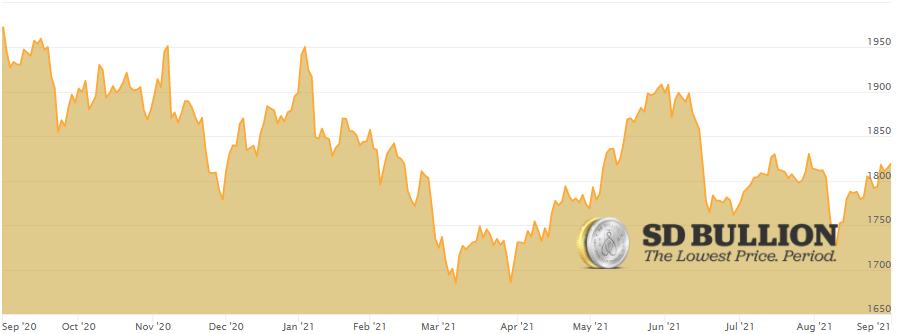

Every gold bullion product (gold coin, gold bar, or gold round) has its value based on the gold spot price of the moment. The spot price is an average value attributed to a troy ounce of gold according to transactions occurring live during business days in mercantile markets such as LBMA and COMEX. Similarly, there is a spot price for platinum, palladium, and silver bullion as well.

Gold spot price chart from September 2020 to September 2021.

Gold coins are one of the most liquid forms of investing in gold bullion. Especially the ones from the most popular series, such as the American Gold Eagle coin or the Canadian Maple Leaf Gold coin. That means you can easily and quickly sell them close to the spot price. Investors and coin collectors flock to them like bees on honey.

Why keep track of the gold spot price?

The gold spot price fluctuates during business days just like stocks or cryptocurrencies. However, gold is much less volatile. You shouldn’t expect huge spikes during the day, but rather small ups and downs. To put it simply, many experts see gold as a long-term investment.

Thus, knowing the historical gold prices and comparing them to the current prices might help you decide whether it is the right moment to liquidate your gold coins. Nevertheless, sensible investors know that gold is a safe haven against inflation. It is a store of value that could potentially help investors get through times of economic downturns.

Local Dealer vs Online Dealer

If you live in big business centers, it won’t be hard to find a local coin dealer or physical precious metal dealer. And that could be a good option if you are in a hurry for a quick buck. But would that be the best decision in terms of value for your coin? Brick-and-mortar shops usually have larger business costs to cover in comparison to online dealers, and typically a smaller portion of the market.

Taking your gold bullion coins to a pawn shop could be an even worse deal. Remember that pawnshops are not specialized dealers. They deal with an array of people and a variety of products. Chances are they won’t be able to properly appreciate and value your gold bullion coin.

There is even the possibility of listing your gold item on eBay or a similar website. That way you can try to sell your gold coin directly to another gold buyer or coin collector. The problem is, there are a bunch of scams ill-intentioned people can try and run on you. It might not be worth the bother.

Our experience shows that selling to an online bullion dealer could be the safest and savviest choice. For instance, SD Bullion has been in the market since 2012. We believe in valuing your investment as much as you do. Our team is constantly and actively buying gold, silver, platinum, and palladium products from the secondary market. If you are thinking about liquidating your assets, consider selling them to us. Keep reading to find out more about our buyback process.

How to sell gold coins at SD Bullion?

If you are considering selling your gold coins to our team at SD Bullion, rest assured the process is quick and simple to follow.

- First and foremost, contact one of our representatives at 1-800-294-8732. You can also contact them through our live web chat feature on the bottom right of your screen;

- Give a brief description of the gold coin or other products you want to sell: brand, the amount you are selling, the gold content of your product (weight and purity), and mint year (if applicable);

- Our agent will then give you our bit price. If you agree upon it, the price gets locked in until the transaction is finalized;

- Next, you will receive a purchase order. That contains the address to where you should ship your gold bullion coins. Include the purchase order with the coins or other products within the parcel;

- As soon as your products arrive, our inventory team inspects them. Once they confirm everything is in order we’ll issue a payment order in your favor. You should receive your payment within 1-3 business days.

At SD Bullion, it is our motto to provide you with the highest payout in the industry. Our experience and expertise in the bullion market are what allows us to offer industry-leading rates with fast payment through a simple buyback process.

As we have mentioned before, we have operated since 2012. We have executed more than $1 billion dollars in transactions and accounted for more than 100,000 satisfied customers.

Our reputation is backed by 8 straight years receiving the A+ rating from the Better Business Bureau and uncountable positive reviews from our customers.

In case you have any other queries regarding our buyback process, make sure to contact our customer support service. Our phone number is 1(800)294-8732, but you can also reach us at sales@sdbullion.com, or through our live web chat feature.